Wednesday, 16 March 2022

Written by Sonia Tan, Portfolio Manager of GAX MD

Equities markets fell in February, down by 3.16% globally, as investors digesting the implications of Russia’s invasion of Ukraine. Most of the sectors struggled in February, energy was the only sector to make gains, in tandem with the surge of oils and gas prices. Generally, the sectors with higher price over earning (P/E) ratios such as the technology and communication service sectors were among the top losers.

On 24th February, Russia launched a large-scale military invasion into Ukraine, and that conflict leads to imperilled supply chains, exacerbated inflation and suppress growth, resulting huge swings in the financial market.

US inflation jumps to 40 years new high in the past month, presented by the consumer price index that rose 7.5%. This is the steepest rise since Feb 1982, which lead by surging prices for groceries, electricity and rent. The negative sentiment has overshadowed the US equities market in February, the S&P 500 index dipped 3.1% for the month, ending at 4373.94 points. Similarly, the Dow Jones Industrial Average (DJIA) index declined 3.53% over the past month while the tech heavy NASDAQ Composite Index fell 3.43%.

Looking at the other regions, equities market in Europe also suffered huge losses, the benchmark FTSE Europe index underperforming the US Nasdaq index by 3.76%. Russia-Ukraine war has greater impact on Europe due to the significant reliance on Russia’s energy export, especially natural gas. In early February, European Central Bank’s president had declined to rule out an interest rate rise this year in response to this situation.

Bond yields rates were volatile over the past month, many yields closed higher due to expected rate hike moves based on the hawkish tone from US FED earlier in the month. Yields initially rose sharply, with the 10-year US Treasury rose above 2% in the month, new high since August 2019. At the end of February, the 10-year US Treasury closed at 1.839%, 0.057% increased from 1.782% on Jan 31.

In the commodities markets, crude oils recorded a strong rise in February 2022, following the Russia’s invasion of Ukraine. Brent crude oil jumped 10.72% to US$100.99 per barrel on February 28, from US$91.21 per barrel on January 31, while the West Texas Intermediate (WTI) crude oil was up 8.59% to US$95.72 per barrel on February 28, from US$88.15 per barrel on January 31.

Gold futures was up 5.79% to US$1,900.70 an ounce, while silver futures and copper futures rose 8.60% and 2.96% respectively.

In Malaysia, the ringgit depreciated against the US dollar in February, down by 0.25% to RM4.1960 in exchange of 1 US Dollar on February 28 compared to RM4.1855 on January 31.

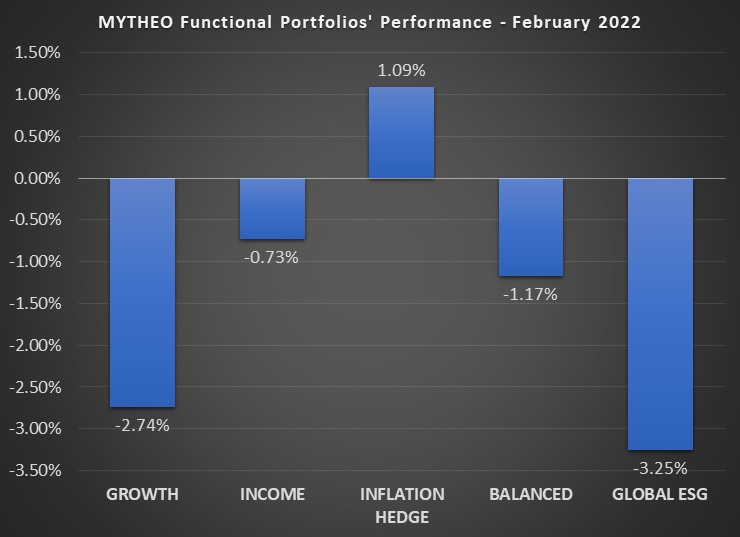

The performances of MYTHEO’s Three Functional Portfolios and the Global ESG portfolio:

Growth Portfolio:

The Growth Portfolio was down 2.74% for the month of February, due to massive sell off in global equities markets as investors grew wary about the Russia’s Invasion of Ukraine. Out of 14 ETFs in this portfolio, 13 of them were down, with the top laggards being iShares MSCI Germany (EWG) at -9.15%, iShares China Large Cap (FXI) at -8.01% and SPDR Euro Stoxx 50 (FEZ) at -7.92%. The only advancer in this portfolio was the iShares MSCI Canada (EWC) with a growth of 0.08%.

Income Portfolio

The Income Portfolio inched lower by -0.73% in February, in line with the market which saw bond yield rising due to lower demand. All ETFs in this portfolio posted losses, dragged down by the VanEck JP Morgan EM Local Currency Bond (EMLC) by -5.30%, iShares 20+ Year Treasury Bond (TLT) by -1.77% and iShares International Treasury Bond (IGOV) by -1.41%.

Inflation Hedge Portfolio

The Inflation Hedge Portfolio jumped 1.09% in February. The top ETFs that have contributed positively to the portfolio were the iShares S&P Global Clean Energy Index (ICLN), Invesco DB Base Metals Fund (DBB) and ISHARES GOLD TRUST (IAU) which registered 10.45%, 6.82% and 6.11% respectively. Portfolio heavyweights iShares US Real Estate (IYR) weighed on the performance, with declines of -4.59%.

Global ESG Portfolio

Like the Growth Portfolio, the Global ESG portfolio declined by -3.25%, due to the poor performance of global equities. Portfolio heavyweights iShares MSCI USA ESG Select (SUSA) and iShares ESG Aware MSCI EAFE (ESGD) were the laggards with declines of -11.20% and -7.26% respectively.

Chart 1: Functional Portfolios’ Performance in February 2022

Source: GAX MD Sdn Bhd, March 2022

Note: Past performance is not an indication of future performance

It must be noted that as part of diversification, the actual portfolio returns to the investors is the combined weightage return from the allocation to each functional portfolio. For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is -1.17% (40% x -2.74% + 40% x -0.73% + 20% x 1.09%)

Note: Past performance is not an indication of future performance

Our thoughts

We remain cautiously optimistic that we are in the early innings of a strong economic and earnings growth. However, due to Russia’s invasion of Ukraine, the world economy faces an unstable outlook. In such an unstable market situation, for a long-term investor, it is important to control risks and continue investing from a long-term perspective without rushing into decisions.

When an event that has a major impact on the world occurs, such as the COVID-19 outbreak and the situation in Ukraine this time, investor sentiment tends to cool and the stock market tends to decline. However, real assets in turn have benefited from these events.

Our combination of three different functional portfolios i.e. Growth, Income and Inflation Hedge offers diversification into real assets in the form of our Inflation Hedge Portfolio. The Inflation Hedge Portfolio invests in a diversified number of ETFs centered on real assets i.e. precious metals, infrastructure, energy related, real estate and commodities that protect asset values from price fluctuations, and aim to match and outperform Malaysia's inflation rate. It is also designed to reduce correlation with bond portfolios which will help to reduce overall portfolio risk.

As February’s performance shows (refer to chart 1 above), diversified investments can help the portfolio as a whole respond better under different market conditions, curb extreme fluctuations in asset value, and have higher potential to deliver good returns over the long term. The same also applies to diversified investments across asset classes, regions and industries.

We are confident and believe that the most effective investment method is to invest on a long-term perspective combining growth, income and inflation hedge functional portfolios that make up our recommended portfolio. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by having a diversified investments in an easy and affordable way.

This material is subjected to MYTHEO's Notice and Disclaimer.