Monday, 20 April 2021

Written by Amirudin Hamid, Portfolio Manager of GAX MD

Sometime in March 2021, a little-known family-run hedge fund became so infamous and grabbed global headlines. Archegos Capital Management roiled the stock market when a few global banks started to dispose of several shares in large blocks following margin calls.

Some of these banks announced hundreds of millions to billions of losses related to this blow-up at the month-end. What did Archegos Capital do that caused such damage to global financial institutions that are known for their best practices?

What went wrong with Archegos Capital Management?

Archegos invests in stocks listed on US exchanges, swap contracts and Contracts for Difference (CFDs). There is nothing wrong to invest in these instruments with proper risk management in mind. However, what hit Archegos was the excessive leverage used to multiply returns (and losses) from margin trading facilities provided by the banks.

According to various sources, Archegos arranged a complex derivative contract called Total Return Swap to hide its excessive exposure. Through this arrangement, Archegos was able to transfer part of its assets owned to a third party but still retain all the rights on the assets' returns.

By doing so, Archegos appeared to not be holding the assets but still retained control and indirectly paid all interest obligations which was masked as a fee to its counterparty.

Markets Insider, an online news website, reported that Archegos Capital was hit with a US$20 billion margin call. To normalize the position, the banks liquidated stocks held by Archegos. Due to the large amount that was needed to be recovered, the affected shares were heavily impacted and fell drastically when large blocks were unloaded into the market.

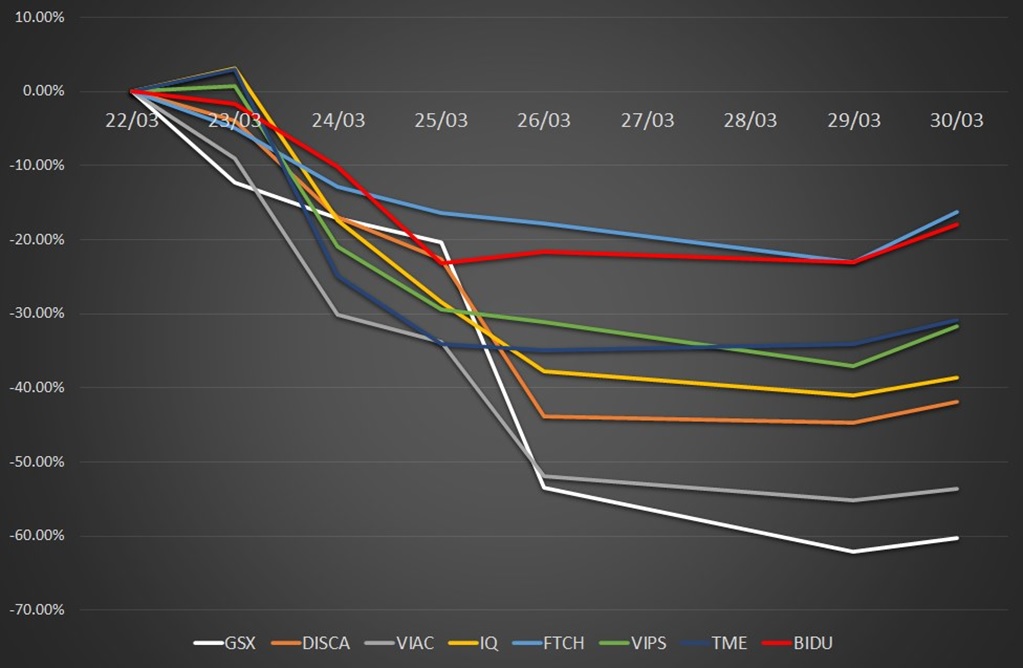

Many shares that were affected, including: GSX Techedu (GSX), Discovery Communications (DISCA), ViacomCBS (VIAC), iQiyi (IQ), FTCH (Farfetch), VIPShop (VIPS), Tencent Music (TME) and Baidu (BIDU), suffered losses of at least 20% in just a week. GSX and VIAC lost half of their values in just a week.

Chart 1: The performances of selected shares owned by Archegos Capital Management and sold by the banks to cover the margin calls from 22 March to 30 March 2021

Source: Investing.com, April 2021

Note: Past performance is not an indication of future performance

Note: Past performance is not an indication of future performance

What is trading on margin?

In margin trading, investors are allowed to invest more than the capital in hand but must maintain equity to asset value ratios called "maintenance margins". Once the ratio hits below the threshold, investors are required to top-up by adding more funds. If investors fail to do so, banks or brokers will force sell the shares.

Many investors use margin trading to get quick returns. Imagine an investor who has a capital of RM10,000 and buys RM10,000 worth of Apple shares. His wealth will grow by RM1,000 to RM11,000 if the share price of Apple rises by 10%.

But if the same investor uses a margin facility with a 50% equity, he would be able to buy RM20,000 worth of Apple shares with a capital of RM10,000. His net worth will increase by RM2,000 to RM12,000 if the share price rose by 10%. This is why many investors are attracted to trade using margin.

Margin trading facilities are easily available to Malaysian investors. Many stockbroking companies in Malaysia offer margin facilities. Furthermore, margin-based trading accounts are the bread and butter of various online trading platforms that trade forex exchange (forex), bitcoins, shares and CFDs.

There is nothing wrong with using margin facilities if appropriately used as the leverage is not too excessive.

Similarly, some retail investors in Malaysia actively trade using Contracts for Difference (CFDs), which are future contract instruments that mimic the underlying share. This instrument is prevalent among investors since it allows one to initiate a position with a sell or short position. And again, when investors trade CFDs, they most likely trade using margin or only pay a portion of the total investment.

That's why many investors and hedge funds use margin facilities and future products. These enable them to multiply the returns without needing to fork out a large capital. But many tend to forget that the same rule also applies to losses. If it can multiply your return, it can multiply your losses too.

MYTHEO does not utilise Margin Trading nor invest in derivatives

MYTHEO does not encourage investors to use leverage, and neither do we use any kind of leveraged instruments such as derivatives or Leverage ETFs. We are aware that these instruments are riskier and not suitable for average investors. Instead, we always encourage investors to invest by focusing on the risks. Always invest based on your risk appetite and your risk tolerance.

MYTHEO’s platform offers 231 portfolios with different risk levels for investors to select. Each of these portfolios is created and optimised by combining different weightages across the three functional portfolios (Growth, Income and Inflation Hedge) depending on each individual’s risk profile. We make investing simple and, more importantly, avoid exposing investors to excessive risks.

This material is subjected to MYTHEO's Notice and Disclaimer.