January 2026 MYTHEO Performance Report covering portfolio returns, market conditions, currency impact, and portfolio breakdowns across strategies.

Read More

The US equity market closed December on a mixed note that highlighted a clear split in performance. The S&P 500 finished the month slightly lower...

Read More

December 2025 MYTHEO Performance Report covering portfolio returns, market conditions, currency impact, and portfolio breakdowns across strategies.

Read More

Geopolitical tensions ease, AI focus shifts to infrastructure, and US midterms signal lower policy volatility—creating a stable environment for diversified portfolio growth.

Read More

November saw a significant pullback in technology and AI stocks as concerns over stretched valuations prompted investors to scale back exposure.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in November 2025.

Read More

Global equity momentum accelerated in October, driven by a worldwide AI rally, surging Asian markets, and booming renewable energy as data-centre power demand grows.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in October 2025.

Read More

September was a blockbuster month for global markets, led once again by the technology sector. The S&P 500 gained 4.61% while the Nasdaq Composite surged 5.61%, marking one of the strongest monthly performances this year.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in September 2025.

Read More

Data centres’ electricity use is expected to rise sharply over the next few years, with some industry estimates suggesting it could approach ~12% of U.S. power consumption...

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in August 2025.

Read More

Nvidia fails Shariah screening under Total Asset rules but passes under Market Cap. MYTHEO Izdihar uses a hybrid approach to capture both.

Read More

AI-Assist helps reduce risk in volatile markets by forecasting bond spread changes and reallocating assets automatically to protect your MYTHEO Income Portfolio.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in July 2025.

Read More

MYTHEO Izdihar is built on proven algorithms featuring Growth style investing, focusing on large-cap market leaders and high-growth technology innovators. It uses cost-efficient tools to multiply your wealth.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in June 2025.

Read More

While global tariffs continue to dominate headlines, President Trump's second term has introduced another sweeping policy move: the One Big Beautiful Bill Act, widely referred to as the "Trump Megabill."

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in May 2025.

Read More

Discover how MYTHEO’s algorithm-driven portfolio re-allocation enhances your investment strategy. Learn how strategic ETF shifts—like the recent increase in US exposure—optimize performance and reduce risk, all without human bias.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in April 2025.

Read More

Explore the AI stock boom in Episode 2 of Invest in a Moment by MYTHEO. Experts break down hype vs. reality, how to manage volatility, and why diversification is key to long-term success in this fast-evolving space.

Read More

Trump’s unexpected “Liberation Day” tariffs sent shockwaves through global markets, exposing key risks in trade and supply chains. Learn how MYTHEO’s globally diversified portfolios help investors stay resilient through volatility and uncertainty.

Read More

Global markets face renewed volatility amid U.S. tariff hikes and trade tensions. Discover how MYTHEO’s diversified Omakase portfolios are built to navigate uncertainty with smart, long-term investment strategies tailored to your goals.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in March 2025.

Read More

Explore the impact of tariffs, trade wars, and U.S.-China tensions on your portfolio in MYTHEO’s latest podcast episode. Expert guests share strategic insights for Malaysian investors navigating today’s volatile market.

Read More

Malaysia's stock market struggled in early 2025, with tech stocks plunging over 22% amid global turbulence. See why Malaysian tech lags behind and how it compares to global markets.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in February 2025.

Read More

Trump's return brings back his favorite economic weapon—tariffs. Could they work in America’s favor, or will they backfire? Even Elon Musk’s AI, Grok, weighs in on the debate.

Read More

Trump calls tariffs ‘the most beautiful word,’ but why? Explore his aggressive tariff policies, their impact on global trade, and the concerns surrounding his potential return to the White House.

Read More

DeepSeek AI's launch in January sent shockwaves through the market, triggering a sharp selloff in semiconductor stocks like Nvidia, TSMC, and Broadcom. Discover why investors reacted and what it means for the AI and chip industry.

Read More

Coffee and chocolate prices are rising due to extreme weather and global events. Find out what's driving the surge and how it may impact your daily treats!

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in January 2025.

Read More

Global equity markets soared in 2024, with the Dow Jones surpassing 40,000 and the Nasdaq 100 gaining 28.86%, driven by tech giants like NVIDIA, which saw a stunning 171% surge. Explore the factors behind this bullish momentum!

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in December 2024.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in November 2024.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in October 2024.

Read More

MYTHEO by GAX MD launches an exclusive, tech-driven investment portfolio for VKA Wealth Planners' clients, regulated by Malaysia's Securities Commission, offering secure, trustee-held funds for enhanced safety.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in September 2024.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in August 2024.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in July 2024.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in June 2024.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in May 2024.

Read More

In this monthly report, we will assess the performance of MYTHEO’s portfolios in light of the financial market developments in April 2024.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in March 2024.

Read More

Breaking down our performance for each portfolio - A concise guide revealing insights for your investment journey. Decode wealth growth and chart your course with confidence.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in January 2024.

Read More

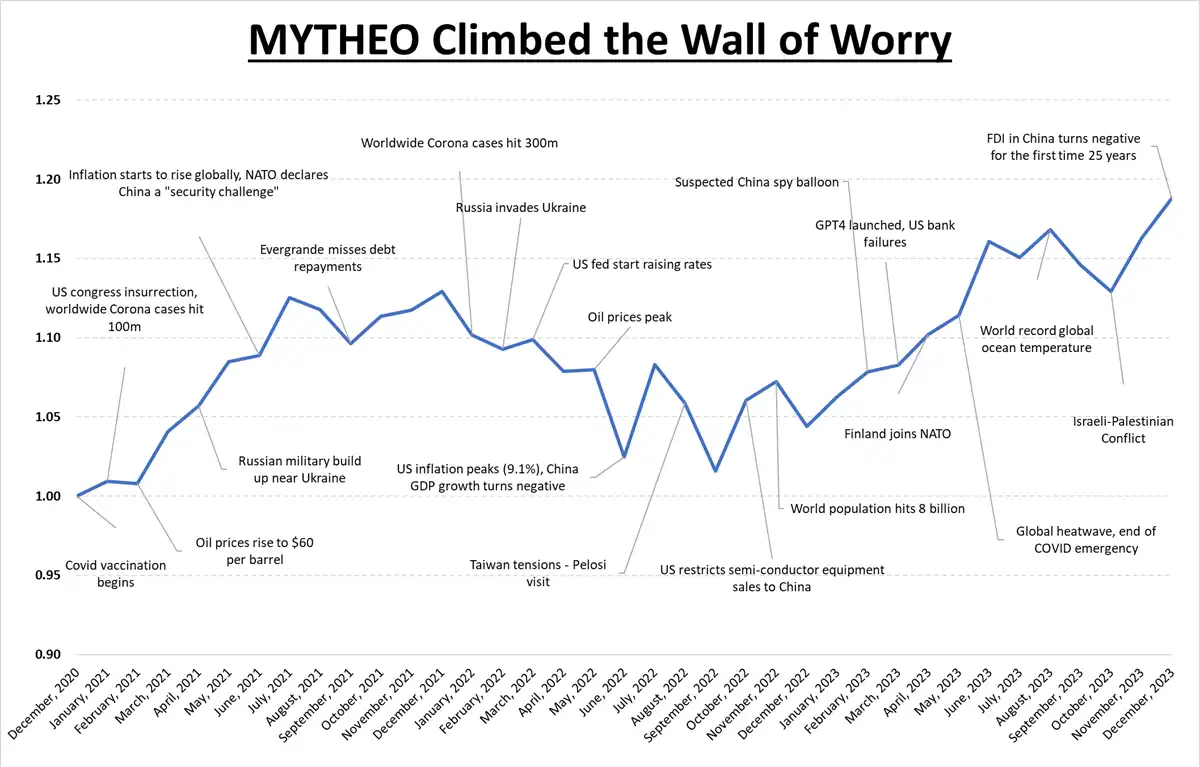

In this report, let’s review how macroeconomic factors, including inflation, interest rates, and ongoing geopolitical uncertainties influenced the economy, financial markets and MYTHEO in 2023.

Read More

MYTHEO achieved an outstanding 19% gain over the past three years, demonstrating resilience through market fluctuations.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in December 2023.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in November 2023.

Read More

GAX MD SDN BHD (MYTHEO), a leading innovative digital investment manager licensed by the Securities Commission Malaysia, is excited to introduce our enhanced app—an app designed to make investing smarter, smoother, and more profitable for everyone.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in October 2023.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in September 2023.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in August 2023.

Read More

In the month of July, the Malaysian Ringgit (MYR) has seen some strengthening against many currency pairings such as the US Dollar...

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in July 2023.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in June 2023.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in May 2023.

Read More

March 2023 provided an interesting case for diversification for two asset classes, namely equities (or stocks) and bonds.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in April 2023.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in March 2023.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in February 2023.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in January 2023.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in December 2022.

Read More

We would like to thank you for bracing 2022 with us. 2022 was a year to remember, and to forget for investors as we saw sharp falls in global equity markets...

Read More

2022 was a tough year to be an investor, with global markets falling as much as 27%* and the S&P 500 on track for its worst annual return since 2008, the year of the Global Financial Crisis.

Read More

There are many lessons that can be learnt from the collapse of FTX, but here at MYTHEO we want to focus on one point in particular when it comes to investing...

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in November 2022.

Read More

There’s no doubt that bear markets can be scary and we understand that...

Read More

We are pleased to announce that MYTHEO USD Trust Portfolio (MUST) is now available to all!

Read More

How can people endure market crashes and stay invested? That was a key question that Matthew Stuart-Box, Chief Investment Officer of MYTHEO, answered on BFM Radio's Ringgit and Sense.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in October 2022.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in September 2022.

Read More

MUST can provide portfolio security and stability via USD (US Dollar) cash, providing a more tolerable option in the face of the volatility that we are seeing.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in August 2022.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in July 2022.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in June 2022.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in May 2022.

Read More

The Collaboration, which is the First of its Kind, Aims to Make Investing Simpler and More Accessible.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in April 2022.

Read More

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in March 2022.

Read More

Uncertainty clouds the world’s economy as Russia's invasion of Ukraine shows no signs of slowing down.

Read More

Russia's invasion of Ukraine has shaken financial markets. For the time being, it seems better to be prepared for asset price volatility to increase.

Read More

Equities markets fell in February, down by 3.16% globally, as investors digesting the implications of Russia’s invasion of Ukraine.

Read More

EQUITY markets kicked off 2022 on a sloppy start as concerns over inflation, the tightening of monetary policies and tensions in the Eastern Europe weighed on sentiments in January.

Read More

THE inflationary fears and mutated Covid-19 variants that dominated the month of December did little to prevent the markets from rallying to a high to end the year 2021

THE economic turmoil triggered by a health crisis in 2020 was expected to be left behind us as we approached 2021 with much optimism of a recovery...

The Omicron variant of Covid-19 and fears over rising inflation spooked investors in November, which led to a massive sell-off in equities...

THE keynote address that you have just watched has gotten you all hyped up about the upcoming flagship smartphones by your favourite manufacturers.

INFLATION has been grabbing headlines in recent months. It is the three syllables that most common men on the street know about but at the same time, truly understanding it is pretty complex.

> Consumer prices in the United States (US) rose to its highest in 30 years for the month of October 2021. The consumer price index (CPI) recorded a rate of 6.2%, compared to the same period last year.

After cooling off in September, stocks surged to new highs in October as the Standard and Poor’s 500 (S&P 500) recorded its best month of the year.

MYTHEO’s entry into the environment, social and governance (ESG)space is rather timely as countries begin to rebuild their economies followingthe aftermath of Covid-19.

PETALING JAYA, 19th October 2021 – MYTHEO, one of the leading digital investment management platforms in Malaysia, has become the first in the country to launch a fully AI-based ESG-themed portfolio, known as the MYTHEO Global ESG.

THE term ESG has been gaining prominence in recent years, especially among the younger generations.

Broad equity indices in the United States were down across the board in September, stemming from the Chinese real estate contagion threat, despite the many positive headlines on the improving Covid-19 situation.

Back in June when China President Xi Jinping dropped a hint during a school visit, that tutors should not be doing things in place of teachers, nobody saw what was coming.

ONE of the many adages in the world of finance is that when China sneezes, the whole world catches a cold.

Major indices posted solid gains in August on the back of the reopening of the economy that has fueled a faster-than-expected recovery in corporate fundamentals and earnings.

The global equity market continued to trend higher in July 2021 despite a series of regulatory shocks that hit Chinese stocks inside and outside of China.

U.S. market hit an all-time high in June 2021, supported by the rally of large technology stocks. The S&P 500 climbed by 2.20%. Meanwhile, Nasdaq Index, a proxy to large-capitalization technology stocks in the U.S jumped by 6.34%.

What distinguishes a robo-advisor from other investment schemes is the automated operations running behind the scenes, utilizing algorithms and Artificial Intelligence (AI).

The Global equity market settled higher once again despite facing a significant bump in May.

US markets continued to ascend higher for the second consecutive month. In April 2021, the key US benchmarks, the S&P 500 Index and Nasdaq 100 Index, were up by 5.24% and 5.88%, respectively, which were the most significant monthly gains since November 2021.

Sometime in March 2021, a little-known family-run hedge fund became so infamous and grabbed global headlines.

In the recent weeks, the market has been a bit more challenging for investors. The financial market has turned more fragile and volatile than usual.

In most cases, individuals tend to start their investment journey in their 30s or 40s. Why?

March 2021 wrapped up with negative news all through out the month.

The market performance in February 2021 was almost exactly the same as that of in January. The equities started well into the month and rallied higher, only to be halted by a panic sell-off right at the month end due to triggers by the persistent rise in US Treasury yields.

A clash between hedge fund managers and retail investors in the GameStop trading frenzy gained so much attention in January 2021 and the market had a roller coaster ride in the final week of the month. Moreover, Asian equities continued to outperform United States (US) equities.

Although the market has been rising strongly since April 2020, the equity market still produced decent gains in December 2020. There was also plenty of good news, such as the implementation of the vaccination program and the finalization of the Brexit deal, that supported the market rally during the month.

There were comments relating to investments on the news and social media as a result of the US Presidential Elections.

After two months of consecutive losses, global equity markets recovered spectacularly. Adding to the bullish sentiment was a series of positive news on the development of COVID-19 vaccines.

Global equities declined for the second consecutive month in October. Rising new COVID-19 cases in the US and Europe was the primary reason for a selldown. Also, investors avoided risky assets on the backdrop of political uncertainty ahead of the US presidential election and the failed negotiation over Brexit.

In light of the questions that we have received about ETFs, we aim to cover the basics and provide investors with an overview on ETFs in this article.

Read More

The United States of America, or the US, is the world’s largest economy and the most influential country in the world. Therefore, the US Presidential election is the most-watched event globally.

Read More