Friday, 11 November 2022

Written by Sonia Tan, Portfolio Manager of GAX MD

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in October 2022.

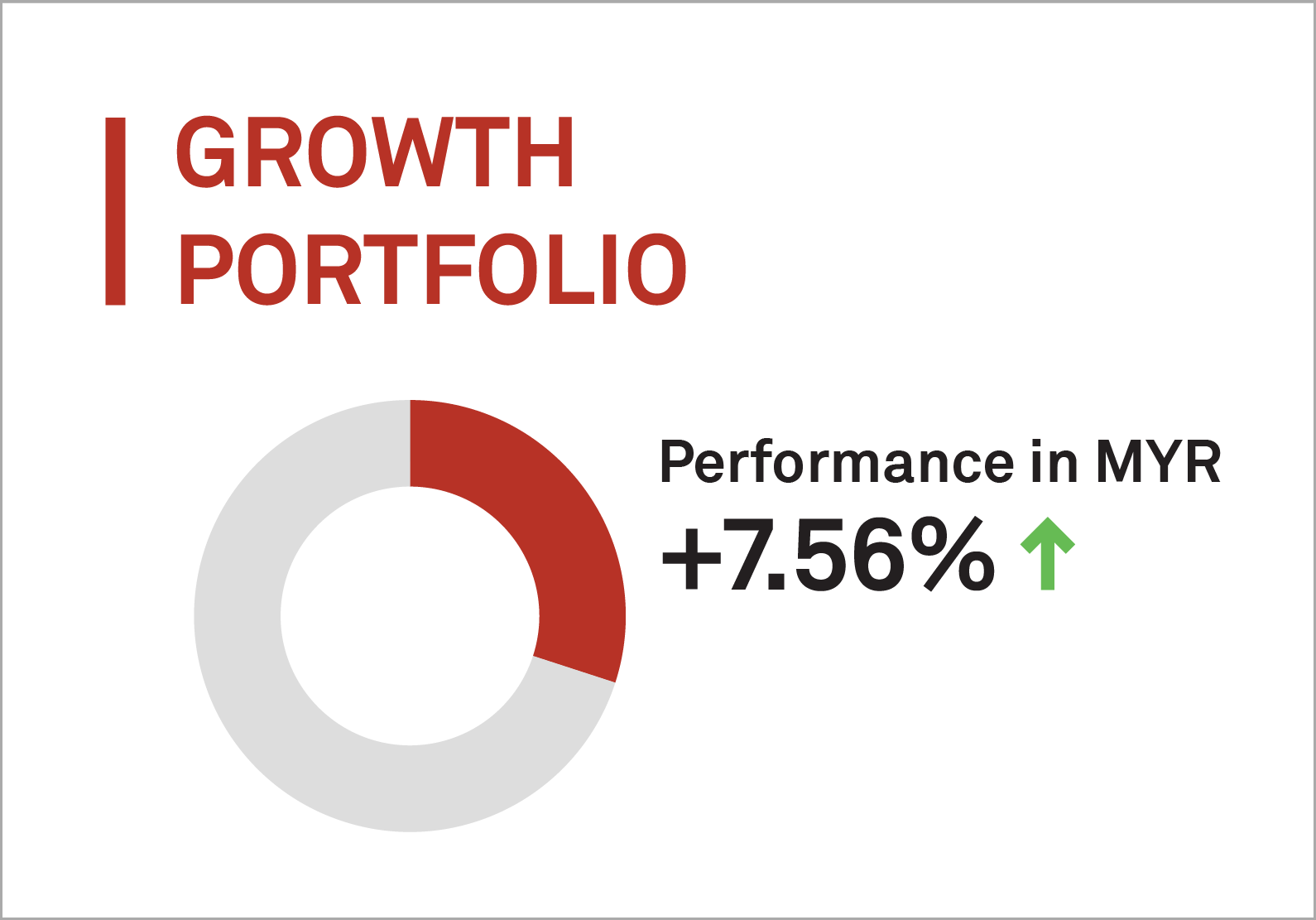

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up 7.56% (in MYR) in October 2022, with the major indexes closing out a strong month of gains on a weaker foot, as investor focus turned to the November Federal Reserve’s policy meeting. The S&P 500 climbed about 8% in the month of October, the Nasdaq composite rose 3.9% to 10,988.15 points and the Dow Jones Industrial Average soared 13.93% to 32,732.95 points.

This month, the Communist Party of China (CPC) held its 20th National party congress, a massive gathering of the country’s top leadership and a platform for the government to communicate its plan for the next 5 years. Hong Kong’s benchmark Hang Seng (HSI) index plunged 6.4%, having its worst day since the 2008 Global Financial Crisis, just a day after Chinese leader Xi JinPing secured his grip on power, with no signs of changing tack on the zero Covid policy.

The dollar gained across the board, with the dollar index rising 0.78% to 111.62, regaining some of the lustre it had lost earlier in the month, bolstered by expectations of another supersized rate increase at the November Federal Reserve monetary policy meeting. Bringing this home, the Malaysia Ringgit fell 1.96% in October versus the US dollar to RM4.7260 (as at 31st October 2022). The Ringgit was RM4.6350 on 30th September 2022.

Top 3 ETFs (Growth portfolio)

ISHARES RUSSELL 2000 VALUE (IWN)

VANGUARD VALUE ETF (VTV)

ISHARES MSCI SOUTH KOREA (EWY)

12.71%

11.73%

9.40%

Bottom 3 ETFs (Growth portfolio)

ISHARES CHINA LARGE-CAP ETF (FXI)

ISHARES MSCI HONG KONG (EWH)

ISHARES MSCI FRONTIER AND SELECT EM (FM)

-18.99%

-11.73%

-3.33%

The performance of ETFs in USD is slightly weaker than in MYR. This is because the Ringgit has weakened versus USD in recent months, causing the portfolio performance to be appreciated more in MYR.

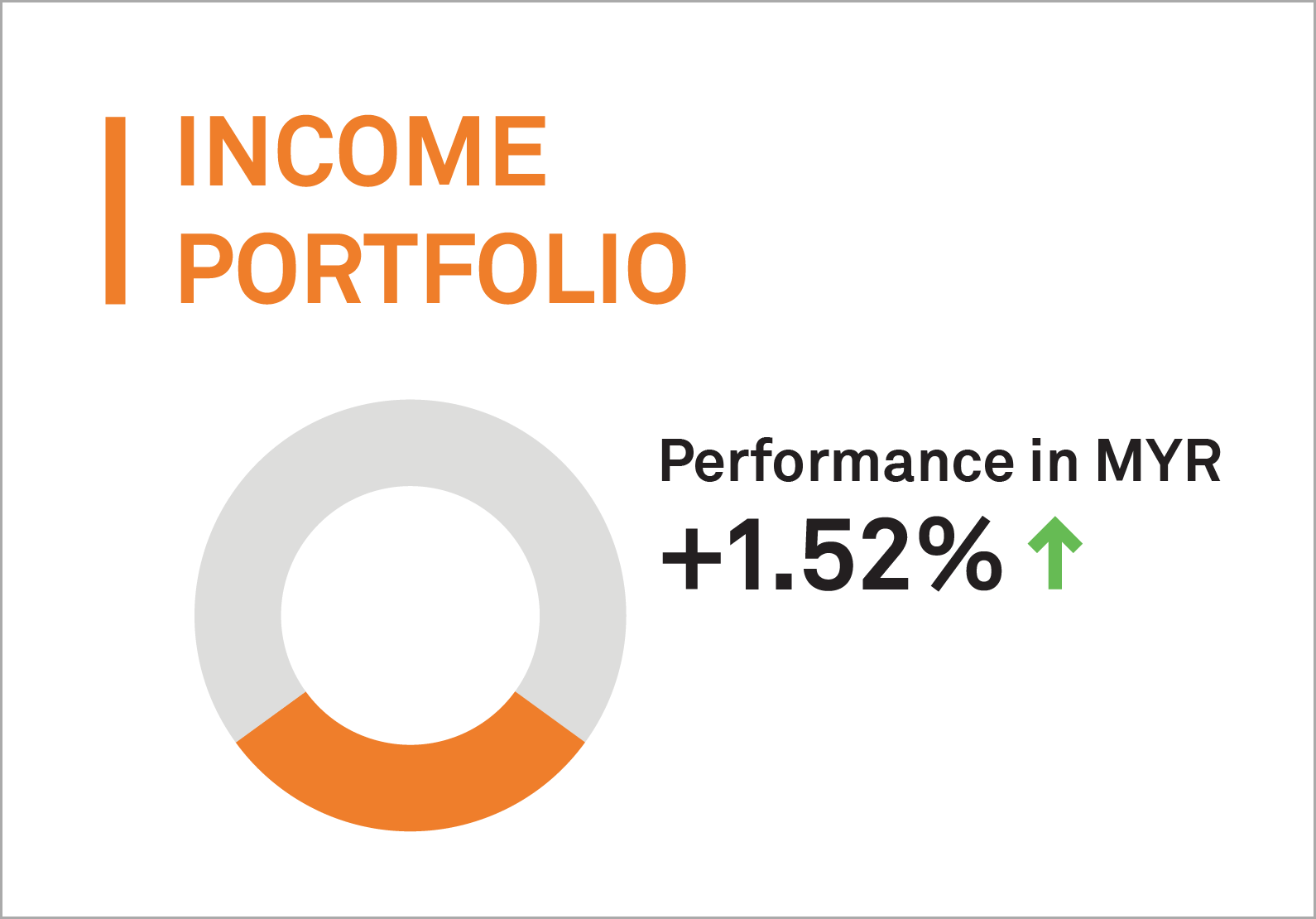

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a positive return of 1.52% (in MYR) in October 2022.

Treasury yields edged higher as a relatively strong U.S economy and labour market suggested that the Federal Reserve will aggressively raise interest rates again to tame inflation. The Fed needs to slow demand for inflation to come down and to do that they need to see moderation in employment rate.

The yield on 10 Year US Treasuries rose from 3.83% to 4.06%, the yield on 10 Year Gilts slid from 4.09% to 3.53%.

Meanwhile, October’s CPI - reflecting September 2022 inflation data - came in at 8.2%, with little change from August’s 8.3% rise. A worsening core CPI, which excludes food and energy prices, increased 6.6% from a year ago to reach a new 40-year high.

Top 3 ETFs (Income portfolio)

ISHARES IBOXX HIGH YIELD CORPORATE BOND (HYG)

SPDR BLOOMBERG SHORT-TERM HIGH YIELD BOND (SJNK)

SPDR BLACKSTONE SENIOR LOAN (SRLN)

2.86%

1.98%

1.15%

Bottom 3 ETFs (Income portfolio)

ISHARES 20+ YEAR TREASURY BOND (TLT)

ISHARES MBS (MBB)

ISHARES IBOXX INVESTMENT GRADE CORPORATE BOND (LQD)

-6.19%

-1.35%

-1.07%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

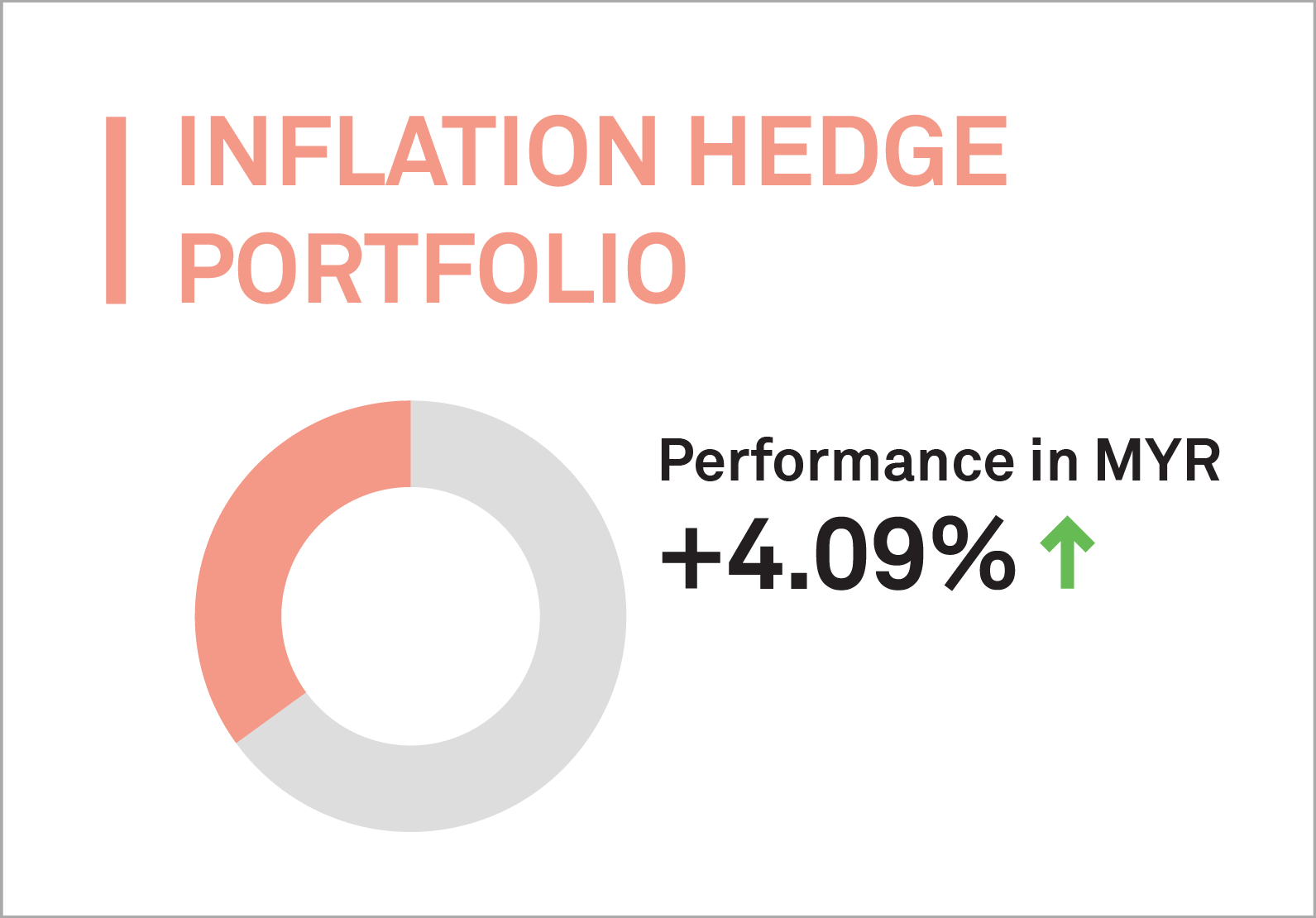

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio saw a positive return in October 2022, rising 4.09% (in MYR).

While the prices of most commodities have declined from their recent peaks amid concerns of an impending global recession, this was somewhat offset by US Dollar strength. For example, while Brent crude oil fell nearly 6% in U.S. dollars from the start of the Russian invasion of Ukraine in February 2022 through to the end of last month, almost 60% of oil-importing emerging markets and developing economies saw an increase in domestic currency oil prices during this period. Additionally, nearly 90% of these economies saw a larger increase in wheat prices in local currency terms compared to the rise in U.S dollars. Although many commodity prices have retreated from their peaks, they are still high compared to their average level over the past two years.

Meanwhile, oil prices fell on expectations that U.S production could rise, while weaker economic data out of China and widening Covid-19 curbs weighed on demand. In October, Brent crude oil dropped 0.96% to $94.85 per barrel. West Texas Intermediate (WTI) crude fell to $86.07 a barrel, a 2.08% loss. Gold was 0.61% lower at $1634.80 per ounce, which edged lower as a stronger dollar, elevated U.S bond yields and prospects of more rate hikes from the federal reserve dented the non-yielding metal’s appeal.

Top 3 ETFs (Inflation hedge portfolio)

ISHARES MORTGAGE REAL ESTATE (REM)

INVESCO DB OIL FUND (DBO)

ISHARES GLOBAL INFRASTRUCTURE (IGF)

12.61%

9.42%

5.36%

Bottom 3 ETFs (Inflation hedge portfolio)

INVESCO DB BASE METALS FUND (DBB)

ISHARES GOLD TRUST (IAU)

ISHARES GLOBAL CLEAN ENERGY (ICLN)

-1.79%

-1.74%

-1.05%

The performance of ETFs in USD is slightly weaker than in MYR. This is because the Ringgit has weakened versus USD in recent months, causing the portfolio performance to be appreciated more in MYR.

4. Global ESG Portfolio

Similar to the Growth Portfolio, MYTHEO’s Global ESG portfolio is up by 6.73% (in MYR).

Top 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE (NULV)

ISHARES MSCI USA ESG SELECT (SUSA)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

11.11%

8.81%

7.98%

Bottom 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EM (ESGE)

ISHARES ESG AWARE MSCI EAFE (ESGD)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

-1.37%

5.83%

6.94%

The performance of ETFs in USD is slightly weaker than in MYR. This is because the Ringgit has weakened versus USD in recent months, causing the portfolio performance to be appreciated more in MYR.

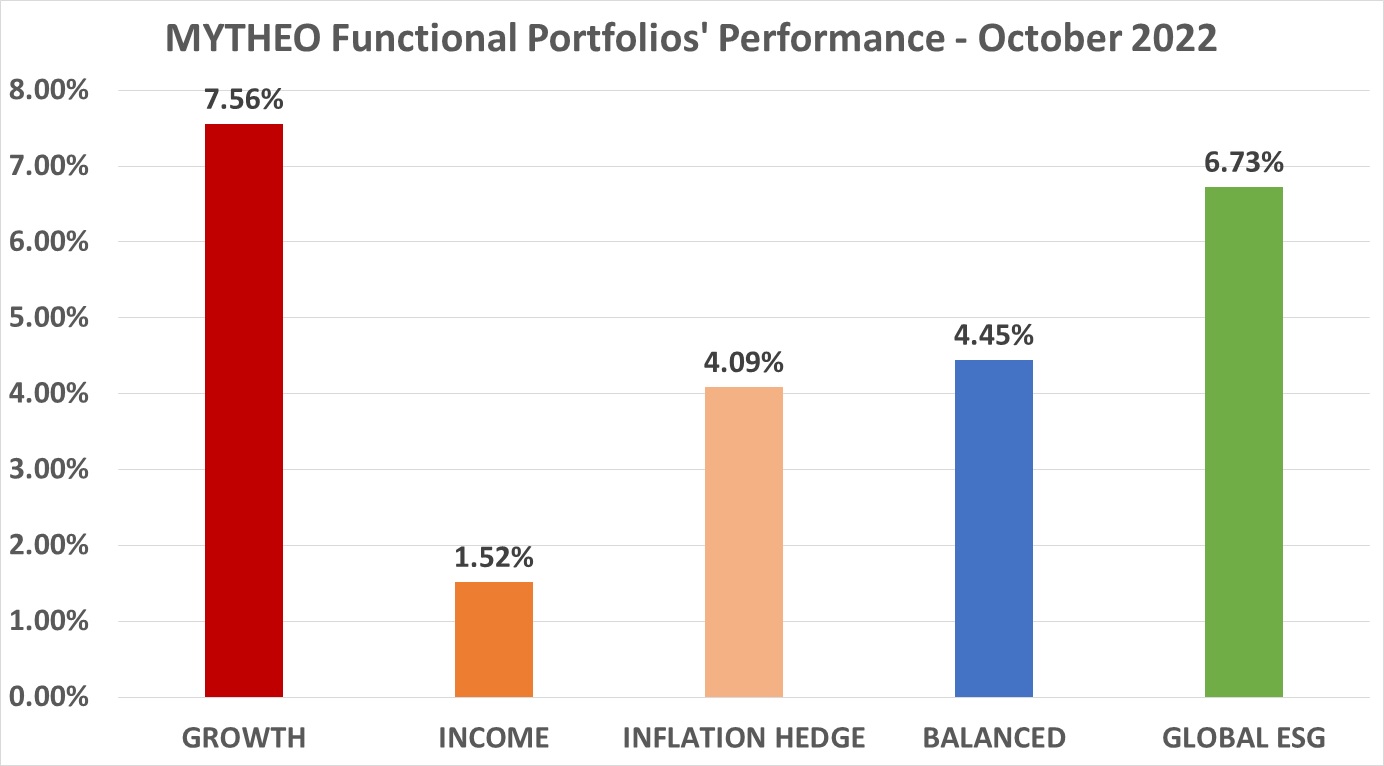

Chart 1: October 2022 - Portfolio Cumulative Rate of Return in % (MYR)

Balanced allocation consists of 40% Growth, 40% Income and 20% Inflation Hedge.

Source: GAX MD Sdn Bhd, November 2022

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weighted return from the allocation to each functional portfolio.

For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is 4.45% [(40% x 7.56%) + (40% x 1.52%) + (20% x 4.09%)]

Our Thoughts

Inflation remains well above target in developed markets. Year to date, 2022 has seen some of the sharpest increases in short and long-term interest rates for decades. Most recently, the UK has amply demonstrated the real-world limits on expansionary fiscal policy and risk premium associated with political instability. The order and timing of economic events like GDP growth, the interest rate increases, followed by inflation and unemployment are in line with the view of positioning portfolios correctly with increasing market ‘noise’ levels.

We believe yields on US government bonds are now set to moderate as the US and global economies slow over coming quarters. Even modestly declining long-term yields would be an important pressure release valve for both the US dollar and equity market valuations.

However, equities will still have to contend with pressure on profit forecasts as rapidly declining demand meets only relatively slowly declining input cost pressure. In an environment where a significant and synchronised slowdown in real economic activity is the base case, with inflation expected to remain well above target over the next 12 months, we still believe investors should remain focused on building robust portfolios keeping in mind the variety of economic outcomes.

With interest rates increasing rapidly this year, many investors are focused on short-duration bonds which suffer lower drops in price. The possibility of a recession and the Fed pivoting, pausing, or even cutting interest rates ahead now makes long-term bonds more attractive. However, a Fed pivot has had a mixed impact on equity markets historically. Fed pivot is not always a necessary condition for equities to advance. What is perhaps more important is an improvement in the economic and earnings outlook.

Our research shows that spending time in the market is more likely to give you good returns over the long term than waiting for the perfect moment to invest. Having a well-balanced, diversified portfolio, with a risk profile consistent with your goals, and being prepared with a plan in the event of an unexpected outcome are keys to successful investing.

MYTHEO’s Omakase portfolio combines Growth, Income and Inflation Hedge functional portfolios based on your goals. It offers intelligent global diversification to protect against extreme fluctuations in any single asset class, diversifying your portfolio into alternative assets which offer a better cushion from the volatility in the equity market.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.