Friday, 16 December 2022

Written by Sonia Tan, Portfolio Manager of GAX MD

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in November 2022.

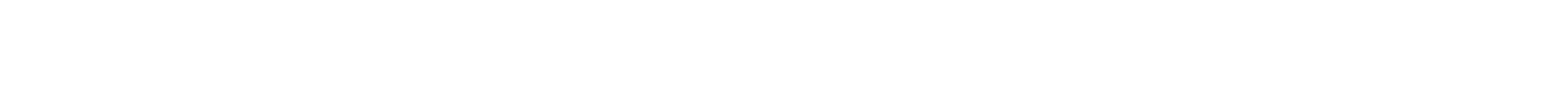

1. Growth Portfolio

MYTHEO’s Growth Portfolio was up 10.12% (4.16% in MYR) in November 2022.

The S&P 500 racked up its second consecutive month of gains in November as investors became more positive that the Federal Reserve would deliver a small rate hike in December.

The S&P 500 climbed about 4.3% in the month of October, the Nasdaq composite rose 2.8% to 11,468 points and the Dow Jones Industrial Average soared 5.04% to 34,587.46 points.

Powell said in a speech at the Brookings Institution on November 30th that the time for moderating the pace of rate increases may come as soon as the December meeting. He also emphasized that the central bank would stay the course until the job is done.

The dollar dipped against a basket of major currencies after data showed that U.S consumer spending increased solidly in October, while the dollar index fell 1.15% to 104.73 against a basket of currencies.

Top 3 ETFs (Growth portfolio)

ISHARES CHINA LARGE-CAP ETF (FXI)

ISHARES MSCI SOUTH KOREA (EWY)

VANGUARD FTSE EMERGING MARKET (VWO)

34.42%

17.16%

14.30%

Bottom 3 ETFs (Growth portfolio)

ISHARES RUSSELL 2000 VALUE (IWN)

INVESCO S&P 500 PURE VALUE (RPV)

INVESCO QQQ TRUST (QQQ)

2.84%

5.26%

5.54%

Source: GAXMD Sdn Bhd, data in USD term for the month of November 2022.

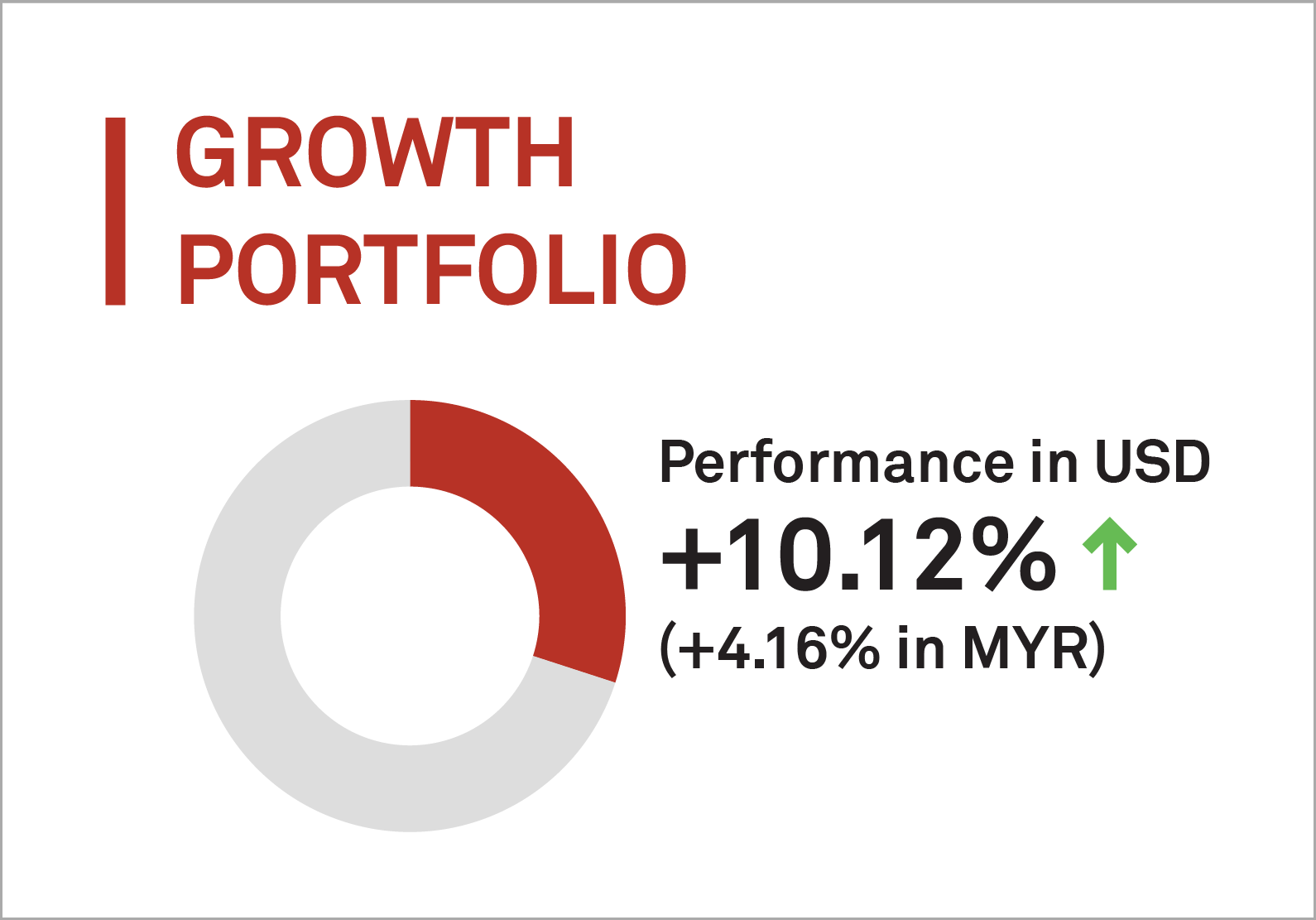

2. Income Portfolio

MYTHEO’s Income Portfolio recorded a return of 5.41% (-1.45% in MYR) in November 2022.

Treasury yields edged lower minutes after the Federal Reserve’s latest policy meeting showed US central bankers looking to moderate the pace of interest rate hikes soon.

The Fed is reaching a critical point in its battle against inflation, and the next couple of months will determine whether it can navigate a “soft landing” for the U.S economy, that is to tame inflation without sparking a recession.

The yield on 10 Year US Treasuries edged lower from 4.06% to 3.61%, while the policy-sensitive 2-year treasury yield similarly inched slightly lower from 4.49% to 4.33%.

Meanwhile, November’s consumer price index (CPI) gained 7.7% year over year in October, down from its peak of 9.1% in June but still well above the Fed’s long-term targets.

Top 3 ETFs (Income portfolio)

VANECK JP MORGAN EM LOCAL CURRENCY BOND (EMLC)

ISHARES 20+ YEAR TREASURY BOND (TLT)

ISHARES IBOXX INVESTMENT GRADE CORPORATE BOND (LQD)

6.97%

6.89%

6.32%

Bottom 3 ETFs (Income portfolio)

SPDR BLACKSTONE SENIOR LOAN (SRLN)

ISHARES 1- 5 YEARS INVESTMENT GRADE CORPORATE BOND (IGSB)

ISHARES 3-7 YEAR TREASURY BONDS (IEI)

0.34%

1.92%

2.09%

Source: GAXMD Sdn Bhd, data in USD term for the month of November 2022.

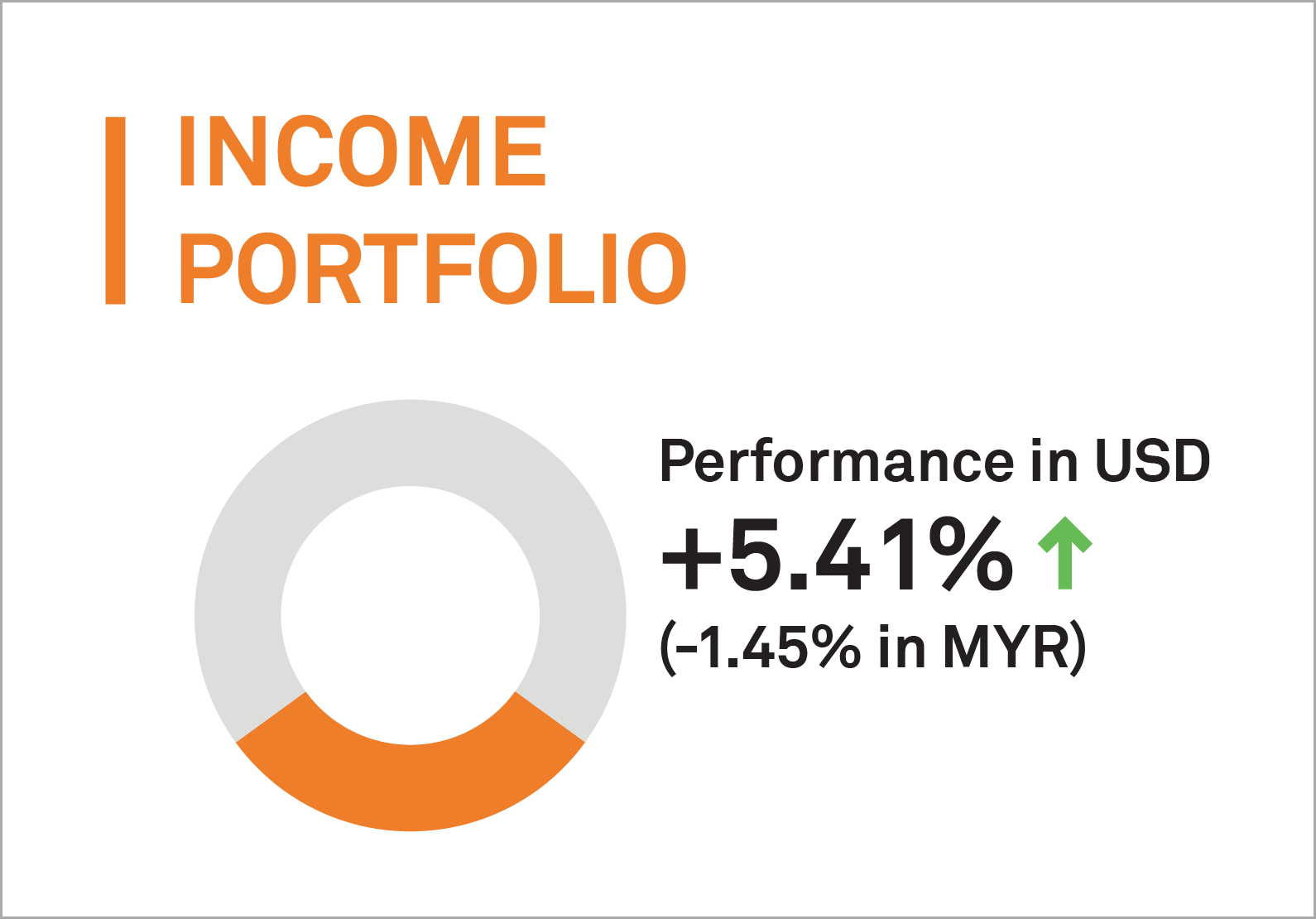

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio saw a positive return in November 2022, rising 6.63% (0.67% in MYR).

Oil prices declined nearly 7% to $85.43 per barrel in November from an early rally built on dollar weakness and hopes for improved fuel demand in China after Covid-19 curbs were eased in two major Chinese cities.

U.S West Texas Intermediate Crude Oil (WTI) was 6.5% lower at $80.56 per barrel. WTI traded as high as $123.70 back in March 2022, a 14 year high, but is now off nearly 35% since then. Oil is up 7.15% year-to-date.

Gold prices rose as much as 9% in November and climbed above the key $1,800 per ounce pivot. This came as the dollar weakened on the prospect of slower rate hikes from the US Federal Reserve and signs of cooling U.S inflation.

Top 3 ETFs (Inflation hedge portfolio)

INVESCO DB BASE METALS FUND (DBB)

ISHARES GLOBAL CLEAN ENERGY (ICLN)

SPDRDOW JONES INTERNATIONAL REAL ESTATE (RWX)

14.51%

12.02%

9.89%

Bottom 3 ETFs (Inflation hedge portfolio)

INVESCO DB OIL FUND (DBO)

ISHARES TIPS BOND ETF (TIP)

ISHARES US REAL ESTATE ETF (IYR)

-5.06%

1.83%

6.17%

Source: GAXMD Sdn Bhd, data in USD term for the month of November 2022.

4. Global ESG Portfolio

Similar to the Growth Portfolio, MYTHEO’s Global ESG portfolio was up by 9.75% (3.79% in MYR).

Top 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI EM (ESGE)

ISHARES ESG AWARE MSCI EAFE (ESGD)

NUVEEN ESG LARGE-CAP GROWTH (NULG)

11.11%

8.81%

7.98%

Bottom 3 ETFs (Global ESG portfolio)

ISHARES ESG AWARE MSCI USA ETF (ESGU)

ISHARES MSCI USA ESG SELECT (SUSA)

NUVEEN ESG LARGE-CAP VALUE (NULV)

5.57%

6.37%

6.41%

Source: GAXMD Sdn Bhd, data in USD term for the month of November 2022.

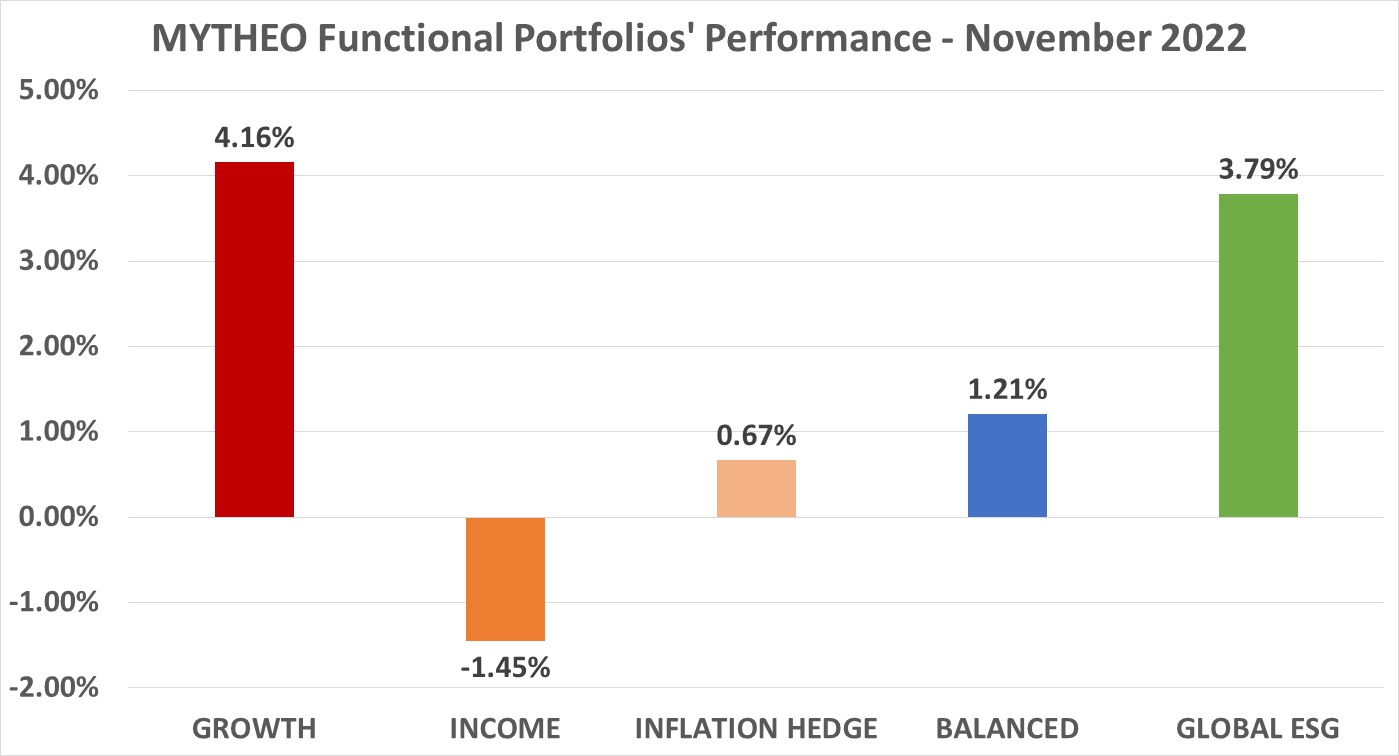

Chart 1: November 2022 - Portfolio Cumulative Rate of Return in % (MYR)

Balanced allocation consists of 40% Growth, 40% Income and 20% Inflation Hedge.

Source: GAX MD Sdn Bhd, December 2022

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weighted return from the allocation to each functional portfolio.

For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is 1.21% [(40% x 4.16%) + (40% x -1.45%) + (20% x 0.67%)]

Our Thoughts

The Malaysian Ringgit rose 5.96% in November versus the US dollar to RM4.4475 (as at 30th November 2022), where the Ringgit was RM4.7260 on 31st October 2022. This has an impact on the performance of the portfolio in ringgit terms due to the appreciation of the ringgit. In USD terms, the Growth portfolio achieved a return of 10.12%, Income Portfolio with a return of 5.41% and Inflation Hedge with a return 6.63%. Similarly, MYTHEO’s Global ESG portfolio achieved a return of 9.75%.

Despite the two-month rally, the S&P 500 remains down nearly 15% year to date and is on track for its worst annual return since 2008, the year of the Global Financial Crisis.

The two major market catalysts that have weighed on stock markets throughout 2022 are inflation and interest rates, and they remain front and center in December.

That aside, geopolitics continues to impact the markets with the war in Ukraine, China’s zero-Covid policy and the risk of global recession high on the list of concerns.

China markets reacted favorably to fresh support from their regulators. The widening of a programme to support about 250-billion-yuan ($34.5 billion) worth of debt sales by private firms including property developers, the reduction of the reserve requirement ratio and the loosening of China’s zero-Covid policy have helped investors recover some of this year's losses. The Hang Seng Index had its best monthly performance (+27.3%) in 24 years, this is despite protests against Covid lockdowns that erupted at the end of the month.

Looking back at US markets, the earning season has nearly come to an end and corporate profits for the S&P 500 grew modestly in Q3 2022 with earnings growth rate at +3.42%. Sectors that saw outsized growth include Energy (+149%), Real Estate (+19%) and Industrials (+17%), while sectors that saw large declines include communications (-21%), Financial (-16%) and Materials (-16%).

Though Q3 earnings growth was lower than expected at the beginning of the quarter and is expected to be slightly negative in Q4, the results were strong enough to support equity valuations as the Fed tightening appears in sight.

Moving over to fixed income, November saw a robust recovery in bond markets in general. Government bond yields were broadly lower and credit spreads tightened across global markets.

This came as investors sensed that inflation may be peaking in the U.S. and the Fed can afford to ease back on its tightening policy. As a result, very positive credit market returns were observed, led by emerging markets high yields, followed by investment grade U.S. and Sterling Bonds.

Despite the uncertain economic outlook for 2023, there are still reasons for investors to be optimistic in December and beyond;

i) Republicans regained control of the House of Representatives in the U.S midterm election in November, and Wall Street has historically preferred political gridlock in Washington. This was discussed in more detail in a recent MYTHEO

webinar.

ii) The S&P 500 has generated an above average annual return of 13.6% since 1950 during the years in which congress is split.

Investors concerned about a potential recession could consider a more defensive approach to the market. The newly launched MYTHEO USD Cash Trust portfolio can make periods of high volatility more tolerable by providing an avenue for investors to diversify away from riskier investments into safe haven USD Cash.

Having a well-balanced, diversified portfolio, with a risk profile consistent with your goals, and being prepared with a plan in the event of an unexpected outcome are keys to successful investing.

MYTHEO’s Omakase portfolio combines Growth, Income and Inflation Hedge functional portfolios based on your goals. It offers intelligent global diversification to protect against extreme fluctuations in any single asset class by diversifying your portfolio into multiple asset classes which offer a better cushion from the volatility in the equity market.

A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having diversified investments in an easy and affordable way. Learn how MYTHEO can help you diversify your portfolio today, and how you can get started here.

This material is subjected to MYTHEO's Notice and Disclaimer.