Monday, 28 March 2022

Written by MYTHEO

Business is no longer as usual. Climate change and poor corporate governance have now become key risks to investing.

That’s why investors are paying closer attention to how corporations integrate sustainability into their business performances. So should you.

We spoke to Matthew Stuart-Box, Chief Investment Officer of MYTHEO, in our recent #MYTHEOLive webinar: Russia’s wake-up call: Why investors are rethinking ESG funds?, to learn more about ESG investing.

Matthew thinks that because global investors screen companies to exclude those who under-deliver on ESG expectations, an ESG investor will likely see greater protection against risks, and a better chance of outperforming against non-ESG counterparts.

Here are the 3 key takeaways we think you should know

1) Build portfolio resilience with ESG

Using MSCI’s Country Performance database, our research shows that ESG investments have a similar or better performance against non-ESG counterparts during the pandemic years. This means that ESG has greater potential to help investors build portfolio resilience against big fluctuations in asset prices.

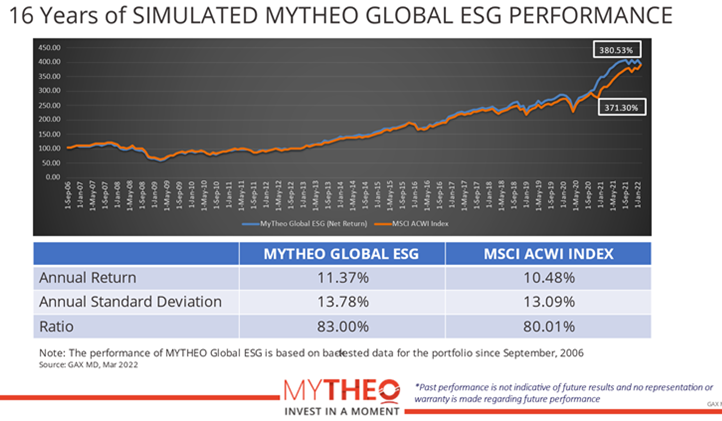

MYTHEO’s simulation also points at ESG investments outperforming its non-ESG counterparts over the longer term. The ESG option also has a better risk-return balance – the ingredient you need for portfolio resilience.

Source: GAX MD Sdn Bhd, March 2022

Note: Past performance is not an indication of future performance

2) Allocate up to 20% for ESG investments in portfolio mix

MYTHEO’s core strategy offers investors an ideal long-term asset allocation that promotes stable performance, and should make up the biggest slice of the portfolio mix.

As for satellite strategy, we recommend investors allocate up to 20% for ESG investments to create room for including alternative investments.

3) Mindset shift: Managing risks rather than avoiding it

Investments will always carry risks and today’s risks will be replaced by another or evolve into something else in the future.

So MYTHEO’s approach is to get better at managing risks – we do this by using AI to track and analyze market news and sentiment. This helps us better prepare our investors against market risks

Finally, as a true blue Robo-advisor, we caution against human intervention as our biases and misjudgement to time the market may not always bring about desired outcomes.

MYTHEO’s digital investment platform is here to help you achieve your long-term financial targets through diversified investments globally – all within a few taps on our apps.

Find out more about MYTHEO’s personalised investment and ESG solutions on our app or website today!

Back to Main Blog

Back to Main Blog