Wednesday, 20 January 2021

Written by Amirudin Hamid, Portfolio Manager of GAX MD

Although the market has been rising strongly since April 2020, the equity market still produced decent gains in December 2020. There was also plenty of good news, such as the implementation of the vaccination program and the finalization of the Brexit deal, that supported the market rally during the month.

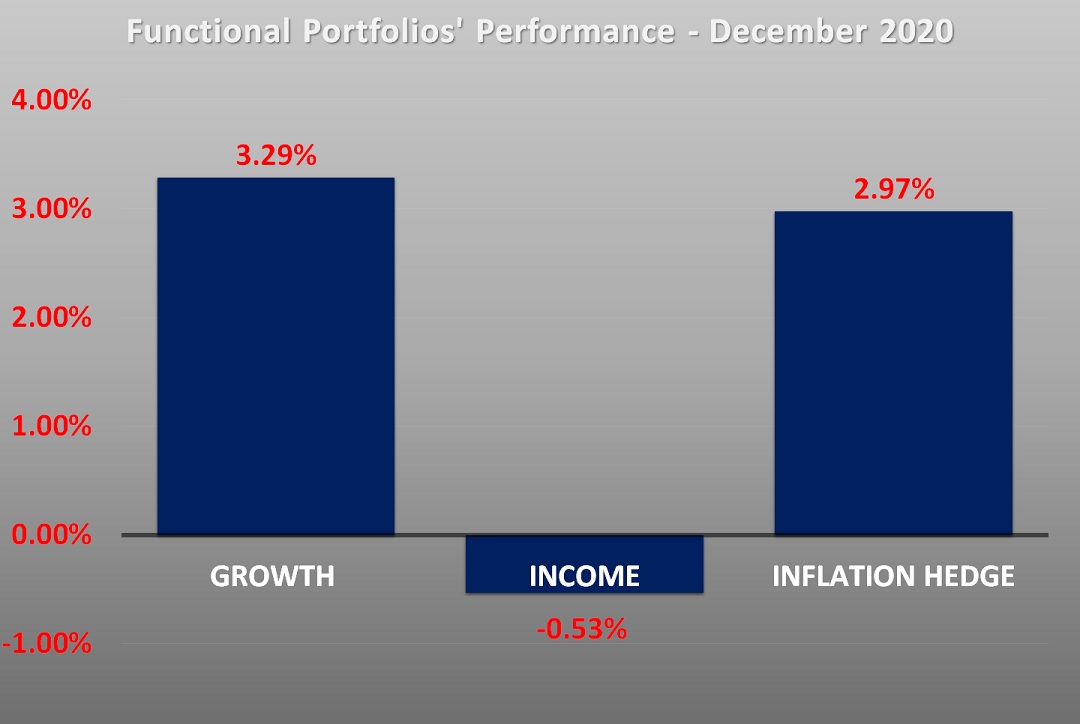

The Growth and Inflation Hedge portfolios rose by 3.29% and 2.97% respectively while the Income portfolio declined by 0.53%.

Chart 1: Functional Portfolios’ Performances for the month of December 2020

Source: GAX MD Sdn Bhd

Note: Past performance is not an indication of future performance

The GROWTH portfolio rose by 3.29% in MYR

The Growth portfolio rose strongly in December, which was driven by the broad-based rally in the equity market. Asia was by far, the best performing region. All the top performers inside MYTHEO’s holdings were exposed to the Asian market, including Taiwan (EWT), Asia Pacific (VPL) and Japan (EWJ) which rose by 7.85%, 5.38% and 3.94% respectively.

China Large-Cap ETF (FXI) eased by 1.07% and was the only investment in the Growth portfolio that fell in December as investors had taken profits after a hefty double-digit gain return over the past three months.

The INCOME portfolio dipped by 0.53% in MYR

The US Treasury market was in the red in December with the 10-year yield moving further up to 0.912% from 0.842% a month earlier and the US Dollar (USD) falling by 1.30% against Ringgit (MYR).

As a result of a higher yield and a declining USD, the valuation of all US Treasuries inside the portfolio were down in MYR. 20+ year Treasury Bond (TLT), 7-10 year Treasury Bond (IEF) and 3-7 year Treasury Bond (IEI), all closed lower by 2.53%, 1.55% and 1.20% respectively.

International bonds performed better when the US Dollar weakened. Emerging Market Local Currency bond (EMLC) was the best performing asset inside the Income portfolio with a 2.27% gain. Meanwhile, International Treasury Bond by iShare (BWX) and International Treasury Bond by SPDR (BWX) both rose by 1.14% and 1.07% respectively.

The INFLATION HEDGE portfolio increased by 2.97% in MYR

The Inflation Hedge portfolio rose further in December and was driven by a strong performance of precious metals, crude oil and international real estate.

Silver ETF (SLV) and Gold ETF (IAU) spiked up by 15.19% and 5.56% respectively, after the Federal Reserve announced that they would continue to maintain liquidity in the market. Simultaneously, the European Central Bank (ECB) expanded its assets buying program by €500 billion and planned to extend it until March 2021.

Oil ETF (DBO) added a further 5.17% after the Organization of the Petroleum Exporting Countries (OPEC) and associated producers, including Russia, announced to supply a small increase of 500,000 barrels of oil which the market deemed too little to affect the current demand and supply balanced in the market.

International Real Asset (RWX) rose by 4.47% due to higher interest in non-USD assets from investors as USD continued to trade lower against major currencies.

It must be noted that, the actual portfolio returns to the investors is the combined weighted return from the allocation to each functional portfolio. For example, if an investor allocates the investment equally: 33.3% in Growth, 33.3% in Income and 33.3% in Inflation Hedge, the actual portfolio return is (33.3% x 3.29%) + (33.3% x-0.53%) + (33.3% x 2.97%) = 2.43%.

Note: Past performance is not an indication of future performance.

Our Thoughts

2020 is the year to remember for being the year of the worst market correction and the best market rebound put together in a pot. Nobody would have anticipated that they would have faced the fastest market meltdown in history just to be reversed by the fastest ever market melt-up. It took slightly more than 30 days for the S&P 500 Index to fall by 33.93% from its all-time high peak of 3,386.15 points on 19 February 2020, before hitting the bottom of 2,237.40 points on 23 March 2020. The market then rebounded and hit a new all-time high again on 24 August 2020.

The vaccination program will be the game-changer for the economy and market to return to normal. Implementation and progress of the vaccination program is expected to influence market sentiment all year round in 2021. However, due to production and logistic constraints, we expect that the vaccination program's impact can only be seen and felt in the second half of the year. Therefore, investors may still have to brace volatility in the first part of the year and expect a few countries to continue imposing lockdowns to contain the virus.

On a political front, there will be huge differences between the year 2020 and 2021. Since 2016, Brexit was a significant overhang in the financial markets and was a primary reason for the UK to be one of the worst-performing markets in the past years. With the deal finally sealed, UK will officially leave the European Union on 31 January 2021 and be allowed to negotiate trade deals with each country separately. The negotiation might cause more ups and downs to the market but it will not grab much attention like it did in the past.

The market rally first started when the US Congress finally struck a deal for an additional second stimulus package to support the economy. They had agreed on a US$900 billion relief package that includes a weekly payment of US$600 to individuals with annual incomes of less than USD75,000. The news got better after an intervention by President Trump, in which the U.S. House of Representatives passed a bill called the CASH Act on 28 December2020, that could substantially raise the payment from US$600 to US$2,000.

US politics, however, was a bit more chaotic than usual last year. The US elections wrapped in November, but when Donald Trump refrained from accepting the result, the uncertainty arising from the US election was prolonged longer than many had predicted. In the end, Joe Biden won, and recently, the Democrats gained control of the Senate by winning the run-off election in Georgia. With the Senate in control, Joe Biden will have a clear path to pass through his policies for at least the next two years.

On an economic front, the Federal Reserve chairman, Jerome Powell reassured investors on 17 December 2020 that the Fed will not raise the interest rate soon even though the "economy is improving faster, the housing sector fully recovered and equity markets are hitting an all-time high". Besides, he also reiterated the Fed's policy to continue buying US$120 billion of bonds each month until the US achieved maximum employment and targeted inflation. This means that the liquidity will continue to flow into the financial market and provide support to the valuation of financial assets.