Wednesday, 5 April 2023

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in March 2023.

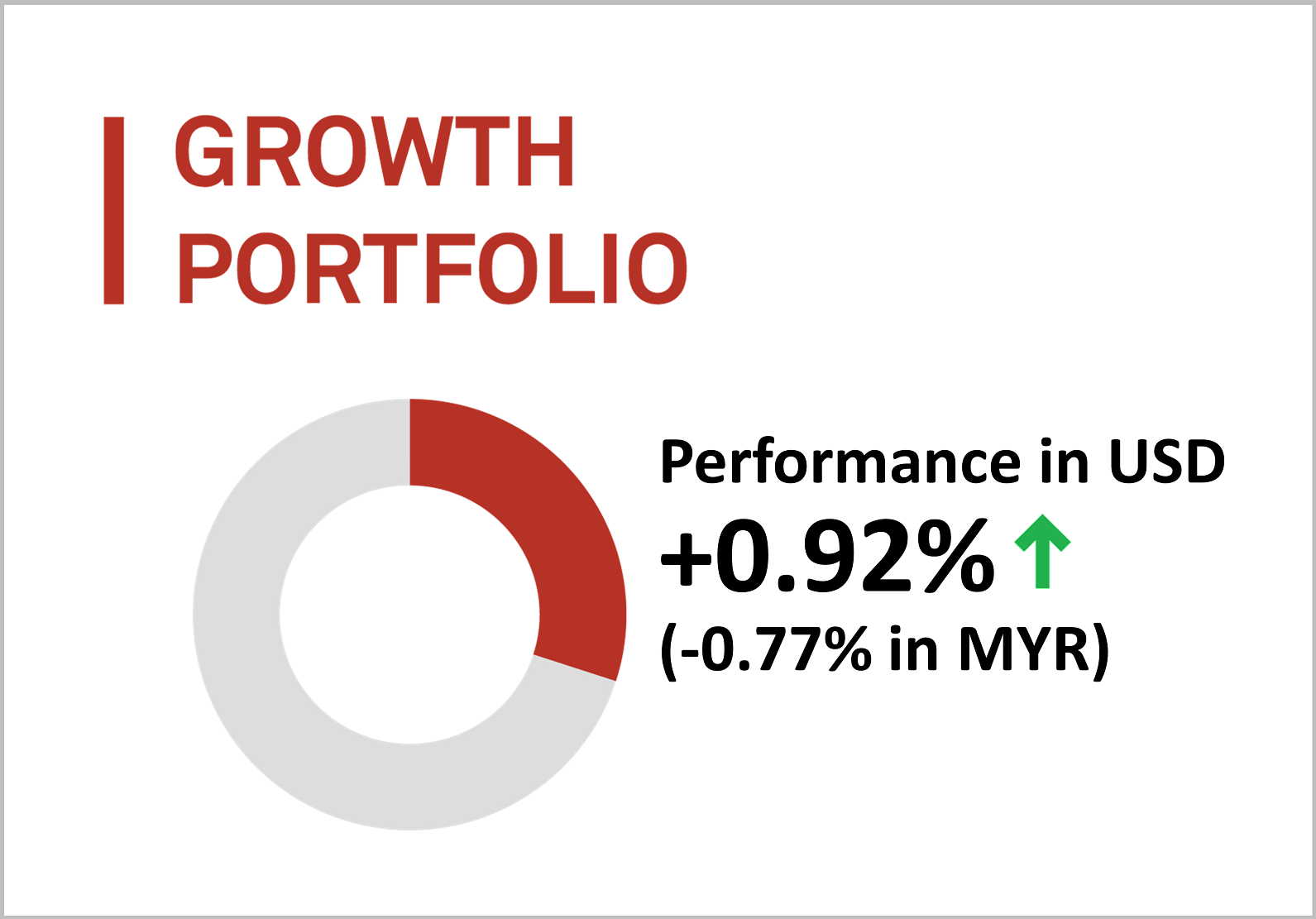

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 0.92% (-0.77% in MYR) in March 2023.

For March, the portfolio’s algorithm remained constant with emphasis on US exposure given a stronger reduction of realised risk compared to Asia and emerging markets exposure. The impact of the downfall of Silvergate Bank, Silicon Valley Bank and Signature Bank resulted in a drag on performance especially with US Value factor ETFs, but this was offset by our diversification into growth-oriented ETFs and foreign markets.

The portfolio’s allocation to the Nasdaq-focused QQQ (about 16%) was a key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Growth portfolio)

INVESCO QQQ (QQQ)

ISHARES CHINA LARGE-CAP (FXI)

ISHARES MSCI JAPAN (EWJ)

+9.49%

+5.62%

+4.92%

Bottom 3 ETFs (Growth portfolio)

VANGUARD VALUE (VTV)

INVESCO S&P 500 PURE VALUE (RPV)

ISHARES RUSSELL 2000 VALUE (IWN)

-0.46%

-6.61%

-7.30%

Source: GAX MD Sdn Bhd, data in USD term for the month of March 2023.

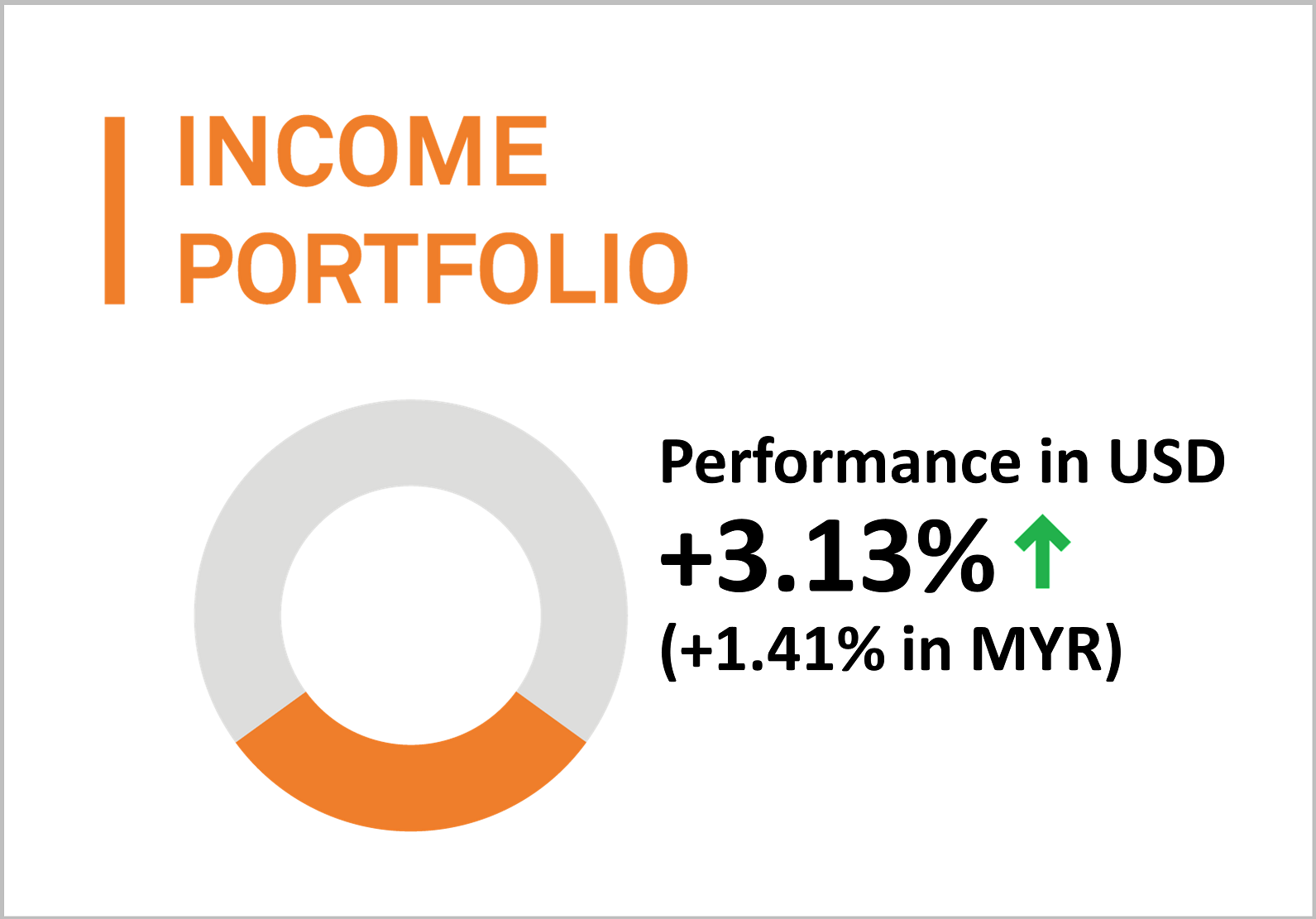

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a return of +3.13% (+1.41% in MYR) in March 2023.

Not much repositioning occurred this month, with the portfolio maintaining a preference towards US bonds, short duration corporate, and investment grade bonds. The overweight positions are mostly driven by the relatively high yields available in these markets, compared to their downside risk. The current weighted 30-day yield of the ETFs in the portfolio is around 5.5%.

The portfolio’s exposure to 3-7 Year Treasuries (about 22%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Income portfolio)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

ISHARES IBOXX INVESTMENT GRADE (LQD)

MARKET VECTORS EMERGING MARKETS (EMLC)

+4.84%

+3.85%

+3.82%

Bottom 3 ETFs (Income portfolio)

ISHARES SHORT-TERM CORPORATE (IGSB)

SPDR BARCLAYS SHORT-TERMHIGH YIELD (SJNK)

SPDR BLACKSTONE/GSO SENIOR LOAN (SLRN)

+1.50%

+1.45%

-0.19%

Source: GAX MD Sdn Bhd, data in USD term for the month of March 2023.

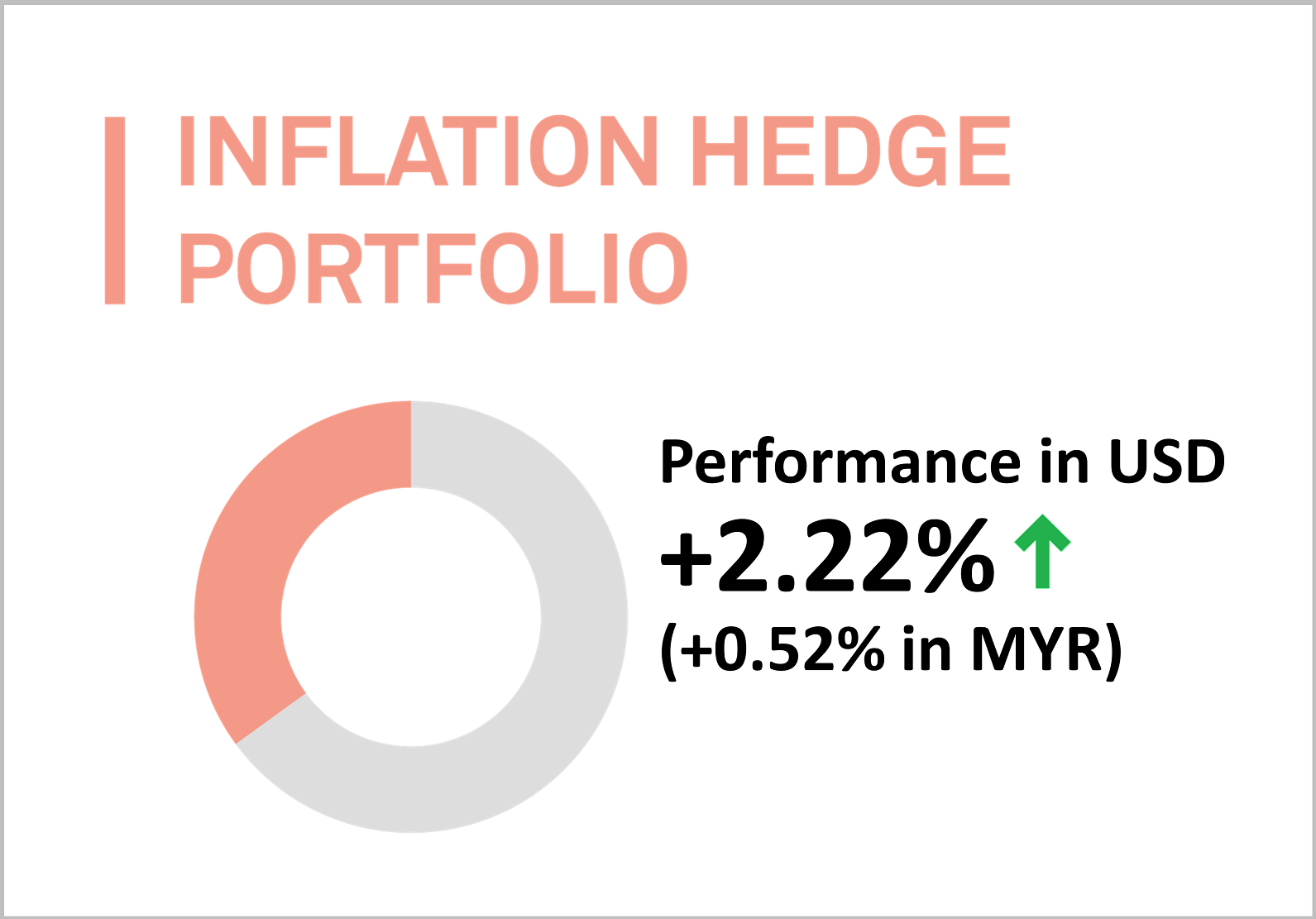

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio saw a positive return in March 2023, increasing by 2.22% (+0.52% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to gold (about 15%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Inflation hedge portfolio)

ISHARES SILVER TRUST (SLV)

ISHARES GOLD TRUST (IAU)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX (ICLN)

+15.09%

+7.94%

+3.02%

Bottom 3 ETFs (Inflation hedge portfolio)

ISHARES US REAL ESTATE (IYR)

SPDR DJ INTERNATIONAL REAL ESTATE (RWX)

ISHARES MORTGAGE REAL ESTATE (REM)

-1.93%

-2.12%

-8.74%

Source: GAX MD Sdn Bhd, data in USD term for the month of March 2023.

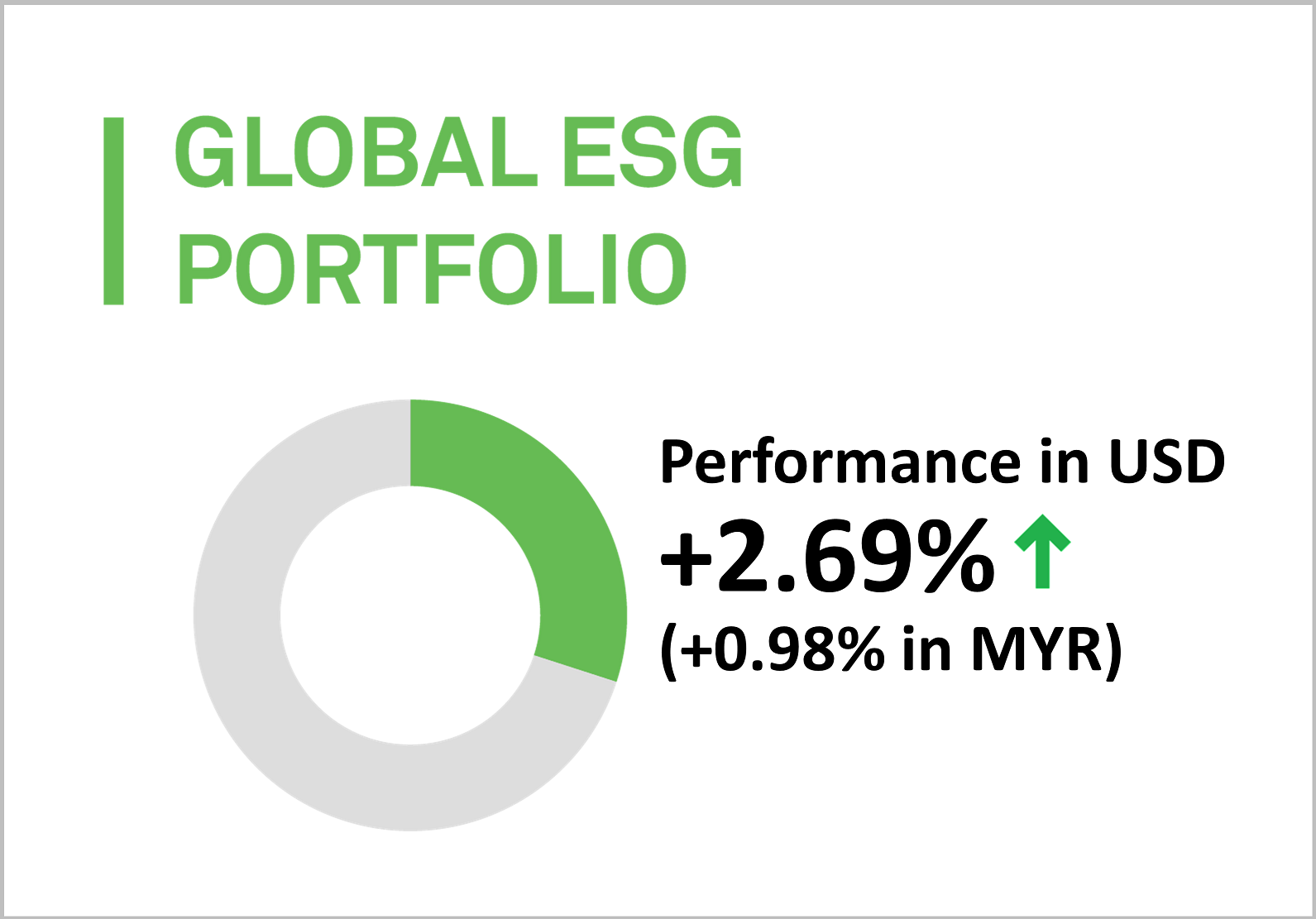

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is up by 2.69% (+0.98% in MYR).

Similar to the growth portfolio, the preference and exposure to US of about 60%, while tilt towards ESG focused equity allowed for outperformance relative to the more conventional portfolio on the collapse of the aforementioned US banks, likely due to stronger risk controls.

The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record, therefore our portfolio follows this trend in terms of placing a higher weighting in US markets, in addition to better risk management compared to investment in newer and more volatile emerging markets.

The portfolio’s allocation to US large-cap growth stocks (about 16%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES ESG AWARE MSCI USA (ESGU)

ISHARESs ESG AWARE MSCI EM (ESGE)

+5.61%

+3.49%

+3.42%

Bottom 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EAFE (ESGD)

ISHARES MSCI USA ESG SELECT (SUSA)

NUVEEN ESG LARGE-CAP VALUE (NULV)

+3.19%

+3.04%

-0.38%

Source: GAX MD Sdn Bhd, data in USD term for the month of March 2023.

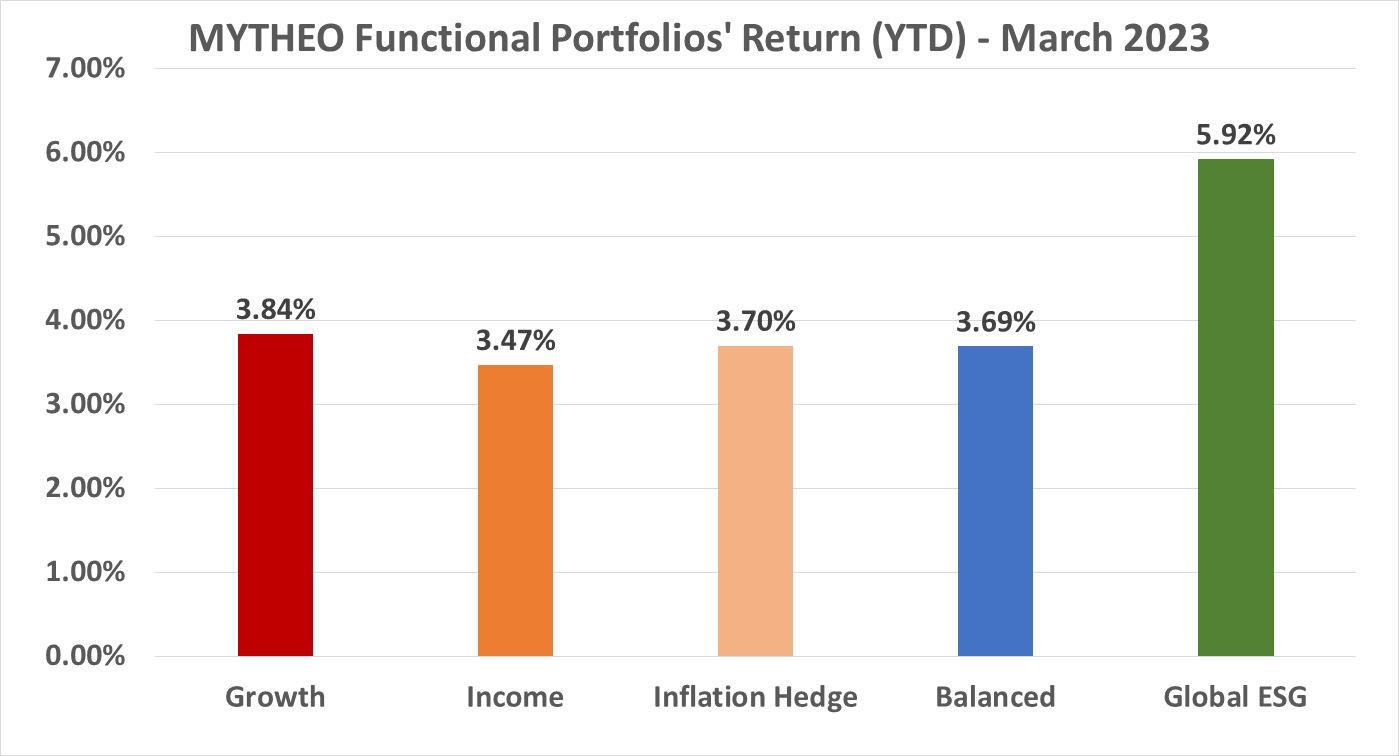

Chart 1: March 2023 - Portfolio Year-to-Date of Return in % (MYR)

Balanced allocation consists of 33% Growth, 32% Income and 35% Inflation Hedge.

Source: GAX MD Sdn Bhd, April 2023

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 33% of their investment in Growth, 32% in Income and 35% in Inflation Hedge, the actual portfolio return for March is 0.38% [(33% x -0.77%) + (32% x 1.41%) + (35% x 0.52%)]

Our Thoughts

The US Dollar weakened against the Malaysian Ringgit in March by 1.67% to RM4.4100 as of the 31st of Mar 2023, compared to RM4.4850 as of the 28th of Feb 2023. This had a negative impact on the performance of the portfolio in ringgit terms due to the depreciation of the US Dollar.

Most global stocks resumed their rally in March, shaking off the collapse of medium sized US banks and the takeover of Credit Suisse by UBS. Global bond prices climbed despite the continued increases in interest rates, with the view of terminal rates being reached sooner rather than later. Precious metals rose as well, as a storage of value in volatile and uncertain markets, while real estate related securities continued to face headwinds.

Central banks around the world are now wary of the stability of their financial markets, hampering easy access to hawkish policy in their fight against persistently high inflation. While some like the European Central Bank (ECB) have room to maneuver, others such as the UK have not much choice but to push forward with rate raising. On the Asian side, troubles persist between the US and China, disrupting potential upsides for investors in economic recovery.

As the fight against inflation appears to hit stumbling blocks, we think investors should remember to keep a long-term view when contemplating their portfolios, with each short-term risk presenting opportunities that can be better covered by adequate diversification rather than knee-jerk reactions.

Investors that are more pessimistic about what is in store for 2023 can also take a more defensive approach to investing and dial back their exposure to equities. Investors can earn 3.83%p.a. (net interest rate) on MYTHEO USD Trust Portfolio, and those rates will likely continue to rise as the Federal Open Market Committee (FOMC) raises interest rates in coming months. This portfolio will be a great place to park your investment funds while waiting for opportunities to emerge.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.