Wednesday, 07 August 2019

Written by Malcolm Schreiber, Chief Investment Officer

In this blog we will discuss how MYTHEO selects the ETFs to include in customer portfolios and how we determine how much of each ETF to hold (i.e. the portfolio “weightage”).

Functional portfolios

MYTHEO takes a “functional portfolio” approach to investing. Instead of categorizing investments based on the type of asset or the expected return and risk, we focus on the investment needs of customers and classify investments based on what kind of investment need they address. Each customer may have different investment objectives and this approach enables MYTHEO to build portfolios based on each customer’s needs rather than asset types.

MYTHEO uses 3 functional portfolios:

• Growth: This portfolio is designed to meet the need for long-term capital growth. The goal of the portfolio is to obtain high returns on a long-term basis in line with the global equity market. In order to achieve this, the portfolio invests in ETFs that invest in assets with a high long-term rate of return, i.e. stocks. In addition, the portfolio is diversified across a range of countries.

• Income: This portfolio is designed to meet the need for stable and steadily returns without suffering significant losses. It invests in mainly fixed income ETFs and well as preferred stock ETFs.

• Inflation Hedge: This portfolio is designed to protect customer assets from the effects of inflation, so it is designed to match and exceed the Malaysian inflation rate. In addition, it also works to reduce the correlation with global stocks and to reduce the risk from major market events. It invests in ETFs that hold a range of assets, such as crude oil, industrial metals, precious metals, real estate, infrastructure-related company stock, Treasury short-term government bonds and inflation-linked bonds.

How does MYTHEO select ETFs?

There are thousands of ETF’s listed on stock markets around the world. MYTHEO uses a rigorous and robust process to select the ETFs that can be included in customer portfolios. You can see a list of the current ETFs here.

Selection criteria

• Type of ETF: MYTHEO uses index-based ETFs (i.e. ETFs that aim to follow an index as a benchmark) and does not include “exotic” ETFs such as leveraged or inverse ETFs.

• Relevance: The ETF must be relevant for one of the 3 MYTHEO functional portfolios described above. This means that it must be expected to contribute either to long-term growth, stable income, inflation hedging or diversification.

• Coverage: The ETF must provide exposure to an asset class or market that is not already covered by other ETFs in the universe.

• Asset size: We set a minimum asset size for each ETF in the investment universe to avoid MYTHEO holding too large a portion of an ETF.

• Liquidity: We set a lower limit on the liquidity of ETFs in the investment universe (i.e. how much the ETF is traded in the market) so that it does not cost too much to buy or sell an ETF.

• Expense ratio: The annual cost of each ETF (the ETF expense ratio) is disclosed by the ETF provider. MYTHEO prefers ETFs with a low ETF expense ratio but it is important to consider the total cost of holding the ETF (see below).

• Track record: The ETF must be well-established and have a proven record of tracking the benchmark closely. We continually monitor the investment universe to check that all the ETFs in customer portfolios continue to meet the investment requirements. ETFs that fail to meet the requirements (e.g. if the liquidity has declined) are removed from customer portfolios.

We also review all listed ETFs regularly to see whether there are any ETFs that should be added to the universe. All decisions on adding or removing ETFs from the investment universe are reviewed and approved by the Investment Committee before the change is made.

Once the ETF is included in the investment universe, MYTHEO’s proprietary investment algorithms will then determine the weightage of the ETF in each functional portfolio depending on the goal of the functional portfolio and the characteristics of the ETF.

It is important to note that, although the expense ratio is one of our criteria, it is not just as simple as choosing the ETF with the lowest expense ratio. Other factors such as liquidity (which impacts the cost of buying or selling the ETF), dividend payout (e.g. dividends paid by US ETFs to Malaysian residents are subject to withholding tax of 30%) and tracking error can affect the total cost of holding the ETF. MYTHEO’s selection aims to maximise the net return to the customer, i.e. after considering all costs, not just the expense ratio.

Weightage of ETFs

MYTHEO's 3 functional portfolios are managed by algorithms. Each functional portfolio also has its own optimization algorithm designed by MYTHEO to meet the goal of the functional portfolio. These algorithms are based on techniques used by professional money managers, especially in pension investing and have been supported by a lot of academic research.

Each functional portfolio has an investment universe of between 10 and 26 ETFs, and the algorithms determine weightages, which are updated monthly and quarterly.

For example, the Growth Portfolio, which invests in equity ETFs, uses an optimization algorithm based on minimizing volatility (i.e. minimizing the variability of the portfolio returns). Although the individual ETFs used in the Growth Portfolio are relatively high risk, this algorithm enables the portfolio to achieve long-term growth without taking unnecessary risk. The algorithm also incorporates data on valuations and momentum of markets as well.

Our model does not take views on individual sectors. The ETFs in the portfolio are individual country or region ETFs as well as style and market capitalization ETFs in the US and it is on this basis that the algorithm makes allocations.

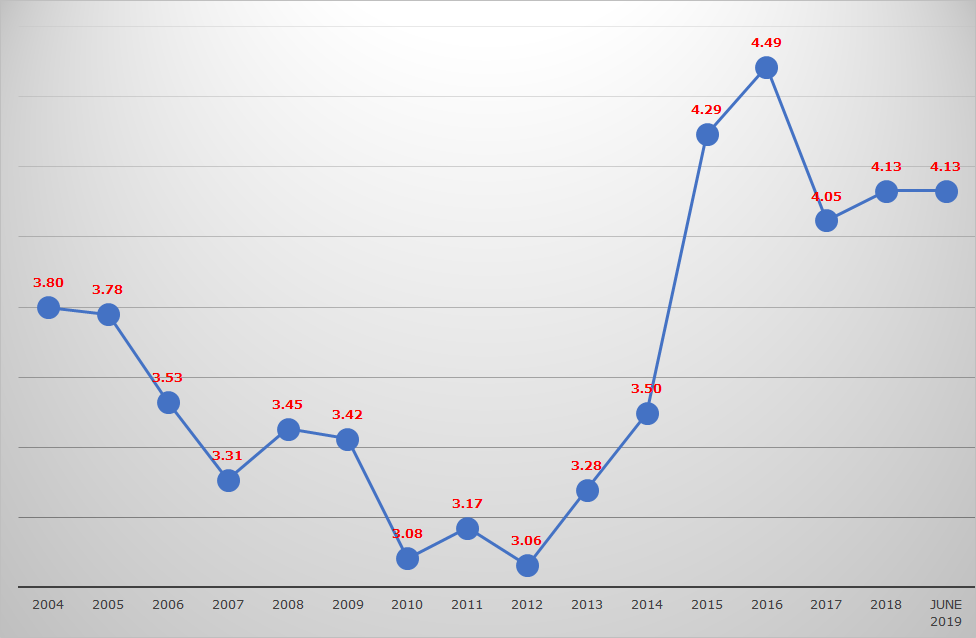

Currently, the model has a lower weightage to the US than its share of the total world capitalization. This is not due to any opinion we may have on the US currency or equity markets. This is because the volatility of US stocks and their correlations with other ETFs have increased. Also, US stocks look overvalued if one compares their Price to Book ratios to the past Price to Book ratios for US stocks, as opposed to other countries where the valuations don't look as high.

For more details on our investment approach and how the algorithms work, please see our Whitepaper.