Wednesday, 7 February 2024

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in January 2024.

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down by 0.28% (up 2.33% in MYR) in January 2024.

For the month of January 2024, the portfolio did not shift by much and the US market remains as our largest investment exposure.

The portfolio’s allocation to the Nasdaq 100 ETF (about 17%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE GROWTH (RPG)

INVESCO NASDAQ 100 ETF (QQQM)

VANGUARD VALUE (VTV)

+2.26%

+1.82%

+0.87%

Bottom 3 ETFs performance (Growth portfolio)

VANGUARD FTSE PACIFIC (VPL)

ISHARES MSCI UNITED KINGDOM (EWU)

VANGUARD FTSE EMERGING MARKETS (VWO)

-0.90%

-1.88%

-3.55%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2024.

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a loss of 0.37% (up by 2.24% in MYR) in January 2024.

For the month of January 2024, the income portfolio underwent its quarterly re-optimization, the U.S preferred stock ETF was introduced to the portfolio on improving yield. The portfolio continued to hold significant levels of short-term duration corporate bonds and investment grade bonds that balanced out longer-term US Treasury holdings. The current yield-to-maturity of the bond ETFs in the portfolio (excluding preferred stock) is around 5.54%.

The portfolio’s exposure to U.S preferred stock (about 6%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Income portfolio)

ISHARES US PREFERRED STOCK (PFF)

ISHARES FLOATING RATE BONDS (FLOT)

ISHARES SHORT-TERM CORPORATE (IGSB)

+2.79%

+0.63%

+0.39%

Bottom 3 ETFs performance (Income portfolio)

ISHARES IBOXX INVESTMENT GRADE (LQD)

MARKET VECTORS EMERGING MARKETS (EMLC)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

-0.44%

-1.50%

-2.25%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2024.

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a negative USD return in January 2024, down by 3.01% (-0.46% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to oil (about 2%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Inflation hedge portfolio)

INVESCO DB OIL FUND (DBO)

ISHARES TIPS BOND ETF (TIP)

ISHARES GOLD TRUST (IAU)

+4.17%

+0.33%

-1.38%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES US REAL ESTATE ETF (IYR)

SPDR DJ INTERNATIONAL REAL ESTATE (RWX)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

-5.10%

-5.50%

-11.30%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2024.

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is down by 0.60% (+1.99% in MYR) in January 2024.

Similar to the growth portfolio, the preference and exposure to US is about 60%. The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record. As such, MYTHEO portfolio consists a higher weighting in US markets in addition to better risk management compared to investment in newer and more volatile emerging markets.

Top 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

+1.32%

+0.94%

+0.76%

Bottom 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

-0.33%

-0.38%

-5.05%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2024.

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio was down by 6.85% (-4.41% in MYR) in January 2024.

MYTHEO's Essential Products portfolio was launched on 9 November 2023 strategically crafted to invest in a diversified range of equity ETFs focusing on key themes such as water-related, food-related, energy resources, and renewable energy.

Top 3 ETFs performance (Essential products portfolio)

ENERGY SELECT SECTOR SPDR (XLE)

FIRST TRUST WATER ETF (FIW)

INVESCO S&P GLOBAL WATER INDEX (CGW)

-0.51%

-3.20%

-3.92%

Bottom 3 ETFs performance (Essential products portfolio)

FIRST TRUST GLOBAL WIND ENERGY (FAN)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

GLOBAL X LITHIUM & BATTERY TECH (LIT)

-7.04%

-11.30%

-18.63%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2024.

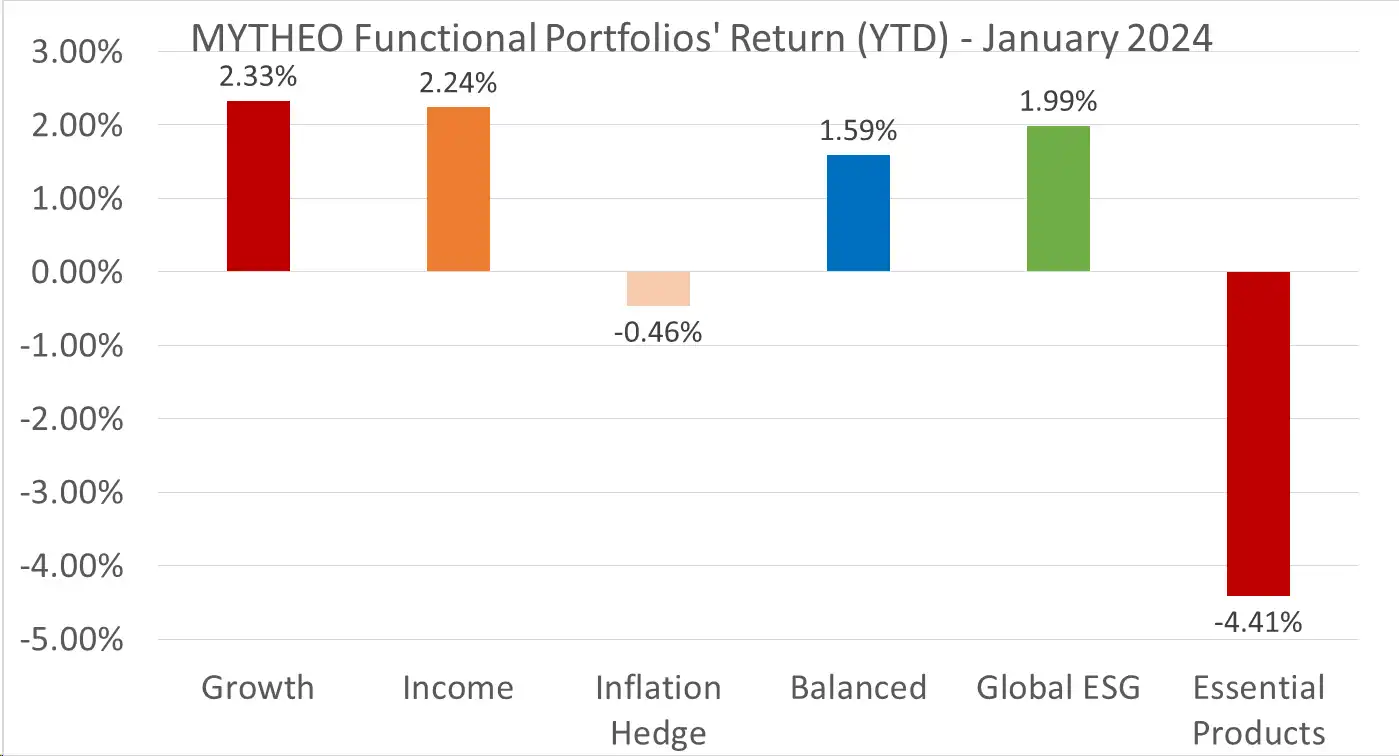

Chart 1: January 2024 - Portfolio Year-to-Date Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, February 2024

Note: Past performance is not an indication of future performance

Balanced allocation has been revised to consist of 30% Growth, 45% Income and 25% Inflation Hedge

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 30% of their investment in Growth, 45% in Income and 25% in Inflation Hedge, the actual portfolio return in MYR for January is +1.79% [(30% x 2.48%) + (45% x 2.50%) + (25% x -0.31%)]

Our Thoughts

2024 started with a normalisation of expectations from the Federal Reserve, with rates being held at the 5.25% - 5.50% range targeting a return to 2% inflation from December 2023’s 3.4%. As such, the scaling back of overenthusiasm resulted in a retreat in fixed income assets performance.

Building on this, real estate counters were similarly impacted as expectations of a rate cut were pushed back, leading to declines. In commodities, oil experienced a momentary uplift as the Houthis mounted attacks on Red Sea shipping near oil-producing states, while other commodities fell on low demand due to weakening global growth.

Outside of US big tech, many other equity markets reported muted to declining figures, especially with those related to clean energy and electric vehicle production. China experienced yet another setback with a ruling for Evergrande to liquidate, shaking confidence even further. One exception appears to be Japan, with equities there strengthening despite a still weakening yen.

Despite this, most portfolios were able to give positive gains in MYR due to the strengthening of the USD by 2.6%. In line with our personalised portfolio creation methodology, proper diversification allows for steady investment growth, balancing the profits and losses of different assets and regions to give long term net gains.

As market conditions evolve, MYTHEO remains committed to providing investors with choices that align with your financial goals. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subject to MYTHEO’s Notice and Disclaimer.