Wednesday, 22 September 2021

Written by Royce Tan, Chief Market Insights Officer of GAX MD

ONE of the many adages in the world of finance is that when China sneezes, the whole world catches a cold.

News surrounding the second largest economy in the world, from its regulatory crackdown (which we will discuss in our next article) to the grand saga of the Evergrande Group have sent markets topsy-turvy.

Before diving deeper into the said crisis, here are five things to know about Evergrande:

1) A Fortune 500 company formerly known as Hengda Group founded by Xu Jiayin in 1996

2) Listed in October 2009 on the Hong Kong Stock Exchange

3) Its main business is real estate, but it also involved in manufacturing electric cars, manufacturing consumer products like food and drinks, renewable energy and wealth management. It also owns a theme park and the Guangzhou Football Club

4) It owns more than 1,300 real estate projects spread across 280 cities in China

5) Employs 200,000 people and creates more than 3.8 million jobs each year

Many have claimed that the undoing of Evergrande marks another episode of Lehman Brothers that went bust in 2008, triggering the Global Financial Crisis. The investment bank’s total debts were about USD600 billion back then, about USD760 billion in today’s terms.

So, how severe exactly are the problems faced by Evergrande? The number two property developer in China after Country Garden, has been hogging global headlines after racking up USD300 billion of debts, an amount higher than the total government debts of many countries, including Malaysia. They have previously warned investors that they may default on their debts. They only have USD 15 billion in cash.

The fact that it missed interest payments due on Monday (Sept 20, 2021) to at least two of its largest bank creditors triggered further worries on top of the economic uncertainties globally, sending the Dow Jones Industrial Average south by 929.44 points to 33,657.19 points, before some bottom scraping pared some of its losses to 33,964.66 points.

Despite bouncing back in early day trade on Sept 21, 2021, the Dow failed to maintain the momentum as bearish sentiments overwhelmed the market. Investors are watching closely its next deadlines on Sept 23, 2021 where it is supposed to pay USD 83.5 million in interest for its March 2022 bond and USD47.5 million on Sept 29, 2021 for its March 2024 notes.

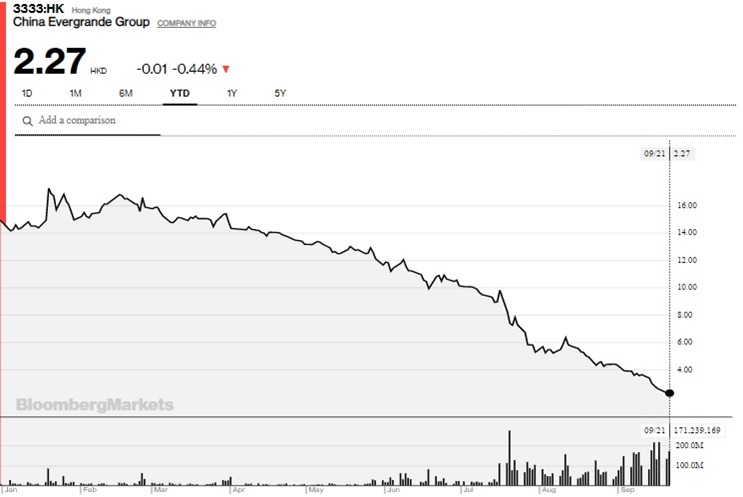

Year-to-date, Evergrande’s share price has tanked 83.95%.

Source: Bloomberg Markets

The worries of Evergrande’s financial fallout are its contagion effect, though it seems much of the concerns are still contained in China.

Despite talks over the past few months of the property developer defaulting, investment banks HSBC and UBS and investment management company BlackRock have been adding for Evergrande bonds into their portfolio.

Beijing’s silence on the whole Evergrande saga aggravated the anxiety, as it gave no indication whether it would extend a helping hand to Evergrande or leave it to fend for itself, but we think the fears of a Lehman Brothers 2.0 may be farfetched at the moment.

We view that even if Beijing would not give the company a direct bailout, it may do so behind the scenes through the financial institutions, most of which are state-controlled in order to avoid a massive shock to China’s economy.

It is known that a debt-fueled economic growth is something that President Xi Jinping has been trying to do away with and this may be the best chance for his administration to go on a full-fledged reform.

Xi has always wanted a sustainable economic growth, though its rates may be lower, rather than having firms feed on excessive debts to achieve excessive growth, such as Evergrande, which took only 25 years to reach where it is today.

His administration may leverage on Evergrande’s current situation to send out a message to corporates in China, that none of them are too big to fail and a Government bailout is not always the case.

Watch this space as we continue to monitor the developments of Evergrande and China.

Globally diverse

Amidst the ongoing uncertainties in China, we would like to highlight that our exposures in China is only about 6%, through Blackrock’s iShares China Large-Cap ETF (FXI) in our Growth portfolio.

While we may not be overly optimistic in the short-term, we believe some short-term pains like what is panning out now sets the future of China’s economic growth on a more sustainable path.

MYTHEO reduces risk by diversifying investments in global asset classes. Through our investing universe of 60 ETFs, you will be investing in thousands of companies worldwide, both in developed and emerging markets. Our strategy is to allocate investments in a wide range of asset classes, from stocks and bonds to commodities and real estate.

Assuming you have a balanced portfolio on MYTHEO, or what we like to call the 40-40-20 (40% in Growth, 40% in Income and 20% in Inflation Hedge), your exposure towards China is effectively only 2.4%, based on our current weightage in FXI.

Financial sector stocks make up 28.02% of the ETF, while real estate constitutes only 3.83%. These are the two sectors that may reel from the effects if Evergrande were to collapse, which seems unlikely to us at the moment.

This material is subjected to MYTHEO's Notice and Disclaimer.