16 December 2025

Written by Amirudin Hamid, Chief Investment Officer of GAX MD

Key Takeaways

- After a period of positive news, the sudden silence in November caused investors to overinterpret routine economic data, demonstrating that "no news" can signal uncertainty and lead to sentiment-driven volatility.

- The technology sell-off was not uniform. While the Nasdaq was down, high-profile stocks like Alphabet, Broadcom, and Apple posted strong gains. This highlights selective weakness rather than a broad sector correction.

- Against steep cryptocurrency losses (up to 28.70%), the majority of the 45 ETFs in our disciplined portfolios posted positive returns, with the worst loss contained to just 4.27%.

November saw a significant pullback in technology and AI stocks as concerns over stretched valuations prompted investors to scale back exposure. Despite headline emphasis on tech weakness, the broader equity market remained resilient. The S&P 500 spent most of the month in negative territory but still closed with a modest 0.13 percent gain, while the Dow Jones rose 0.32 percent.

Technology stocks were the main target of this anxiety-driven repositioning. The Nasdaq Composite Index declined by 1.51% as investors reassessed valuations and trimmed risk exposure. However, the sell-off was far from universal. Major tech names like Alphabet, Broadcom, and Apple delivered gains of 13.87%, 9.02%, and 3.14%, respectively. This performance dispersion highlights that the market was not rejecting technology as a sector but recalibrating expectations around perceived overvaluation of certain stocks.

Outside the equity space, speculative assets saw sharper adjustments. Cryptocurrencies experienced even sharper losses as speculative risk appetite contracted. Bitcoin fell 17.54%, Ethereum dropped 22.25%, and Solana sank 28.70%, marking the steepest crypto retreat since June 2021. The contrast with precious metals was striking. Amid uncertainty, defensive assets rallied. Gold gained 6.02%, Platinum rose 7.44%, and Silver surged 17.61%, its best monthly move since July 2020.

For Malaysian investors with exposure to foreign markets, the currency effect was significant. The Malaysian Ringgit (MYR) was one of the strongest global currencies in November, appreciating 1.34% against the US Dollar. While this strength reflects improving confidence in the Ringgit, it also means that foreign investments delivered lower returns when converted back into MYR.

Why Silence Break Positive Momentum

To understand this reaction, it is important to consider what preceded November. For months, markets had been carried by an uninterrupted series of positive developments:

- A series of positive corporate results, especially from large technology companies, which beat market expectations.

- Massive AI-related investments, including a historic US$300 billion deal between OpenAI and Oracle.

- Global trades overhang removed after China and the US reached an agreement on a one-year trade deal.

- The Federal Reserve delivered its first interest rate cut of the year in September, followed by another in October.

- Two consecutive upgrades to the IMF global growth forecasts, first in July and again in October.

Markets had grown accustomed to a steady stream of positive developments. When that news momentum paused in November, the shift did not feel neutral. It introduced uncertainty. With expectations built on continuous positive reinforcement, the absence of new information was interpreted as a potential warning signal, prompting investors to reassess risk exposure, stirring a sell-down in technology stocks.

When Economic Data Confuses Instead of Clarifying

With headlines fading, investor attention turned to economic data. Instead of providing clarity, it became a source of volatility.

September payroll data revealed gains of 119,000 jobs, well above the prior 31,000 monthly trend. This prompted a major investment bank to forecast that the Federal Reserve might skip its anticipated December rate cut. Markets reacted sharply. On October 20, the S&P 500 fell 1.55% and the probability of a rate cut collapsed from 97% to 22%.

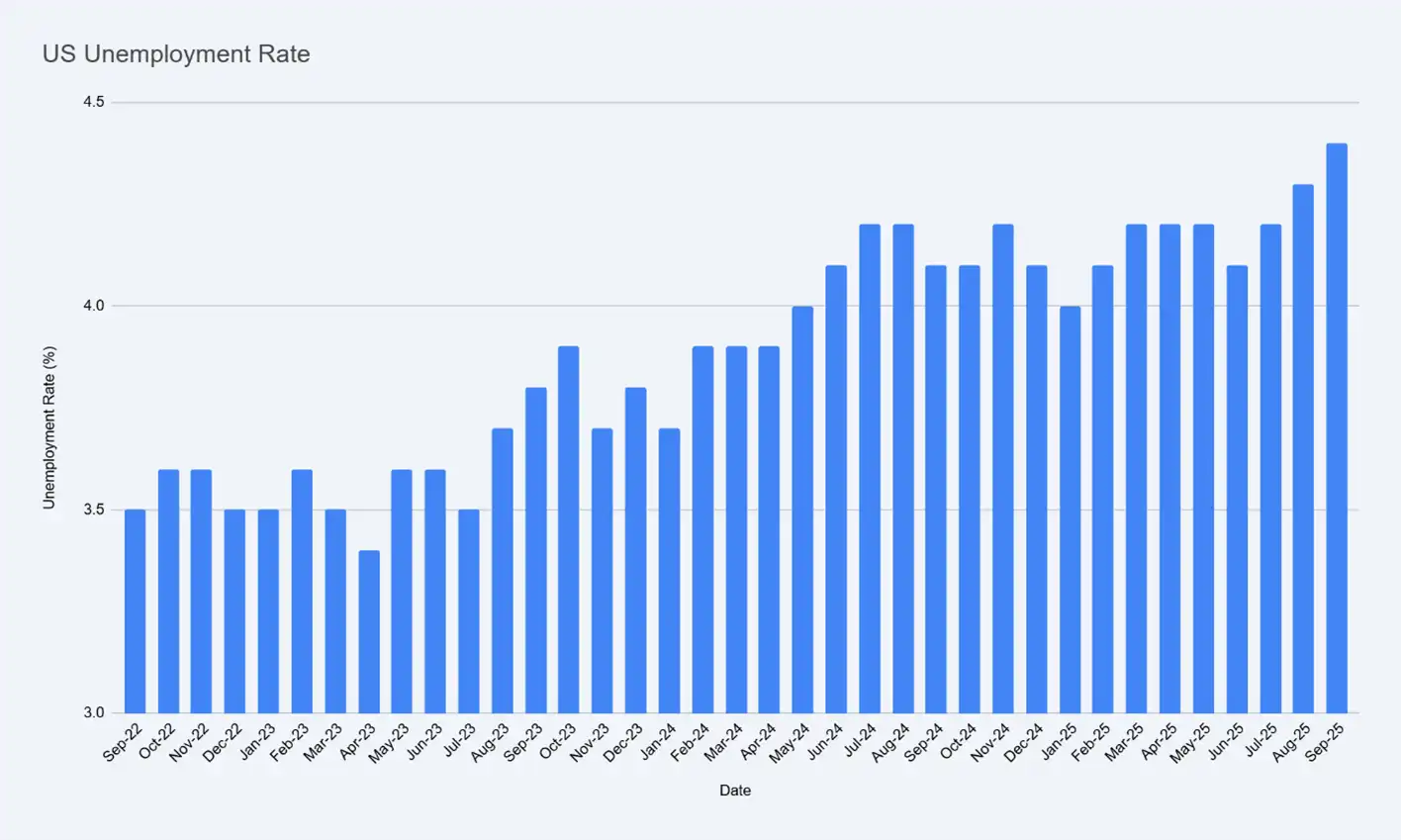

Just weeks later, sentiment reversed. A rise in unemployment to 4.4% pushed the rate-cut probability back to 89% (Source: FedWatch: as at 3rd December 2025), lifting the S&P 500 by 1.55% on November 24th.

In this environment, even routine economic data created outsized swings in sentiment. The figures themselves were within normal ranges, but the lack of clear direction in the news flow made investors more prone to react strongly to regular datapoints.

US Monthly Unemployment Rate Data from September 2022 to September 2025

Source: GAX MD, Reuters.com, November 2025

November demonstrated how quickly markets can turn sensitive when the steady flow of positive news pauses.

Following a prolonged period of consistently positive news flow, investor confidence had become reliant on the continuation of this favourable momentum. Consequently, the sudden absence of fresh positive catalysts in November generated uncertainty, effectively turning "no news" into bad news.

Without new developments to support existing valuations or justify further upward movement, the market became highly sensitive. Routine economic indicators, such as monthly employment data, were disproportionately amplified, leading to abrupt swings in investor sentiment and market volatility.

Diversification is Your Best Defence

The steep decline in cryptocurrencies highlights the risks inherent in highly volatile assets. At MYTHEO, we are not opposed to crypto as part of an investment, but investors must understand its high volatility and structural risk. Across our Omakase portfolio (Growth, Income, Inflation Hedge) and Satellite portfolios (ESG, Essential, and Izdihar), we utilised 45 assets. Most of these assets posted positive returns in November, showing strong resilience against the market's volatility. Even among the assets that incurred losses, the worst performer was the Global Technology ETF (SPTE), which posted a loss of 4.27%, a performance nowhere near the scale of the crypto sell-off.

Performance of all ETFs inside MYTHEO portfolios versus Bitcoin, Ethereum and Solana

Source: GAX MD, November 2025

This strong resilience is because MYTHEO portfolios are built for consistency, risk awareness, and are resilient, making them suitable for a wide range of investors. Our portfolio strategy stays focused on stability, long-term growth, and avoiding speculative excess. The market's experience in November reinforces the core message of this insight: When market dominated by bad news, diversification across different strategies and geographical exposures is your greatest defence!

Even in quieter or more volatile periods, the key is to maintain a disciplined approach guided by diversified strategies. MYTHEO’s portfolios are designed to help investors navigate these cycles with clarity and stability. If you wish to understand our portfolio approach in more detail, please visit: www.mytheo.my

This material is subject to MYTHEO’s Notice and Disclaimer.