Thursday, 8 June 2023

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in May 2023.

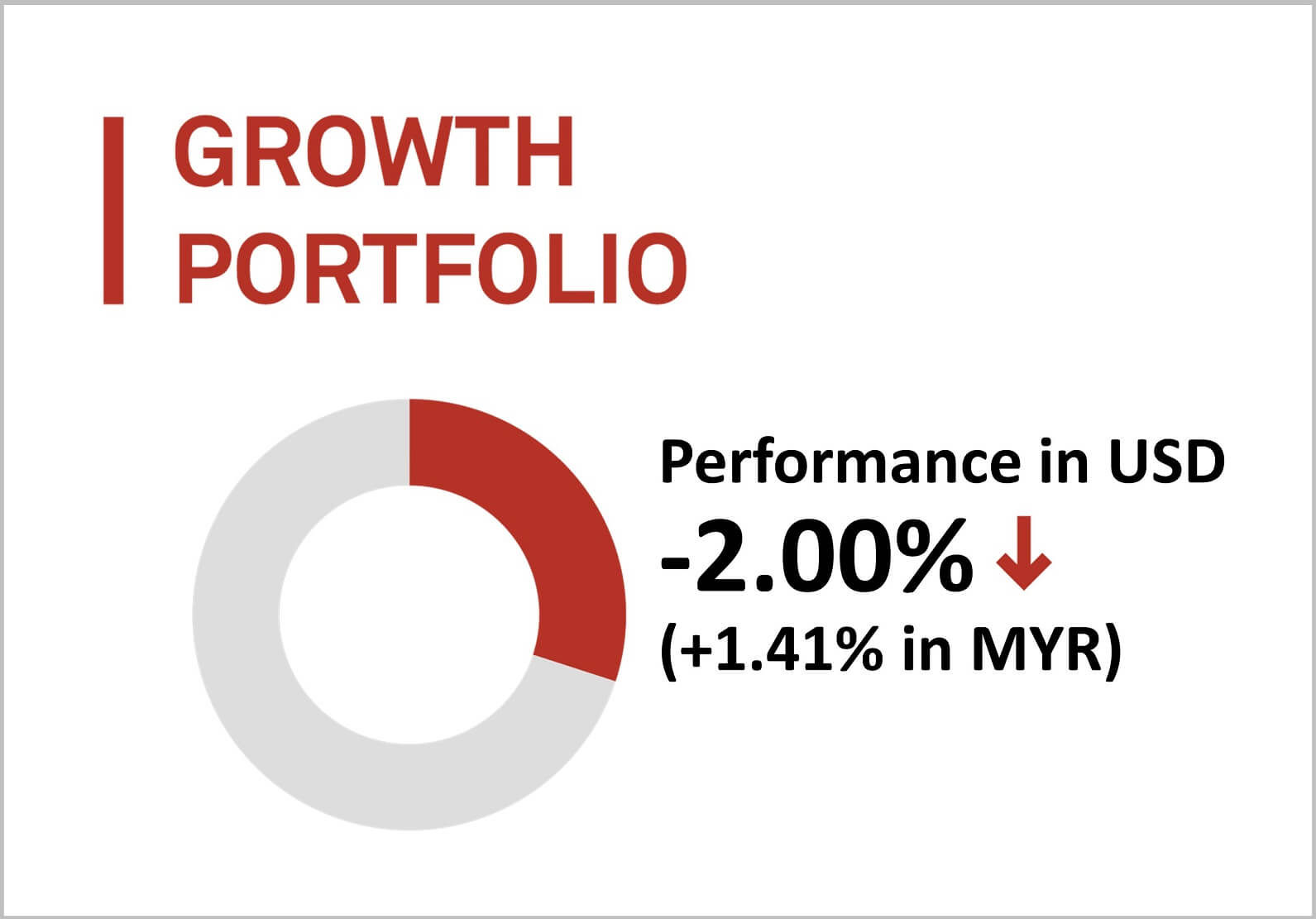

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down by 2.00% (up 1.41% in MYR) in May 2023.

For May, the portfolio’s algorithm repositioned slightly, moving away from a small weighting in Frontier Markets due to the underlying exchange-traded fund (ETF) shifting to a more actively managed fund. Some US exposure was shifted to South Korea and Emerging Markets; however, the US remains as our largest investment exposure.

The portfolio’s allocation to the Nasdaq-100 QQQ (about 15%) was a key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Growth portfolio)

INVESCO QQQ ETF (QQQ)

ISHARES MSCI SOUTH KOREA (EWY)

ISHARES MSCI BRAZIL (EWZ)

+7.88%

+3.48%

+1.95%

Bottom 3 ETFs (Growth portfolio)

INVESCO S&P 500 PURE VALUE (RPV)

ISHARES CHINA LARGE-CAP (FXI)

ISHARES MSCI HONG KONG (EWH)

-6.02%

-8.33%

-9.03%

Source: GAX MD Sdn Bhd, data in USD term for the month of May 2023.

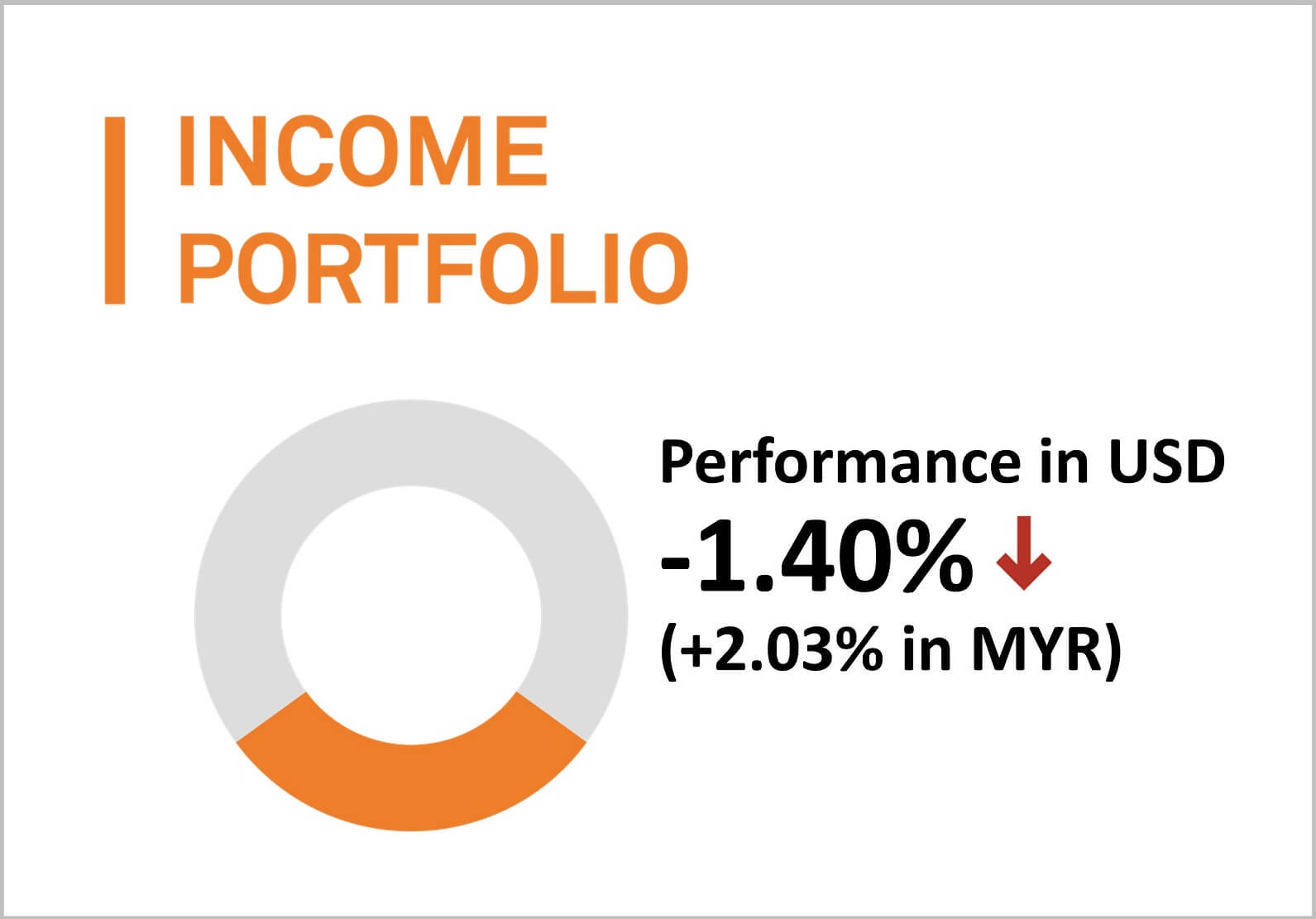

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a loss of 1.40% (up by 2.03% in MYR) in May 2023.

The portfolio in May has a higher weighting towards short-term and high yield corporate bonds that add to portfolio yield, as well as mid- to long-term US Treasuries which contribute to portfolio returns stability. The current weighted 30-day yield of the ETFs in the portfolio is around 5.54%.

The portfolio’s exposure to Floating Rate bonds (about 6%) was yet again the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Income portfolio)

ISHARES FLOATING RATE BONDS (FLOT)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

ISHARES SHORT-TERM CORPORATE (IGSB)

+0.68%

-0.34%

-0.47%

Bottom 3 ETFs (Income portfolio)

ISHARES IBOXX HIGH YIELD CORPS (HYG)

ISHARES IBOXX INVESTMENT GRADE (LQD)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

-1.23%

-1.76%

-3.01%

Source: GAX MD Sdn Bhd, data in USD term for the month of May 2023.

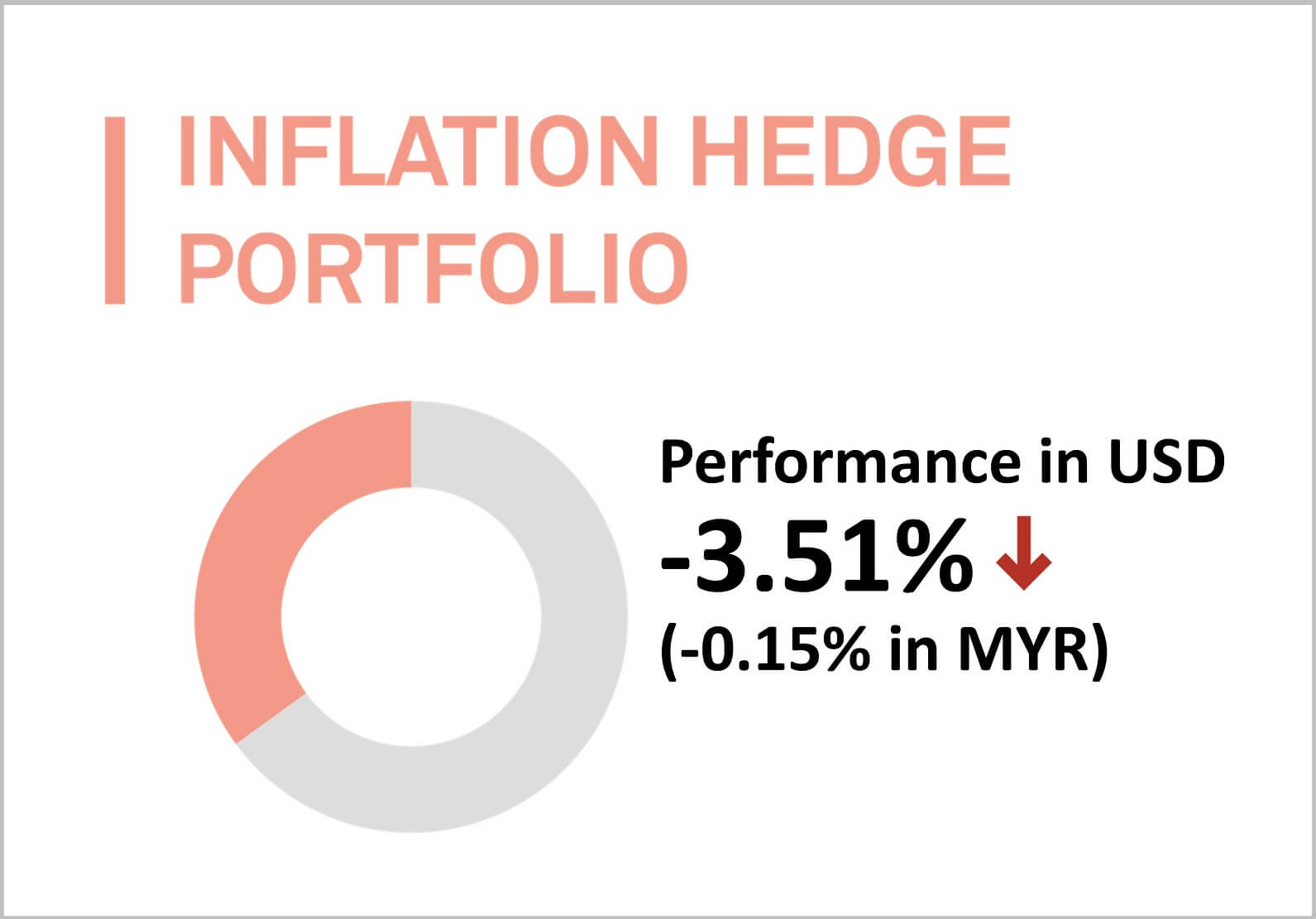

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio saw a negative return in May 2023, decreasing by 3.51% (-0.15% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to Clean Energy (about 3%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Inflation hedge portfolio)

ISHARES TIPS BOND (TIP)

ISHARES GOLD TRUST (GLD)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX (ICLN)

-1.19%

-1.35%

-1.98%

Bottom 3 ETFs (Inflation hedge portfolio)

SPDR DJ INTERNATIONAL REAL ESTATE (RWX)

INVESCO DB BASE METALS (DBB)

INVESCO DB OIL FUND (DBO)

-7.09%

-7.82%

-9.36%

Source: GAX MD Sdn Bhd, data in USD term for the month of May 2023.

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is down by 1.52% (+1.91% in MYR) in May.

Similar to the growth portfolio, the preference and exposure to the US is about 60%. The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record, therefore our portfolio follows this trend in terms of placing a higher weighting in US markets, in addition to better risk management compared to investment in newer and more volatile emerging markets.

The portfolio’s allocation to US Large-Cap Growth stocks (about 15%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES ESG AWARE MSCI USA (ESGU)

ISHARES MSCI USA ESG SELECT (SUSA)

+4.40%

+0.45%

-0.32%

Bottom 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EM (ESGE)

ISHARES ESG AWARE MSCI EAFE (ESGD)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

-1.77%

-3.82%

-4.52%

Source: GAX MD Sdn Bhd, data in USD term for the month of May 2023.

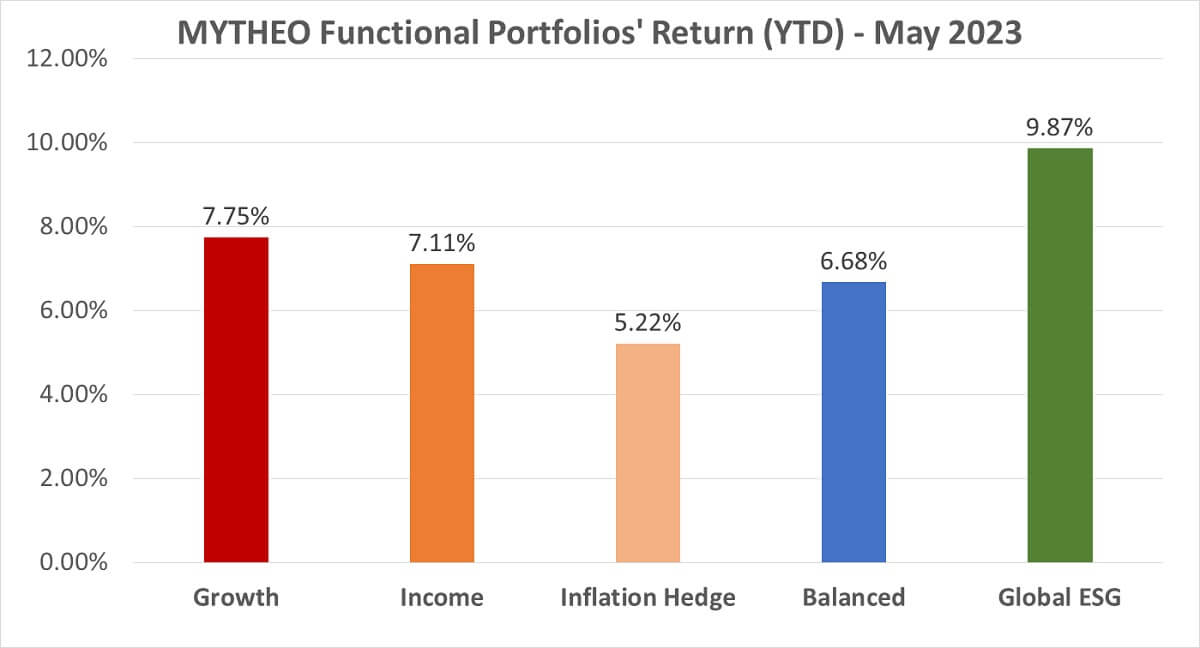

Chart 1: May 2023 - Portfolio Year-to-Date of Return in % (MYR)

Balanced allocation consists of 33% Growth, 32% Income and 35% Inflation Hedge.

Source: GAX MD Sdn Bhd, June 2023

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 33% of their investment in Growth, 32% in Income and 35% in Inflation Hedge, the actual portfolio return for May is 1.06% [(33% x 1.41%) + (32% x 2.03%) + (35% x -0.15%)]

Our Thoughts

The US Dollar strengthened against the Malaysian Ringgit in May by 3.48% to RM4.6130 as of the 31st of May 2023, compared to RM4.4580 as of the 30th of April 2023. This has had a positive impact on the performance of the portfolio in Ringgit terms due to the appreciation of the US Dollar, turning most negative USD performances into positive MYR returns.

Most equity markets in our universe suffered losses in May, with our Hong Kong- and China-linked ETFs leading underperformance at -9.03% and -8.33% respectively due to a weaker-than-expected recovery from their Covid lockdowns, both in manufacturing output grew 5.6% year-on-year and in consumer demand sales rose 18.4%, both coming in below expectations. The US market was not fully spared from this, with Value ETFs taking losses and Growth ETFs giving lukewarm returns at +0.2% and below.

However, the Nasdaq-100 continued its stratospheric trajectory gaining 7.88% in May alone, adding up to a year-to-date performance of above +30.89%. This could be attributed to increased interest in AI and chipmaking, with GPU maker Nvidia touching the USD1 trillion mark on a stunning revenue forecast. In circumstances like this however, caution would be warranted given potential bubble formation from overhyped investments. For instance, Samsung Electronics was impacted by supply gluts in memory chips that caused quarterly operating profits to drop by 96% in April.

Our bond ETF universe also largely retreated in May. Default risk was the hot button topic for May, as Janet Yellen, the head of the US Treasury, sounded the alarm that the government may default on its obligations by early June due to depleted cash reserves. As Democrats and Republicans struggled to come to a compromise deal, US Treasuries was placed on negative watch by Fitch, shaking up not only the bond market but the financial markets as a whole.

On the inflation hedging front, commodities, real estate and other associated ETFs dropped as well. In this case, it follows the pattern of dropping inflation numbers for April, with the US’ figures moving from 5% to 4.9%, the UK improving from 10.1% to 8.7%, Germany from 7.4% to 7.2% with a preliminary report for May being from 7.2% to 6.1%, and closer to home, Malaysia also improved from 3.4% to 3.3%. REITs continue to suffer from rising interest rates that reduce their attractiveness in addition to making loans and mortgages expensive, while industrial metals were impacted by soft demand.

Overall, losses were broad-based in May, covering multiple regions and asset classes. As such, it pays to remain diversified across these categories in order to avoid suffering unnecessarily large losses by having exposure to the stronger performers. We believe that although times may occasionally be rough, staying invested rather than timing the market while remembering that markets will grow alongside the development of the world as a whole will lead to financial security in the long run.

Investors who are looking for a more defensive approach to investing may consider investing in MYTHEO USD Trust Portfolio. The current net interest rate for this portfolio is 4.08%p.a. and is subject to change depending on the Federal Reserve's monetary policy and the Federal Open Market Committee's (FOMC) decision on the federal funds rate. This portfolio will be a great place to park your investment funds while waiting for opportunities to emerge.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.