Wednesday, 13 September 2021

Written by Nazifah Mohd Arshad, Senior Portfolio Manager of GAX MD

Major indices posted solid gains in August on the back of the reopening of the economy that has fueled a faster-than-expected recovery in corporate fundamentals and earnings. The MSCI All-Country World Index registered an increase of 2.36% month-on-month. In the United States (US), the S&P 500 rose 2.9% for the month, while the tech-heavy Nasdaq Composite climbed 4.0% for its third winning month in a row. The blue-chip Dow lagged but still added 1.2%.

US economic indicators remained positive in August, supported by a new stimulus package of an additional USD3.5 trillion that President Joe Biden has tried to push through in spending on public health, social security and environmental measures.

Meanwhile, European stocks closed higher in August as investors shrugged off better-than-expected euro zone inflation data. London’s FTSE 100, Germany’s DAX and France’s benchmark CAC 40 rose 1.24%, 1.87% and 1.02% respectively.

In mainland China, the Shanghai composite jumped 4.0% to close at 3,543.94 points while the Shenzhen component shed 1.0% in August to 14,328.38 points. The slowdown in Chinese growth indicated a softening domestic demand with pressures emanating from new wave infections driven mainly by the Delta variant and the temporary closure of the Ningbo-Zhoushan Port in response to the outbreak containment after a worker tested positive for Covid-19. This disrupted domestic and international shipping.

The ongoing regulatory clampdown, especially on some listed tech giants was also a major headwind. However, the Chinese authorities are expected to ramp up stimulus measures to ease negative impacts and maintain recovery in real sector.

The yield on the benchmark 10-year US Treasury (UST) increased in August from a low of 1.17% to close at 1.30% at month-end. However, bond yields have steadily declined from the March highs of above 1.7%, supporting equities as inflation concerns abated. Demand for UST was initially pressured as investors anticipated a potential announcement of the Federal Reserve’s tapering plans at the Jackson Hole Symposium held on Aug 26 to 28. However, by the end of the symposium, demand for UST rebounded, given the lack of a tapering announcement and with Fed chair Jerome Powell stating that interest rate hikes were still far off.

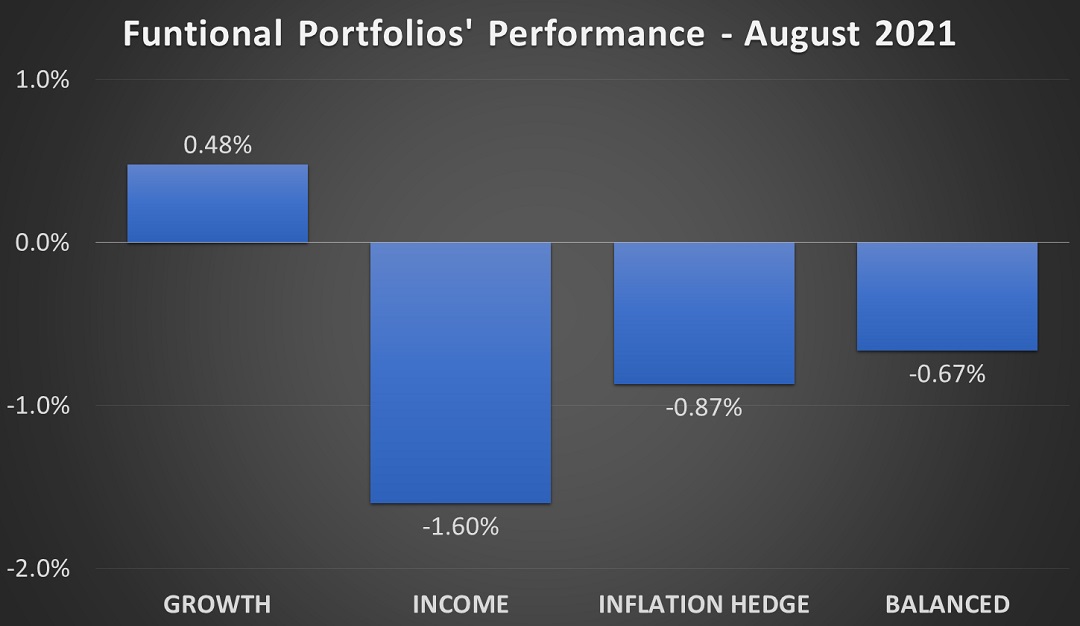

The ringgit strengthened by 1.43% in August, ending the month at 4.1575 against the US dollar on signs of an improving Malaysian political landscape under newly-appointed Prime Minister Datuk Seri Ismail Sabri Yaakob’s administration and the optimism of the economy reopening as its Covid-19 vaccination scheme progresses.[]In August, the Growth portfolio inched up 0.48% while the Income and Inflation Hedge portfolios slid 1.60% and 0.87% respectively.

Chart 1: Functional Portfolios' Performance for the month of August 2021

Source: GAX MD Sdn Bhd, September 2021

Note: Past performance is not an indication of future performance

Growth Portfolio

MYTHEO’s Growth portfolio recorded positive return of 0.48% for the month, mainly attributed to the positive performance of its heavyweight ETFs - Invesco QQQ Trust (QQQ) and Vanguard Value ETF (VTV) – which increased by 2.61% and 0.51% respectively.

Income Portfolio

The Income portfolio recorded a -1.60% return in August due to the negative performances of the portfolio’s heavyweight ETFs. The iShares 7-10 Treasury Bond ETF (IEF), iShares MBS ETF (MBB) and iShares International Treasury Bond ETF (IGOV) recorded a -1.94%, -1.57% and -2.42% returns respectively in the month of August. The performance was in line with the performance of the 10-year UST which increased by 13 basis points in August to close at 1.30%.

Inflation Hedge Portfolio

The Inflation Hedge portfolio registered a -0.97% return in August, mainly due to the negative performance of its commodities ETFs as well as the strengthening of ringgit against the US dollar. For the month of August, ringgit rose by 1.43% against the greenback

It must be noted that the actual portfolio returns to the investors is the combined weighted return from the allocation to each functional portfolio. For example, if an investor allocates the investment 40% in Growth, 40% in Income and 20% in Inflation Hedge, the actual portfolio return is -0.67% (40% x 0.48% + 40% x -1.60% + 20% x -0.87%).

Note: Past performance is not an indication of future performance

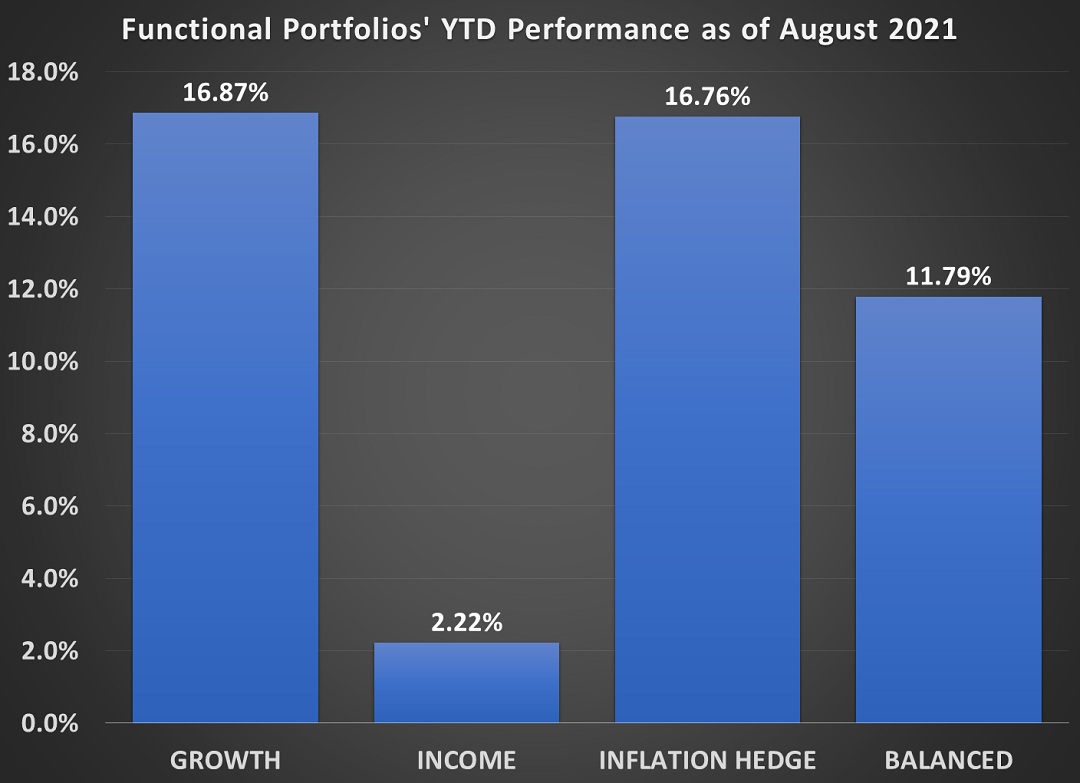

As for year-to-date performance, all portfolios registered positive returns as of August 2021. The Growth, Income and Inflation Hedge portfolios increased by 16.87%, 2.22% and 16.76% respectively. Those who invested in a balanced portfolio with a 40%:40%:20% allocation in Growth, Income and Inflation Hedge portfolios would be seeing a return of 11.79%, outperforming the FBM KLCI which declined 0.07% during the same period.

Chart 2: Year-to-date Portfolios' Performance for the month of August 2021

Source: GAX MD Sdn Bhd, September 2021

Note: Past performance is not an indication of future performance

There were a few significant changes to the portfolio in our August rebalancing. The iShares China Large-Cap ETF (FXI) removed in the May rebalancing was re-included into the Growth portfolio. Meanwhile, the Silver ETF (SLV) was removed from the Inflation Hedge portfolio, resulting in the increase of iShares TIPS Bond ETF (TIP) and iShares US Real Estate ETF (IYR).

Our Thoughts

We believe that we are still in the early innings of the cycle and that strong economic and earnings growth as well as the relatively low rates through 2022 should support higher equity prices and sustain the bull market.

Nevertheless, uncertainties remain due to a rebound in Covid-19 infections, largely driven by the spread of the Delta variant in areas with low vaccination rates. The authorities are unlikely to reintroduce lockdowns, but local restrictions may be tightened in certain areas. It would weigh on services in these areas, while the overall economic recovery is likely to continue.

It is clear that the investors who diversified some of their investments into the offshore market would have enjoyed a better return at this point in the year. Investing offshore is no longer complicated given the advent of new technology. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by investing in the global markets in an easy and affordable way.

This material is subjected to MYTHEO's Notice and Disclaimer.