Monday, 11 March 2024

Written by MYTHEO

Breaking down our performance for each portfolio - A concise guide revealing insights for your investment journey. Decode wealth growth and chart your course with confidence.

Key Takeaways

- 📈The Growth Portfolio rode on the current momentum of bullishness, particularly with regards to the US and AI-related counters.

- 💰The Income Portfolio continued to be pressured by the higher-for-longer rate environment, while the Inflation Hedge Portfolio pulled ahead slightly due to some recovery in US real estate.

- Expectations on the ground appear to suggest no rate movements by the Federal Reserve on the upcoming FOMC meeting.

- 💎Lithium-related companies were supported by higher lithium commodity prices and higher sales volumes expectation, which may have helped pull rare-earth metals related companies higher on related battery production (in addition to the AI theme).

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in February 2024.

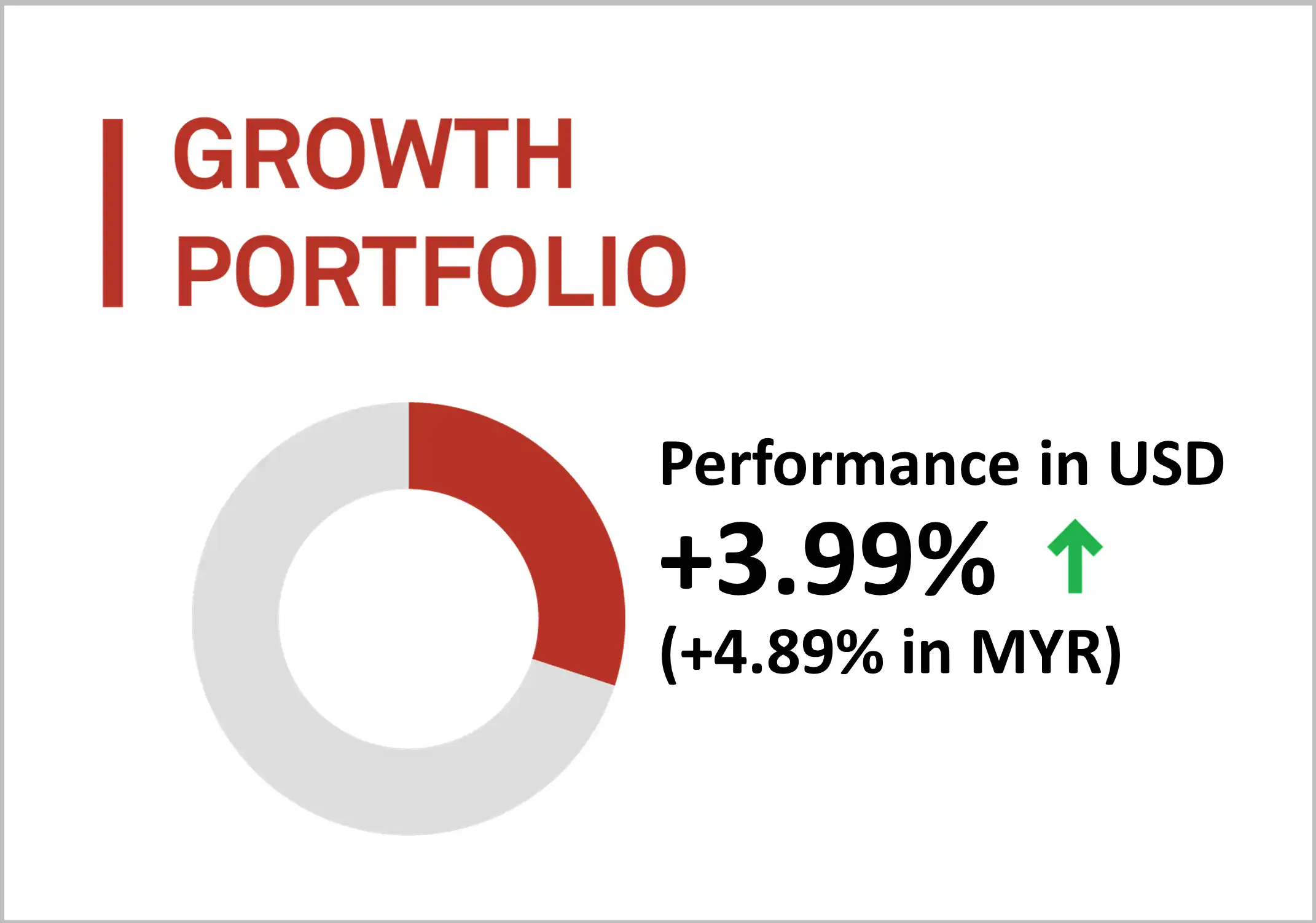

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 3.99% (up 4.89% in MYR) in February 2024.

For the month of February 2024, the portfolio did not shift by much and the US market remains as our largest investment exposure.

The portfolio’s allocation to the Nasdaq 100 ETF (about 17%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE GROWTH (RPG)

SPDR EURO STOXX 50 (FEZ)

INVESCO NASDAQ 100 ETF (QQQM)

+8.06%

+5.98%

+5.29%

Bottom 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE VALUE (RPV)

ISHARES MSCI CANADA (EWC)

ISHARES MSCI UNITED KINGDOM (EWU)

+2.18%

+1.16%

+0.99%

Source: GAX MD Sdn Bhd, data in USD term for the month of February 2024.

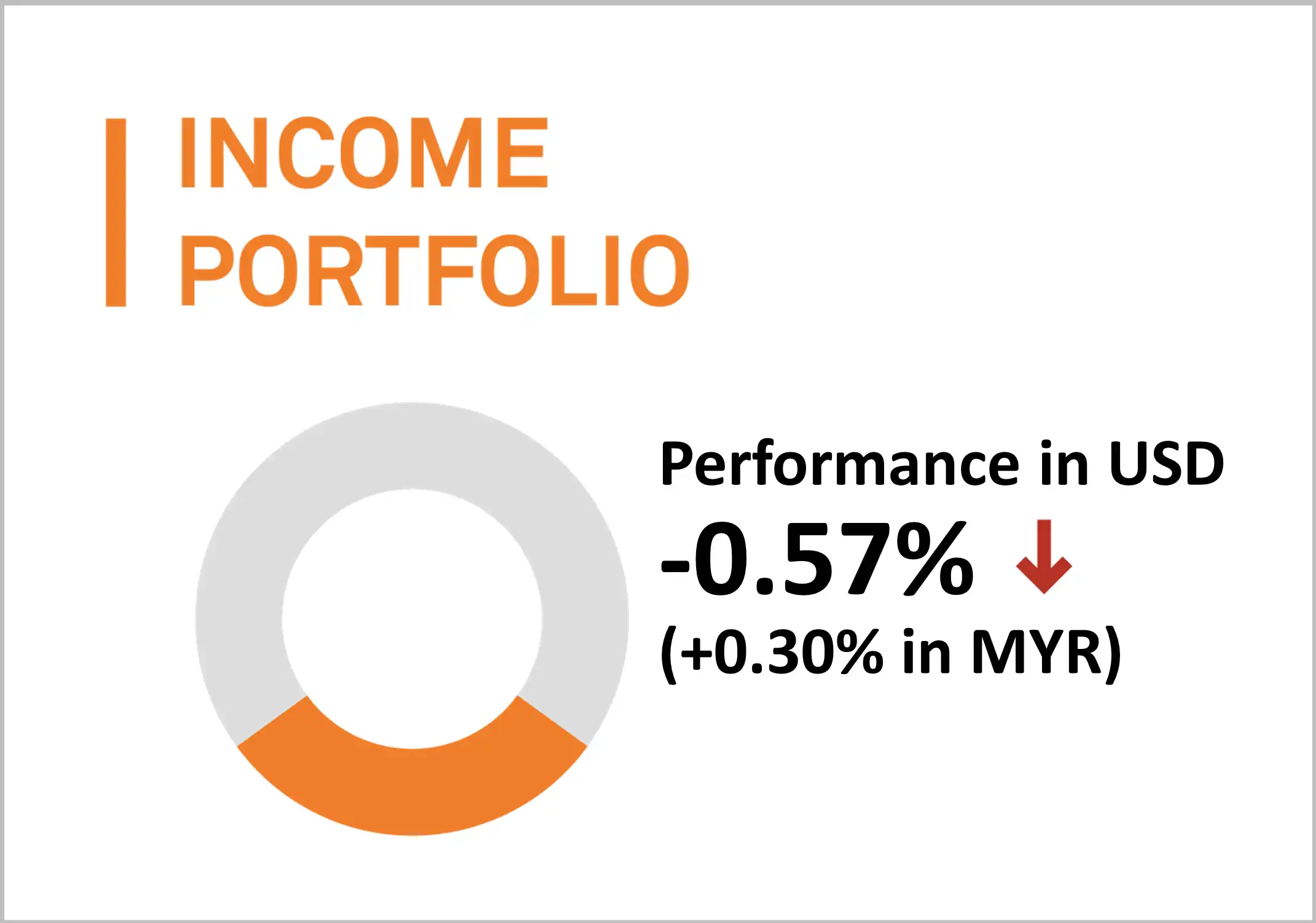

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a loss of 0.57% (up by 0.30% in MYR) in February 2024.

For the month of February 2024, the income portfolio continued to hold significant levels of short-term duration corporate bonds and treasury bonds that balanced out longer-term US Treasury holdings. The current yield-to-maturity of the bond ETFs in the portfolio (excluding preferred stock) is around 5.59%.

The portfolio’s exposure to senior loan ETF (about 10%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Income portfolio)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

ISHARES US PREFERRED STOCK (PFF)

ISHARES FLOATING RATE BONDS (FLOT)

+0.96%

+0.93%

+0.75%

Bottom 3 ETFs performance (Income portfolio)

ISHARES 3-7 YEAR TREASURY BONDS (IEI)

ISHARES IBOXX INVESTMENT GRADE (LQD)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

-1.38%

-1.93%

-2.25%

Source: GAX MD Sdn Bhd, data in USD term for the month of February 2024.

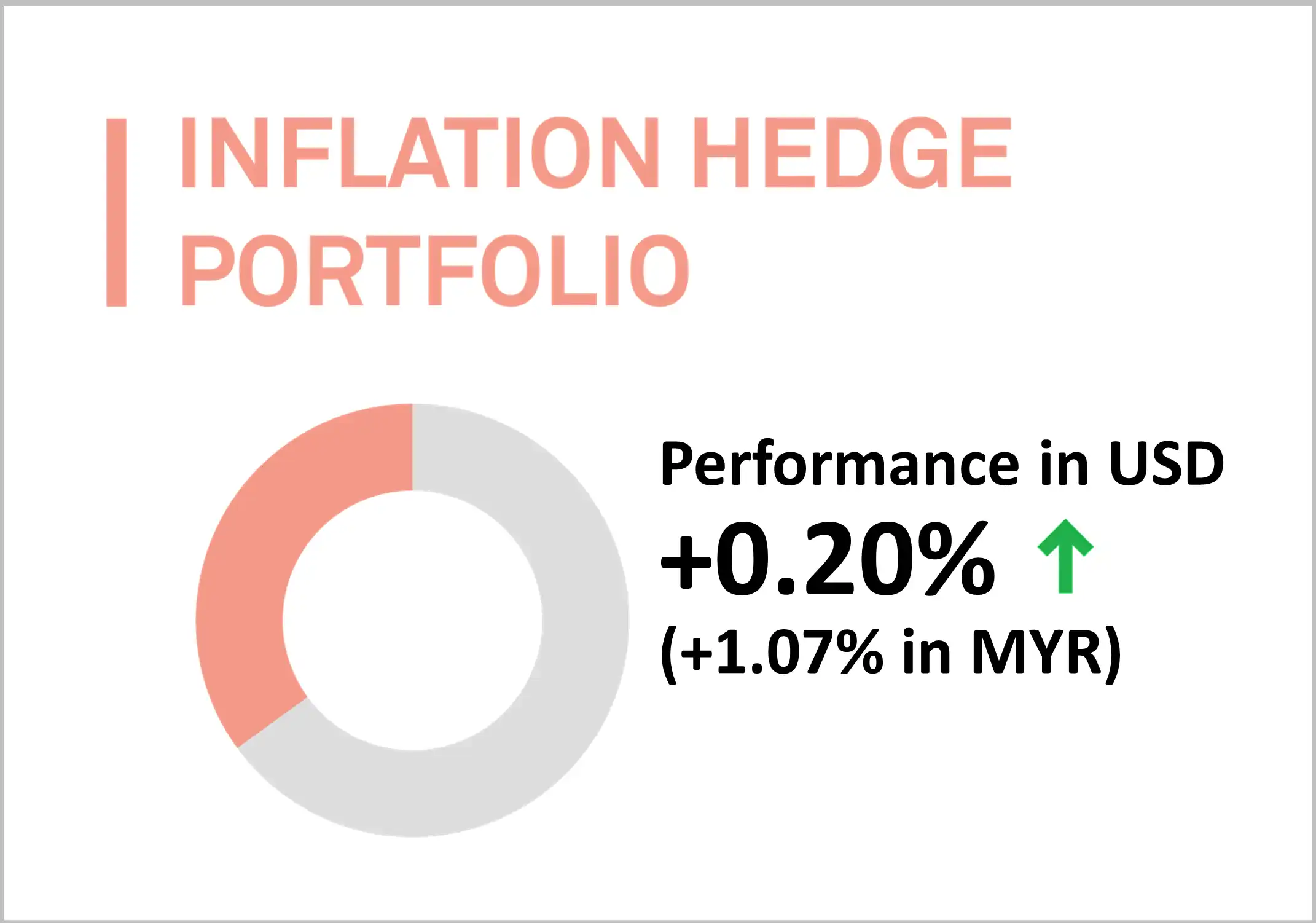

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a positive USD return in February 2024, up by 0.20% (+1.07% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to US real estate (about 30%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Inflation hedge portfolio)

ISHARES US REAL ESTATE ETF (IYR)

INVESCO DB OIL FUND (DBO)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

+2.13%

+0.83%

+0.72%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES MORTGAGE REAL ESTATE (REM)

INVESCO DB BASE METALS (DBB)

SPDR DJ INTERNATIONAL REAL ESTATE (RWX)

-1.28%

-2.31%

-3.49%

Source: GAX MD Sdn Bhd, data in USD term for the month of February 2024.

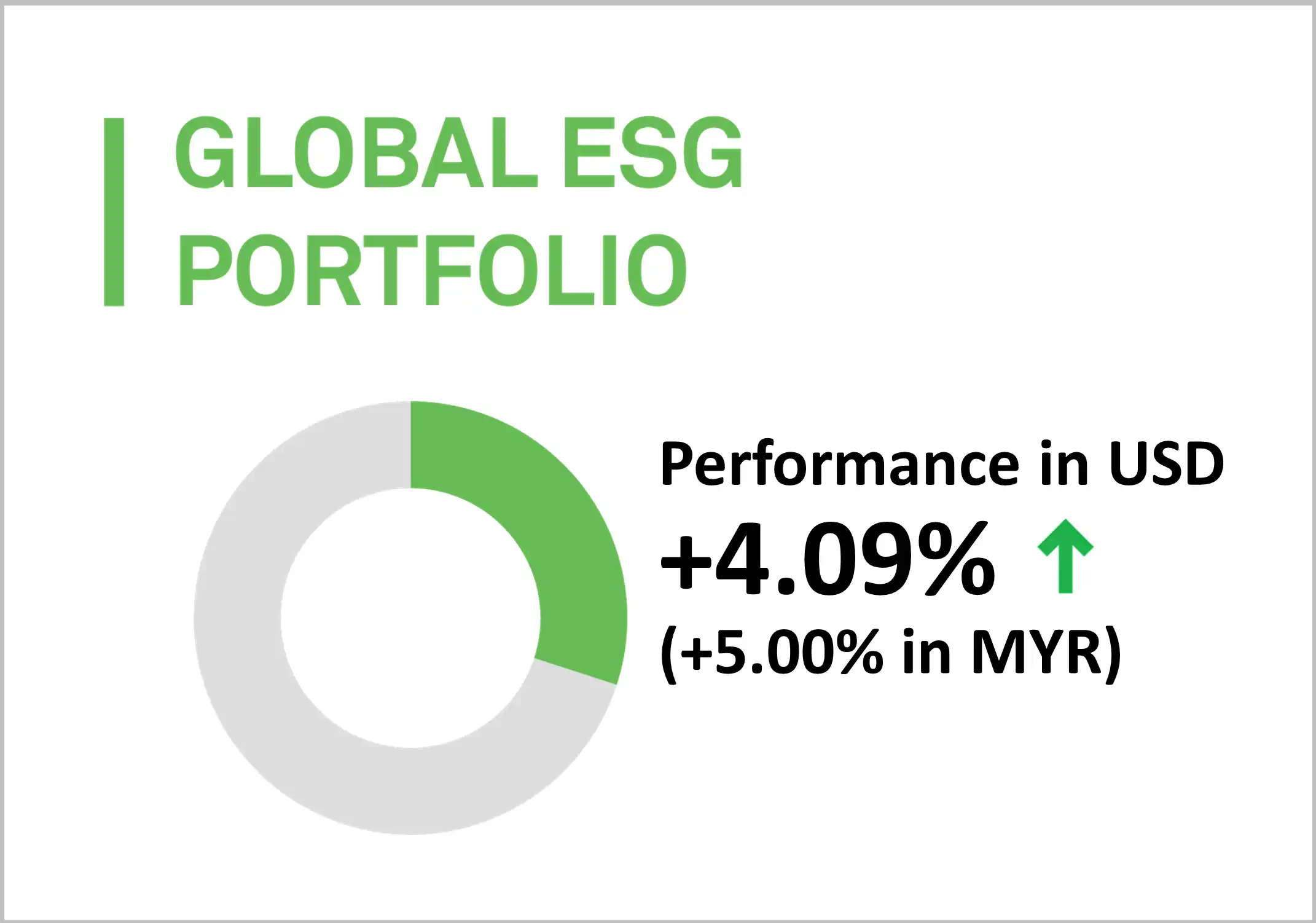

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is up by 4.09% (+5.00% in MYR) in February 2024.

Similar to the growth portfolio, the preference and exposure to US is about 60%. The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record. As such, MYTHEO portfolio consists a higher weighting in US markets in addition to better risk management compared to investment in newer and more volatile emerging markets.

Top 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

+5.70%

+5.13%

+4.65%

Bottom 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

+3.68%

+3.44%

+2.68%

Source: GAX MD Sdn Bhd, data in USD term for the month of February 2024.

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio was up by 3.48% (+4.37% in MYR) in February 2024.

The preference and exposure for MYTHEO’s Essential Products portfolio to the US market is about 60%. This is weighted according to appropriate investment opportunities from technology development and business model transformation within the water, food and energy sector in a global sense.

Top 3 ETFs performance (Essential products portfolio)

GLOBAL X LITHIUM & BATTERY TECH (LIT)

FIRST TRUST WATER ETF (FIW)

INVESCO S&P GLOBAL WATER INDEX (CGW)

+11.12%

+6.72%

+4.38%

Bottom 3 ETFs performance (Essential products portfolio)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

ISHARES MSCI AGRICULTURE PRO (VEGI)

FIRST TRUST GLOBAL WIND ENERGY (FAN)

+0.72%

+0.42%

-0.91%

Source: GAX MD Sdn Bhd, data in USD term for the month of February 2024.

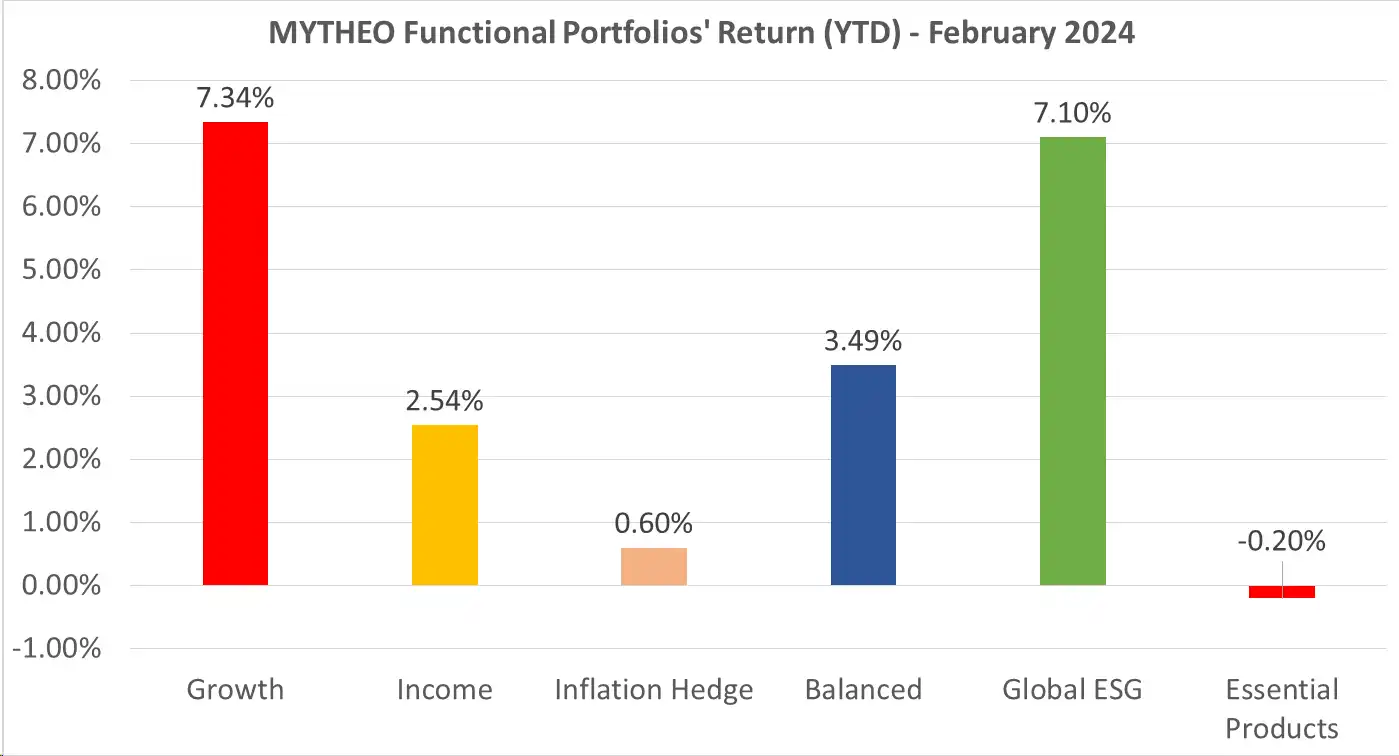

Chart 1: February 2024 - Portfolio Year-to-Date Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, March 2024

Note: Past performance is not an indication of future performance

Balanced allocation has been revised to consist of 30% Growth, 45% Income and 25% Inflation Hedge

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 30% of their investment in Growth, 45% in Income and 25% in Inflation Hedge, the actual portfolio return in MYR for February is +1.87% [(30% x 4.89%) + (45% x 0.30%) + (25% x 1.07%)]

Our Thoughts

Global equities continued to perform in February 2024, with the S&P 500 repeatedly breaking new highs throughout the month on the back of the artificial intelligence (AI) theme in the US. In Asia, Japan’s Nikkei 225 also reached a new high watermark not attained since December 1989, while Chinese shares also picked up with the Shanghai Composite recovering to three-month highs. These gains however paled in comparison to the interest in Bitcoin (BTC), which has appreciated by 43.7% in February as BTC ETFs continued to draw in funds.

Longer-termed US Treasury yields rose towards the Fed Funds Target Range of 5.25%-5.50%, leading to sharper declines in higher tenured US Treasuries. A higher for longer rate regime is expected to be upheld in the coming March meeting, with the current inflation rate holding above the target 2% at 3.1%. Tepid fixed income performance was slightly uplifted by USD strength, gaining 0.8% against the MYR.

US housing total inventory held about level for the first time after 9 months of consecutive decline despite high home and mortgage prices, hinting at possible supply recovery. The same could not be said about office spaces, case in point being the Canada Pension Plan Investment Board selling buildings at a discount, including one New York office building at USD1.

Lithium-related counters staged a comeback this month as lithium carbonate prices experienced an uptick of 8.2% since the start of 2024, in addition to expectations of increases in sales volume in the coming months. Considering batteries use a mix of metals plus the aforementioned AI theme that supports semiconductor production, this also likely propped up the price of rare earth-related counters as well.

As market conditions evolve, MYTHEO remains committed to providing investors with choices that align with your financial goals. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subject to MYTHEO’s Notice and Disclaimer.