Thursday, 08 December 2022

Written by MYTHEO

In case you missed it, here’s a brief recap of the webinar (or you can watch the webinar playback here).

So, are bear markets great buying opportunities?

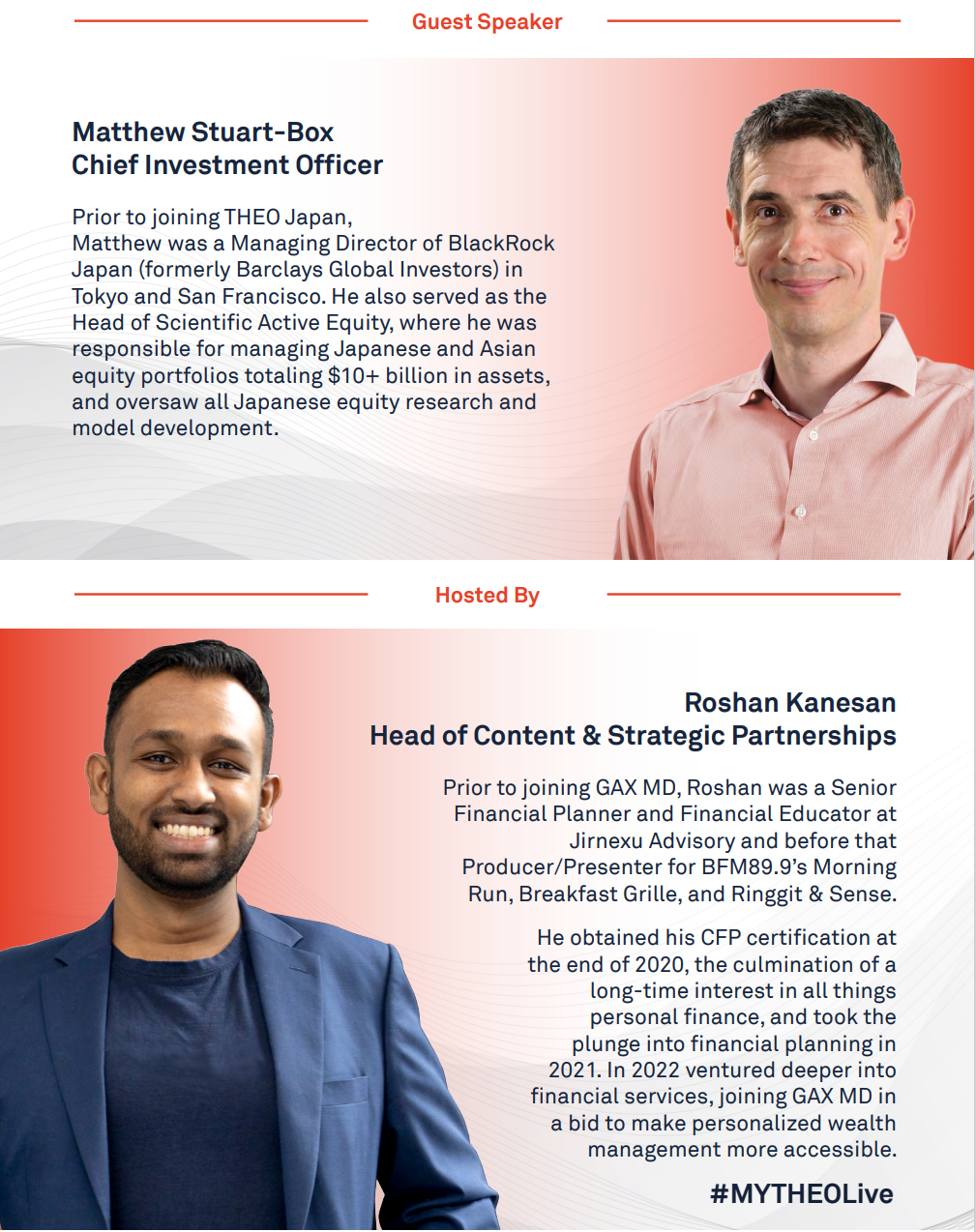

According to MYTHEO’s Chief Investment Officer, Matthew Stuart-Box, most of the time, bear markets are buying opportunities for diversified portfolios as global markets tend to recover over time. However, the real question is how to take advantage of the opportunity?

This is where regular monthly investments, or Dollar-Cost Averaging, comes into play.

The act of steady dollar-cost averaging can be a great wealth builder in the long term, even when taking into consideration market crashes such as the Global Financial Crisis in 2008, the Pandemic market crash in early 2020, and this year’s bear market.

But wait, what if the market “never comes back”?

The Nikkei 225 is still below its bubble peak from 30 years ago and the NASDAQ took 17 years to surpass its DotCom Bubble high. Matt breaks this down in more detail during the webinar, but in essence this highlights the importance of intelligent global diversification that MYTHEO uses in its investment strategy.

MYTHEO uses 3 functional portfolios (Growth, Income and Inflation Hedge) as building blocks for the personalized portfolios clients receive. This level of intelligent diversification helps to deliver better risk/return balance and smaller/shorter drawdowns over the long run.

Hold on, should investors then wait for bear markets to invest and avoid bull markets?

Matt emphasized that this is tempting but very dangerous.

Theoretically speaking, if you can accurately predict bull and bear markets then you should sell at the start of a bear market and buy at the start of a bull market. But this is (almost) impossible to do consistently.

On top of that, bull markets tend to be longer than bear markets so the opportunity cost of not investing during bull markets is high.

Instead, investors should stay invested, be smartly diversified and add to your investments regularly. This is generally a more realistic way of building wealth than trying to time markets.

Want to learn more about all this? Watch the webinar by clicking the button below.

MYTHEO is a Digital Investment Manager, more commonly known as a robo-advisor, licensed by the Securities Commission Malaysia.

Disclaimers:

Past performance is not a guarantee of future performance.

This communication is subject to terms available at the following link:https://www.mytheo.my/MYTHEO/resources#legal-and-documents