05 April 2024

Written by MYTHEO

Key Takeaways

- 📈Equity markets continued to perform well, with US Value-related counters doing better than market cap-equivalent Growth.

- 🇯🇵Japan made a big step towards the normalisation of its economy by emerging from a 17-year negative interest rate environment.

- 💰The Income portfolio gave a flat performance due to a US Federal Reserve rate hold and the slight strengthening of the MYR.

- 🔹Precious metals rose in value due to future rate cut expectations, while crude oil continued to climb due to supply constraints.

In this monthly report, we will review MYTHEO’s portfolio performances based on financial market developments in March 2024.

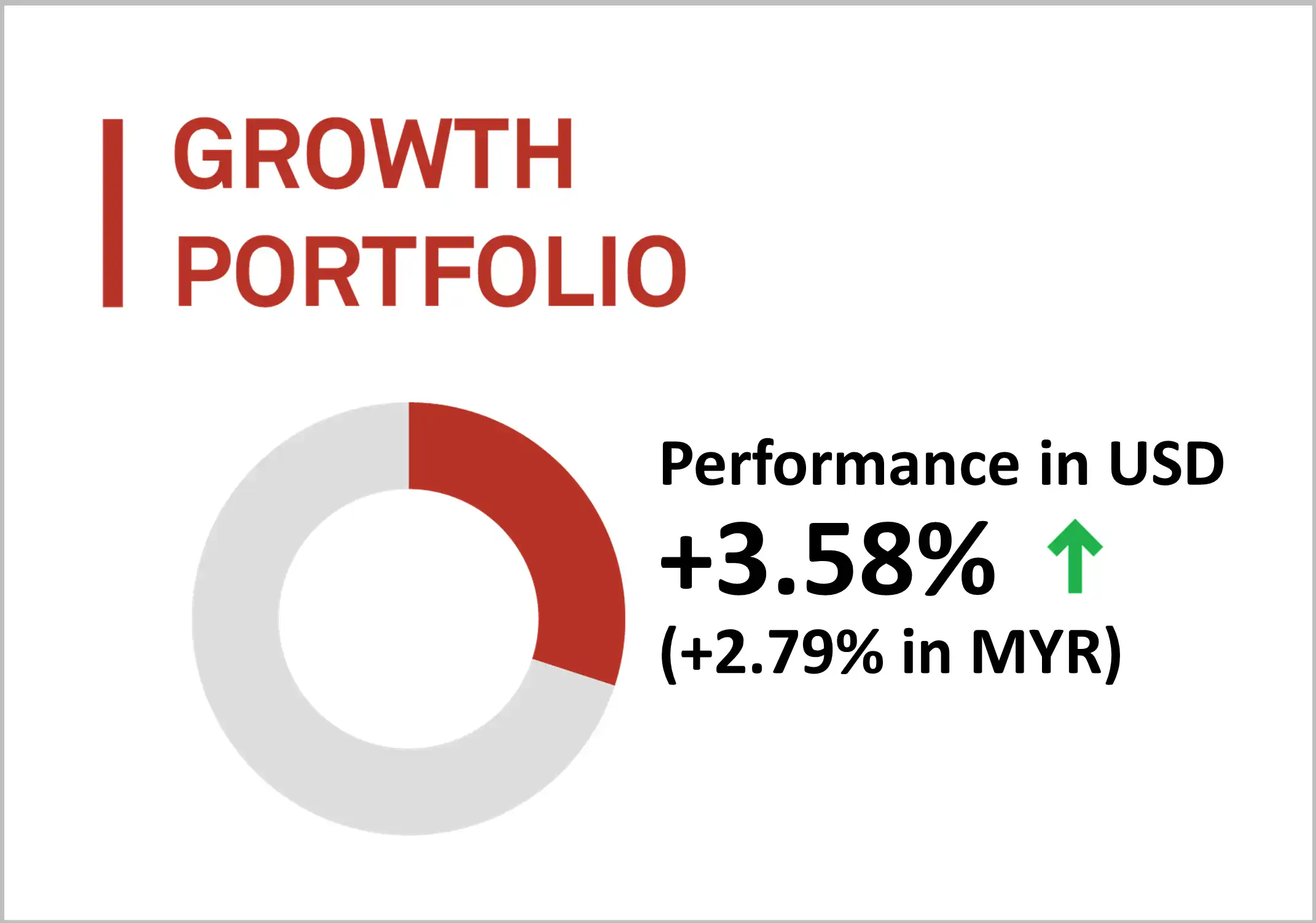

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up by 3.58% (up 2.79% in MYR) in March 2024.

In March 2024, a portion of the profit was redirected from the Asia-Pacific region to the US markets, solidifying the US market's position as our primary investment focus.

The portfolio’s allocation to the U.S large cap value ETF (about 20%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE VALUE (RPV)

VANGUARD VALUE (VTV)

ISHARES MSCI UNITED KINGDOM (EWU)

+6.88%

+5.17%

+4.46%

Bottom 3 ETFs performance (Growth portfolio)

INVESCO S&P 500 PURE GROWTH (RPG)

VANGUARD FTSE EMERGING MARKETS (VWO)

INVESCO NASDAQ 100 ETF (QQQM)

+3.04%

+1.92%

+1.30%

Source: GAX MD Sdn Bhd, data in USD term for the month of March 2024.

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a gain of 0.84% (up by 0.10% in MYR) in March 2024.

In March 2024, the income portfolio remained relatively stable, maintaining substantial positions in short-term duration corporate bonds and treasury bonds, which were strategically balanced with longer-term US Treasury holdings. The current yield-to-maturity of the bond ETFs in the portfolio (excluding preferred stock) stands at approximately 5.34%.

The portfolio’s exposure to short term corporate bonds (about 20%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Income portfolio)

ISHARES IBOXX INVESTMENT GRADE (LQD)

SPDR BLACKSTONE/GSO SENIOR LOAN (SRLN)

SPDR BARCLAYS SHORT-TERM HIGH YIELD (SJNK)

+1.54%

+0.87%

+0.80%

Bottom 3 ETFs performance (Income portfolio)

ISHARES FLOATING RATE BONDS (FLOT)

ISHARES 3-7 YEAR TREASURY BONDS (IEI)

MARKET VECTORS EMERGING MARKETS (EMLC)

+0.40%

+0.43%

-0.66%

Source: GAX MD Sdn Bhd, data in USD term for the month of March 2024.

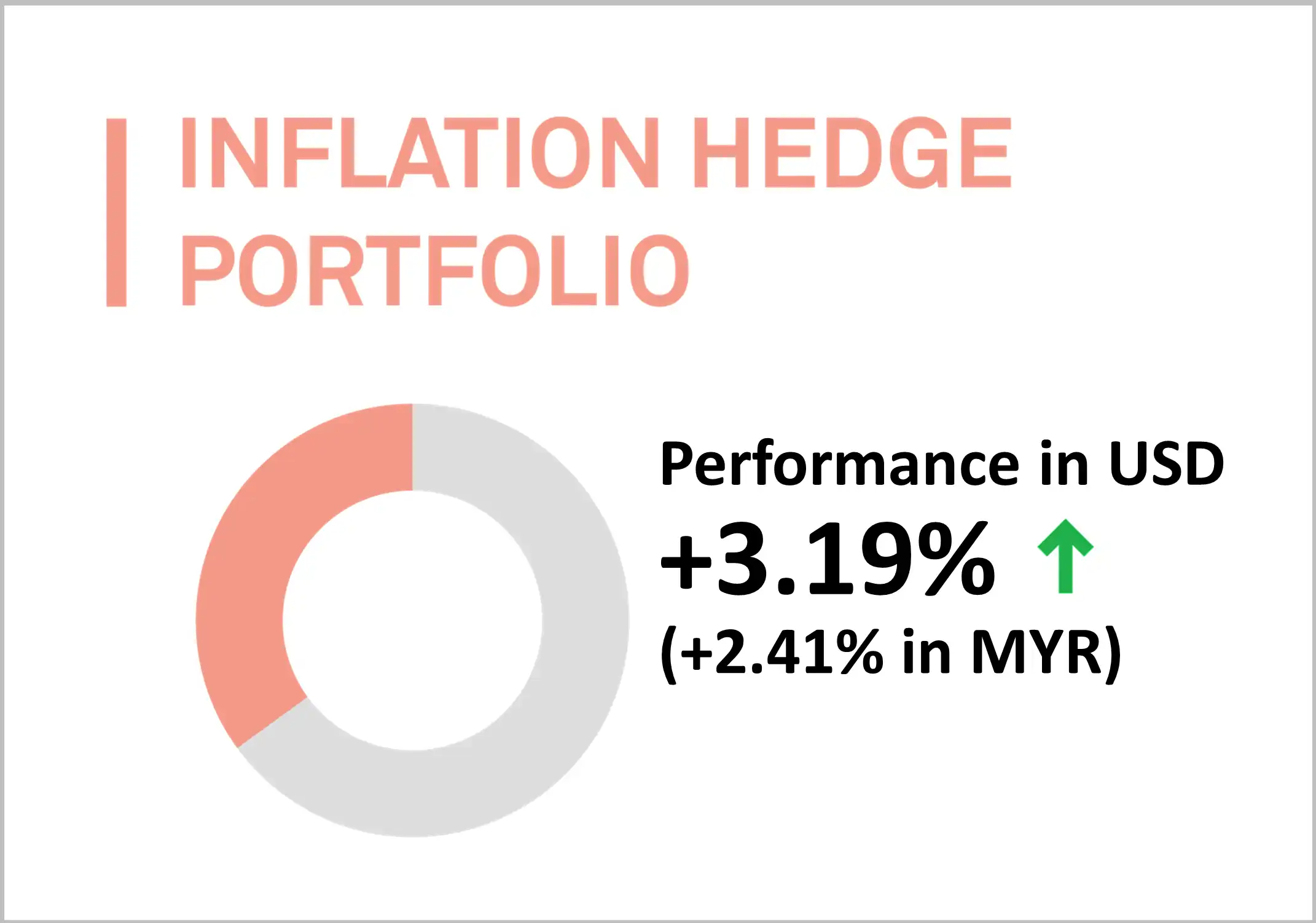

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio recorded a positive USD return in March 2024, up by 3.19% (+2.41% in MYR).

The predominant holdings in this portfolio currently consist of US real estate and inflation-linked bonds. The allocation to US real estate, infrastructure and base metals primarily stems from their effectiveness in hedging against long-term inflation. Furthermore, investments in inflation-linked bonds and gold serve a dual purpose: they not only act as a hedge against inflation but also offer enhanced diversification benefits compared to other asset classes.

The portfolio’s allocation to gold (about 15%) was the key contributor to the overall portfolio performance during the period.

Top 3 ETFs performance (Inflation hedge portfolio)

ISHARES SILVER TRUST (SLV)

ISHARES GOLD TRUST (IAU)

INVESCO DB OIL FUND (DBO)

+9.74%

+8.69%

+6.37%

Bottom 3 ETFs performance (Inflation hedge portfolio)

ISHARES US REAL ESTATE ETF (IYR)

ISHARES TIPS BOND ETF (TIP)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

+1.85%

+0.65%

+0.50%

Source: GAX MD Sdn Bhd, data in USD term for the month of March 2024.

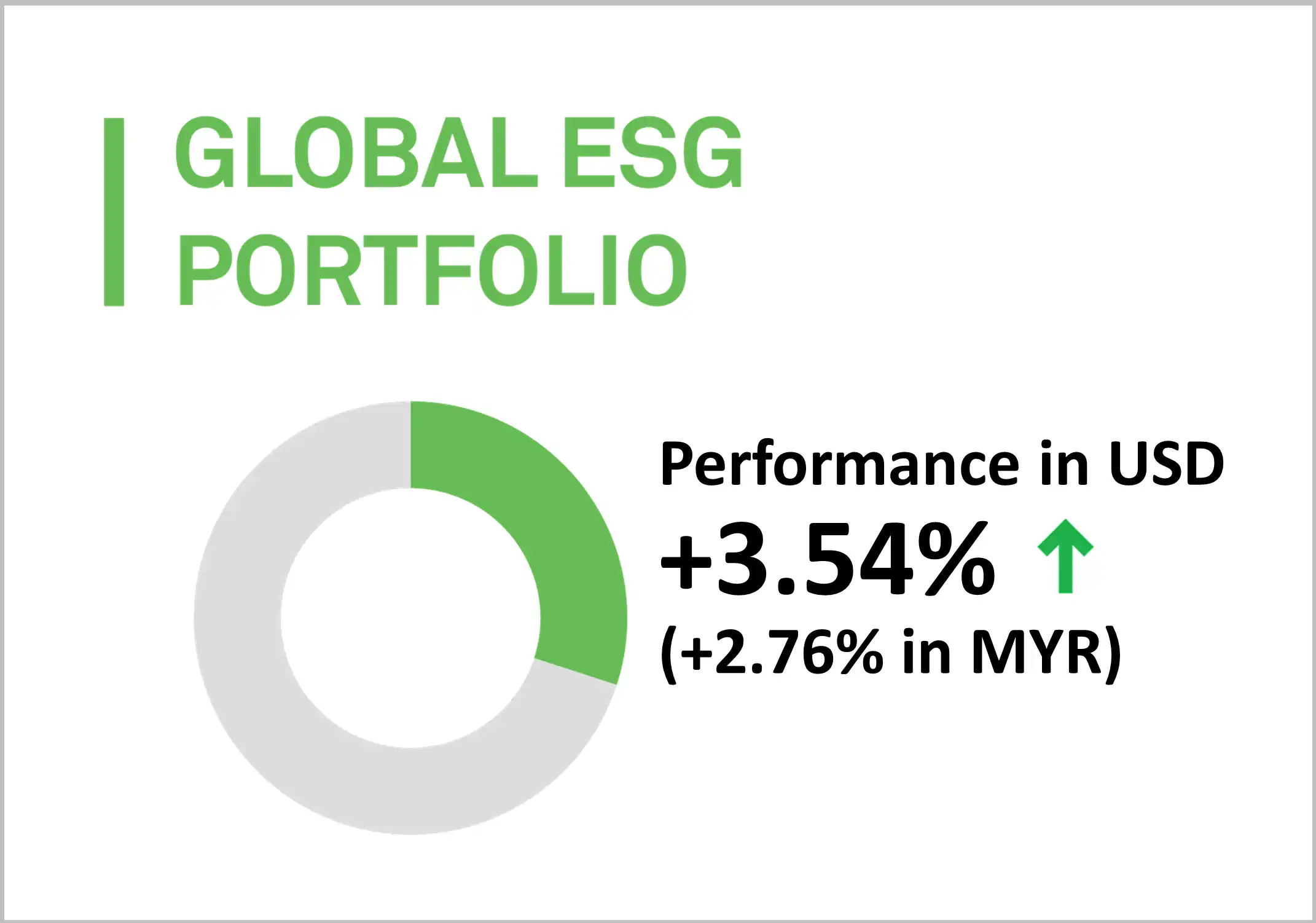

4. Global ESG Portfolio

MYTHEO’s Global ESG portfolio is up by 3.54% (+2.76% in MYR) in March 2024.

In line with the growth portfolio, the preference and exposure to the US market stand at approximately 60%. Given the US's substantial presence in Environmental, Social, and Governance-focused (ESG) investments, along with its established track record, MYTHEO Global ESG portfolio maintains a heavier weighting in US markets. This strategic decision not only reflects the maturity of the US market but also underscores MYTHEO's commitment to robust risk management practices, especially when compared to investing in newer and potentially more volatile emerging markets.

Top 3 ETFs performance (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

+4.97%

+3.42%

+3.32%

Bottom 3 ETFs performance (Global ESG portfolio)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

NUVEEN ESG LARGE-CAP GROWTH ETF (NULG)

ISHARES ESG AWARE MSCI EM ETF (ESGE)

+3.22%

+2.91%

+2.12%

Source: GAX MD Sdn Bhd, data in USD term for the month of March 2024.

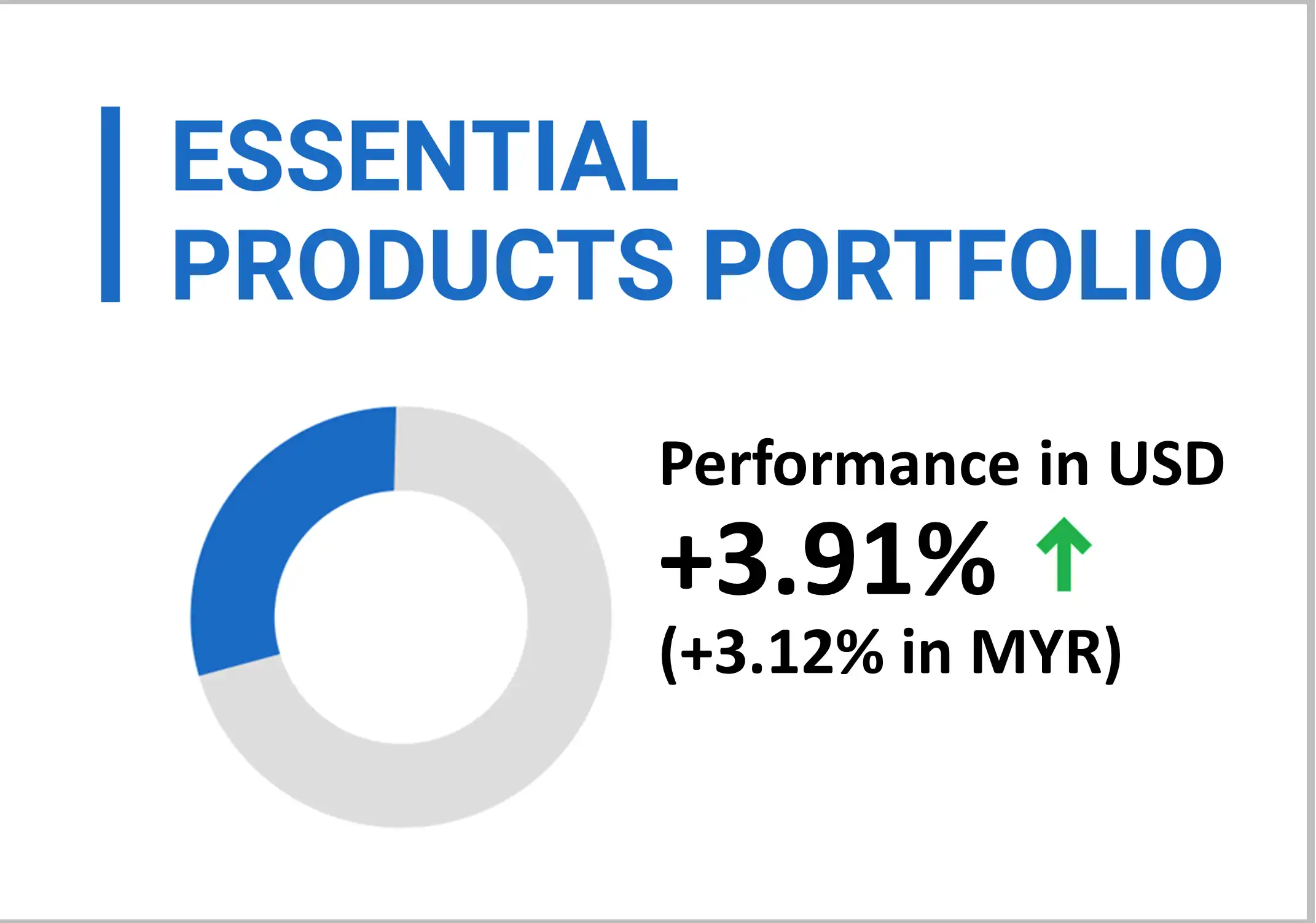

5. Essential Products Portfolio

MYTHEO’s Essential Products portfolio was up by 3.91% (+3.12% in MYR) in March 2024.

The portfolio retained its focus on ETFs chosen to reflect essential themes of food, water, and energy (both new energy and energy resources). With a preference and exposure to the US market accounting for about 60%, this allocation is carefully balanced to leverage promising investment prospects arising from technological development and business model transformation within these three essential sectors on a global scale.

In the current market climate, the performance of the themes emphasized in this portfolio showed a slight negative for new energy but exhibited notably positive returns for energy resources, food and water related investments.

Top 3 ETFs performance (Essential products portfolio)

ENERGY SELECT SECTOR SPDR (XLE)

ISHARES MSCI AGRICULTURE PRO (VEGI)

INVESCO S&P GLOBAL WATER INDEX (CGW)

+10.49%

+6.53%

+4.46%

Bottom 3 ETFs performance (Essential products portfolio)

FIRST TRUST GLOBAL WIND ENERGY (FAN)

ISHARES S&P GLOBAL CLEAN ENERGY INDEX ETF (ICLN)

GLOBAL X LITHIUM & BATTERY TECH (LIT)

+1.75%

+0.50%

-1.67%

Source: GAX MD Sdn Bhd, data in USD term for the month of March 2024.

Chart 1: March 2024 - Portfolio Year-to-Date Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, April 2024

Note: Past performance is not an indication of future performance

Balanced allocation consists of 30% Growth, 45% Income and 25% Inflation Hedge

How to calculate MYTHEO Omakase actual monthly portfolio return

For MYTHEO Omakase, the actual portfolio returns derive from the combined weighted returns of each allocated functional portfolio.

For instance, assuming allocations of 30% to the Growth portfolio, 45% to the Income portfolio, and 25% to the Inflation Hedge Portfolio, the actual portfolio return in MYR for March would be +1.47%, calculated as follows: [(30% x 2.79%) + (45% x 0.10%) + (25% x 2.41%)].

Our Thoughts

The US maintained its robust performance in equity markets during the period, particularly with value-oriented indices outperforming their growth-focused counterparts across similar market capitalisation ranges. These value indices, which typically prioritise financial services over technology and similar sectors, thrived amid widening spreads between savings interest rates and loan/mortgage rates in high interest rate regimes. Meanwhile, in Japan, the central bank took advantage on global inflation trends by ending 17 years of negative interest rates, adjusting them from -0.1% to a range of 0-0.1%. This moved signals a return to normalcy and coincided with continued growth in Japan’s equity markets.

Fixed income instruments delivered modest returns as the US Federal Reserve maintained the target rate at 5.25-5.50%. Coupled with the MYR strengthening against the USD by 0.7% in March, this resulted in a subdued performance for the Income portfolio.

Anticipation of future rate cuts stimulated inflows into gold and silver, driving gold prices to a record high above USD2,200 per ounce. Concurrently, crude oil sustained a five-month uptrend, surpassing USD83 per barrel. This rise was fueled by supply constraints stemming from oilfield maintenance in Saudi Arabia, production cuts by OPEC+ and escalating domestic consumption in the Middle East.

As market dynamics evolve, MYTHEO stays dedicated to offering investors options that resonate with their financial objectives. As a digital investment platform, MYTHEO stands ready to assist you in reaching your long-term financial goals through diversified investments, conveniently and affordably. Discover how MYTHEO can enhance portfolio diversification for you today, and take the first step towards your financial journey here.

This material is subject to MYTHEO’s Notice and Disclaimer.