Monday, 11 May 2020

Written by Amirudin Hamid, Portfolio Manager of GAX MD

Economic red flags were scattered across April 2020. The International Monetary Fund (IMF) forecasted that the current global economic downturn is much deeper than that of the financial crisis in 2008. Amazingly, all the negative news of bad economic data and dovish forecasts did little to stop the stock market from rallying.

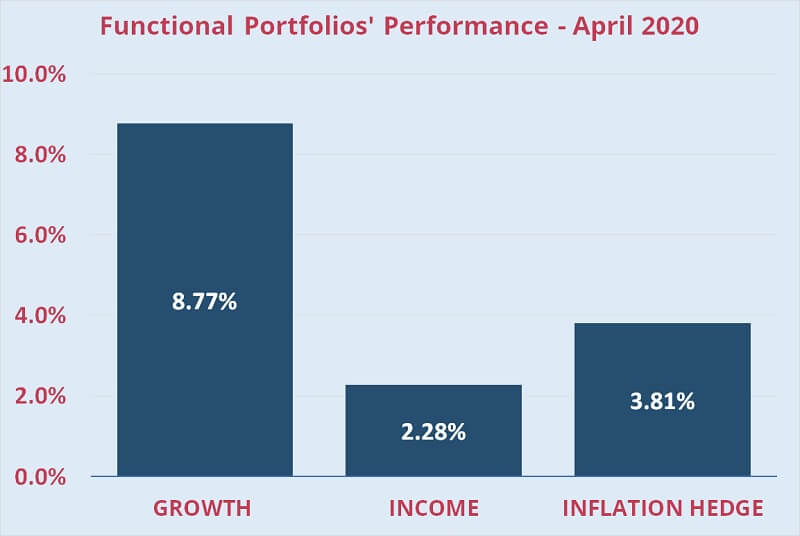

MYTHEO functional portfolios’ performed positively in April 2020. Growth portfolio rose by 8.77% while the Inflation Hedge and Income portfolios achieved a positive return of 3.81% and 2.28% respectively.

Chart 1: Functional Portfolios' Performances for the month of April 2020

Note: Past performance is not an indication of future performance

The GROWTH portfolio rose by 8.77% in MYR

The stock market had been racking up strongly following signs that the COVID-19 pandemic had already hit its peak. Many affected countries such as the US, Italy and Spain all showed a decline in reported new confirmed cases. What further excites investors is that many of these countries have begun lifting the lockdowns to restart the stalling economy.

The rally was broad-based almost across all sectors and countries. All ETFs within the growth portfolio were up by at least 4%.

Medium size “value” stocks in the US (IWS) was the top performer with a 12.8% gain. A few more exposures enjoyed double-digit percentage gains, including Indian growth stocks (EPI), Canadian Equity (EWC), and large size “value” stocks in the US (VTV), which gained by 12.3%, 10.6% and 10.2% respectively.

The INCOME portfolio rose by 2.28% in MYR

Likewise, the bond market also had a good month, in which the high yield bonds had led the strong performance of high risks assets. MYTHEO holds two types of high yield bonds. The conventional high yield bonds (HYG) and the other high yields bonds with a shorter period to maturity (SJNK), both went up by 4.4% during the period under review. Strong performance on these assets may be due to both being oversold in the market routs earlier this year. Besides, the performance was also sparked by the Federal Reserve's Bond Buying Program, which includes some high-yield debt and ETFs that invest in them.

The medium-term US government (VGIT) was the only asset inside the income portfolio with the negative return, however the losses were minimal.

The INFLATION HEDGE portfolio up by 3.81% in MYR

The price action in the crude oil market was the hottest topic of the month after the crude oil price in the US fell to negative US$37.63 a barrel. That means oil sellers were paying the buyers to take oil off their hands as the oil storage hit maximum capacity. As a result, the oil ETF (DBO) fell by a further 10.0% in April.

However, the worst might be over for the crude oil outlook. The re-opening of the economy in many countries should re-ignite the demand that disappeared during the pandemic. Furthermore, the Trump administration is now more likely to get more involved in regulating the oil supply. It was reported that the US is considering to impose a tariff on oil imports as part of measures to protect its oil industry.

The Oil stocks (DBO) was the only loser within MYTHEO’s Inflation Hedge portfolio in April. The real estate stocks were the primary drivers to overall portfolio positive performance as real estate mortgage stocks (REM) jumped by 17.5% and US real estate stocks (IYR) advanced by 8.8%. Gold and Inflation Hedge bonds continued the performing steadily with further gains of 6.4% and 2.6% respectively.

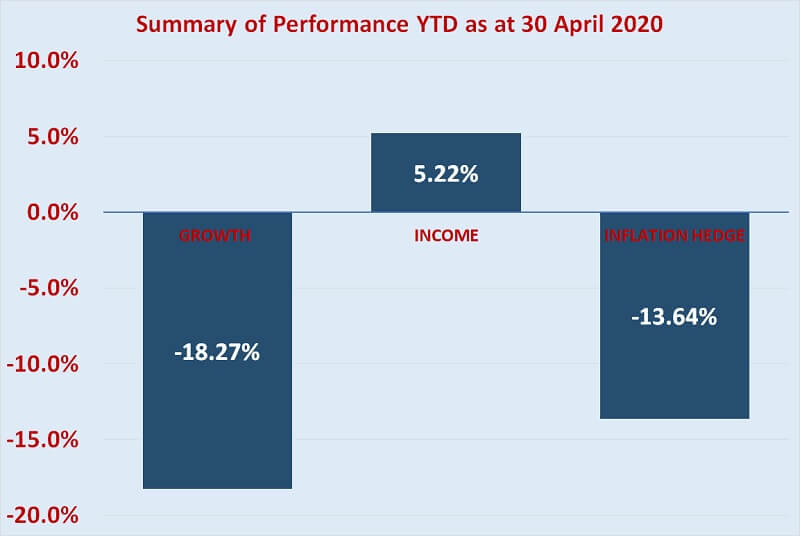

Chart 2: Summary of Performance YTD as at 30 April 2020

Note: Past performance is not an indication of future performance

Chart 2 above shows the performance of the functional portfolio since the beginning of 2020. Growth portfolio registered a return of -18.27%, Income portfolio was up by 5.22% and Inflation Hedge portfolio dropped by 13.64%.

It must be noted that, the actual portfolio returns to the investors is the combined weighted return from the allocation to each functional portfolio. For example, if an investor allocates the investment equally: 33.3% in Growth, 33.3% in Income and 33.3% in Inflation Hedge, the actual portfolio return is (33.3% x -18.27%) + (33.3% x 5.22%) + (33.3% x -13.64%) = -8.90% over a four-month period from January to April 2020.

What's Happening In The World Market?

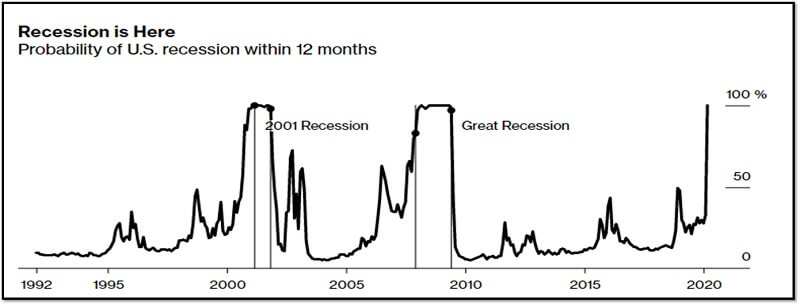

Recession is certain. The Bloomberg Recession indicator, which is the most widely followed indicator by investment professionals, showed that the probability of US recession within the next 12-months is 100% certain.

Chart 3: Bloomberg Recession Indicator

Note: Past performance is not an indication of future performance

The International Monetary Fund (IMF) seemed to have supported Bloomberg’s prediction. In the report published in early April, the IMF forecasted that the global economy will contract by 3% in 2020, much worse than the 1.7% contraction in Global Financial Crisis in 2008.

Soon after, the economic report in the US confirmed the negative economic outlook. In the first quarter of 2020, it was reported that the US economy had contracted by 4.8%, and well below the average estimates of 4.0%. The market is expecting a much deeper contraction in the third quarter of 6.0% or more.

Despite mounting concerns over recessions, it was amazing to see the financial market react differently. All the negative news of bad economic data and dovish forecasts did little to stop the stocks market from making a massive rally. From the trough of the market as of 23 March to the end of April, the S&P 500 rose by more than 30%!

Chart 4: S&P 500 Index Performance YTD as at 30 April 2020

Financial markets gave more weight to the prospect of the availability of COVID-19 treatments in the near future, and that could help in healing the global economy too. Also, the Earnings Season in the US kicked-off with more positives after the first few companies reported quarter earnings that were better than expected.

Our Thoughts

Just not too long ago, the market was crashing just like the world was going to end. However, before even realizing it, the stock market suddenly rebounded, and it was a significant one. The S&P 500 rebounded by more than 30% from the market bottom on 23 March to the end of April. That’s how fast the market moves in both ups and downs.

It is always hard to justify when exactly the rebounds will occur at times of mounting economic concerns. The US second-quarter GDP is looking to be worse than the already bad forecast. Many economy experts are still advising all investors to stay on the sidelines to wait for a worse outcome in the third quarter.

Even professional managers are unsure of which way to turn. The market drops, then pops, seemingly for no reason. Professionals are constantly trying to predict the market and they usually fail.

In the final week of April, Warren Buffett openly admitted a mistake of buying into airline stocks and just to sell at losses after a few months. Mr Buffett is the legendary stock market “guru”, yet he had wrongly picked shares and miscalculated the right time to invest. That is proof of how difficult it is to predict what would happen to the market and to time the peak and the bottom of the market.

That is why passive investing has been growing in popularity over the past decade. This approach of investing in a basket of stocks/asset classes by buying ETFs is effective in avoiding the risks of both bad stock pickings and trying to outperform the market especially with such volatilities in the market.

Our platform, MYTHEO could be the right solution for you. MYTHEO digital platform provides the easiest and cheapest way for investors to achieve financial objectives through passive investing, and at the same time, diversifying the investment across at least 25 ETFs with exposure in more than 80 countries and over 11,000 stocks in a portfolio combination of growth, income and inflation hedge based asset classes. An algorithm does the optimisation and selection of ETFs, and the rebalancing of the portfolios without any human intervention.

Therefore, don't let market volatility and negative news keep you from investing. Invest consistently and practicing dollar-cost averaging by investing a fixed amount regularly either on a weekly, monthly or quarterly basis.

Lastly, never time the market because the best time to invest is always now!