Thursday, 15 September 2022

Written by Sonia Tan, Portfolio Manager of GAX MD

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in August 2022.

Watch the Performance Review below.

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down 2.48% (in MYR) in August 2022, as investors extended a sell-off that began last week of August after hawkish comments by Federal Reserve (Fed) chair Jerome Powell at the central bank’s gathering in Jackson Hole. The stock market plummeted after Fed Jerome Powell said in his speech the central bank won’t back off in its fight against rapid inflation. S&P 500 fell 4.24% to 3955.01, the Nasdaq composite slid 4.64% to 11,816.20 and the Dow Jones Industrial Average dropped 4.06% to 31,509.75 points.

Meanwhile, China bucked the trend, posting positive results over the month, primarily driven by the Chinese tech behemoths, Alibaba and Tencent, which posted positive results over the month. Other emerging market economies, in particular India, Indonesia and Brazil, also deliver good returns over the month, leaving the broad MSCI Emerging Markets Index in positive territory over the month and significantly ahead of developed market indices.

In Foreign Exchange (FX) markets, DXY (an Index measuring the value of the US dollar vs major global currencies) hit a 20-year high. Malaysia Ringgit gave up ground versus the US dollar in August by 0.6% to RM4.4740 on 31st August 2022, compared to RM4.4480 on 31st July 2022.

Top 3 ETFs (Growth portfolio)

WISDOMTREE INDIA EARNINGS (EPI)

ISHARES MSCI FRONTIER AND SELECT EM (FM)

ISHARES CHINA LARGE-CAP ETF (FXI)

1.47%

0.26%

-0.56%

Bottom 3 ETFs (Growth portfolio)

ISHARES MSCI GERMANY (EWG)

ISHARES MSCI UNITED KINGDOM (EWU)

ISHARES MSCI MEXICO (EWW)

-7.38%

-6.47%

-5.45%

The performance of ETFs in USD is slightly weaker than in MYR. This is because the Ringgit has weakened versus USD in recent months, causing the portfolio performance to be appreciated more in MYR.

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a negative return of 1.68% (In MYR) in August 2022. As mentioned above, for pretty much the entire month of August, global bond markets were under severe pressure as investors continued to weigh Fed’s hawkish rhetoric that interest rates would likely stay higher for longer than markets were currently pricing. Some examples across major bond markets show the yield on 10 Year US Treasuries rose from 2.65% to 3.20%, the yield on 10 Year Gilts rose from 1.86% to 2.80% and the yield on 10 Year Bunds rose from 0.18% to 0.95%. Taking their lead from the Govt Bond markets, Investment Grade (IG) and High Yield (HY) credits also fell sharply during August continuing the same bearish move seen in Treasuries.

Meanwhile, Inflation cooled slightly in July, rising 8.5% over the prior 12 months, down from a 9.1% annual rate in June.

Top 3 ETFs (Income portfolio)

SPDR BLACKSTONE SENIOR LOAN (SRLN)

VANECK JP MORGAN EM LOCAL CURRENCY BOND (EMLC)

ISHARES 1- 5 YEARS INVESTMENT GRADE CORPORATE BOND (IGSB)

0.73%

-1.03%

-1.68%

Bottom 3 ETFs (Income portfolio)

ISHARES 20+ YEAR TREASURY BOND (TLT)

ISHARES IBOXX HIGH YIELD CORPORATE BOND (HYG)

ISHARES IBOXX INVESTMENT GRADE CORPORATE BOND (LQD)

-4.73%

-4.68%

-4.66%

The performance for ETFs returns in USD are slightly weaker than MYR. This is due to the Ringgit has been weakened versus US dollar in recent month, causing the portfolio performance being appreciated more in MYR.

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio saw a negative return on August 22, edging lower by 2.59% (in MYR). Commodity prices were generally weaker in August led lower by worries that the global economy would slow further with renewed restrictions to curb Covid-19 in China. Oil and Wheat prices fell by more than 9%, copper prices by about -1.5% and gold prices by about -3%. A similar pattern was seen with Iron Ore which fell by 6.5% over the month. It’s getting much clearer post the Jackson Hole symposium where the Fed reiterated their commitment to stamp out inflation.

The obvious exception in this complex was Natural gas which surged another 10.9% during the month driven by investor fears of declining Russian supply to Europe.

Meanwhile, US mortgage rates which tend to track 10-year US Treasury bonds climbed for a second week in a move that threatens to further cool the housing market.

Top 3 ETFs (Inflation hedge portfolio)

ISHARES GLOBAL CLEAN ENERGY (ICLN)

INVESCO DB BASE METALS FUND (DBB)

ISHARES GLOBAL INFRASTRUCTURE(IGF)

-0.49%

-0.81%

-2.19%

Bottom 3 ETFs (Inflation hedge portfolio)

SPDR DOW JONES INTERNATIONAL REAL ESTATE (RWX)

ISHARES MORTGAGE REAL ESTATE (REM)

ISHARES US REAL ESTATE(IYR)

-7.30%

-7.15%

-5.86%

The performance of ETFs in USD is slightly weaker than in MYR. This is because the Ringgit has weakened versus USD in recent months, causing the portfolio performance to be appreciated more in MYR.

4. Global ESG Portfolio

Similar to the Growth Portfolio, MYTHEO’s Global ESG portfolio is down by 2.97% (in MYR).

Top 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EM (ESGE)

NUVEEN ESG LARGE-CAP VALUE(NULV)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

-1.91%

-3.02%

-4.03%

Bottom 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EAFE (ESGD)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES MSCI USA ESG SELECT (SUSA)

-6.28%

-5.38%

-4.31%

The performance of ETFs in USD is slightly weaker than in MYR. This is because the Ringgit has weakened versus USD in recent months, causing the portfolio performance to be appreciated more in MYR.

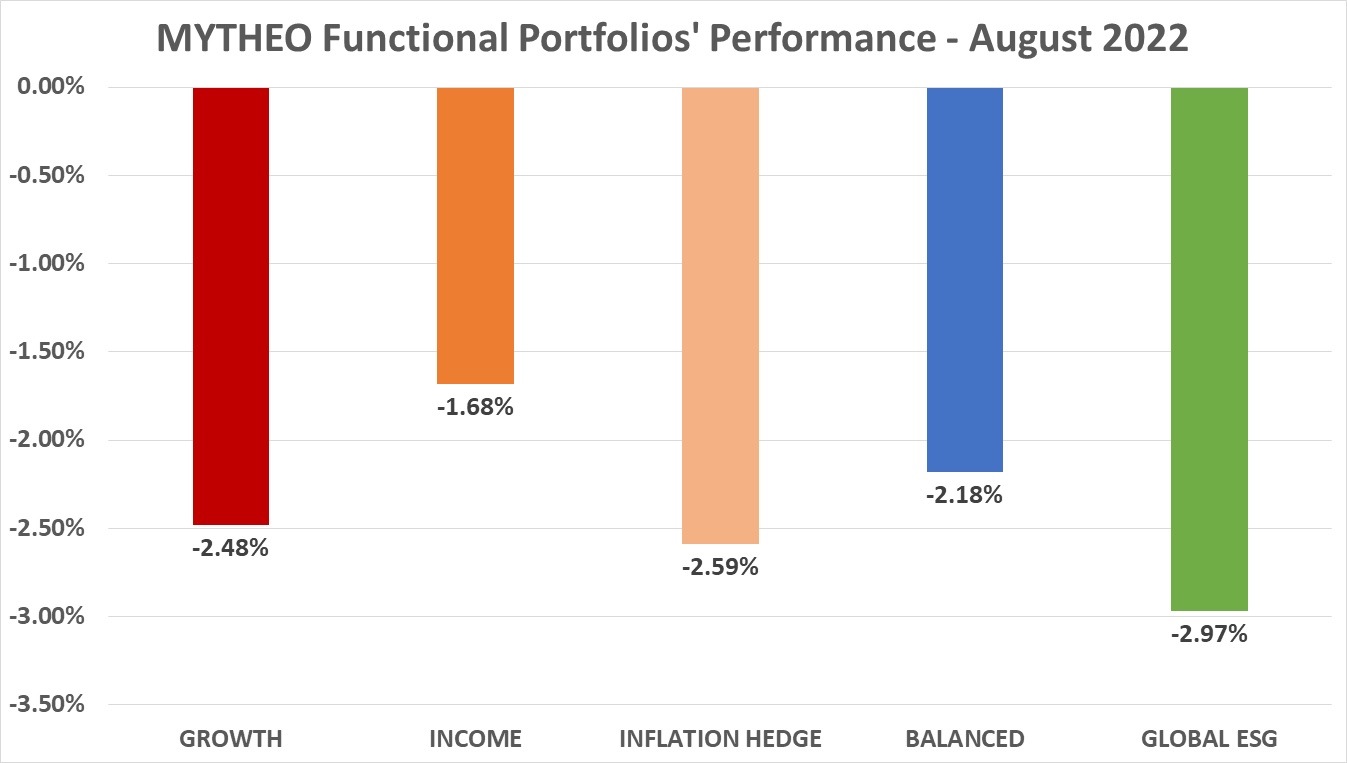

Chart 1: August 2022 - Portfolio Cumulative Rate of Return in % (MYR)

Balanced allocation consists of 40% Growth, 40% Income and 20% Inflation Hedge.

Source: GAX MD Sdn Bhd, September 2022

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is -2.18% [(40% x -1%) + (40% x -0.67%) + (20% x -0.52%)]

Our Thoughts

We mentioned in last month’s commentary that “investors are conscious of the fact that central banks, whilst anxious to look as if they are doing something about inflation, are actually very restricted as to the extent of monetary tightening that is possible without hurting the economy.

This sentiment persisted into the first half of August where risky assets staged a relatively strong rally from their mid-June lows to their mid-August peak, with global equities rising about 13% over this period. Since mid-August, though, global equities have given back over half their gains, with other major risk assets following a similar pattern.

The outlook for US monetary policy remains a key driver of these moves. Until recently, expectations had risen that the Fed could consider softening the pace of rate hikes amid what appeared to be relatively weak data points across key growth and housing market indicators. However, at the Jackson Hole conference, Fed Chair Powell was at pains to emphasise the fight with inflation remained the primary priority.

Already, the U.S. economy shrank in the first two quarters of 2022, raising fears of a recession and suggesting the economy is already slowing markedly, even while inflation remains high. With The Fed indicating that they are not likely to pivot in 2023 and interest rates would likely stay higher for longer than markets were currently pricing, for investors, the more important question to ask is what might the next recession look like and what are the implications for different assets? Would a recession result in a mild market pullback or something more severe since steep declines in stock markets often coincide with severe economic downturns?

A review of history suggests the following:

(i) Bear markets caused by economic imbalances or financial bubbles tend to be long-lasting and the most damaging as they are not easily resolved by conventional policy tools;

(ii) Event-driven bear markets caused by one-off shocks (COVID-19 and wars) tend to be sharp, but short-lived; and

(iii) Cyclical bear markets are the most common of the three and are part and parcel of economic cycles as central banks tighten policy in response to rising inflation.

The US economy will eventually succumb to a recession at some point over the coming years. But, if history is any guide, losses from cyclical bear markets, while sharp, can be relatively swift to recover. A bear market will test the resolve of even the most resolute investors. Selling out entirely during a drawdown is just as risky as being fully invested during a bear market. Few investors can expect to reliably time markets. Investors who sell during a drawdown will most likely miss out on sharp rallies that tend to follow bear markets, reducing their long-term returns. Similarly, one who stays over invested in equities will subject the portfolio to unnerving drawdowns.

Ensuring one’s portfolio has a diversified “foundation” allocation (which includes exposure to different asset classes) is important to build resilience in a bear market. The inclusion of safe-haven assets such as gold to an existing portfolio is one way to mitigate bear market losses, while remaining invested. The bigger picture: Every bear market in the past has been followed by a bull market, so they represent opportunities to buy on the cheap, in hindsight.

Having a well-balanced, diversified portfolio, with a risk profile consistent with your goals, and being prepared with a plan in the event of an unexpected outcome are keys to successful investing. MYTHEO’s Omakase portfolio combines Growth, Income and Inflation Hedge functional portfolios based on your goals. It offers global diversification to protect against extreme fluctuations in any single asset class, diversifying your portfolio into alternative assets which offer a better cushion from the volatility in the equity market.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.