Monday, 14 August 2023

From the Desk of the Portfolio Managers at MYTHEO

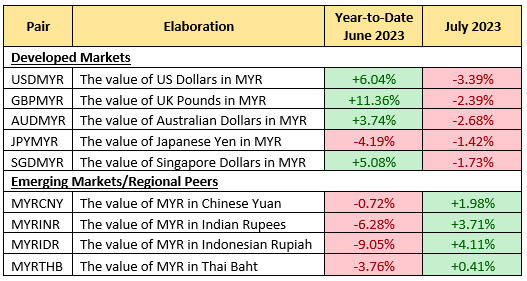

In the month of July, the Malaysian Ringgit (MYR) has seen some strengthening against many currency pairings such as the US Dollar (USD), and in many cases, it has been the strongest showing since the start of the year on a monthly basis, with an exception being Japan. The Japanese Yen (JPY) is one of the more volatile currencies with significant weakness in recent times under a policy of zero-bound interest rates and import dependency for food and energy.

Source: GAX MD Sdn Bhd, August 2023.

While a stronger MYR may be cause for celebration especially with regards to Malaysian buying power, for instance with the cheaper cost of goods for local importers, or for locally-based Malaysians traveling abroad be it for tourism or studies, this also results in the decrease of returns for investments denominated in currencies other than MYR of which includes the MYTHEO portfolios that flip to the red in the month due to holdings in USD terms.

What Contributes to Currency Strength?

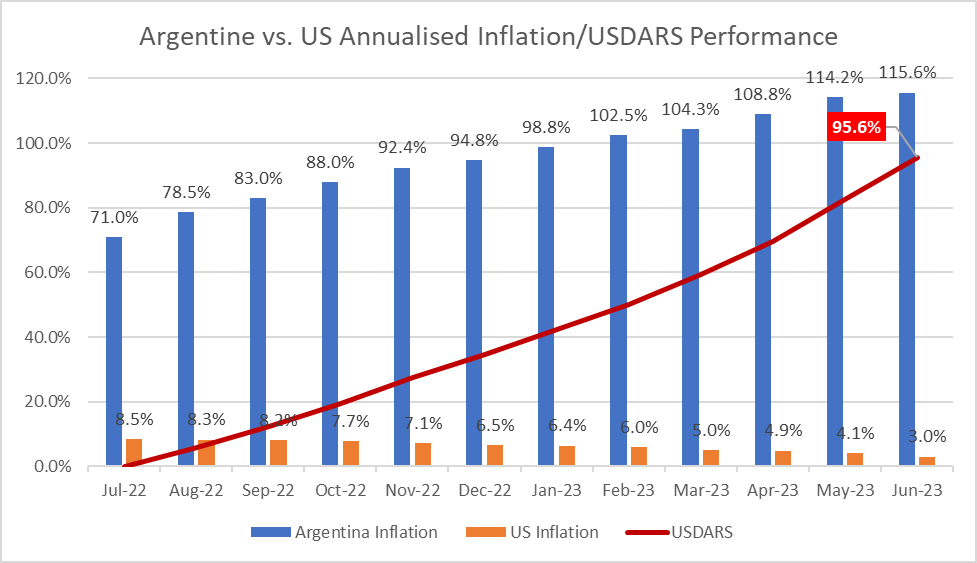

Let’s get some understanding on some things that may cause currencies (unpegged currencies in particular) to fluctuate in value. The first of which is the difference in inflation rate, whereby a country with a higher inflation rate compared to its peers will lead to its relative devaluation. An example would be Argentina and its annual inflation rate that has gone from 71.0% in July 2022 to 115.6% in June 2023 and compare it to the US’s 8.5% and 3.0% respectively: 1 USD that fetched 131.26 Argentinian Pesos (ARS) in the former date would get you ARS256.70 by the latter date resulting in a 95.6% appreciation in USD strength (or a full 48.9% depreciation in ARS strength).

Source: GAX MD Sdn Bhd, August 2023.

Interest rates also play a factor in currency valuation. Investors in a low interest rate country may choose to pour funds into a foreign country with better central bank policy rates to enjoy better returns which in turn creates demand for that currency. A more sophisticated example is the carry trade whereby traders borrow from a country, say Malaysia (Overnight Policy Rate currently at 3.0%) and make the differential from investing in a fixed income instrument in the US (Federal Funds Target Rate at 5.25%-5.50%), giving around 2.0% and indirectly increasing demand for USD but exposing them to currency risk.

This inflow of funds from foreign countries that could boost currencies could also be into other investments. While the prospect of exchange rate losses inflicted by currency depreciation may deter foreign investors, currency weakness also presents opportunities for foreign investors to enter the market provided that there is sufficient currency stability. In tandem with the strong MYR performance in July 2023, it just so happened that a twelve-week foreign funds outflows streak from the Malaysian equity markets was reversed into a three-week consecutive inflow in July (now at a fourth week as of August 7, 2023) as reported by Malaysian Industrial Development Finance Berhad (MIDF).

Of course, there are many other factors in play, such as current account balances, central bank controls (independent or otherwise) and other fiscal-related aspects. For instance, net exports have an inverse correlation of the strength of the domestic currency. A stronger currency can reduce exports competitiveness while making imports cheaper which can cause the trade deficit to widen further. Eventually the weakening of currencies will take place in a self-adjusting mechanism. Political stability also contributes to economic stability through consistent policy although this is also contingent on competent governance.

One example is the aforementioned Argentina, which has had successive governments employing different policies, while scenes such as having three economy ministers in four weeks last summer add to the chaos. In addition, the country is also saddled with massive debts that led to multiple defaults and restructurings while rampant inflation led to a cycle of massive spending as goods become more valuable than the money. The rigid capital controls also contributed to a rise in black market exchanges that weakened central bank control.

Global Diversification as Part of the MYTHEO Portfolios and What Does It Mean for You?

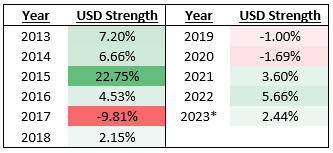

As mentioned before, the MYTHEO portfolios have experienced a negative impact on relative currency performance this month. However, one aspect of our investment lies in the form of investment in different asset classes globally (outside of Malaysia) and hence a currency diversification away from MYR too. Looking at the table below, you can see how this would have played a factor in contributing to the attractiveness of a USD portfolio against the MYR over the past 10 years.

Asterisk(*) denotes year-to-date up to end-July 2023. Source: GAX MD Sdn Bhd, August 2023.

Part of this is due to the combination of the 1MDB scandal that was revealed in 2015, where massive amounts of hidden debt and missing funds were uncovered, as well as decreasing petroleum revenue due to the oil glut in the 2010s that saw the price of oil plummet with WTI Oil Futures dropping from USD98.42/bbl in end-2013 to just about USD37.04/bbl by end-2015.

We would like to stress that investments in MYTHEO allow for diversification away from local market impacts but at the same time may also expose the investor to, in this case, US market movements which in part affect USD valuation, in addition to global economic and geopolitical challenges. Currency risk is part of the risk of investing in overseas assets, and it is not the objective of MYTHEO to speculate in the currency market in the course of diversification into global assets overseas that have good risk-adjusted returns in the long term.

Also, while hedging can be carried out to protect investors from risks arising from inflation, interest rate changes and currency exchange rate fluctuation, this can become a complex process that – even when done well – could very well offset the potential overall gain of assets due to the high costs involved. As such, MYTHEO does not carry out any currency hedging.

We hope that this article will keep the public well informed on MYTHEO’s investment rationale, as well as for your own benefit in your investments overseas.

This material is subjected to MYTHEO's Notice and Disclaimer.