Monday, 7 August 2023

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in July 2023.

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 4.19% (up 0.66% in MYR) in July 2023.

For July, the portfolio did not shift by much, while US markets remains as our largest investment exposure.

The portfolio’s allocation to the Nasdaq-100 QQQ (about 21%) was a key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Growth portfolio)

VANGUARD FTSE EMERGING MARKETS (VWO)

WISDOMTREE INDIA EARNINGS (EPI)

INVESCO S&P 500 PURE VALUE (RPV)

+5.88%

+5.11%

+4.17%

Bottom 3 ETFs (Growth portfolio)

ISHARES RUSSELL MID-CAP GROWTH (IWP)

ISHARES MSCI UNITED KINGDOM (EWU)

ISHARES MSCI JAPAN (EWJ)

+3.00%

+2.94%

+2.46%

Source: GAX MD Sdn Bhd, data in USD term for the month of July 2023.

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a gain of 0.58% (down by 2.83% in MYR) in July 2023.

For the month of July 2023, the ICP underwent its quarterly reallocation. More weight was added from shorter-term to longer-term US Treasuries on improvement of yield spread, while high yield corporate bonds gave way to the even higher yielding senior loans. The current average weighted 30-day yield of the ETFs in the portfolio is around 5.79%.

Despite this, the portfolio’s exposure to high yield corporate bonds (about 6%) was for the third consecutive time the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Income portfolio)

MARKET VECTORS EMERGING MARKETS (EMLC)

ISHARES IBOXX HIGH YIELD CORPS (HYG)

SPDR BARCLAYS SHORT-TERM HIGH YIELD (SJNK)

+1.84%

+1.12%

+1.11%

Bottom 3 ETFs (Income portfolio)

ISHARES 3-7 YEAR TREASURY BONDS (IEI)

ISHARES IBOXX INVESTMENT GRADE (LQD)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

+0.07%

+0.05%

-2.54%

Source: GAX MD Sdn Bhd, data in USD term for the month of July 2023.

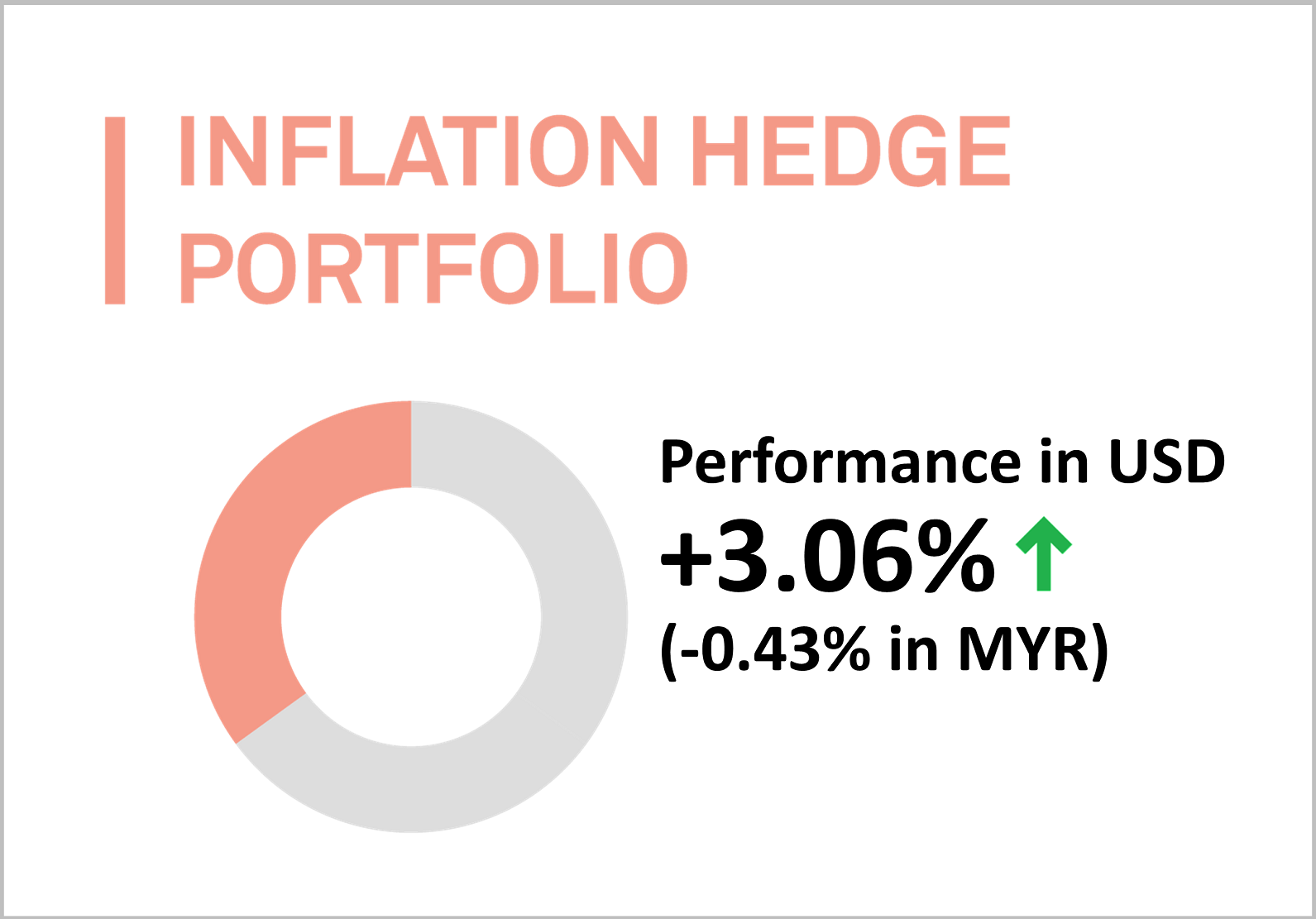

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a positive USD return in July 2023, increasing by 3.06% (-0.43% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to U.S real estate (about 30%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Inflation hedge portfolio)

INVESCO DB OIL FUND (DBO)

ISHARES SILVER TRUST (SLV)

INVESCO DB BASE METALS (DBB)

+14.45%

+8.62%

+7.13%

Bottom 3 ETFs (Inflation hedge portfolio)

ISHARES US REAL ESTATE (IYR)

ISHARES TIPS BOND (TIP)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX (ICLN)

+1.74%

+0.04%

-0.65%

Source: GAX MD Sdn Bhd, data in USD term for the month of July 2023.

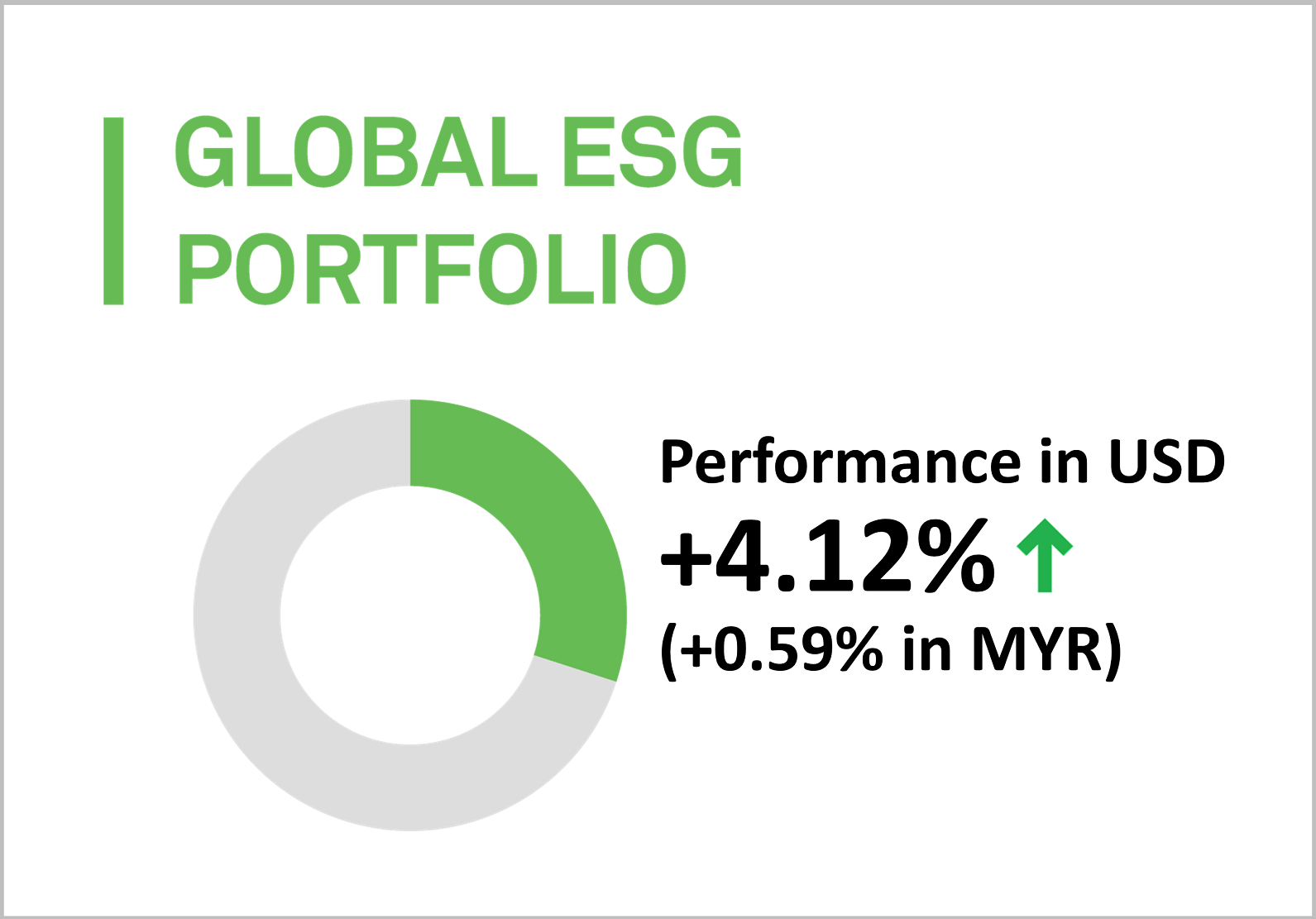

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is up by 4.12% (+0.59% in MYR) in July.

Similar to the growth portfolio, the preference and exposure to the US is about 60%. The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record, therefore our portfolio follows this trend in terms of placing a higher weighting in US markets, in addition to better risk management compared to investment in newer and more volatile emerging markets.

The portfolio’s allocation to Emerging Markets stocks (about 15%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EM (ESGE)

ISHARES MSCI USA ESG SELECT (SUSA)

NUVEEN ESG LARGE-CAP VALUE (NULV)

+6.29%

+3.71%

+3.55%

Bottom 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI USA (ESGU)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES ESG AWARE MSCI EAFE (ESGD)

+3.49%

+3.05%

+2.51%

Source: GAX MD Sdn Bhd, data in USD term for the month of July 2023.

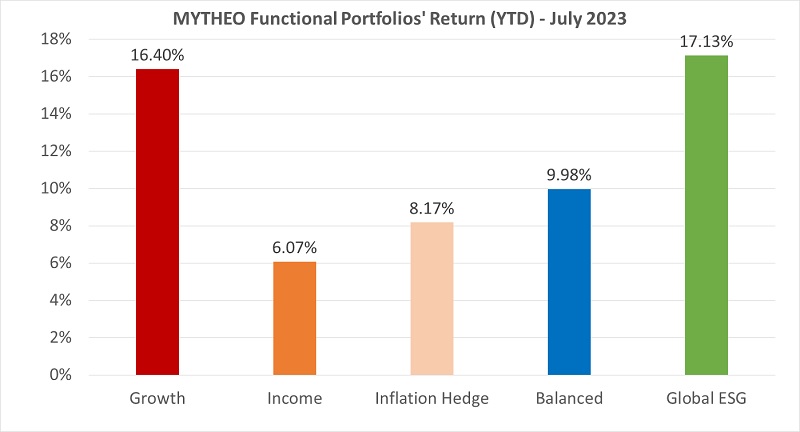

Chart 1: July 2023 - Portfolio Year-to-Date of Return in % (MYR)

Balanced allocation consists of 32% Growth, 36% Income and 32% Inflation Hedge

Source: GAX MD Sdn Bhd, August 2023

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 32% of their investment in Growth, 36% in Income and 32% in Inflation Hedge, the actual portfolio return in MYR for July is -0.94% [(32% x 0.66%) + (36% x -2.83%) + (32% x -0.43%)]

Our Thoughts

The US Dollar weakened against the Malaysian Ringgit in July by -3.4% to MYR4.5070 as of the 31th of July 2023, compared to MYR4.6650 as of the 30th of June 2023. This has had a negative impact on the performance of the portfolio in Ringgit terms due to the depreciation of the US Dollar.

It was a positive month in USD terms for all portfolios with the exception of the Income Portfolio. Equities within our universe all recorded positive returns, and the stock market rallied in July despite the FOMC delivering another quarter percentage point rate hike, putting the federal funds target rate range at 5.25% to 5.50%. Meanwhile, those related to Asian Emerging Markets largely strengthened. Chinese equities in particular were boosted by government efforts to boost household consumption of goods and services such as in the automobile, real estate and services sector, while supporting private investment in infrastructure sectors. This led to a China Large-Cap Exchange Traded Fund (ETF) gaining 11.88% in a single month, although it still remains a highly volatile investment prospect with weakened economic indications.

The Income Portfolio showed a similar pattern, with Emerging Market bond ETFs showing marked outperformance to US ones, while US Treasuries settled lower after a volatile month following another rate hike by the US Federal Reserve nearing the end of July, thereby impacting our returns on their higher weight. As for Inflation Hedge Portfolio-related ETFs, many commodities rallied in line with recovering economic activity where demand catches up or even exceeds supply.

Given the high interest rate levels within the US, investors who are looking for more consistent returns to investing outside of Malaysia may consider investing in MYTHEO USD Trust Portfolio. The current net interest rate for this portfolio is 4.83% p.a. and is subject to change depending on the Federal Reserve's monetary policy and the Federal Open Market Committee's (FOMC) decision on the federal funds rate.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.