November 2023

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in November 2023.

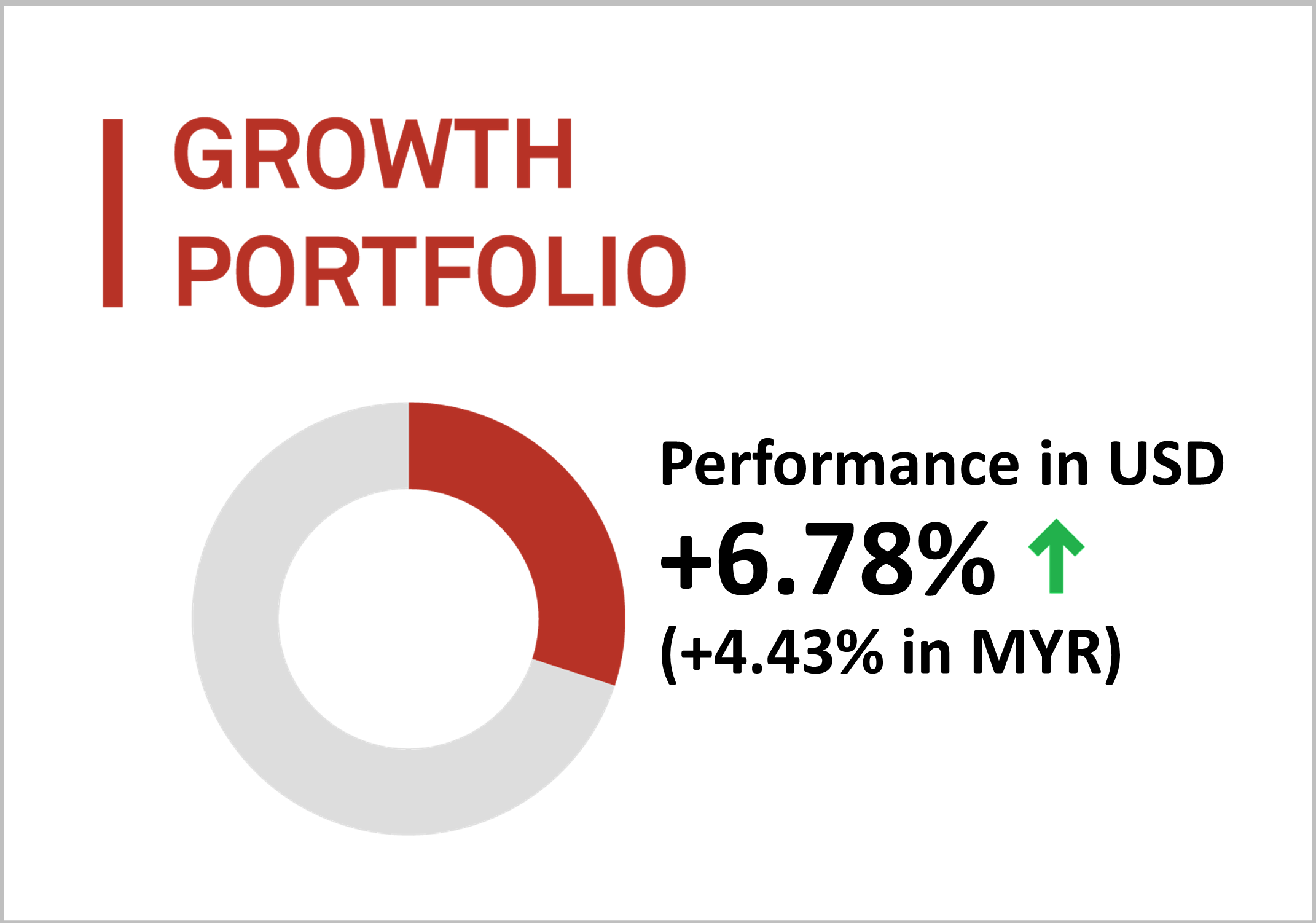

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 6.78% (up 4.40% in MYR) in November 2023.

For the month of November 2023, the portfolio did not shift by much and US market remains as our largest investment exposure.

The portfolio’s allocation to the European stocks (about 11%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Growth portfolio)

SPDR EURO STOXX 50 (FEZ)

INVESCO NASDAQ 100 ETF (QQQM)

INVESCO S&P 500 PURE VALUE (RPV)

11.13%

10.82%

10.45%

Bottom 3 ETFs performance (Growth portfolio)

VANGUARD VALUE (VTV)

ISHARES MSCI UNITED KINGDOM (EWU)

INVESCO S&P 500 PURE GROWTH (RPG)

6.68%

6.20%

5.84%

Source: GAX MD Sdn Bhd, data in USD term for the month of November 2023.

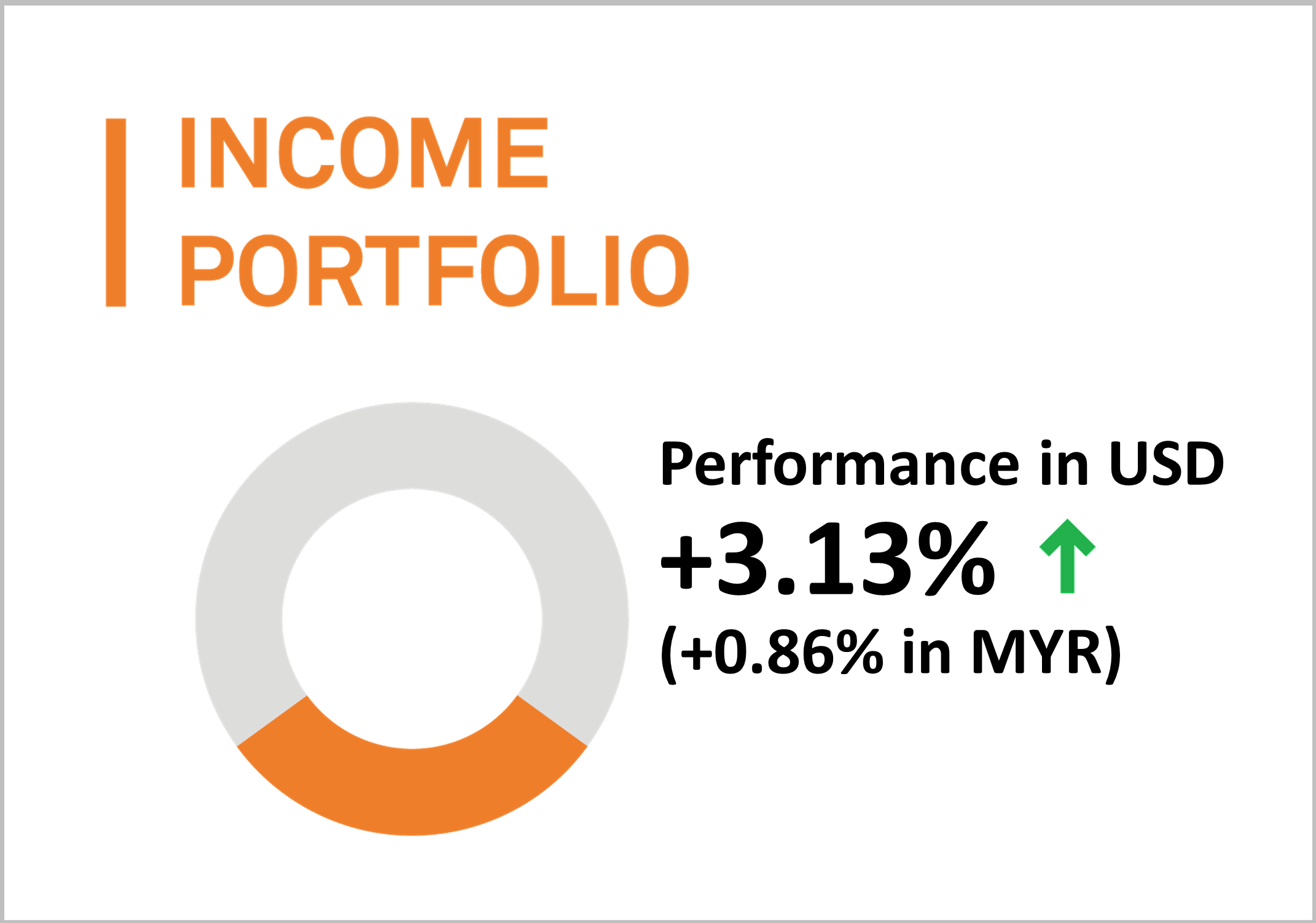

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a gain of 3.13% (up by 0.86% in MYR) in November 2023.

For the month of November 2023, the income portfolio continued to hold significant levels of short-term duration corporate bonds and investment grade bonds that balanced out longer-term US Treasury holdings. The current yield-to-maturity of the ETFs in the portfolio is around 5.95%.

The portfolio’s exposure to Long Duration Treasury Bonds (about 18%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Income portfolio)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

ISHARES IBOXX INVESTMENT GRADE (LQD)

MARKET VECTORS EMERGING MARKETS (EMLC)

9.92%

7.57%

5.58%

Bottom 3 ETFs performance (Income portfolio)

ISHARES SHORT-TERM CORPORATE (IGSB)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

ISHARES FLOATING RATE BONDS (FLOT)

2.31%

1.48%

0.44%

Source: GAX MD Sdn Bhd, data in USD term for the month of November 2023.

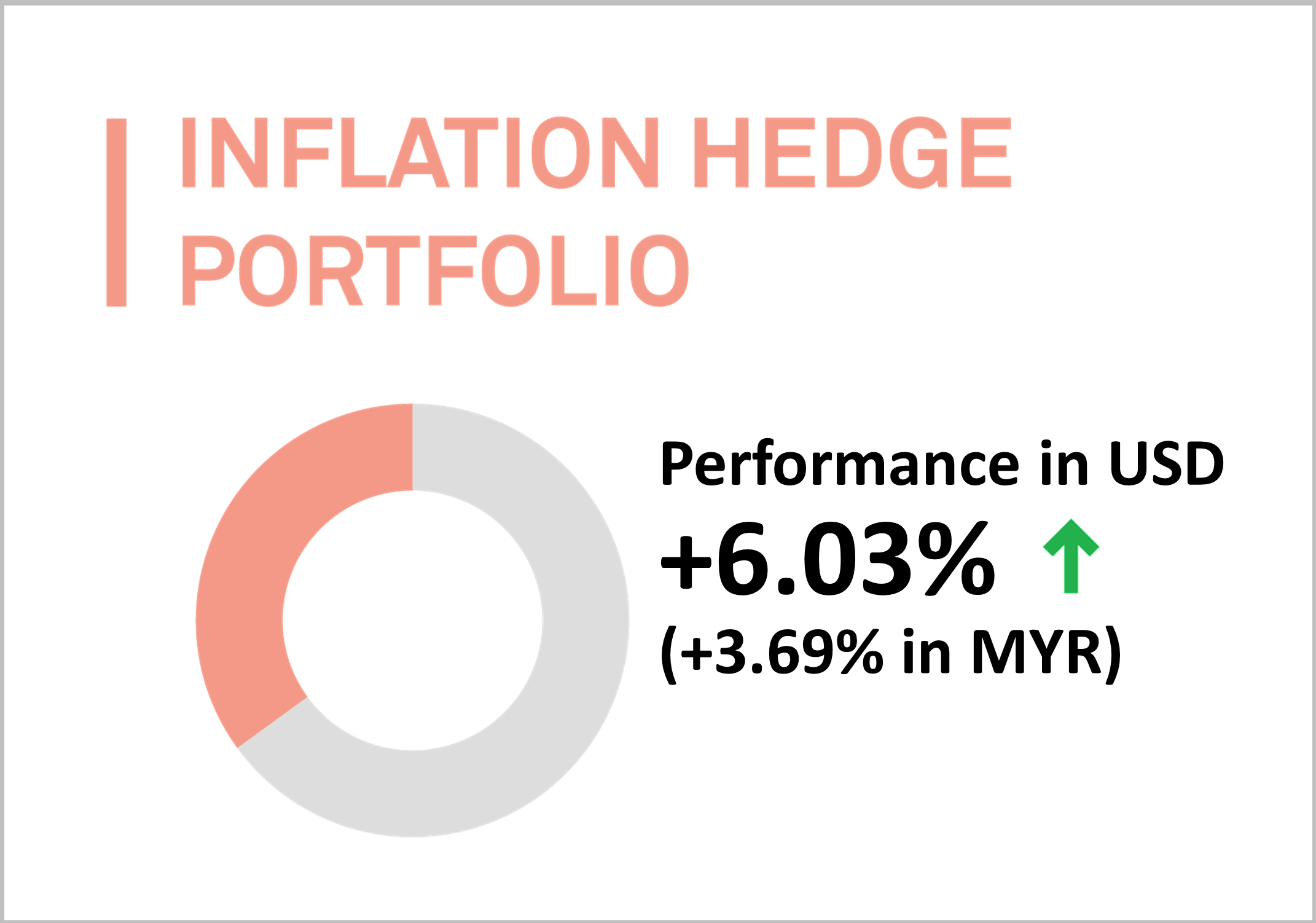

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a positive USD return in November 2023, up by 6.03% (+3.69% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to US real estate (about 30%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Inflation hedge portfolio)

ISHARES MORTGAGE REAL ESTATE (REM)

ISHARES US REAL ESTATE ETF (IYR)

ISHARES SILVER TRUST (SLV)

+14.57%

+12.29%

+10.25%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES GOLD TRUST (IAU)

INVESCO DB BASE METALS F (DBB)

INVESCO DB OIL FUND (DBO)

+2.53%

+1.53%

-6.53%

Source: GAX MD Sdn Bhd, data in USD term for the month of November 2023.

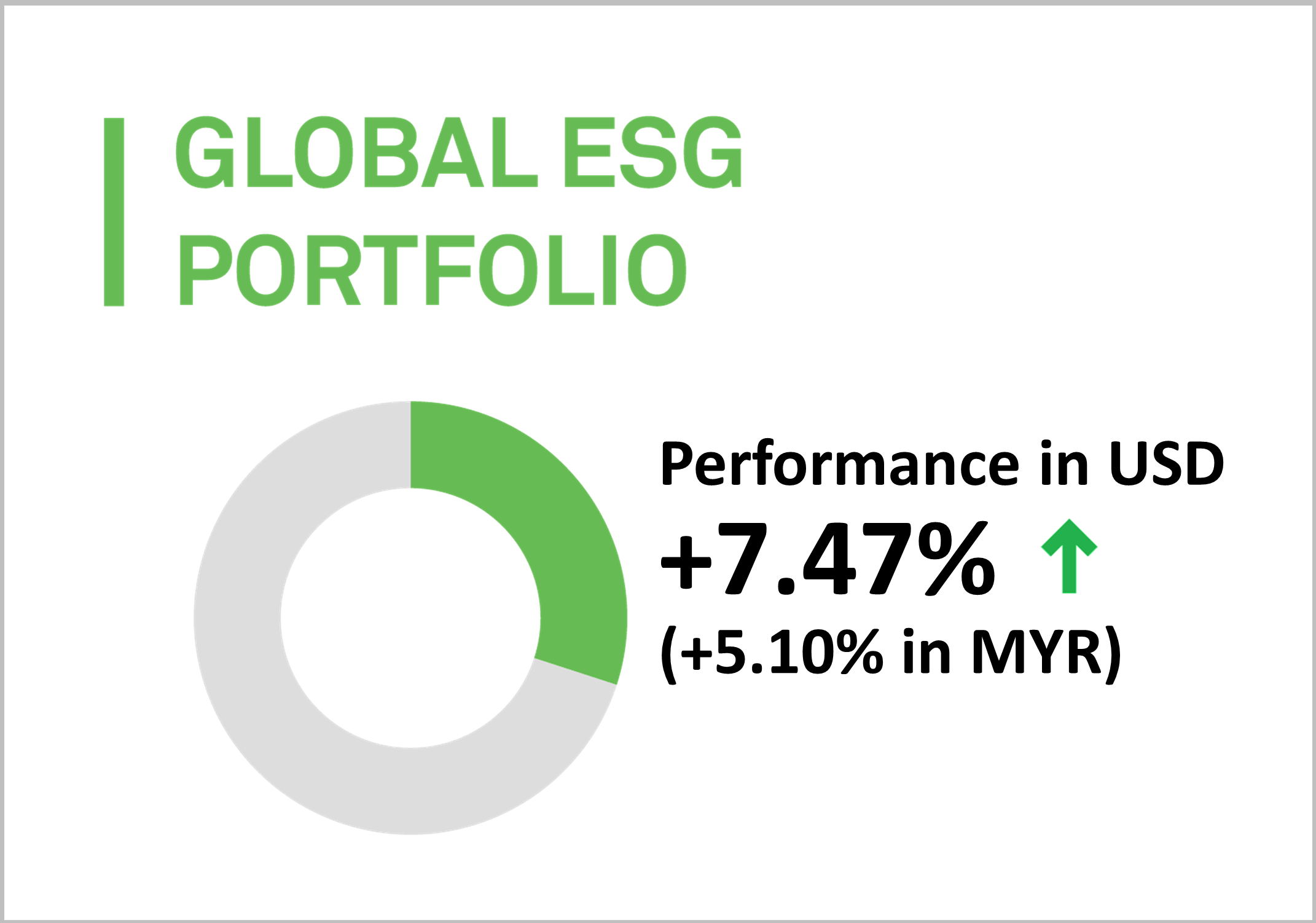

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is up by 7.47% (+5.10% in MYR) in November 2023.

Similar to the growth portfolio, the preference and exposure to US is about 60%. The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record. As such, MYTHEO portfolio consists a higher weighting in US markets in addition to better risk management compared to investment in newer and more volatile emerging markets.

Top 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

+12.07%

+10.45%

+9.63%

Bottom 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

+8.58%

+7.89%

+7.39%

Source: GAX MD Sdn Bhd, data in USD term for the month of November 2023.

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio is up by 4.63% (+3.89% in MYR) in November 2023.

MYTHEO's Essential Products portfolio was launched on 9 November strategically crafted to invest in a diversified range of equity ETFs focusing on key themes such as water-related, food-related, energy resources, and renewable energy.

Top 3 ETFs performance (Essential products portfolio)

FIRST TRUST WATER ETF (FIW)

INVESCO S&P GLOBAL WATER IND (CGW)

FIRST TRUST GLOBAL WIND ENER (FAN)

+12.18%

+11.44%

+11.04%

Bottom 3 ETFs performance (Essential products portfolio)

VANECK AGRIBUSINESS ETF (MOO)

GLOBAL X LITHIUM & BATTERY T (LIT)

ENERGY SELECT SECTOR SPDR (XLE)

+1.48%

-0.15%

-0.72%

Source: GAX MD Sdn Bhd, data in USD term for the month of November 2023.

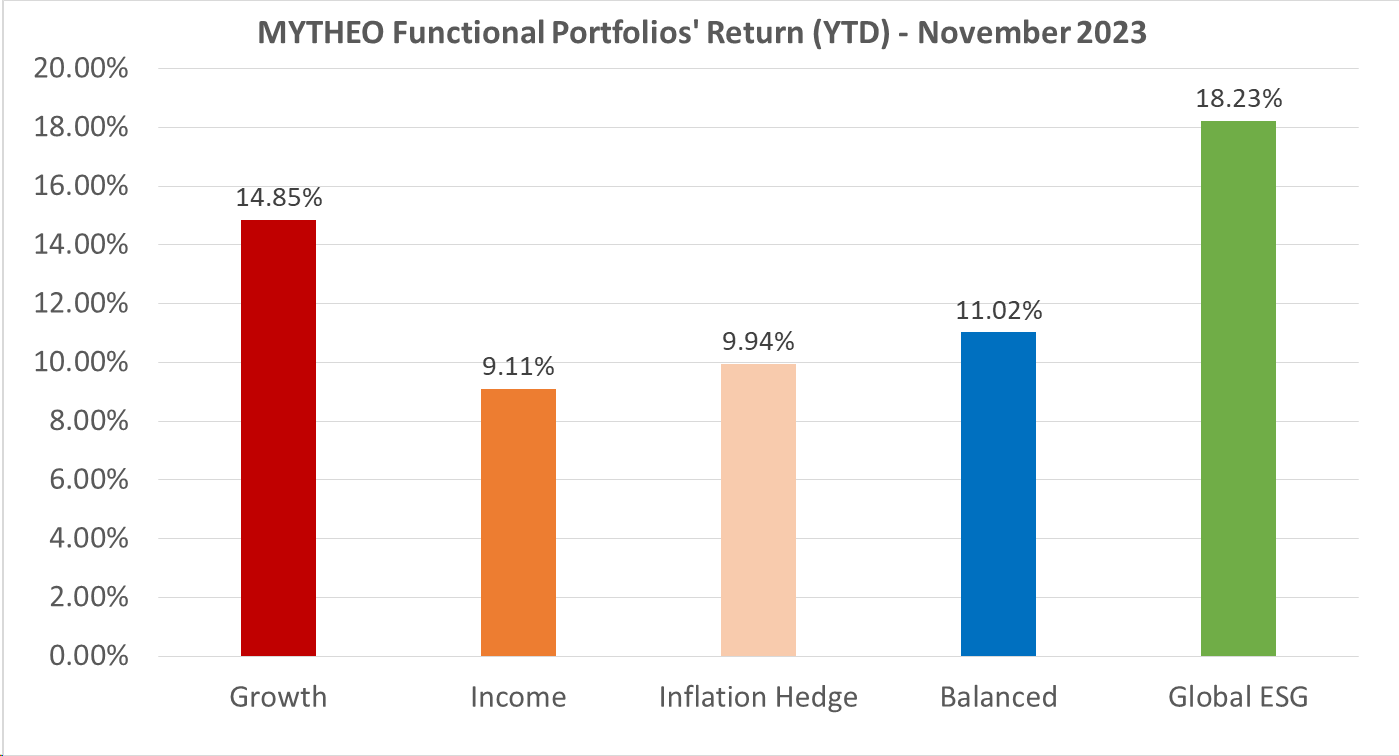

Chart 1: November 2023 - Portfolio Year-to-Date Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, December 2023

Note: Past performance is not an indication of future performance

Balanced allocation has been revised to consist of 30% Growth, 45% Income and 25% Inflation Hedge

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 30% of their investment in Growth, 45% in Income and 25% in Inflation Hedge, the actual portfolio return in MYR for October is +2.63% [(30% x 4.43%) + (45% x 0.86%) + (25% x 3.69%)]

Our Thoughts

The US Dollar (USD) weakened against the Malaysian Ringgit (MYR) in November by -2.2% to MYR 4.6570 as of the 30th of November 2023, compared to MYR 4.7620 as of the 30th of October 2023. This has had a minor negative impact on the performance of the portfolio in Ringgit.

Apart from the US Dollar itself, November was a great month for investment in the market. Global equities experienced a significant rally from developed markets like the US to emerging markets like India as the US Federal Reserve continued to hold rates steady while annualised US inflation steadied at 3.2%. China continued to lag despite government stimulus with factory activity contraction for a second straight month suggesting more may be needed to further support the economy.

As US rates continued to hold steady, this brought much needed relief to their long-term bonds with the 20+ year tenured treasuries in TLT strongly breaking its steady downtrend to return 9.9% in a single month. The continued rate freeze indicated some relief in mortgage rate hikes in a US real estate market with a limited supply and high demand together with cooling inflation . As a result, the US real estate-related ETFs also showed strong performance.

Conversely, challenges were observed in investments tied to crude oil and its associated companies attributed to the uncertainty surrounding OPEC+ output cuts, global demand fluctuations, and regional conflicts.

Investing in the Future of Resource Management

In the context of the new MYTHEO Essential Products portfolio, November showcased the opportuneness afforded by our investment strategy and its exposures. Water-related ETFs demonstrated notable resilience and almost fully recovering from a two-month decline within this single month period. This in part underscores the portfolio's affinity to dynamic market conditions.

As we navigate through challenges, MYTHEO Essential Products is strategically positioned to capitalize on emerging opportunities brought about by “Technological Development” and “Business Model Transformation”. These initiatives are designed to address supply-demand gaps within the three essential themes or water, food and energy, ensuring our portfolio remains relevant to real-life issues and forward-looking by investing in the ever-increasing efficiency of resource management.

Stable Returns with Interest-Focused Portfolios

Amidst the prevailing high interest rate environment in the United States, investors seeking stability coupled with attractive yields and USD exposure may find the MYTHEO USD Trust Portfolio to be a compelling option. Presently offering a net interest rate of 4.33% per annum, it is important to note that this rate is subject to potential adjustments based on the Federal Reserve's monetary policy and decisions by the Federal Open Market Committee (FOMC) regarding the federal funds rate.

Meanwhile, the MYTHEO MYR Portfolio which invests in the Malaysian Ringgit (MYR) money market fund allows investors to explore stability in a local currency market and adding a layer of flexibility to their portfolio strategy.

As market conditions evolve, MYTHEO remains committed to providing investors with choices that align with your financial goals. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subject to MYTHEO’s Notice and Disclaimer.