Thursday, 09 November 2023

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in October 2023.

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down by 5.39% (down 4.01% in MYR) in October 2023.

For the month of October 2023, we streamlined the Growth Portfolio, focusing on regional consolidation rather than country level dispersion. The US markets continue to hold the lion’s share of our investment exposure.

The portfolio’s allocation to the SPDR EURO STOXX 50 (about 4%) was the least negative contributor to the overall portfolio performance during the period.

Top 3 ETFs (Growth portfolio)

SPDR EURO STOXX 50 (FEZ)

INVESCO QQQ ETF (QQQ)

VANGUARD VALUE (VTV)

-2.05%

-2.07%

-2.64%

Bottom 3 ETFs (Growth portfolio)

ISHARES MSCI CANADA (EWC)

INVESCO S&P 500 PURE VALUE (RPV)

ISHARES RUSSELL 2000 VALUE (IWN)

-5.14%

-5.72%

-6.01%

Source: GAX MD Sdn Bhd, data in USD term for the month of October 2023.

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a loss of 1.57% (down by 0.13% in MYR) in October 2023.

For the month of October 2023, the portfolio underwent its quarterly reallocation. This resulted in some high yield ETFs shifting to long-term treasury and emerging market bonds, due to high yield corporate bond yield reduction against yield improvements in long-termed Treasuries and emerging market bonds. The current yield-to-maturity of the ETFs in the portfolio is around 6.32%.

The portfolio’s exposure to floating rate notes (about 7%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Income portfolio)

ISHARES FLOATING RATE BONDS (FLOT)

ISHARES SHORT-TERM CORPORATE (IGSB)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

+0.49%

-0.03%

-0.14%

Bottom 3 ETFs (Income portfolio)

SPDR BARCLAYS SHORT-TERM HIGH YIELD (SJNK)

ISHARES IBOXX INVESTMENT GRADE (LQD)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

-0.90%

-2.41%

-5.46%

Source: GAX MD Sdn Bhd, data in USD term for the month of October 2023.

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a negative USD return in October 2023, down by 1.67% (-0.23% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to Gold (about 15%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Inflation hedge portfolio)

ISHARES GOLD TRUST (IAU)

ISHARES SILVER TRUST (SLV)

ISHARES TIPS BOND (TIP)

+7.43%

+3.15%

-0.72%

Bottom 3 ETFs (Inflation hedge portfolio)

INVESCO DB OIL FUND (DBO)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX (ICLN)

ISHARES MORTGAGE REAL ESTATE (REM)

-6.29%

-11.01%

-11.24%

Source: GAX MD Sdn Bhd, data in USD term for the month of October 2023.

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is down by 2.90% (-1.48% in MYR) in October.

Similar to the growth portfolio, the preference and exposure to US is about 60%. The US occupies a significant fraction of Environmental, Social and Governance-focused (ESG) investments with a longer track record, therefore our portfolio follows this trend in terms of placing a higher weighting in US markets, in addition to better risk management compared to investment in newer and more volatile emerging markets.

Top 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

NUVEEN ESG LARGE-CAP VALUE (NULV)

-2.32%

-2.40%

-2.98%

Bottom 3 ETFs (Global ESG portfolio)

ISHARESs ESG AWARE MSCI EM (ESGE)

ISHARES ESG AWARE MSCI EAFE (ESGD)

ISHARES MSCI USA ESG SELECT (SUSA)

-3.01%

-3.18%

-3.53%

Source: GAX MD Sdn Bhd, data in USD term for the month of October 2023.

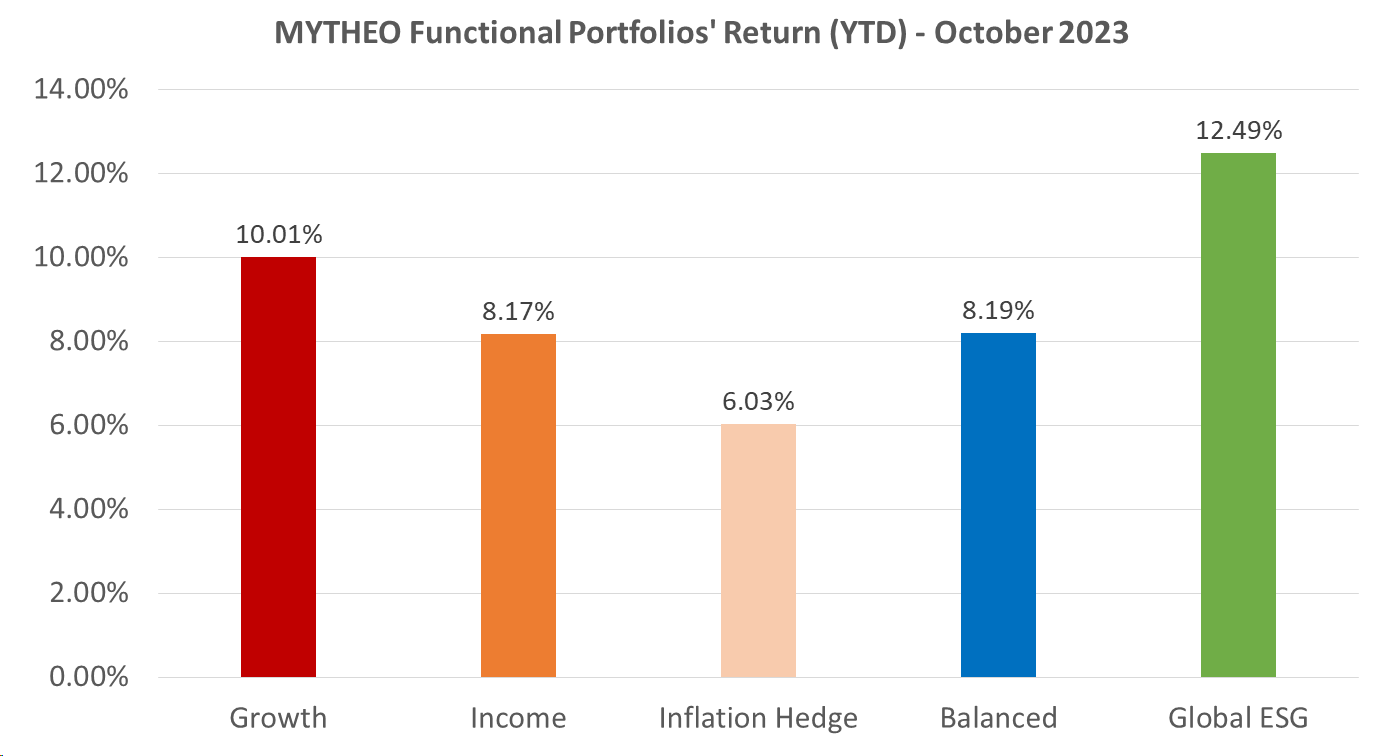

Chart 1: October 2023 - Portfolio Year-to-Date Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, November 2023

Note: Past performance is not an indication of future performance

Balanced allocation has been revised to consist of 30% Growth, 45% Income and 25% Inflation Hedge

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 30% of their investment in Growth, 45% in Income and 25% in Inflation Hedge, the actual portfolio return in MYR for October is -1.32% [(30% x -4.01%) + (45% x -0.13%) + (25% x -0.23%)]

Our Thoughts

The US Dollar (USD) strengthened against the Malaysian Ringgit (MYR) in October by 1.5% to MYR 4.7620 as of the 31st of October 2023, compared to MYR 4.6935 as of the 29th of September 2023. This has had a minor positive impact on the performance of the portfolio in Ringgit.

The All-Country World Index ETF (ACWI) representing equities was down by 2.54%. Jitters on further rate hiking in the US due to sticky inflation overcame a relatively positive Q3 earnings quarter. According to Zacks Research Daily, 82% of the 377 constituents within the S&P 500 Index which have released their Q3 report beat EPS estimates, with 61.8% of these also beating revenue estimates as of the 2nd of November 2023, which should provide some tailwinds for further equity appreciation when coupled with a hold in Fed Funds hiking.

On the other end of the world, the Chinese market continued to be held back by its weakness in the property market, with Evergrande trying to fend off liquidation and Country Garden defaulting on their offshore loans. In response, China has taken stimulus measures including the approval of a 1T yuan sovereign bond issue and a law to allow local governments to frontload part of their 2024 bond quotas, in which the strength of its effect remains to be seen.

For bonds, iShares Core U.S. Aggregate Bond ETF (AGG) losses stretched to a 6th month in a row. Long duration US Treasury yields continued to grow through the month, leading to a corresponding further price depreciation. This yield differential between US yields and other countries’ yields, such as our own, will add a confounding factor to other countries’ central bank rate decisions in balancing inflation and currency depreciation against local economic stimulus.

One bright spot shone through in terms of precious metals, whereby gold and silver prices trended higher in October. This may be partially attributed to an interest in asset diversification due to the conflict that recently erupted in the Middle East, which has the potential to spread geographically as well as affect major trade routes around the area.

Given the high-interest rate levels within the US with the potential occurrence of further rate hikes, investors who are looking for a safe haven with attractive yield may consider MYTHEO USD Trust Portfolio. The current net interest rate for this portfolio is 4.33% p.a. and is subject to change based on the Federal Reserve's monetary policy and the Federal Open Market Committee's (FOMC) decision on the federal funds rate.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subject to MYTHEO’s Notice and Disclaimer.