Friday, 10 March 2023

Written by MYTHEO

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in February 2023.

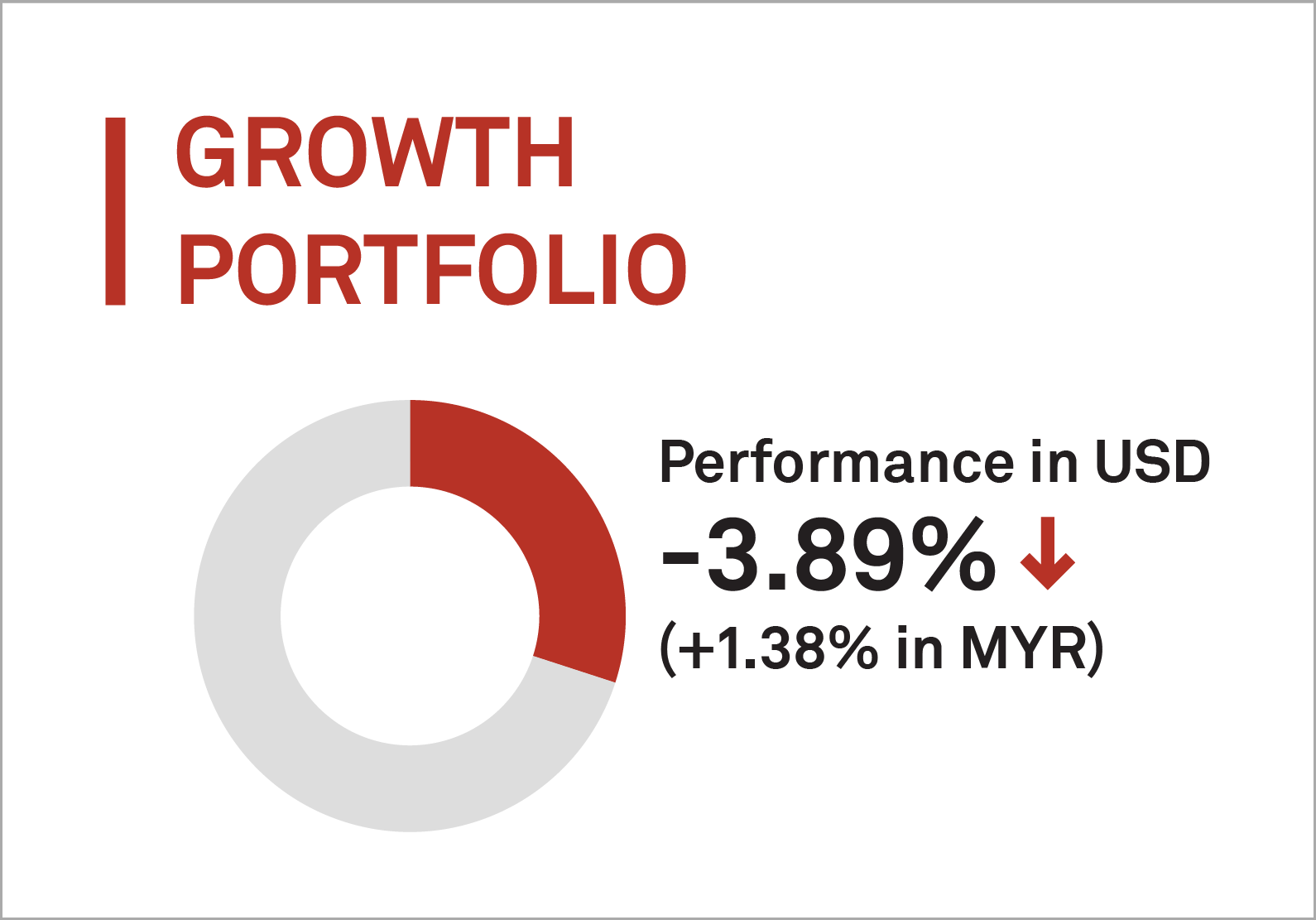

1. Growth Portfolio

MYTHEO’s Growth Portfolio was down by 3.89% (+1.38% in MYR) in February 2023.

For February, the portfolio’s algorithm repositioned with emphasis on US exposure given a reduction of realised risk, at the expense of Asia and emerging markets exposure. This allowed the portfolio to reduce the downside suffered through the month as US equities fell by a lesser degree compared to other regions.

The portfolio’s allocation to Mexico (about 3%) was a key contributor to the overall portfolio performance during the period, with the broad market registering losses due to a sentiment of sticky inflation.

Top 3 ETFs (Growth portfolio)

ISHARES MSCI MEXICO (EWW)

INVESCO QQQ (QQQ)

ISHARES MSCI UNITED KINGDOM (EWU)

-0.02%

-0.36%

-0.89%

Bottom 3 ETFs (Growth portfolio)

ISHARES MSCI HONG KONG (EWH)

ISHARES MSCI BRAZIL (EWZ)

ISHARES CHINA LARGE-CAP (FXI)

-7.57%

-10.12%

-12.08%

Source: GAX MD Sdn Bhd, data in USD term for the month of February 2023.

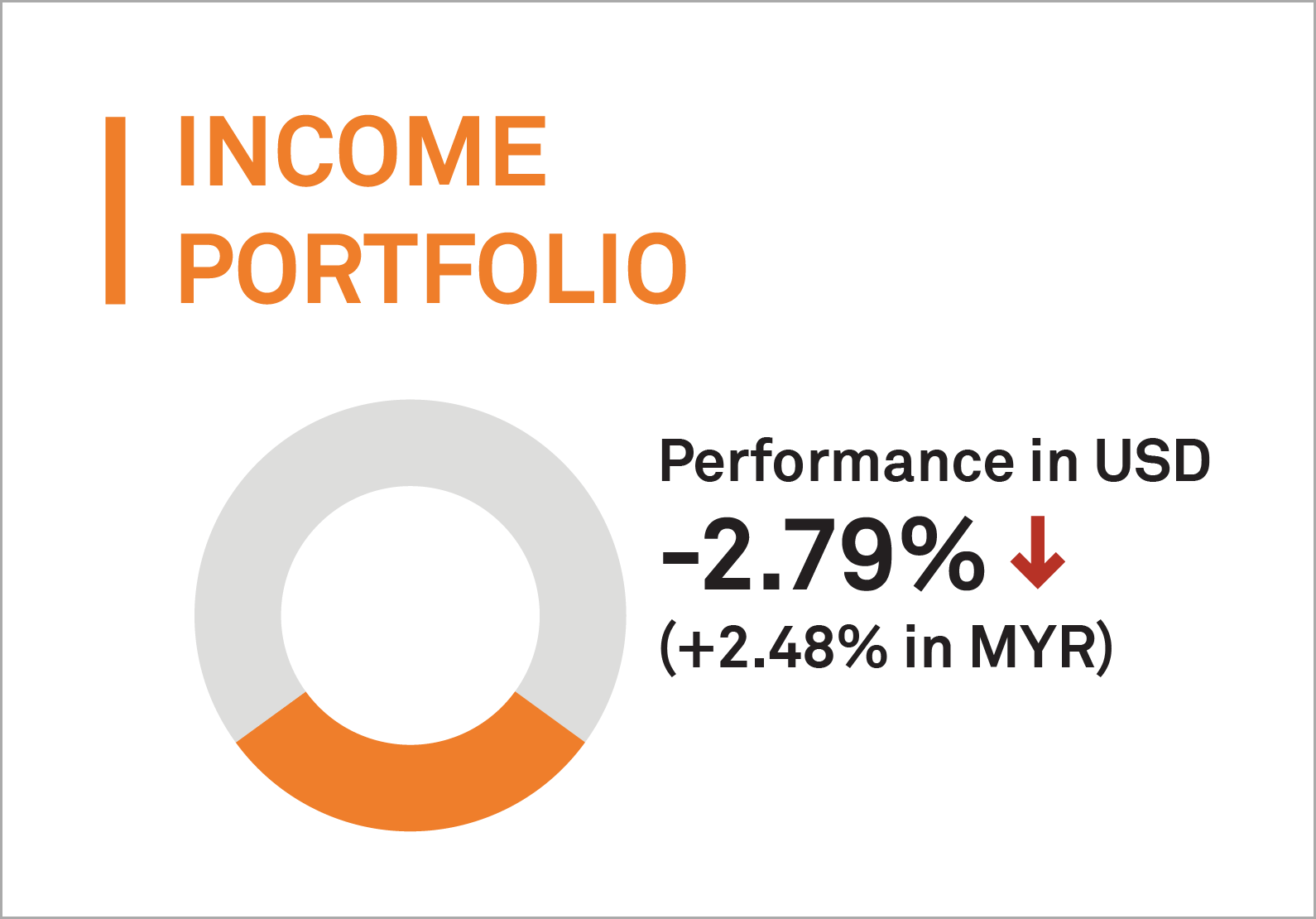

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a return of -2.79% (+2.48% in MYR) in February 2023.

Not much repositioning occurred this month, with the portfolio maintaining a preference towards US bonds, short duration corporate, and investment grade bonds. The overweight positions are mostly driven by the relatively high yields available in these markets, compared to their downside risk. The current weighted 30-day yield of the ETFs in the portfolio is around 6%.

The portfolio’s exposure to senior loans (about 3%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Income portfolio)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

SPDR BARCLAYS SHORT-TERM HIGH YIELD (SJNK)

ISHARES SHORT-TERM CORPORATE (IGSB)

-0.12%

-1.00%

-1.24%

Bottom 3 ETFs (Income portfolio)

MARKET VECTORS EMERGING MARKETS (EMLC)

ISHARES IBOXX INVESTMENT GRADE (LQD)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

-2.87%

-4.17%

-4.85%

Source: GAX MD Sdn Bhd, data in USD term for the month of February 2023.

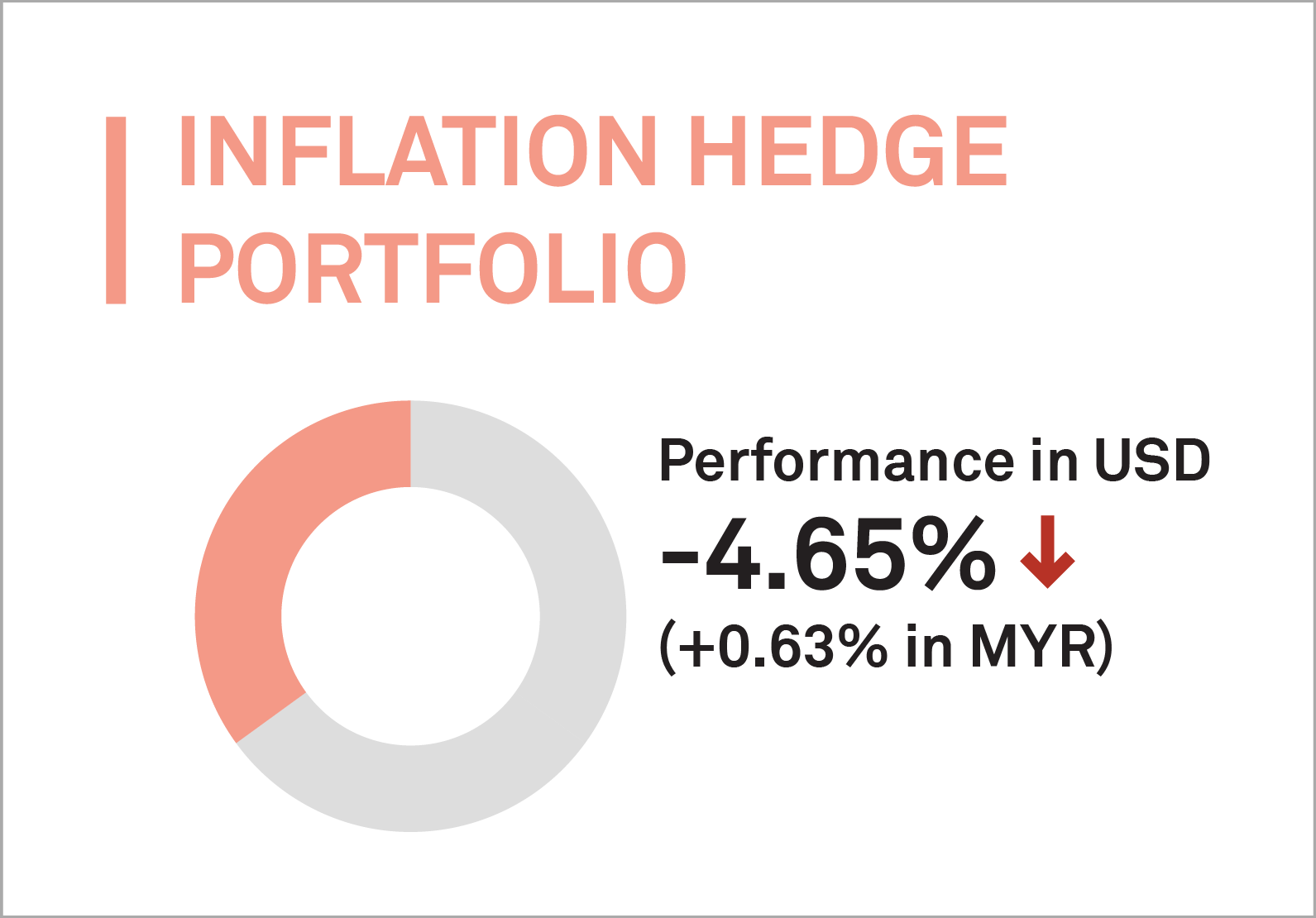

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio saw a negative return in February 2023, decreasing by 4.65% (+0.63% in MYR).

The current largest positions in this portfolio are U.S real estate and inflation linked bonds. The positions in US real estate, infrastructure and base metals positions are mostly driven by their ability to hedge long-run inflation. The positions in inflation-linked bonds and gold not only help to hedge against inflation but also provide a higher diversification benefit relative to other asset classes.

The portfolio’s allocation to oil (about 2%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Inflation hedge portfolio)

ISHARES TIPS BOND (TIP)

INVESCO DB OIL FUND (DBO)

ISHARES GLOBAL INFRASTRUCTURE (IGF)

-1.35%

-2.78%

-3.61%

Bottom 3 ETFs (Inflation hedge portfolio)

ISHARES GLOBAL CLEAN ENERGY (ICLN)

INVESCO DB BASE METALS (DBB)

ISHARES MORTGAGE REAL ESTATE (REM)

-7.43%

-7.87%

-8.26%

Source: GAX MD Sdn Bhd, data in USD term for the month of Februry 2023.

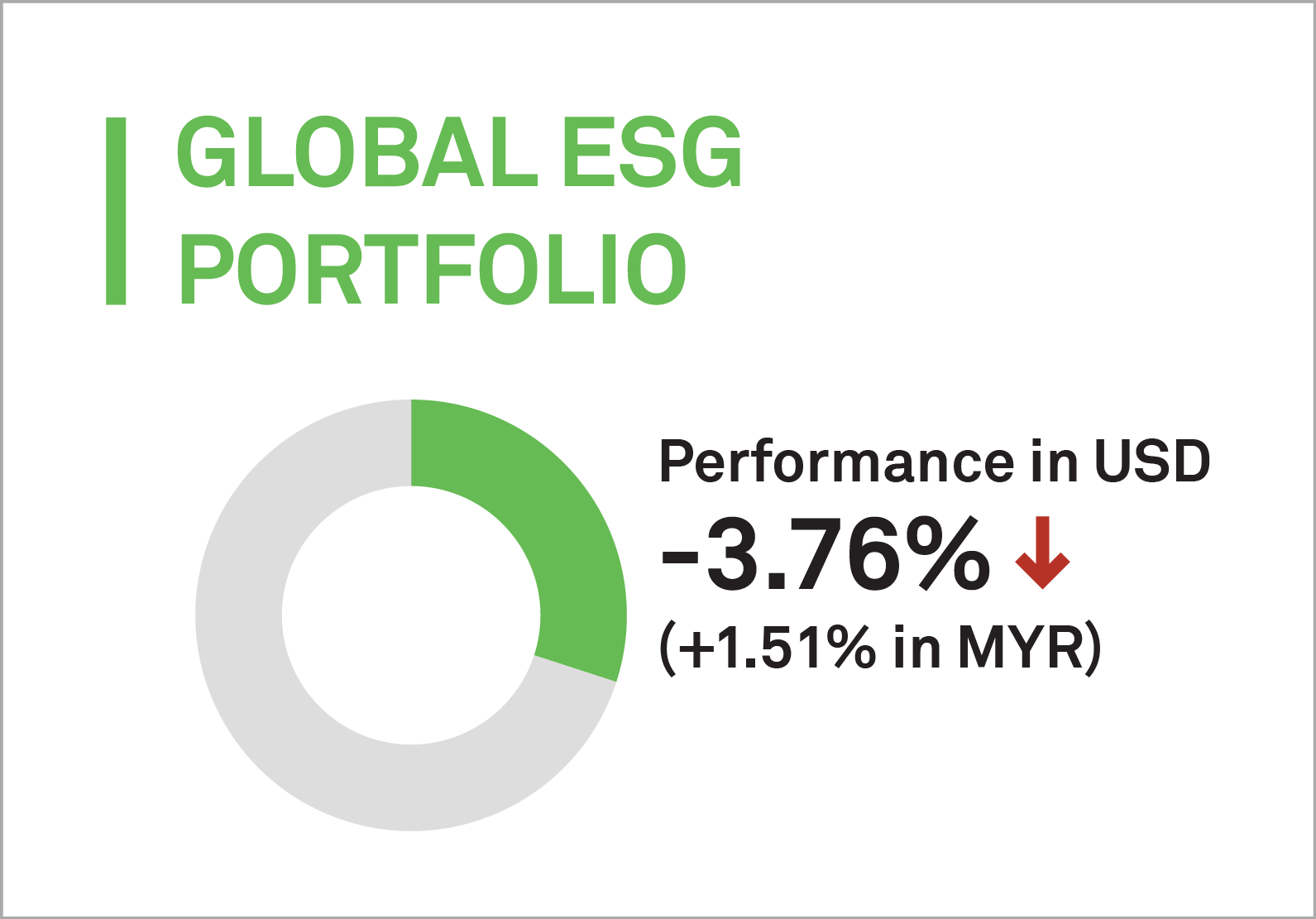

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is down by 3.76% (+1.51% in MYR).

Similar to growth portfolio, the preference and exposure to US of about 60% allowed the portfolio to pare its losses as the drop in US ETFs was less severe than Emerging Markets ETFs.

The US occupies a significant fraction of ESG investments with a longer track record, therefore our portfolio follows this trend in terms of placing a higher weighting in US markets, in addition to better risk management compared to investment in newer and more volatile emerging markets.

The portfolio’s allocation to USA Gender Diversity ETF (about 5%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

ISHARES ESG AWARE MSCI USA (ESGU)

ISHARES ESG AWARE MSCI EAFE (ESGD)

-1.31%

-2.63%

-2.97%

Bottom 3 ETFs (Global ESG portfolio)

SPDR SSGA GENDER DIVERSITY INDEX (SHE)

NUVEEN ESG LARGE-CAP VALUE (NULV)

ISHARESs ESG AWARE MSCI EM (ESGE)

-3.30%

-3.85%

-7.79%

Source: GAX MD Sdn Bhd, data in USD term for the month of January 2023.

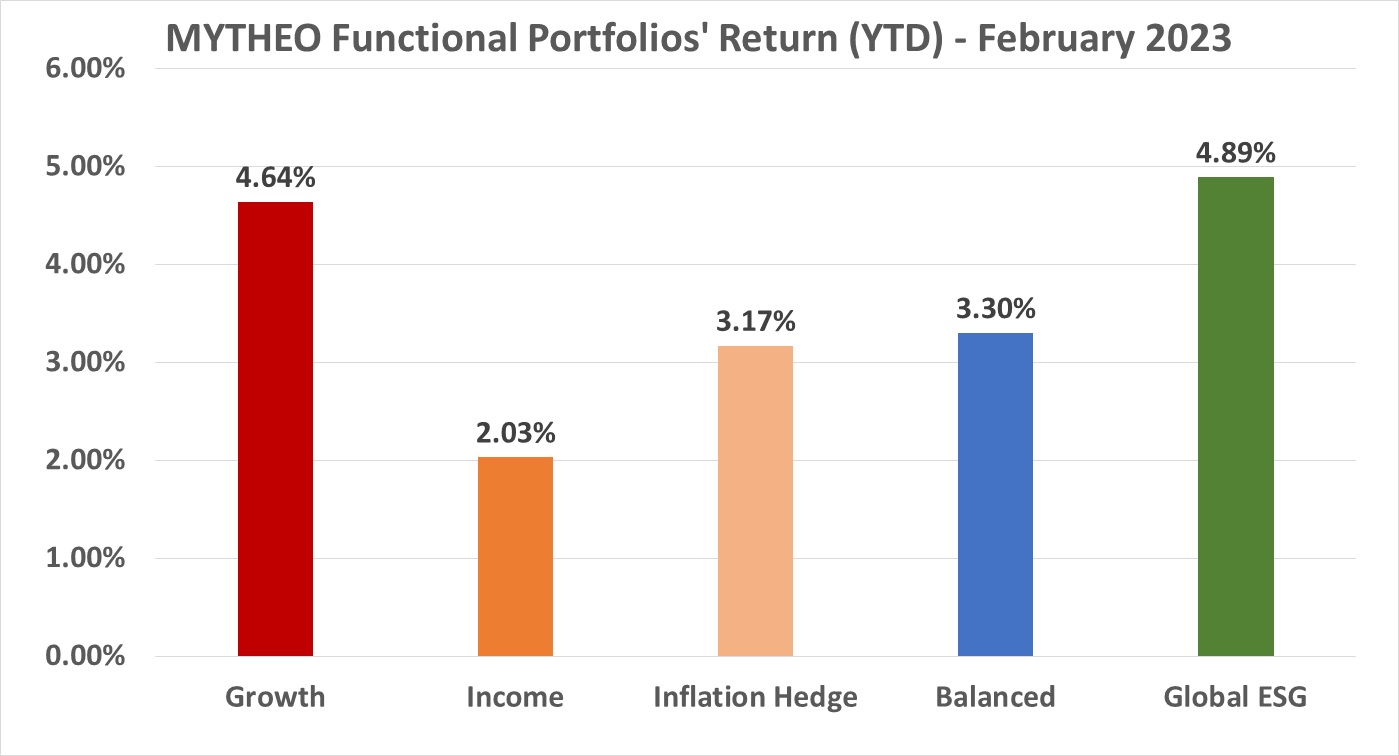

Chart 1: February 2023 - Portfolio Year-to-Date of Return in % (MYR)

Balanced allocation consists of 33% Growth, 32% Income and 35% Inflation Hedge.

Source: GAX MD Sdn Bhd, March 2023

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 33% of their investment in Growth, 32% in Income and 35% in Inflation Hedge, the actual portfolio return for February is 1.47% [(33% x 1.38%) + (32% x 2.48%) + (35% x 0.63%)]

Our Thoughts

The US dollar strengthened against the Malaysian Ringgit in February by 5.27% to RM4.4875 (as of 28th Feb 2023), compared to RM4.2630 on 31st Jan 2023. This has a positive impact on the performance of the portfolio in ringgit terms due to the depreciation of Malaysia Ringgit.

Global equities declined in February after the strong advance seen in January. Stronger than expected economic and inflation data is likely to encourage the Fed and the ECB to push for higher-for-longer rates. The Federal Reserve, European Central Bank and Bank of England all raised rates in the month, at +25bps, +50bps and +50bps respectively. In fixed income, government bond yields were higher (meaning prices fell) as expectation of a higher terminal rate being in place for longer periods of time placed pressure on bond prices. Meanwhile, most commodities and other real assets trended downwards, in line with a strengthening US dollar and likely higher costs on mortgages and rent.

In the US, a still-robust job market and waning inflation pressures have helped revive consumer sentiment and supported services sector activity, although these also contribute back to said inflationary pressures. In Europe, an unusually warm winter has helped the region avoid widespread energy shortages triggered by energy supply disruption from the Russia-Ukraine conflict and combined with the moderation of the intensity of said conflict, these contributed to a rebound in consumer and services business confidence. Meanwhile, in China, the early lifting of COVID-19-related mobility restrictions has led to a rapid normalisation of economic activity.

Inflation which remains well above central bank targets in both US and Europe could force policymakers to turn increasingly hawkish. As a result, money markets estimated that the Fed funds rate and the ECB deposit rate to peak in the current hiking cycle close to 5.5% and 3.75%, respectively, in Q3 this year, which suggest the policy rates to stay near the peak for longer, raising the risk of an economic downturn later in the year or early next year. In contrast with the Developed Markets, the still-low inflation in China may give room for the authorities to implement market-friendly policies, and thus revive domestic consumption and encourage FDI inflows.

Against this fragmented backdrop, we think investors should remain cautious but recognise that uncertainty is high on both sides (upside and downside), supporting the case to keep portfolios appropriately diversified and more closely aligned with your long-term investment strategy.

However, investors still concerned about the possibility of a U.S. recession in 2023 can also take a more defensive approach to investing and dial back their exposure to equities. Investors can earn 3.58%p.a.(net interest rate) on MYTHEO USD Cash Trust Portfolio, and those rates will likely continue to rise as the FOMC raises interest rates in coming months. This portfolio will be a great place to park your investment funds while waiting for opportunities to emerge.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.