Friday, 11 January 2023

Written by Sonia Tan, Portfolio Manager of GAX MD

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in December 2022.

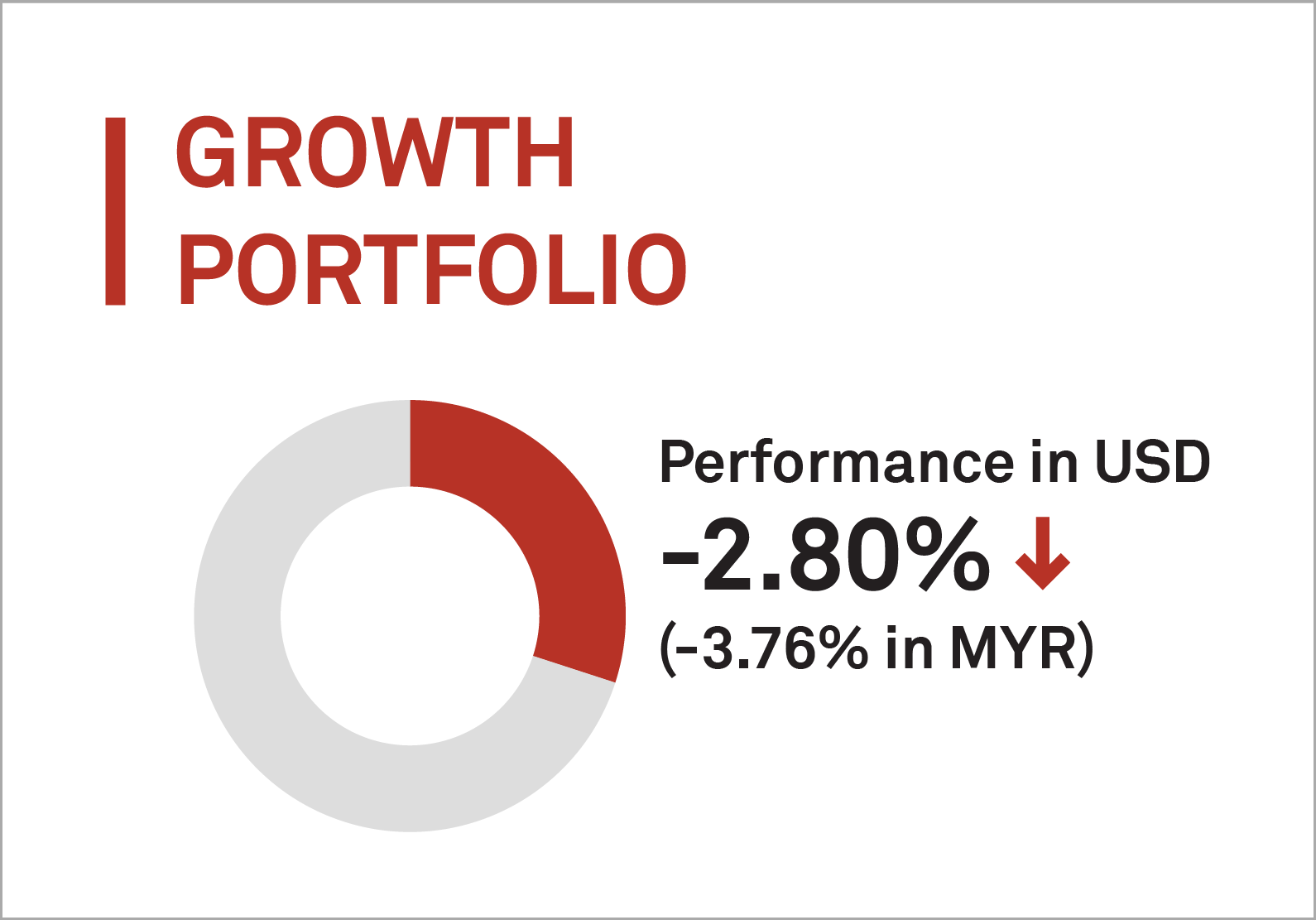

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down -2.80% (-3.76% in MYR) in December 2022.

U.S stocks market closed out 2022 lower, capping a year of sharp losses driven by aggressive interest rate hikes to curb inflation, recession fears, the Russia-Ukraine war, and rising concerns over Covid cases in China.

The three main indexes registered solid losses on a yearly basis. The S&P 500 benchmark has shed 19.4% to 3839.50 points this year, the tech-heavy Nasdaq has lost 33.1% to 10,466.5 points and the Dow Jones Industrial Average has fallen 8.9% to 33,147.30 points.

Top 3 ETFs (Growth portfolio)

ISHARES MSCI HONG KONG ETF (EWH)

ISHARES CHINA LARGE-CAP ETF (FXI)

ISHARES MSCI SINGAPORE (EWS)

5.00%

0.50%

-2.13%

Bottom 3 ETFs (Growth portfolio)

INVESCO QQQ TRUST (QQQ)

ISHARES MSCI MEXICO (EWW)

INVESCO S&P 500 PURE GROWTH (RPG)

-9.23%

-8.26%

-7.59%

Source: GAXMD Sdn Bhd, data in USD term for the month of December 2022.

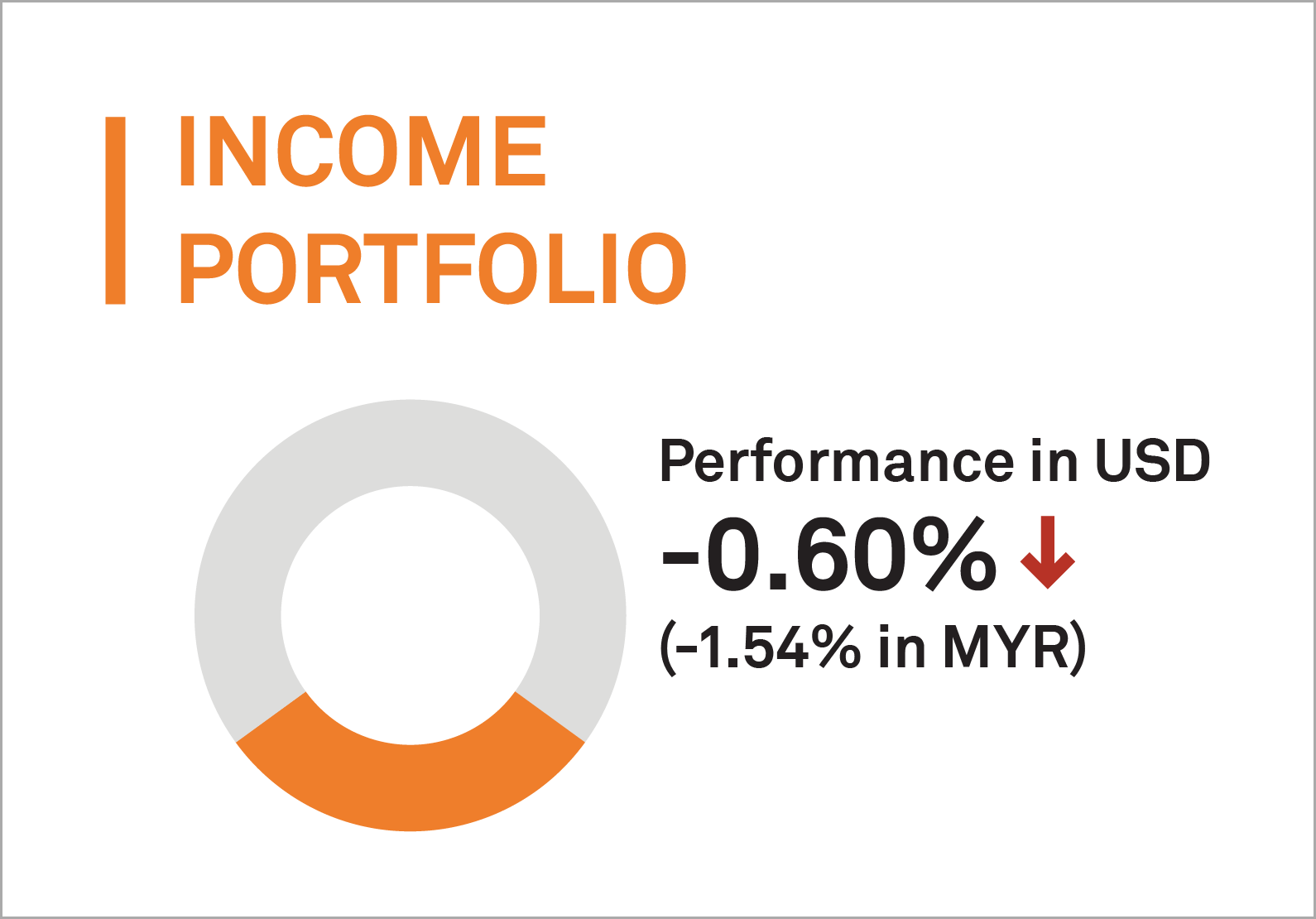

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a return -0.6% (-1.54% in MYR) in December 2022.

Treasury yields edged higher on the last trading day as traders wrapped up a brutal 2022 for bond investing and assessed the potential headwinds the market could face in the new year.

The yield on the benchmark 10 Year US Treasuries note rose about 4 basis points to 3.88%, while the policy-sensitive 2-year treasury yield rose roughly 6 basis points to 4.43%.

Meanwhile, Consumer Price Index (CPI) eased for a fifth straight month to 7.1% in November 2022, the lowest since December 2021 and below market expectations of 7.3%. Still, the latest reading remained well above the US federal Reserve 2% target.

Top 3 ETFs (Income portfolio)

VANECK JP MORGAN EM LOCAL CURRENCY BOND (EMLC)

ISHARES 1- 5 YEARS INVESTMENT GRADE CORPORATE BOND (IGSB)

ISHARES 3-7 YEAR TREASURY BONDS (IEI)

-0.04%

-0.36%

-0.88%

Bottom 3 ETFs (Income portfolio)

SPDR BLOOMBERG SHORT-TERM HIGH YIELD BOND (SJNK)

ISHARES IBOXX HIGH YIELD CORPORATE BOND (HYG)

ISHARES 20+ YEAR TREASURY BOND (TLT)

-2.38%

-2.68%

-3.09%

Source: GAXMD Sdn Bhd, data in USD term for the month of December 2022.

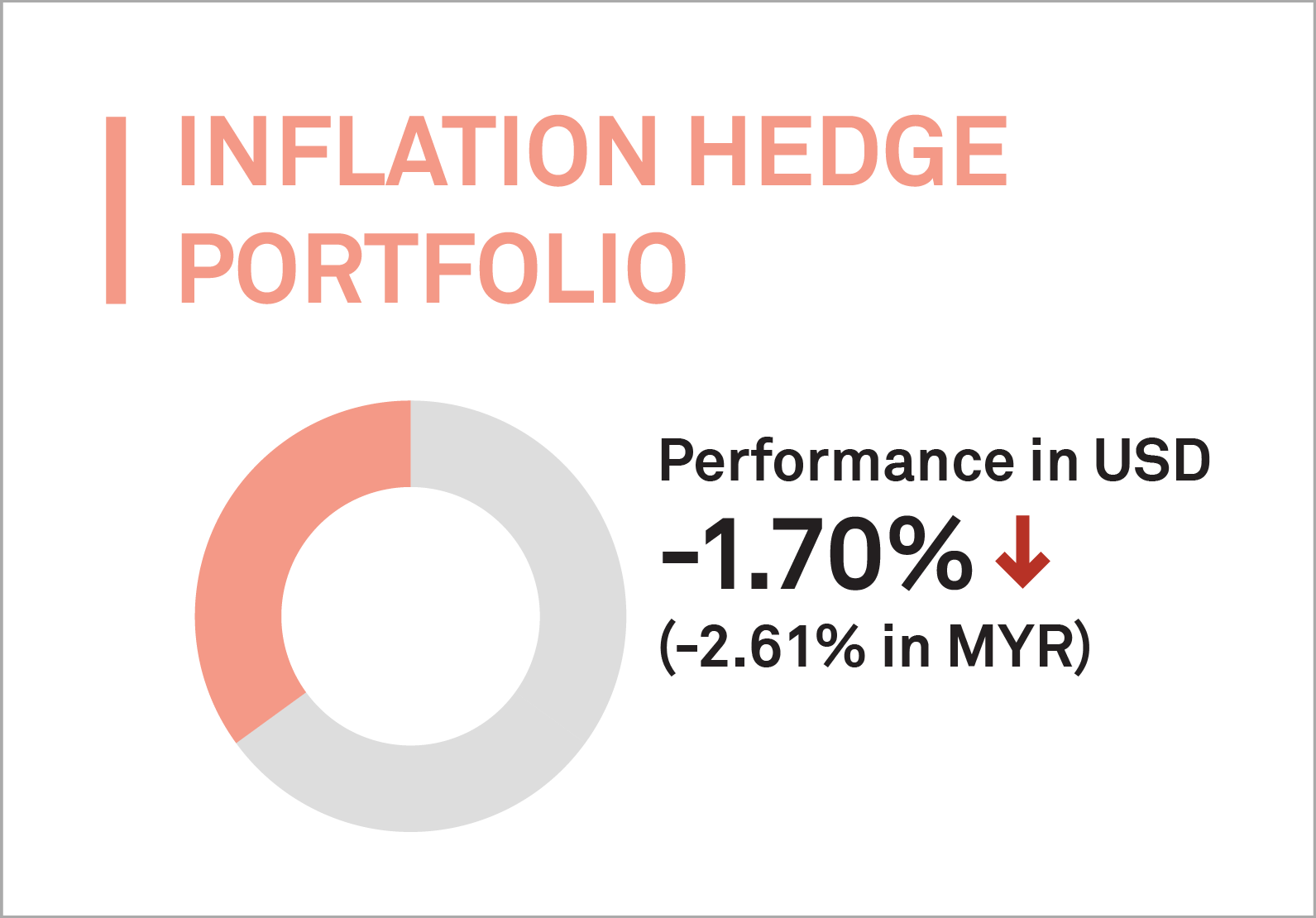

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio saw a negative return in December 2022, down by -1.7% (-2.61% in MYR).

Oil prices declined nearly 1% to $85.91 per barrel in December on an uncertain demand outlook as more countries considered restrictions on Chinese travelers with Covid-19 infections spreading in the top oil-importing nation. China’s government is dismantling pandemic restrictions, yet a surge in infections there is prompting tougher travel rules on Chinese visitors in some countries.

U.S West Texas Intermediate Crude Oil (WTI) was 1% lower at $80.47 per barrel. WTI traded as high as $123.70 back in March 2022, a 14 year high, but is now off nearly 35% since then. Oil is up 7.15% year-to-date.

Gold prices rose as much as 4% in December and climbed above the key $1,800 per ounce pivot, after hitting a six-months high of $1,833 in the previous session, weighed down by an uptick in the dollar and surging treasury yields.

Top 3 ETFs (Inflation hedge portfolio)

ISHARES GOLD TRUST (IAU)

SPDR DOW JONES INTERNATIONAL REAL ESTATE (RWX)

ISHARES TIPS BOND ETF (TIP)

2.95%

-0.41%

-1.75%

Bottom 3 ETFs (Inflation hedge portfolio)

ISHARES US REAL ESTATE ETF (IYR)

ISHARES GLOBAL CLEAN ENERGY (ICLN)

ISHARES MORTGAGE REAL ESTATE (REM)

-5.58%

-6.19%

-11.05%

Source: GAXMD Sdn Bhd, data in USD term for the month of December 2022.

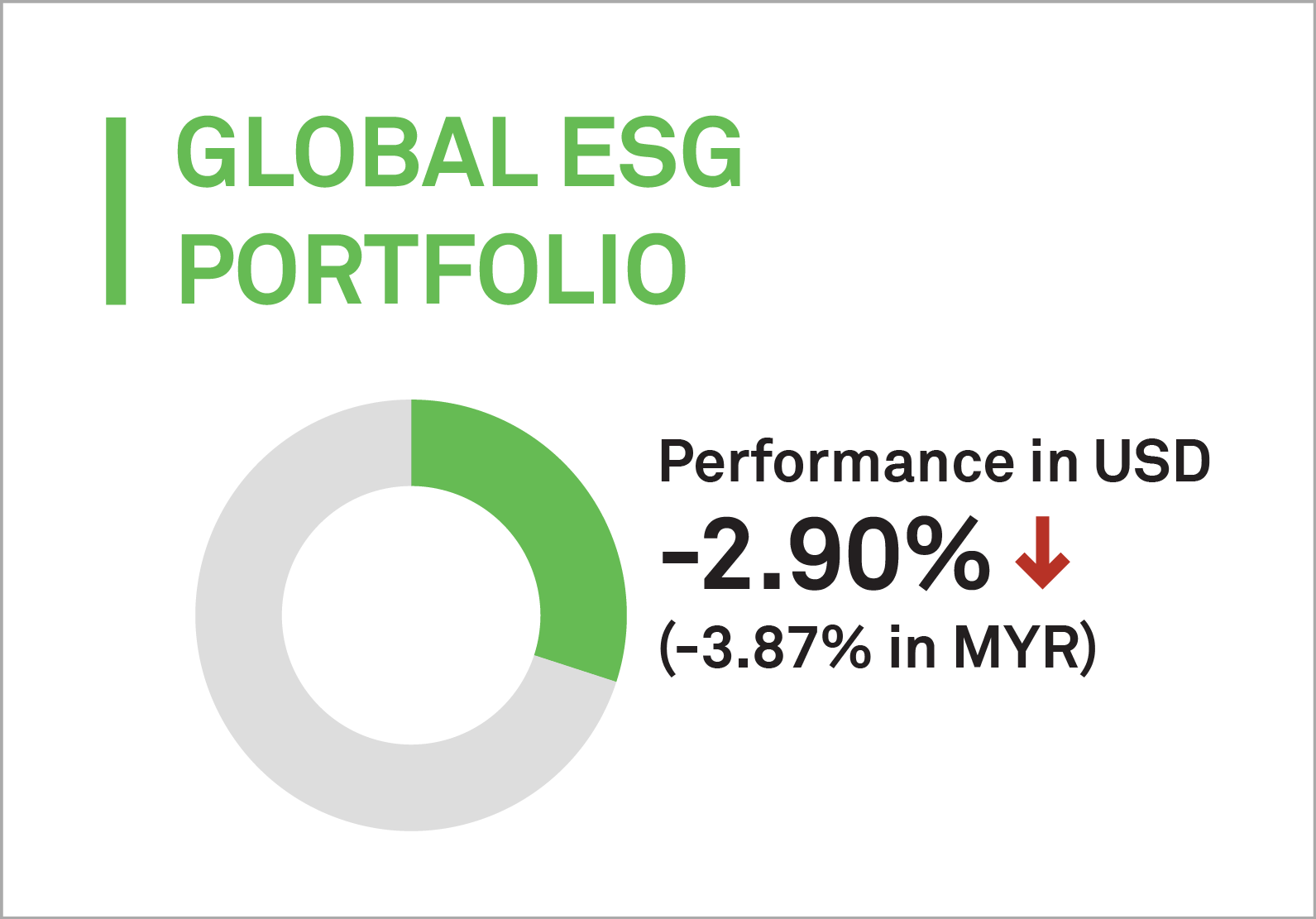

4. Global ESG Portfolio

Similar to the Growth Portfolio, MYTHEO’s Global ESG portfolio was up by -2.90% (-3.87% in MYR)

Top 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EAFE (ESGD)

ISHARES ESG AWARE MSCI EM (ESGE)

NUVEEN ESG LARGE-CAP VALUE (NULV)

-2.32%

-4.72%

-6.19%

Bottom 3 ETFs (Global ESG portfolio)

ISHARES MSCI USA ESG SELECT (SUSA)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

-6.31%

-6.38%

-6.96%

Source: GAXMD Sdn Bhd, data in USD term for the month of December 2022.

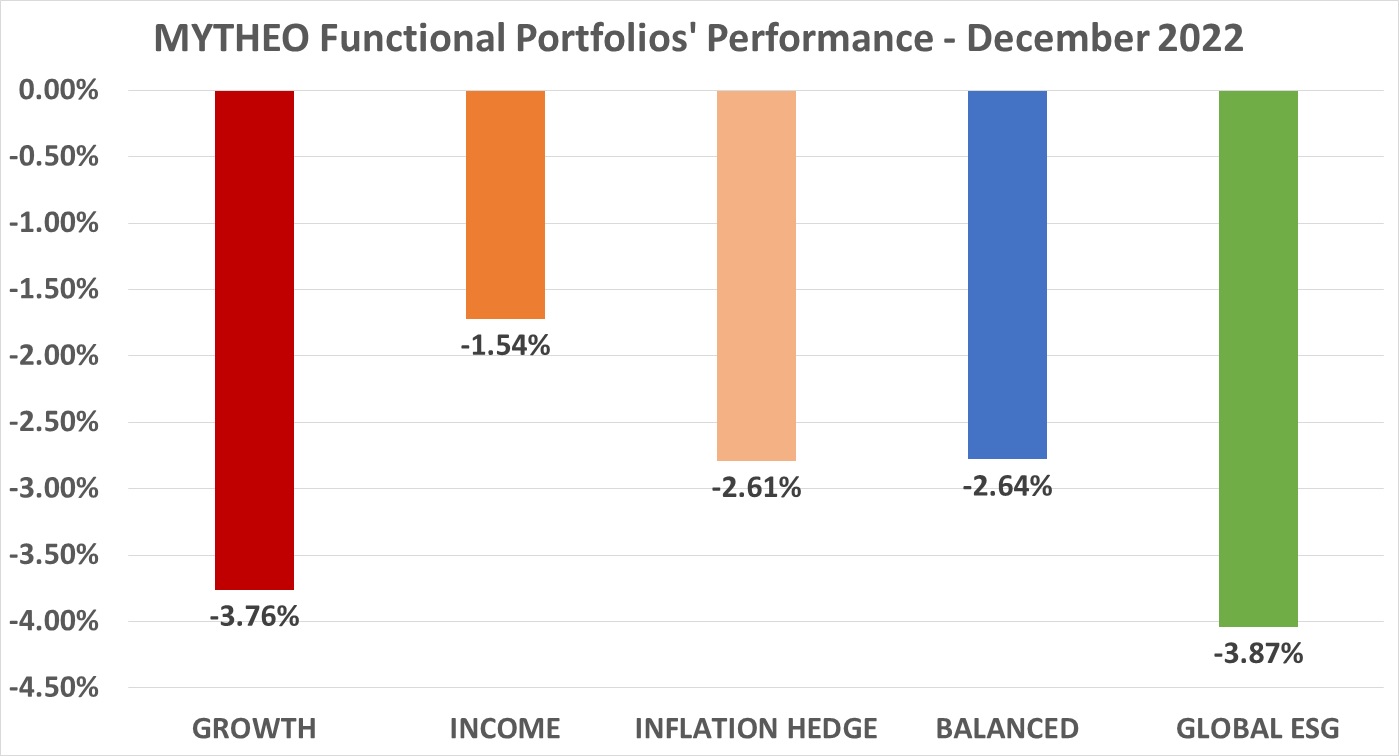

Chart 1: December 2022 - Portfolio Cumulative Rate of Return in % (MYR)

Balanced allocation consists of 40% Growth, 40% Income and 20% Inflation Hedge.

Source: GAX MD Sdn Bhd, January 2023

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weighted return from the allocation to each functional portfolio.

For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is -2.64% [(40% x -3.76%) + (40% x -1.54%) + (20% x -2.61%)]

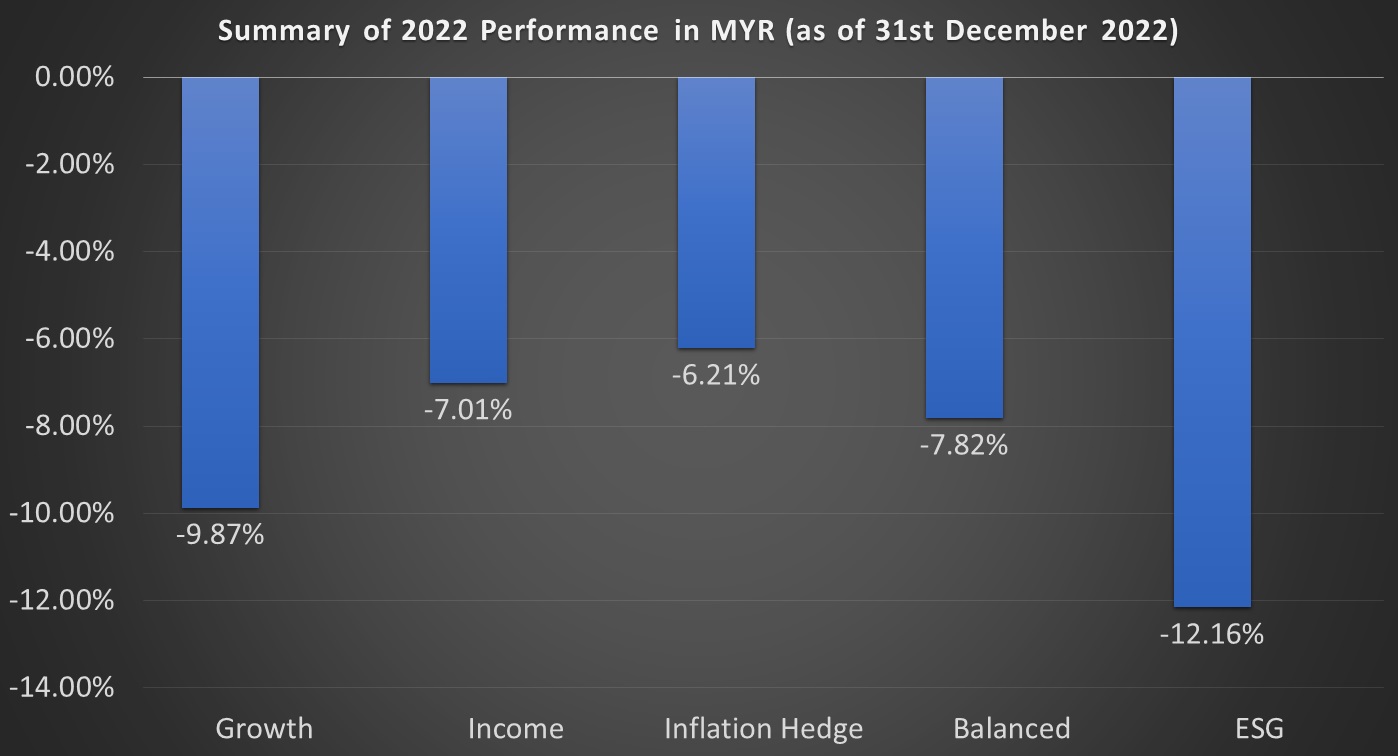

Chart 2: Summary of 2022 Performance in MYR (as of 31st December 2022)

Source: GAX MD Sdn Bhd, January 2023

Note: Past performance is not an indication of future performance

Chart 2 above shows the cumulative performance of the functional portfolios since the beginning of 2022. The Growth portfolio registered a negative return of 9.87%, the Income portfolio was down by 7.01%, the Inflation Hedge portfolio dropped by 6.21% and ESG portfolio registered a negative return of 12.16%.

*Please note that this is the cumulative performance based on model portfolios as of December 2022. Your portfolio performance may differ from the model portfolio as it is subject to any deposits and/or withdrawals, as well as asset allocations made during the month.

Our Thoughts

Malaysia Ringgit appreciated against the US dollar in December by 0.97% to RM4.400 (as at 31st Dec 2022), compared to RM4.4430 on 30th Nov 2022. This has a slight negative impact on the performance of the portfolios in ringgit terms due to the depreciation of the US dollar.

Financial markets in 2022 left investors with unusually few places to hide, with stocks and bonds both down for only the fourth time in the last 150 years. The experience raises the risk of investors falling prey to the recency bias and extrapolating recent trends into the future. However, history suggests that an unusually bad year for investors is rarely, if ever, followed by yet another poor year.

In terms of absolute returns, all 3 MYTHEO functional portfolios are in negative territory for 2022, and while negative absolute returns can never be a “good” result, it is unrealistic to expect returns to be positive every year. In fact, since inception returns remain strong.

The relatively small size of the drawdowns (around 8%) was well within the normal range of expectations and shows the value of diversifying across regions and across asset classes.

The uniqueness of MYTHEO’s algorithms in combination with the high-quality ETFs selected by our process for our investment universe worked well during this period.

That said, we expect the economic growth backdrop to remain challenging in 2023. One of the fastest Fed interest rate hiking cycles on record makes a US economic recession very likely. We also expect a recession in Europe due to the energy price shock. An economic slowdown should help inflation cool significantly, but not all the way back to 2%. We expect growth in China to be the exception as a gradual removal of mobility restrictions and a policy focus on growth stabilisation will improve consumer and business sentiments.

Against this backdrop, we believe staying invested, keeping smartly diversified, and not trying to time the market will best serve investors from here.

MYTHEO’s Omakase portfolio combines Growth, Income and Inflation Hedge functional portfolios based on your goals. It offers intelligent global diversification to protect against extreme fluctuations in any single asset class by diversifying your portfolio into multiple asset classes which offer a better cushion from the volatility in the equity market.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.