21 January 2026

Written by Amirudin Hamid, Chief Investment Officer of GAX MD

Key Takeaways

- Metals delivered exceptional returns in 2025 with silver and platinum rising over 100% due to demand from green energy sectors. This surge in commodities played a major role in lifting our overall portfolio performance.

- Geopolitical shocks throughout the year caused only temporary volatility before markets returned to economic fundamentals. This consistent pattern confirms that sticking to long-term objective is more effective than reacting to political headlines.

- The unexpected rally in metals and the resilience of the economy show that precise forecasting is often impossible. Our strategy relies on algorithms to analyze market dynamics and manage risk instead of trying to predict the future

The US equity market closed December on a mixed note that highlighted a clear split in performance. The S&P 500 finished the month slightly lower, dipping by 0.05%, while the tech-focused Nasdaq Composite fell by 0.53%. In contrast, the Dow Jones Industrial Average broke away from the pack to hit a fresh all-time high of 48,731.16 on 24 December 2025.

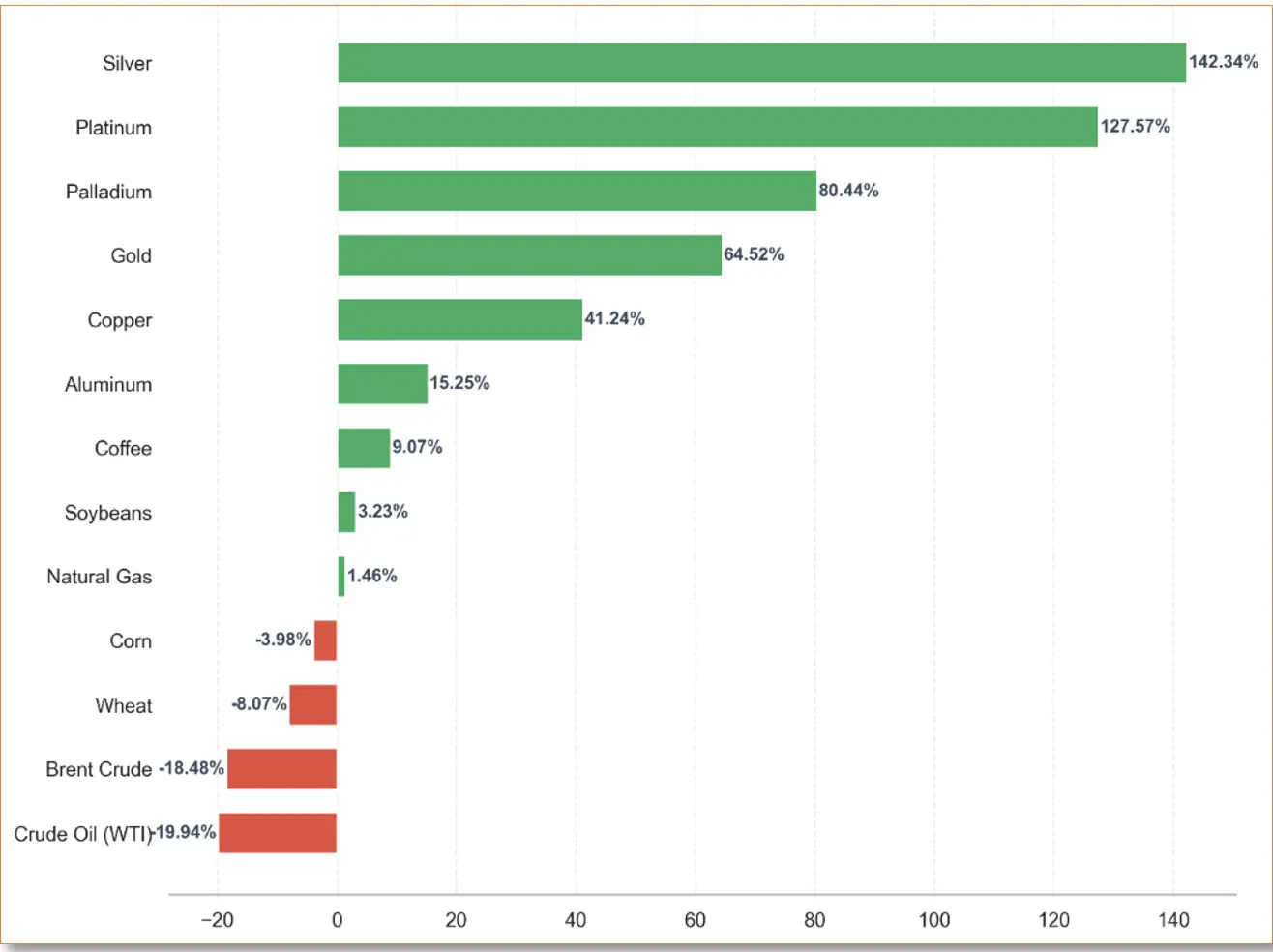

Commodities delivered one of their strongest annual performances. Metals drove the vast majority of these gains, claiming all top six spots for best performing commodities in 2025. Silver and platinum led the charge with exceptional returns of 143.34% and 127.57% respectively.

The massive rally for both metals was fuelled by their essential role in renewable energy, specifically for solar panels and the EV sector. They also benefited as they played catch-up with gold, which has enjoyed a multi-year rally.

Despite taking a breather toward the end of the year, US equities still delivered solid full year returns. The Nasdaq Composite gained 20.36%, the S&P 500 rose 16.39%, and the Dow Jones finished the year well in positive territory.

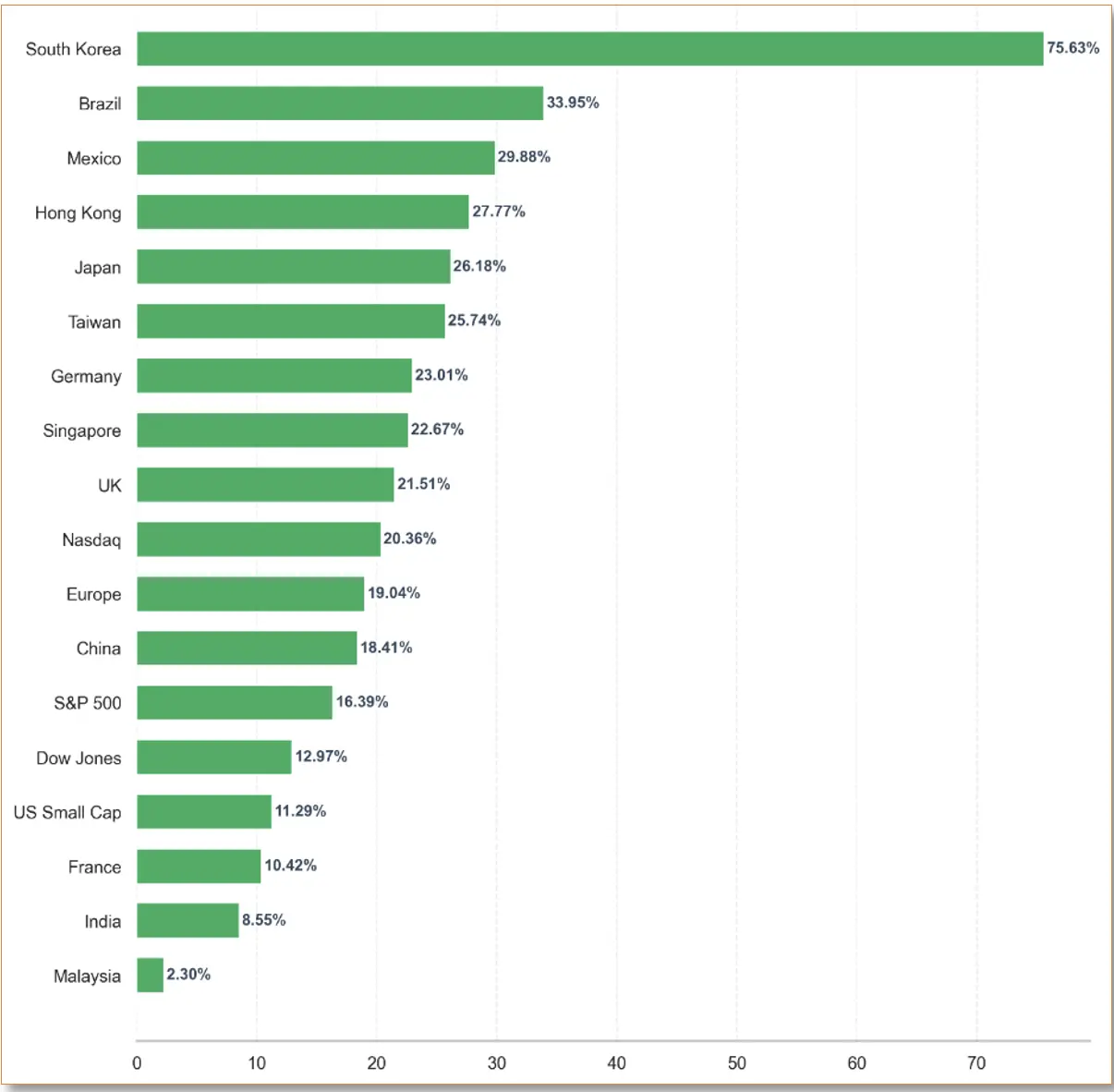

However, the standout story of 2025 was that the US was not the top dog. South Korea emerged as the strongest market globally, surging by 75.63%. Brazil, Mexico, and Hong Kong also outperformed US equities in 2025. On the other end of the spectrum, only a handful of markets trailed behind the US. Unfortunately, Malaysia was among them. The FBM KLCI saw a return of just 2.30% in 2025, making it the weakest market on our radar.

2025 Total Return Performance of Key Markets, Including Dividends

(Data as of 31 December 2025)

Source: Gax MD Sdn Bhd, January 2026

2025 Total Return Performance of key commodities

(Data as of 31 December 2025)

Source: Gax MD Sdn Bhd, January 2026

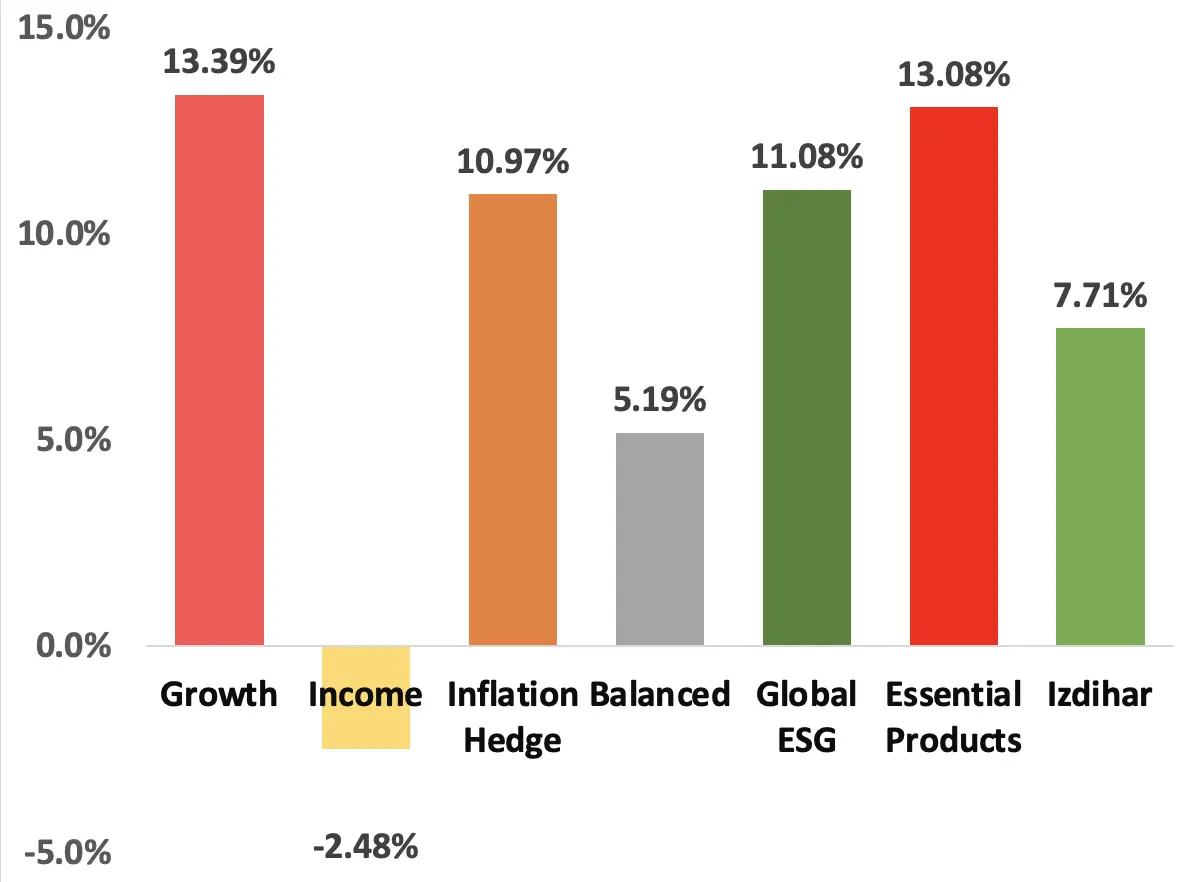

Against this backdrop, MYTHEO portfolios demonstrated resilience and delivered positive outcomes. All portfolios recorded gains in Ringgit terms, with the exception of the Income Portfolio. This result is particularly notable given the US Dollar depreciated by more than 9.00% against the Ringgit in 2025, alongside an environment marked by shifting monetary policy expectations, policy uncertainty, and geopolitical developments.

While many underlying assets in our portfolios trade on US exchanges, performance did not simply mirror US market returns. Exposure across multiple regions, including strong performers such as South Korea, Brazil, and Mexico, contributed meaningfully to results. In addition, both direct and indirect exposure to commodities including silver, gold, and copper played a significant role in lifting portfolio performance.

2025 MYTHEO Portfolio Performance (Data as of 31 December 2025)

Source: GAX MD Sdn Bhd, December 2025

Note: Past performance is not an indication of future performanceBalanced allocation consists of 30% Growth, 47% Income and 23% Inflation HedgeThe Izdihar portfolio YTD performance is calculated from July 17, 2025, aligning with its official launch date.

Economic and market developments took centre stage as the year drew to a close. In the US, the Federal Reserve delivered its third rate cut of the year in December. While inflation remains elevated, it continued to cool down, with the annual rate easing to 2.7% in November from 3.0% in September. However, robust economic data has complicated the outlook for interest rates. US third quarter GDP growth surprised on the upside at 4.3%. This was the strongest quarterly expansion in two years, pushing treasury yields higher and creating near term pressure for assets that are sensitive to interest rates.

In the equity markets, AI sectors experienced some selling pressure. It is natural for investors to lock in profit after such a prolonged rally. However, from a fundamental perspective, the sector remains solid and well positioned to anchor market performance for 2026 and beyond.

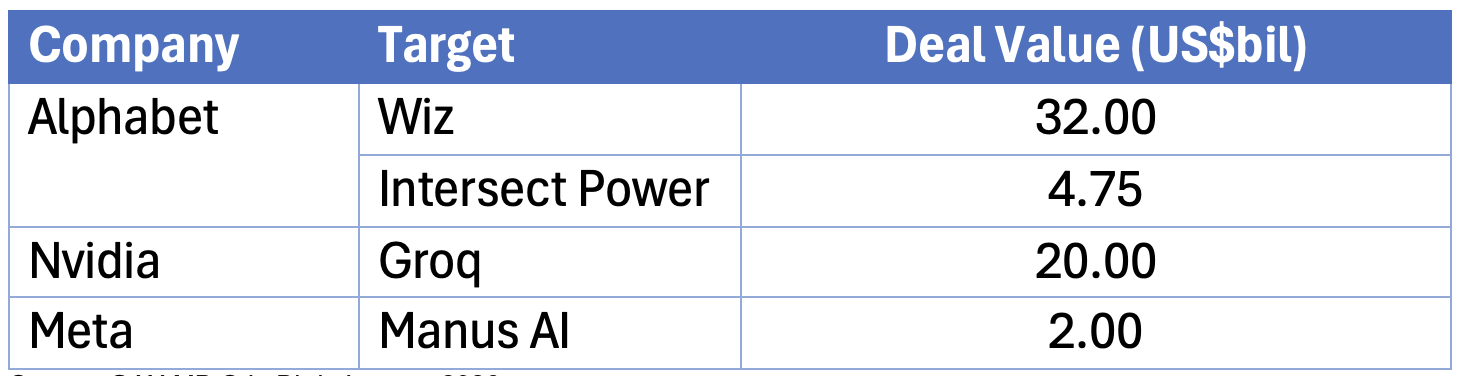

We are increasingly observing a market where the big get bigger. Large companies are becoming even more dominant, not only because they attract top talent, but because they possess the deep resources to acquire the specialized technology that widens their competitive moat. Corporate activity in December 2025 confirmed this trend with a series of high profile moves by major US technology firms.

Alphabet’s acquisitions of Wiz for US$32 billion and Intersect Power for US$4.75 billion have significantly strengthened its cloud security and AI data center ecosystem. Similarly, Meta is reportedly set to acquire Singapore based Manus AI at a valuation exceeding US$2 billion, following its US$14.8 billion investment in Scale AI earlier in the year. Nvidia also joined this trend with a US$20 billion deal to license assets from AI chip startup Groq and absorb its team, including the cofounder and CEO.

Significant Corporate Acquisition Activity in December 2025

Source: GAX MD Sdn Bhd, January 2026

Geopolitical developments dominated headlines at the start of the year. The United States launched a military operation in Venezuela, after which President Donald Trump indicated that the objective was to secure access to the country’s substantial oil and natural resource reserves. At face value, such an event could be perceived as negative for the energy market, given that Venezuela holds the world’s largest proven oil reserves. Any subsequent increase in Venezuelan production could potentially add significant supply to global markets, raising concerns about oversupply and downward pressure on prices.

However, history suggests that US led regime change rarely results in immediate national stability or a smooth economic recovery. The track record of such interventions shows that the US government often struggles to stabilize countries after the transition. Deep structural challenges, fragile institutions, and decayed infrastructure typically limit any meaningful supply response. This makes the long-term outlook far more complex than initial headlines suggest, as political and operational risks often persist for years.

Throughout 2025, we observed a consistent pattern across several regional shocks. Events such as the Thailand-Cambodia conflict, US-Iran tensions, and friction betweenIndia and Pakistan produced only short-lived volatility. In each instance, markets returned quickly to core fundamental drivers and resumed their upward price trend. drivers and resumed their upward price trend.

These events emphasize the value of maintaining a disciplined investment strategy. The year 2025 highlighted how unpredictable financial markets can be. A strong US economy paired with softer-than-expected inflation is not the outcome any economist expert expected when President Trump announced global tariffs and after multiple geopolitical conflicts that broke out.

The surprises didn’t end there, nobody expected silver and platinum to outshine gold, let alone to see both metals end up with gains exceeding 100% in 2025. This is why the MYTHEO algorithm driven strategy focuses on managing overall portfolio risk by strictly analysing market dynamics and volatility rather than trying to guess the future. In a year that defied every human forecast, our algorithms remained anchored in the only thing that matters: market reality.

To learn more about MYTHEO, visit mytheo.my or download the MYTHEO app on the App Store and Google Play.

This material is subject to MYTHEO’s Notice and Disclaimer.