14 November 2025

Written by Amirudin Hamid, Chief Investment Officer of GAX MD

Key Takeaways

- Strong earnings and rising capital expenditure in AI and cloud infrastructure continue to power global equity performance, reaffirming that the rally in big technology stocks is backed by fundamental growth.

- The US–China trade truce has significantly reduced immediate trade related uncertainty, supporting market stability and improving risk sentiment globally.

- The rapid expansion of AI data centers is fueling massive global demand for renewable energy, opening powerful new opportunities for thematic investments in clean and sustainable technologies.

- A surge in Asian markets, particularly Japan and South Korea, delivered historic monthly equity gains, signalling that AI driven investor enthusiasm has now move beyond the US market.

- The US and China trade truce has significantly reduced immediate trade related uncertainty, supported market stability and improved risk sentiment globally.

- Massive power demands from AI data centres are accelerating a rotation into renewable energy, propelling key clean energy stocks up over 30% Year to Date.

October delivered a compelling global performance story, affirming that the multiyear uptrend is not just intact but accelerating, fuelled by breakthroughs in technology and key policy de-risking. Global equity markets extended their winning streak, with the S&P 500 Index rising 2.27%, while the Nasdaq Composite Index broke through the 23,000 level for the first time after gaining 4.70%. Once again, large technology companies led the charge, driven by strong earnings results and easing geopolitical tensions.Interestingly, the spotlight in October shifted away from the United States to Asia, where Japan and South Korea delivered remarkable performances. Japan’s Nikkei 225 surged 16.64%, its biggest monthly gain in more than three decades, following the election of Sanae Takaichi as the new leader of the ruling party and Japan’s first female prime minister. In South Korea, the Kospi Index soared 19.94% after Nvidia CEO Jensen Huang’s visit and subsequent partnership announcement with the South Korean government to expand the nation’s AI infrastructure.

Key AI related shares in both countries delivered mega gains; for instance, SoftBank, Japan’s major technology investment group, jumped nearly 45%, while SK Hynix, one of the world’s largest memory chipmakers, surged more than 60% in just one month. These extraordinary gains reflect how enthusiasm surrounding Artificial Intelligence has now gone beyond Silicon Valley, transforming Asia into another epicenter of innovation and investor optimism.

Positive Earnings Reports Drive Market Performance

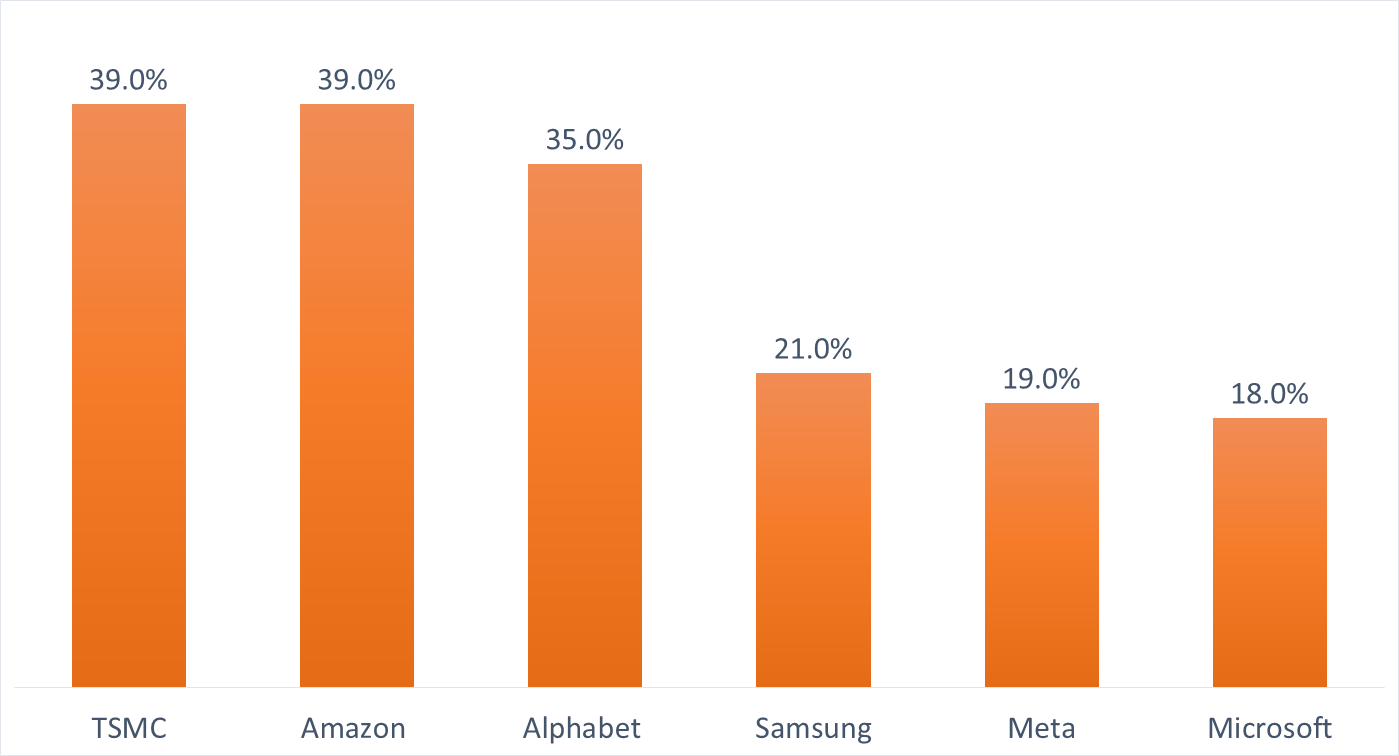

The October earnings season provided irrefutable evidence: the AI boom is translating directly into exceptional financial performance across the technology sector. Technology giants such as Taiwan Semiconductor Manufacturing Co (TSMC) reported robust results during their quarterly reporting. TSMC, which serves as one of the best proxies for the AI boom, reported a record breaking 39.1% surge in third quarter profit on the back of 30% revenue growth.

Other US leading technology companies, including Microsoft, Alphabet, Meta, Amazon, and Samsung Electronics, also reported strong financial numbers in October, with profit growth ranging from 18% to 39%. The substantial growth across these technology leaders clearly justifies the rally in the technology sectors.

Net profit growth of leading technology companies that announced financial results in October 2025.

Note: Meta earnings are based on adjusted number following one-off tax charge

Source: Companies report, Compiled by GAX MD Sdn Bhd, November 2025

More importantly, most of these companies also raised their capital expenditure forecasts, signaling that elevated growth will continue through 2026. This sentiment was echoed by AMD CEO Lisa Su, who projected that the total addressable market for AI data centers could increase to US$1 trillion over the next five years during AMD's Financial Analyst Day in New York on 11 November 2025.

Investors Rotate into Renewable Energy.

The AI boom is no longer confined solely to software or chips. The massive, non-stop infrastructure buildout by AI players is creating an unprecedented incremental demand for electricity, effectively transforming power consumption into a core investment theme. This trend has naturally prompted investors to turn their attention toward the Renewable Energy sector.

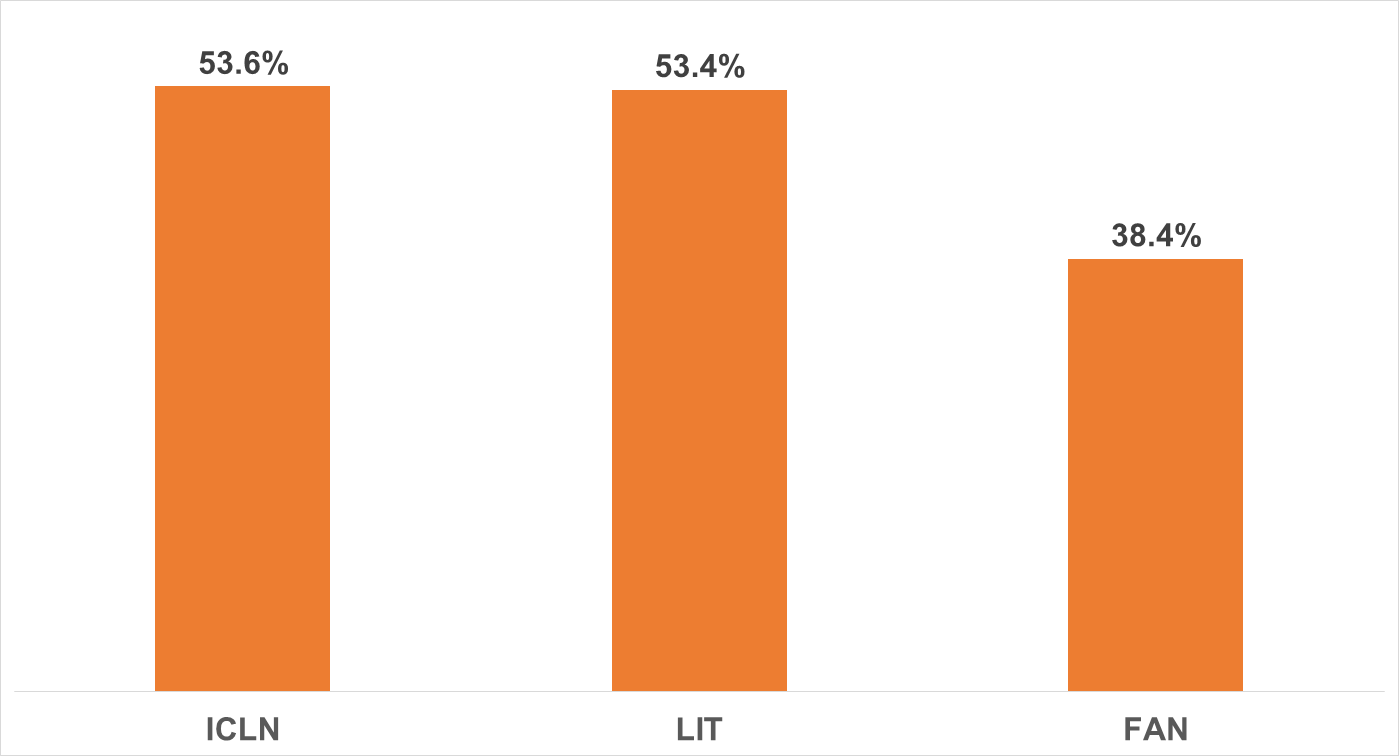

As a direct result, Exchange Traded Funds (ETFs) such as ICLN (Clean Energy), LIT (Battery and Lithium), and FAN (Wind Energy)—all held across MYTHEO Inflation Hedge and Essential portfolios—recorded solid gains in October and are already up over 30% year to date. According to Refinitiv data, alternative energy funds have attracted inflows in three of the past four months, marking a sharp reversal after more than two years of outflows. This reflects growing investor conviction that renewable energy stands to benefit directly from the accelerating expansion of AI infrastructure and the rising need for sustainable power sources.

Performance of Clean Energy (ICLN), Lithium & Battery (LIT) and Wind Energy (FAN) year-to-date up to 31 October 2025.

Source: GAX MD, November 2025

US–China Trade Truce Creates Market Clarity

A significant geopolitical de-risking event occurred in October when the US and China agreed to a one -year trade truce. This marked a meaningful pause in years of tariff driven uncertainty that had weighed on global trade sentiment.

Under the agreement, China postponed new export controls on rare earth elements and committed to increasing purchases of American soybeans. In return, the United States reduced selected tariffs and suspended new investigations into China’s shipbuilding industry. This deal helped remove the immediate threat of broad based tariffs and eased tensions between the world’s two largest economies. While deeper structural disagreements are unlikely to disappear entirely, the truce has reduced the "fear premium" that had constrained markets. As a result, investors are now shifting their focus back to company earnings and underlying fundamentals.

Markets Outpace Economic Forecasts

In October, the International Monetary Fund (IMF) released its latest World Economic Outlook (WEO), projecting global growth to slow modestly from 3.3% in 2024 to 3.1% by 2026. This was an upgrade from the previous forecast, reflecting improving sentiment and greater resilience in global economic conditions.

The IMF’s shifting projections also highlight the difficulty of accurately predicting economic trends. Earlier this year, the organization warned of potential growth dropping to 2.8% amid escalating tariff fears, only to revise the forecast upwards twice by October. This pattern powerfully illustrates why markets are forward looking engines, often moving well ahead of official economic projections. The S&P 500 Index bottomed on April 8, just weeks before the IMF’s initial gloomy outlook, which was published on April 22, and went on to rally for six consecutive months through October.

This is why MYTHEO’s investment approach focuses on dynamic, data-driven asset allocation rather than relying on delayed macroeconomic forecasts. Our algorithms continuously assess volatility, and momentum across global asset classes, enabling our portfolios to respond quickly to changing market conditions instead of reacting to backwards-looking economic data.

Separately, the Federal Reserve’s decision to cut interest rates by 25 basis points in October was largely in line with expectations and had little effect on market sentiment. A similar reaction is likely when the Fed meets again in December. The only meaningful surprise would come if the central bank decided not to cut rates, which could trigger a short-term pullback. Meanwhile, the ongoing US government shutdown, now the longest in history, has had minimal impact on financial markets, as investors continue to view such political standstills as temporary noise rather than fundamental risks.

US Politics and Policy Stability

Recent developments in US politics offer early insights into the landscape ahead of the mid-term elections. The conclusion of the New York Mayoral race, while locally focused, indicated a potential shift in voter sentiment away from the current administration., suggesting that popular support for the ruling Republican party may be waning among the US voters. This serves as a reference point for the broader mid-term elections, which are less than 12 months away.

We foresee that a loss by the Republican party of either the Senate or the House of Representatives in the 2026 mid term election could introduce significant difficulties for President Trump in implementing his policy agenda. That scenario, however, may be favorable for investors, as it could result in a reduced risk premium in the US market, given that Trump's policies have historically been disruptive and volatile. Sectors that were previously hit, such as clean energy and those related to global trade, stand to benefit the most from policy stabilization.

Conclusion: The Path Forward

October highlighted two defining themes in today’s global markets. First, artificial intelligence (AI) remains the primary driver of innovation, capital spending, and productivity growth, propelling both AI sectors and their supporting industries. Second, a return to policy clarity, catalysed by the easing of US-China trade tensions and the conclusion of the longest US government shutdown in history on 12 November after 43 days, has allowed earnings and fundamentals to once again guide market direction.

Looking ahead, we foresee that AI will continue to drive market and portfolio performance, as AI investment is still in its early stages. Massive investments in new data centres and cloud infrastructure are expected to support sustained revenue growth for AI companies and related sectors, such as renewable energy, for many years to come. Additionally, there have been growing talks that OpenAI may pursue an initial public offering (IPO) at a US$1 trillion valuation. Given that OpenAI recently signed a US$300 billion, five-year agreement with Oracle, equivalent to about US$60 billion per year, and has raised a cumulative US$48.97 billion as of end-October, a major IPO at such a valuation would be well aligned with its funding needs. Such a large listing could further boost investor interest across the AI and related sectors.

At MYTHEO, our portfolios are strategically diversified across asset classes and geographical regions, enabling us to capture opportunities from a variety of market scenarios. Through our Growth, ESG, and MYTHEO Izdihar portfolios, investors gain broad exposure to global markets. As seen in October, these portfolios continued to benefit from the strong performance driven by the AI rally, particularly the surge in Asian technology markets. Meanwhile, our Inflation Hedge and Essential portfolios provide exposure to renewable energy themes through holdings such as ICLN (Clean Energy), LIT (EV Battery and Lithium), and FAN (Wind Energy). Together, MYTHEO’s portfolios enable investors to benefit from multiple growth stories, from the ongoing AI revolution to the rising interest in renewable energy and position themselves effectively for any emerging themes in the future.

Discover how MYTHEO can enhance your portfolio diversification today and embark on your financial journey with confidence. Take the first step towards your financial goals now.

This material is subject to MYTHEO’s Notice and Disclaimer.