Monday, 10 December 2021

Written by Royce Tan, Chief Market Insights Officer of GAX MD

THE inflationary fears and mutated Covid-19 variants that dominated the month of December did little to prevent the markets from rallying to a high to end the year 2021.

Although restrictions have been reimposed in some countries coupled with numerous cancelled flights and events, the investors’ hope for an economic recovery in 2022 was reflected in the markets, coupled with the ramped-up vaccination programmes and the rollout of vaccine booster shots, the key for the full reopening of the global economy.

Covid-19 cases are starting to rise globally again amidst initial studies and news reports that the Omicron variant is about 70 times more transmissible than the Delta variant, but investors remained optimistic as the rate of hospitalisation and fatalities related to the variant remained low, though this may not seem to be the case anymore moving forward with news reports of renewed restrictions and the rising hospital occupancy rate.

The optimism saw the S&P 500 index jumping 4.36% over the past month while the Dow Jones Industrial Average (DJIA) rose 5.38%. On a year-on-year (y-o-y) basis, the S&P 500 and the DJIA both posted strong gains at 26.89% and 18.73% respectively in 2021.

Both indexes recorded new highs last year. The S&P 500 for instance, had 70 rounds of record highs throughout 2021. Meanwhile, the tech-heavy Nasdaq Composite Index was up 0.69% month-on-month (m-o-m) in December while its one-year movement showed an increase of 21.39%.

Commodities also enjoyed a splendid month of December and the whole of 2021. Brent crude oil ended 2021 at US$77.78 per barrel, up 10.22% month-on-month. From 2020, it was up 50.15% from US$51.80 per barrel. The West Texas Intermediate (WTI) finished at US$75.21 per barrel on Dec 31.

Gold futures advanced 2.93% m-o-m, silver futures rose 2.71% m-o-m while copper futures was up 4.24% m-o-m. On a y-o-y basis, gold and silver were decliners at 4.46% and 12.07% respectively while copper posted strong gains of 26.55%.

December was also a weak month for the fixed income markets especially after the Federal Reserve (Fed) announced its plans to accelerate the tapering of its monthly asset purchases, which is expected to end in March instead of the central bank’s initial timeline of mid-2022.

This means that the Fed will further cut down its monthly bond purchases that were used to stimulate the US economy. This will be slashed by US$30bil a month starting in January, which will allow the Fed some room to raise interest rates soon as it focuses on lowering the inflation rate. Officials are expecting three hikes in 2022.

The yield on the benchmark 10-year US Treasury rose to 1.512% on Dec 31 as compared to 1.456% on Nov 30, in line with the rally of stock markets as investors ditch safer investments in favour of optimism in equities. A year ago on Dec 31, 2020, investors were more wary of market developments and opted to be more risk averse, which saw the yield drop to 0.916%.

In Malaysia, the ringgit appreciated against the US dollar in December, up 0.86% to RM4.164 on Dec 31 from RM4.20 on Nov 30. On a y-o-y basis, the ringgit dipped 3.52% from RM4.0225 on Dec 31, 2020.

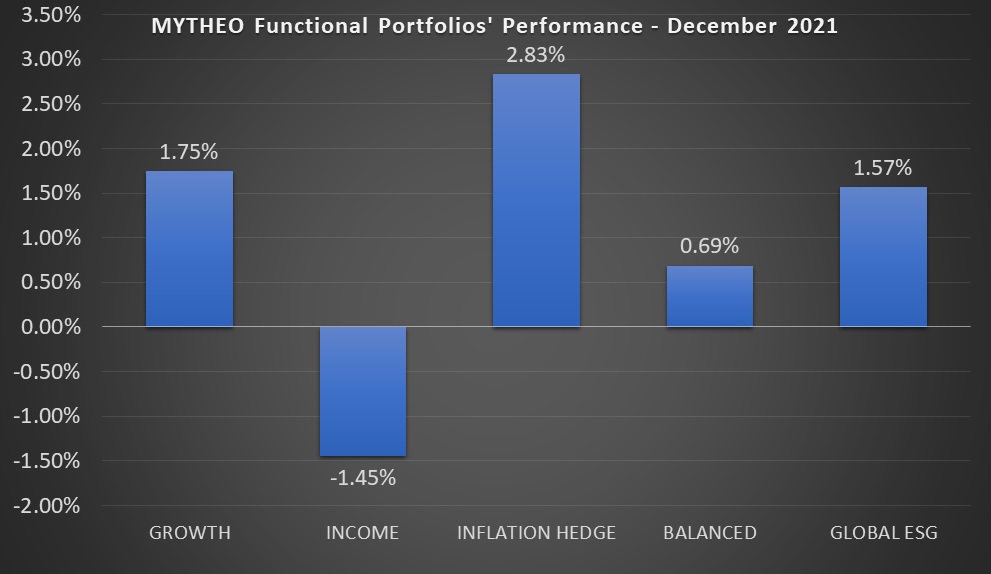

The performances of MYTHEO’s Three Functional Portfolios and the Global ESG portfolio:

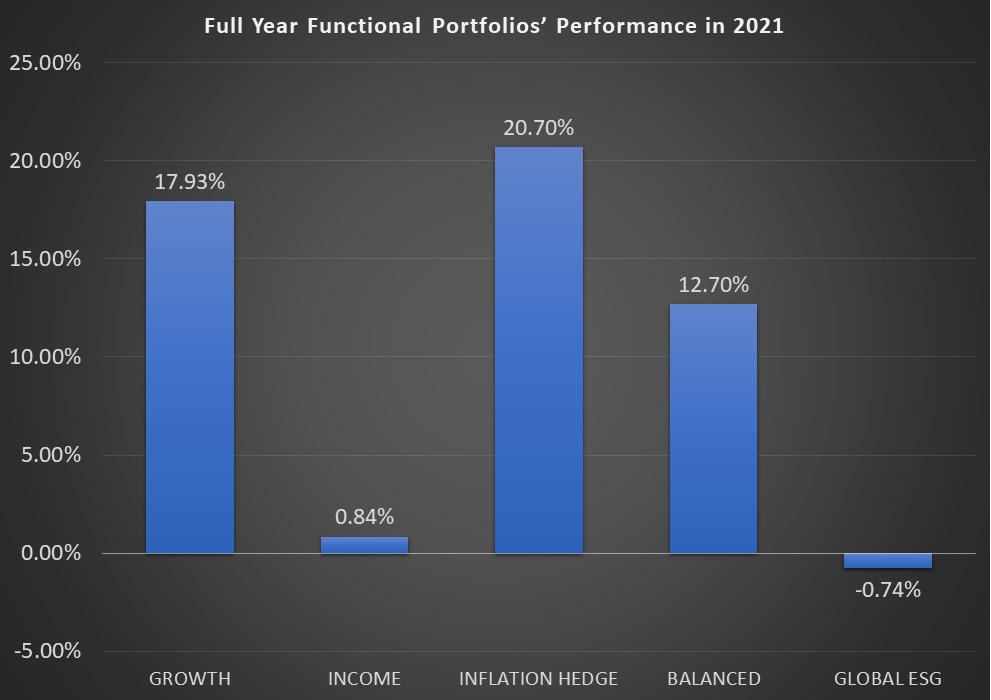

Growth Portfolio

The Growth Portfolio advanced 1.75% for the month of December, in line with the rally in equities on the back of strong earnings growth and optimism among investors that 2022 would see the economic recovery that 2021 had missed. The portfolio was given a boost through our heavyweight ETF Vanguard Value (VTV), which has risen 6.29% over the past month. There were also solid gains coming from iShares MSCI United Kingdom (EWU) and iShares MSCI Mexico (EWW) with a growth of 3.43% and 11.68% respectively. Out of the 13 ETFs in the Growth Portfolio, only two registered declines – iShares China Large Cap (FXI) at -4.22% and iShares MSCI Brazil (EWZ) at -3.17%. The full year performance of the Growth Portfolio saw a huge gain of 17.93%.

Income Portfolio

The Income Portfolio inched lower by -1.45% in December in line with the market which saw bond yields rising due to lower demand. The portfolio was dragged down by our holdings in iShares 7-10 Year Treasury Bond (IEF) and iShares 20+ Year Treasury Bond (TLT) which declined by -0.69% and -2.24% respectively. The performance of ETFs in this portfolio over the past month was rather balanced with five decliners against four gainers. The full year performance of the Income Portfolio was a gain of 0.84%.

Inflation Hedge Portfolio

The Inflation Hedge Portfolio jumped by 2.83% in December on the back of inflationary pressures and rising prices. Portfolio heavyweight iShares US Real Estate (IYR) rose 8.35% while Invesco DB Base Metals Fund (DBB) and iShares Gold Trust (IAU) were up 6.51% and 3.36% respectively. The Inflation Hedge Portfolio is our outperformer this year with a full year gain of 20.70%.

Global ESG Portfolio

In line with the rally in equities for the month of December, the Global ESG Portfolio recorded its best performance so far since inception with an increase of 1.57%. This latest portfolio by MYTHEO which was launched in October shares the same strategy as the Growth Portfolio, but with ESG elements infused. On a year-to-date basis, the portfolio posted a marginal decline of -0.74%.

Chart 1: Functional Portfolios’ Performance in December 2021

Source: GAX MD Sdn Bhd, January 2022

Note: Past performance is not an indication of future performance

Chart 2: Full Year Functional Portfolios’ Performance in 2021

Source: GAX MD Sdn Bhd, January 2022

Note: Past performance is not an indication of future performance

It must be noted that as a part of diversification, the actual portfolio returns to the investors is the combined weighted return from the allocation to each functional portfolio. For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is 0.69% (40% x 1.75% + 40% x -1.45% + 20% x 2.83%).

Note: Past performance is not an indication of future performance

Our thoughts

The year 2021 was an erratic one that sent the financial markets on a roller coaster ride. The economic recovery that was expected did not turn out to be, especially with the new waves of Covid-19 cases, mutations in the form of Delta and Omicron variants, inflationary pressures and ongoing geopolitical tensions.

Despite that, MYTHEO managed to record a stellar performance for the year 2021, with the results as stated above. We attribute this to our proven investment strategy using our proprietary algorithm based on quantitative analysis to eliminate human bias and emotions from the investment decision process.

We also rely on MYTHEO’s AI Assist in mitigating our downside risks and to improve our mid-to-long term performance. AI Assist predicts whether an ETF or asset class is at a risk of a large drawdown in the near future based on market data. One of the examples was in May 2021 during the peak of China’s regulatory clampdown, when it picked up a high volatility coming from FXI. We had an exposure of about 3% then and our algorithms removed it entirely from our Growth Portfolio before the ETF began tanking badly.

In 2022, we view that inflation will still be a major theme shaping the markets and central banks are expected to be more hawkish and will begin tightening monetary policies to curb inflation.

In China, regulatory clampdowns remain a risk as the country focuses on its priorities for common prosperity but we do not foresee it to be as intense as what it was in 2021. New Covid-19 outbreaks also remain a risk, especially with the World Health Organisation (WHO) warning against describing the Omicron variant as mild as it is killing people across the world, although less severe than the Delta variant. There has since been a newly identified variant from France, known as the IMU. How transmissible or deadly the variant is remains to be known but the WHO has classified it as “not a threat” for now.

There are now renewed restrictions in various regions around the world and cases are expected to spike again. Hospitalisation rates and the intensive care unit (ICU) occupation rates are also showing signs of surging while thousands of flights are being cancelled daily, as airlines attribute the disruptions to the Omicron variant. There are more than 2,000 flight cancellations daily in the US alone.

We still remain cautiously optimistic that we are in the early innings of a strong economic and earnings growth. If the Omicron variant remains under control, we should be looking at a favourable economic outlook in 2022. Inflation will continue to remain on the high side for the time being and we believe fiscal measures by policy makers worldwide remain accommodative to support the economy.

It is clear that the investors who diversified some of their investments into the offshore market would have enjoyed a better return at this point in the year. Investing offshore is no longer complicated given the advent of new technology. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by investing in the global markets in an easy and affordable way.

This material is subjected to MYTHEO's Notice and Disclaimer.