Wednesday, 7 September 2023

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in August 2023.

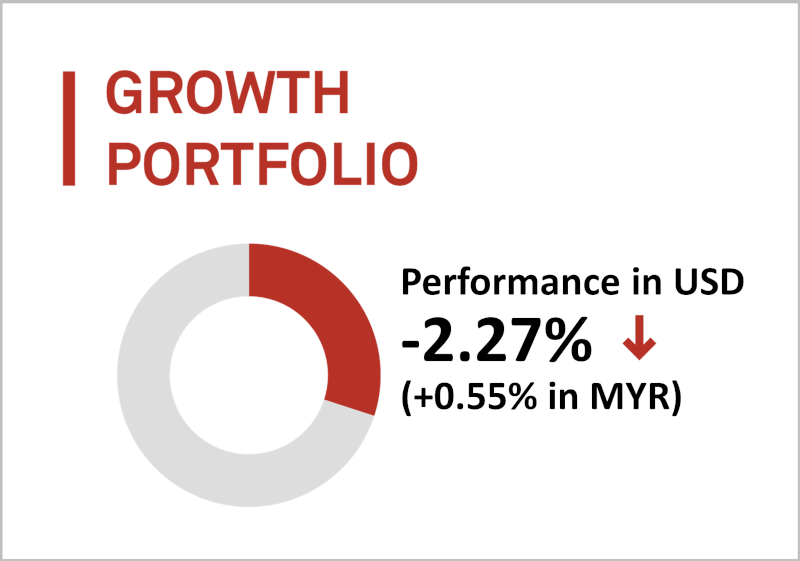

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down by 2.27% (+0.55% in MYR) in August 2023.

August marked our portfolio’s routine quarterly reallocation. Notably, this exercise resulted in a steamlined portfolio that focuses on regional consolidation rather than country level dispersion. The US markets continue to hold the lion’s share of our investment exposure.

The portfolio’s allocation to the WisdomTree India Earning ETF (about 6%) was a key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Growth portfolio)

WISDOMTREE INDIA EARNINGS (EPI)

INVESCO QQQ ETF (QQQ)

VANGUARD VALUE (VTV)

-1.04%

-1.48%

-2.38%

Bottom 3 ETFs (Growth portfolio)

ISHARES MSCI UNITED KINGDOM (EWU)

INVESCO S&P 500 PURE VALUE (RPV)

VANGUARD FTSE EMERGING MARKETS (VWO)

-3.90%

-4.62%

-5.90%

Source: GAX MD Sdn Bhd, data in USD term for the month of August 2023.

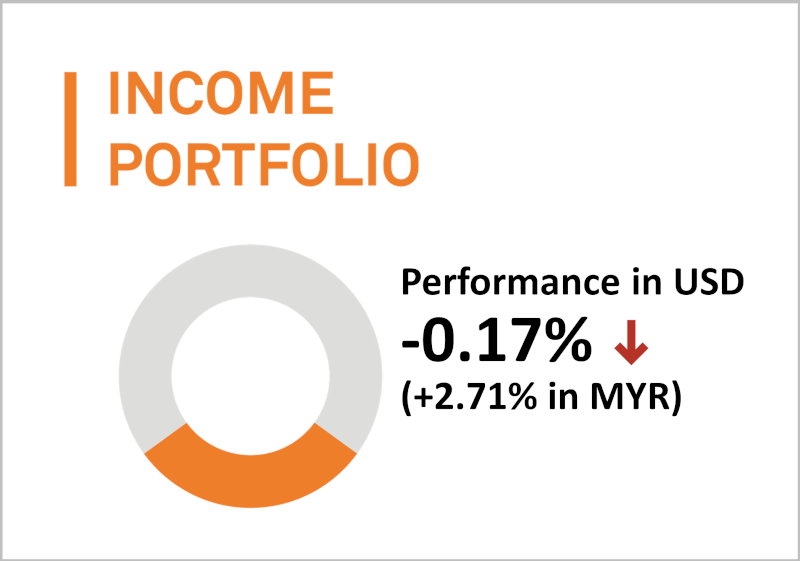

2. Income Portfolio

MYTHEO’s Income Portfolio was down by 0.17% (+2.71% in MYR) in August 2023.

For the month of August 2023, the income portfolio continues to hold significant levels of short-term duration corporate bonds and investment grade bonds that balance out longer term US Treasury holdings. These bonds mitigate short-term interest rate risks while the US Treasury holdings provide capital appreciation potential for the portfolio. The current average weighted 30-day yield of the ETFs in the portfolio is around 5.92%.

The portfolio’s exposure to senior loans (about 9%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Income portfolio)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

SPDR BARCLAYS SHORT-TERM HIGH YIELD (SJNK)

ISHARES FLOATING RATE BONDS (FLOT)

+1.13%

+0.53%

+0.51%

Bottom 3 ETFs (Income portfolio)

ISHARES IBOXX INVESTMENT GRADE (LQD)

MARKET VECTORS EMERGING MARKETS (EMLC)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

-1.23%

-2.46%

-3.14%

Source: GAX MD Sdn Bhd, data in USD term for the month of August 2023.

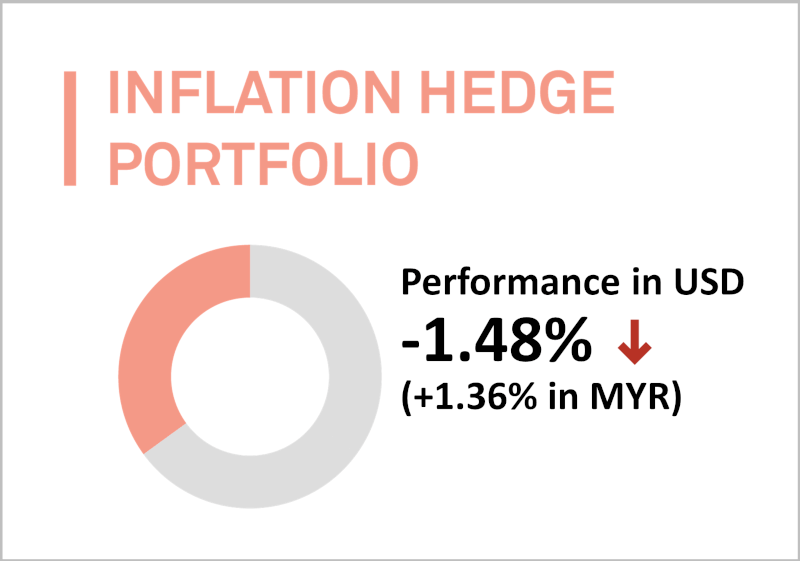

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio was down by 1.48% (+1.36% in MYR) in August 2023.

The current largest positions in this portfolio are U.S real estate and inflation-linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to oil fund ETF (about 3%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Inflation hedge portfolio)

INVESCO DB OIL FUND (DBO)

ISHARES TIPS BOND ETF (TIP)

ISHARES GOLD TRUST (IAU)

+2.41%

-0.81%

-1.21%

Bottom 3 ETFs (Inflation hedge portfolio)

INVESCO DB BASE METALS (DBB)

ISHARES GLOBAL INFRASTRUCTURE (IGF)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX (ICLN)

-4.26%

-4.96%

-12.04%

Source: GAX MD Sdn Bhd, data in USD term for the month of August 2023.

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio was down by 2.07% (+0.75% in MYR) in August 2023.

Similar to the growth portfolio, the preference and exposure to the US is about 60%. The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record, therefore our portfolio follows this trend in terms of placing a higher weighting in US markets, in addition to better risk management compared to investment in newer and more volatile emerging markets.

The portfolio’s allocation to US ESG large and midcap broad market stocks (about 5%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES ESG AWARE MSCI USA (ESGU)

ISHARES MSCI USA ESG SELECT (SUSA)

-0.64%

-1.64%

-1.66%

Bottom 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE (NULV)

ISHARES ESG AWARE MSCI EAFE (ESGD)

ISHARES ESG AWARE MSCI EM (ESGE)

-2.29%

-3.92%

-7.08%

Source: GAX MD Sdn Bhd, data in USD term for the month of August 2023.

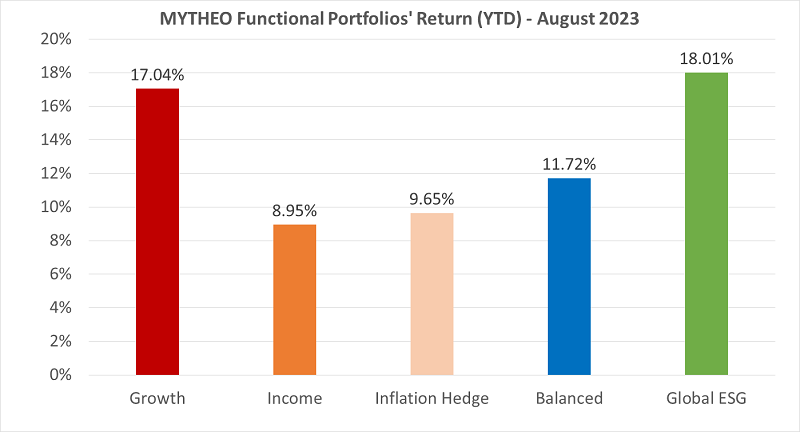

Chart 1: August 2023 - Portfolio Year-to-Date of Return in % (MYR)

Balanced allocation consists of 32% Growth, 36% Income and 32% Inflation Hedge

Source: GAX MD Sdn Bhd, September 2023

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 32% of their investment in Growth, 36% in Income and 32% in Inflation Hedge, the actual portfolio return in MYR for August is 1.59% [(32% x 0.55%) + (36% x 2.71%) + (32% x 1.36%)]

Our Thoughts

The US Dollar (USD) strengthened against the Malaysian Ringgit (MYR) in August by 2.9% to MYR4.6370 as of the 31st of August 2023, compared to MYR4.5070 as of the 31st of July 2023. This has had a positive impact on the performance of the portfolio in MYR.

August 2023 proved to be a tumultuous month marked by a series of concerning developments. US inflation, which has steadily declined for 12 consecutive months, abruptly reversed course, surging from 3.0% to 3.2%. This was then followed by the Fed Chair’s Jackson Hole speech that highlighted a data-dependent policy approach where Fed may need to lift interest rates further to finish the job of lowering inflation on a sustained basis. Meanwhile, the US government’s credit ratings downgrade by Fitch from AAA to AA+ also influenced bond prices earlier in the month.

In the Chinese market, several significant challenges have emerged. These include a substantial USD6.7 billion loss incurred by Country Garden, along with concerns about potential default. Evergrande, another property developer, sought US bankruptcy protection, resulting in a sharp drop in its share price when trading resumed after a 17-month suspension. Additionally, Zhong Rong failed to make payments, sparking concerns about the health of the shadow banking industry. Furthermore, the Chinese economy experienced deflation, with a decline in the inflation rate from 0% to -0.3% in July 2023.

Positively, the Chinese authorities have ramped up policy support. These measures included reducing stamp duties, easing requirements for first- and second-time home buyers, and lowering existing mortgage rates and 1-year loan prime rates. These interventions so far have reversed some subdued Chinese equity market sentiment and created the opportunity for more first-time buyers and second-time investors to tap into the property market, supporting the real estate sector.

Meanwhile, most commodities experienced declines in price as inflation worldwide continued to moderate, save for oil which climbed on expectation of Russian and Saudi Arabian export curb extensions.

During these volatile currents, the MYTHEO Income portfolio provided good risk-adjusted returns supported by short-term and high-yield fixed-income instruments. For investors who are more concerned about short-term market volatility and feel compelled to reduce their current portfolio in favour of something less volatile may consider MYTHEO USD Trust Portfolio. The current net interest rate for this portfolio is 4.33% p.a. and is subject to change depending on the Federal Reserve's monetary policy and the Federal Open Market Committee's (FOMC) decision on the federal funds rate.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.