Thursday, 6 July 2023

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in June 2023.

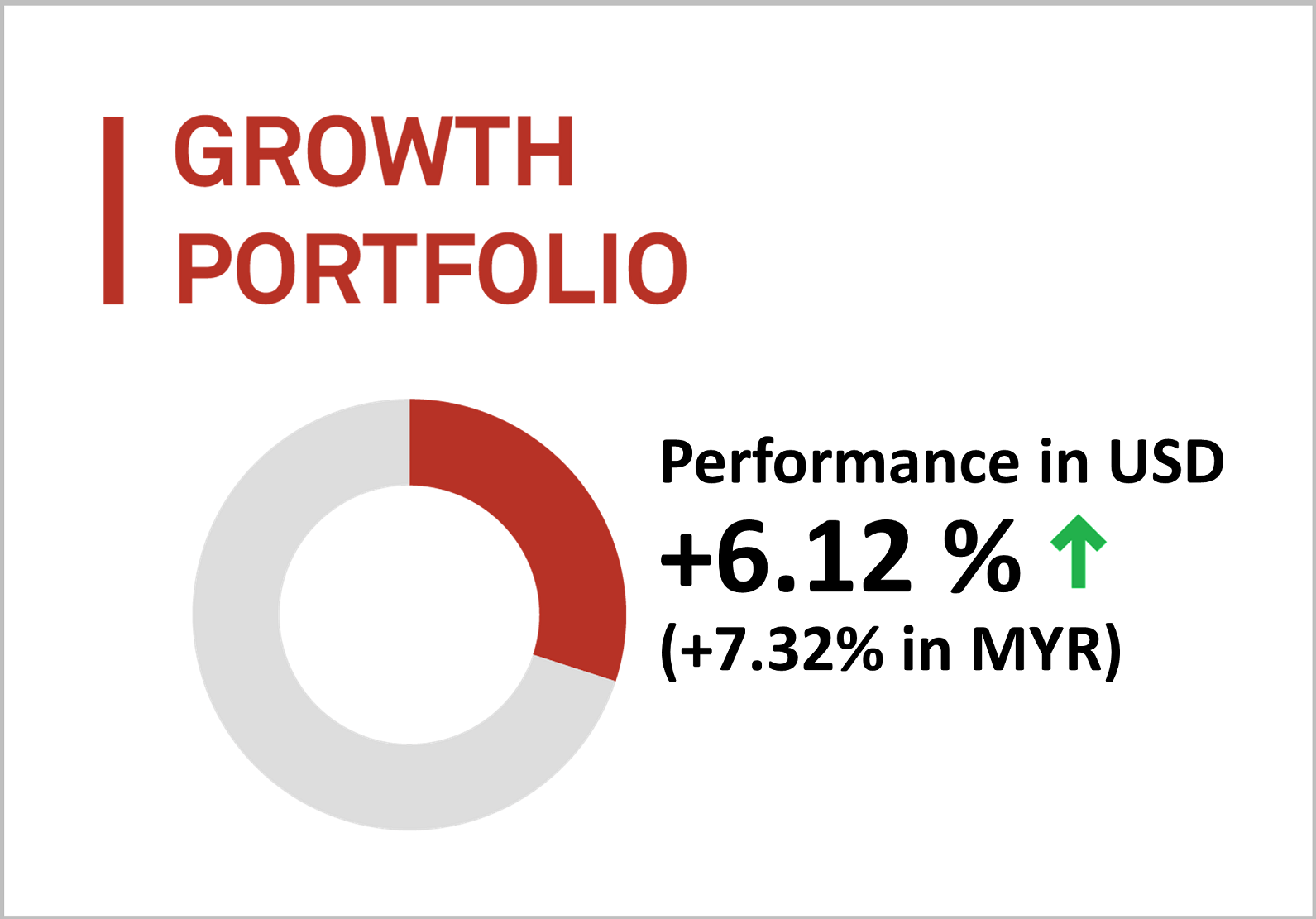

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 6.12% (up 7.32% in MYR) in June 2023.

For June, the portfolio underwent a reallocation, moving a small weighting of ETFs to increase the aggressiveness of the portfolio and shifting to growth-oriented ETFs. However, the US market remains our largest investment exposure.

The portfolio’s allocation to the Nasdaq-100 QQQ (about 21%) was a key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Growth portfolio)

INVESCO S&P 500 PURE VALUE (VTV)

ISHARES RUSSELL MID-CAP GROWTH (IWP)

INVESCO QQQ ETF (QQQ)

+9.25%

+7.68%

+6.30%

Bottom 3 ETFs (Growth portfolio)

VANGUARD FTSE EMERGING MARKETS (VWO)

ISHARES MSCI HONG KONG (EWH)

ISHARES MSCI UNITED KINGDOM (EWU)

+4.75%

+3.65%

+3.38%

Source: GAX MD Sdn Bhd, data in USD term for the month of June 2023.

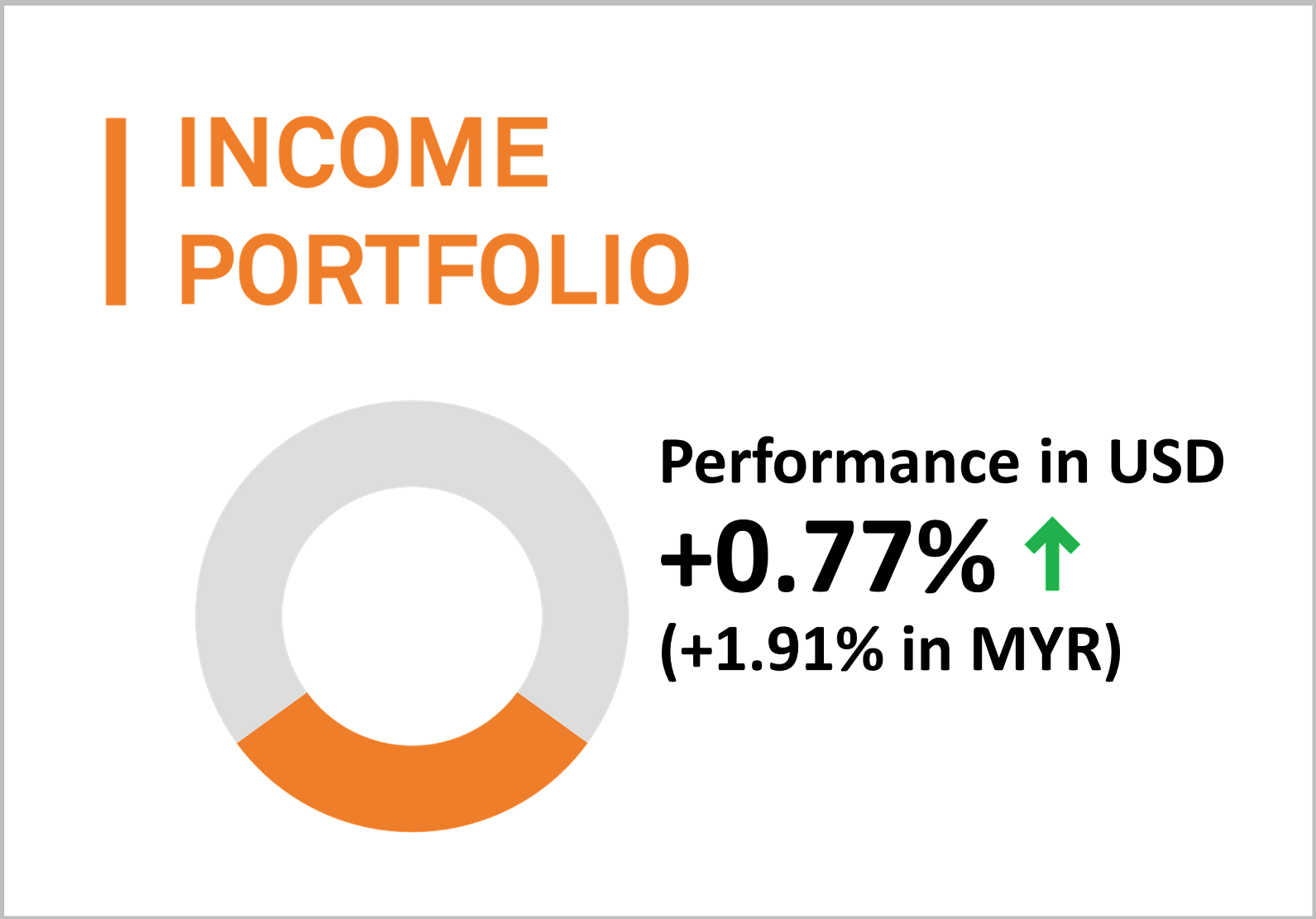

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a gain of 0.77% (up by 1.91% in MYR) in June 2023.

There was no repositioning performed for this month, with the income portfolio maintaining its preferences towards short-term duration corporate bonds and investment grade bonds.

The portfolio in June was mostly driven by the relatively high yields available in these markets, compared to their downside risk. The current average weighted 30-day yield of the ETFs in the portfolio is around 5.69%.

The portfolio’s exposure to high yield corporate bonds (about 11%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Income portfolio)

MARKET VECTORS EMERGING MARKETS (EMLC)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

ISHARES IBOXX HIGH YIELD CORPS (HYG)

+2.77%

+2.60%

+1.78%

Bottom 3 ETFs (Income portfolio)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

ISHARES SHORT-TERM CORPORATE (IGSB)

ISHARES 3-7 YEAR TREASURY BONDS (IEI)

+0.22%

-0.07%

-1.20%

Source: GAX MD Sdn Bhd, data in USD term for the month of June 2023.

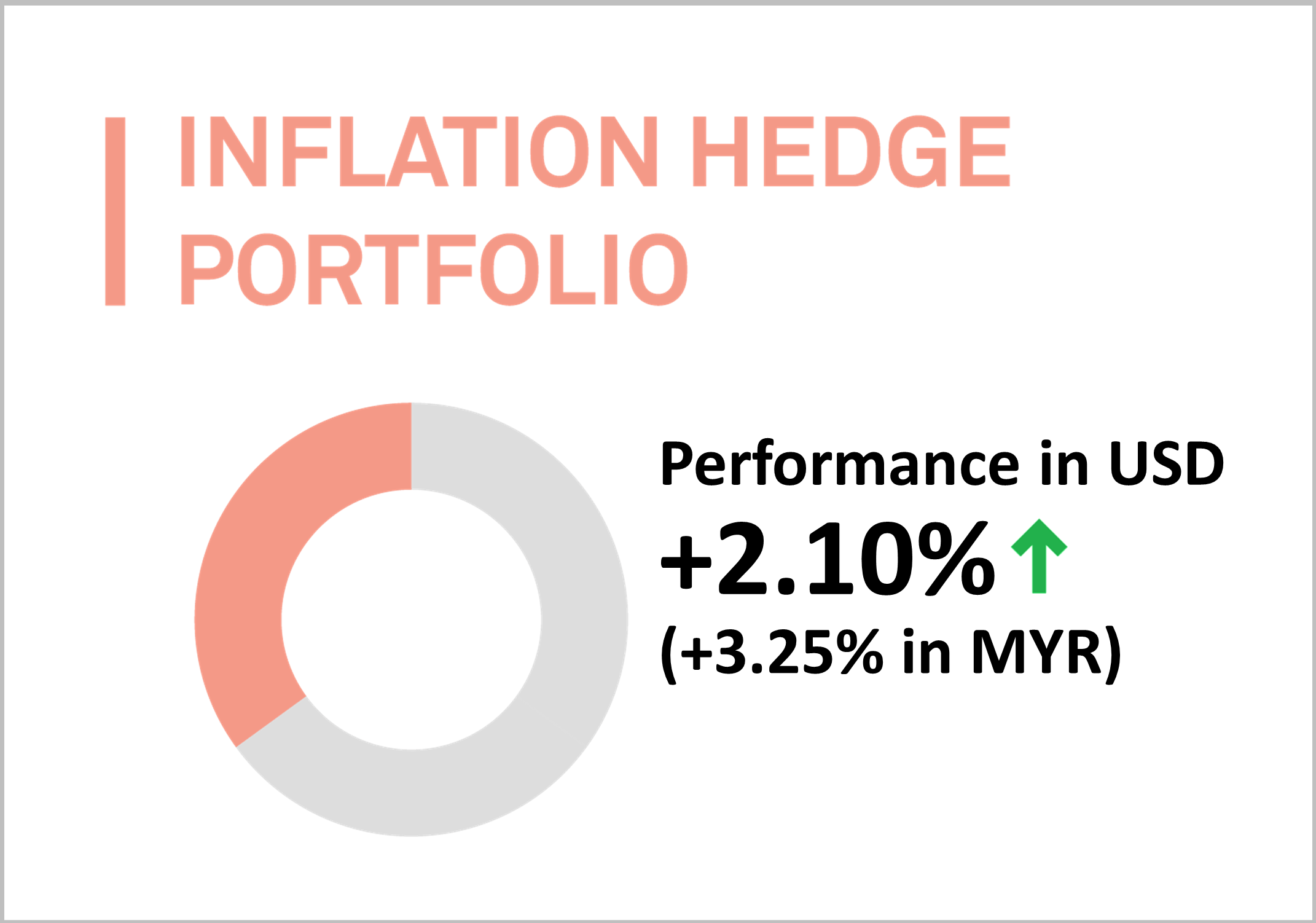

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a positive return in June 2023, increasing by 2.10% (+3.25% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to U.S real estate (about 30%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Inflation hedge portfolio)

ISHARES MORTGAGE REAL ESTATE (REM)

ISHARES US REAL ESTATE ETF (IYR)

INVESCO DB OIL FUND (DBO)

+12.76%

+5.73%

+5.61%

Bottom 3 ETFs (Inflation hedge portfolio)

SPDR DJ INTERNATIONAL REAL ESTATE (RWX)

ISHARES GOLD TRUST (GLD)

ISHARES SILVER TRUST (SLV)

-0.88%

-2.18%

-3.33%

Source: GAX MD Sdn Bhd, data in USD term for the month of June 2023.

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is up by 4.80% (+5.98% in MYR) in June.

Similar to the growth portfolio, the preference and exposure to the US is about 60%. The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record, therefore our portfolio follows this trend in terms of placing a higher weighting in US markets, in addition to better risk management compared to investment in newer and more volatile emerging markets.

The portfolio’s allocation to ESG AWARE MSCI USA ETF (about 20%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES MSCI USA ESG SELECT (SUSA)

ISHARES ESG AWARE MSCI USA (ESGU)

+7.35%

+6.66%

+6.34%

Bottom 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI EAFE (ESGD)

ISHARES ESG AWARE MSCI EM (ESGE)

+5.70%

+4.73%

+4.25%

Source: GAX MD Sdn Bhd, data in USD term for the month of June 2023.

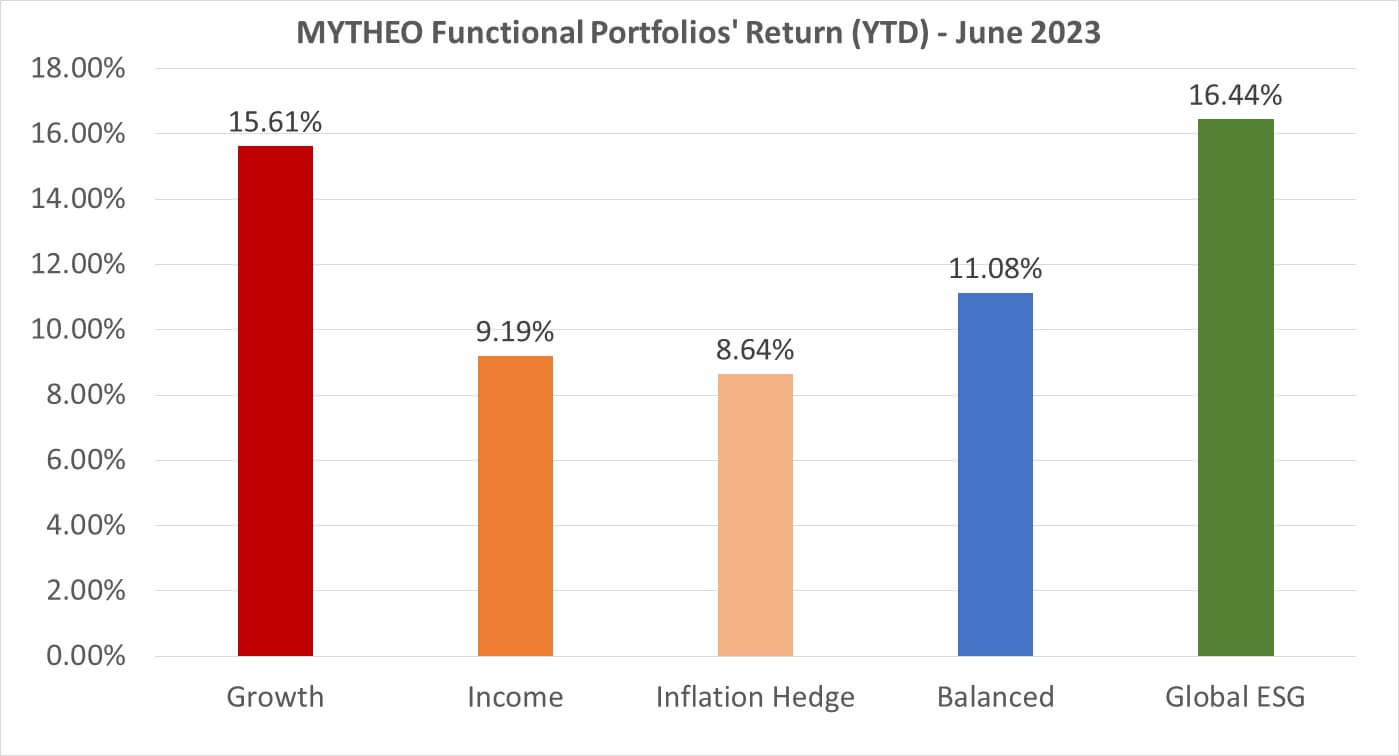

Chart 1: June 2023 - Portfolio Year-to-Date of Return in % (MYR)

Balanced allocation consists of 32% Growth, 36% Income and 32% Inflation Hedge

Source: GAX MD Sdn Bhd, July 2023

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 32% of their investment in Growth, 36% in Income and 32% in Inflation Hedge, the actual portfolio return for June is 4.12% [(32% x 7.32%) + (36% x 1.91%) + (32% x 3.25%)]

Our Thoughts

The US Dollar strengthened against the Malaysian Ringgit in June by 1.13% to MYR4.6650 as of the 30th of June 2023, compared to MYR4.6130 as of the 31st of May 2023. This has had a positive impact on the performance of the portfolio in Ringgit terms due to the appreciation of the US Dollar. This brings the contribution of USD appreciation to the portfolios to +6.04% as we come to the midpoint of the year of 2023.

All our portfolios were up this month, with the Growth Portfolio taking the lead in tandem with our now higher weighting in the US market. Our ETFs tracking this market in which we focus upon performed generally within the range of +6.7% to +9.3% across market cap sizes and value-growth factors, suggesting a more generalised interest in US equity exposure rather than anything specific. Caution is still warranted however, as the Federal Reserve maintains a target of 2% for inflation (currently 4% as of May), with the dot plot showing expectations of at least 2 more hikes before the year is out.

The Income Portfolio was pulled upwards by gains in senior loans, emerging market bonds and short-term high-yield bonds, while US Treasuries declined following the temporary suspension of the US debt ceiling. A similar pattern was observed in the Inflation Hedge Portfolio, where the gains from the recovery in the US real estate equity sector were offset partially by the devaluation of TIPs (also partly reflecting decreasing inflation). Gold and silver were put under pressure, while the more industrial base metals and oil picked up in June.

To round off the first half of the year, ETFs related to bonds and equities largely provided positive returns on a year-to-date (YTD) basis, with a mixed bag in those related to inflation that coincides with the trend of decreasing inflation. Even in Malaysia, the May 2023 inflation figure of 2.8% was the lowest since May 2022, beating expectations of 3% under the current overnight policy rate regime of 3%.

Exceptions to this in our universe are ETFs linked to China and Malaysia. China’s much anticipated post-Covid reopening-boosted recovery did not match investor expectations, with the Caixin Manufacturing PMI missing market expectations 3 out of the 5 times it was reported from January to May 2023 (although it did beat it again in June numbers). Together with the ongoing economic war with the US that restricted access to high-end chips, as well as the threat from surging youth unemployment, a still shaky property market and news of high municipal debt levels, China has started to slash its loan prime rate by 10bps, the first time in 10 months. Whether China’s economy will eventually stabilise to possible steady growth remains to be seen.

Meanwhile, Malaysia’s KLCI was down almost 8% YTD, with not a single month in the first half of 2023 recording a positive return. Within the ASEAN-5 grouping, our underperformance in local currency terms was only beaten by Thailand, which in itself is currently facing political difficulties in leadership selection. A report by MIDF has stated that foreign investors into the Malaysian equities market have been sellers for 20 out of 26 weeks this year with a net outflow of MYR4.19 billion. Coupled with the uncertainty of the outcome of the coming state elections, this may suggest a muted interest in Malaysian equities for the time being.

Overall, global equities have experienced a positive re-rating this year, driven by improving investor sentiment, despite concerns of a potential recession. Market volatility has been easing as there is optimism surrounding the passing of the debt ceiling bill by the US congress. The fixed income asset class has become more attractive due to rising yields along with Federal Reserve’s rate hikes. While China economy data suggests weakness, the US economy remains resilient, supported by strong job data indicators.

Investors who are looking for a more defensive approach to investing outside of Malaysia may consider investing in MYTHEO USD Trust Portfolio. The current gross interest rate for this portfolio is 4.58%p.a. and is subject to change depending on the Federal Reserve's monetary policy and the Federal Open Market Committee's (FOMC) decision on the federal funds rate. This portfolio will be a great place to park your investment funds while waiting for opportunities to emerge.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.