Monday, 14 February 2022

Written by Sonia Tan, Portfolio Manager of GAX MD

EQUITY markets kicked off 2022 on a sloppy start as concerns over inflation, the tightening of monetary policies and tensions in the Eastern Europe weighed on sentiments in January.

Investors have been increasingly wary leading up to the Federal Open Market Committee (FOMC) meeting on Jan 26, sending the markets in huge swings amidst uncertainties.

While no rate hikes were announced this round, the Federal Reserve (Fed) has guided that an interest rate hike in March is extremely likely. The central bank said that with inflation well above 2% and a strong labour market, the committee expects it will soon be appropriate to raise the target range for the federal funds rate.

The Fed has accelerated the tapering of its monthly asset purchases, which means further cutting down its monthly bond purchases to stimulate the United States (US) economy. This is expected to end in March, instead of the initial timeline of mid-2022, which allows the Fed some room to raise interest rates to tackle the inflation rate.

Equities also fell in Europe, tracking the cautious outlook of the central bank development in the US and also due to the escalating tensions between the US and Russia over Ukraine. Annual inflation rose to 5% in December 2021 from 4.9% in November 2021, but the European Central Bank seemed firm on no rate hikes in 2022.

The negative news flows in January saw the S&P 500 dip 5.26% from December 2021 to January 2022, ending the month at 4515.55 points. Similarly, the Dow Jones Industrial Average (DJIA) declined 3.32% over the past month while the tech heavy NASDAQ Composite Index took a heavier hit, tanking 8.98%.

The fixed income market also suffered in January as investors zoomed in on the situation of elevated inflation and the hawkish tone from the Fed. The 10-year US Treasury rose to 1.784% on Jan 31 from 1.512% on Dec 31, in line with the tapering by the Fed and as investors were less willing to purchase Government bonds in this environment.

In terms of commodities, there were strong gains for oils due to supply shortages and geopolitical tensions while precious metals posted declines. Brent crude oil jumped 17.27% to US$91.21 per barrel on Jan 31, from US$77.78 per barrel on Dec 31 while the West Texas Intermediate (WTI) was up 17.21% to US$88.15 per barrel on Jan 31, from US$75.21 per barrel on Dec 31.

Gold futures dropped 1.89% to US$1,769.40 an ounce, while silver futures and copper futures reversed 4.06% and 2.79% respectively.

In Malaysia, the ringgit depreciated against the US dollar in January, down 0.52% to RM4.1855 on Jan 31 from RM4.164 on Dec 31.

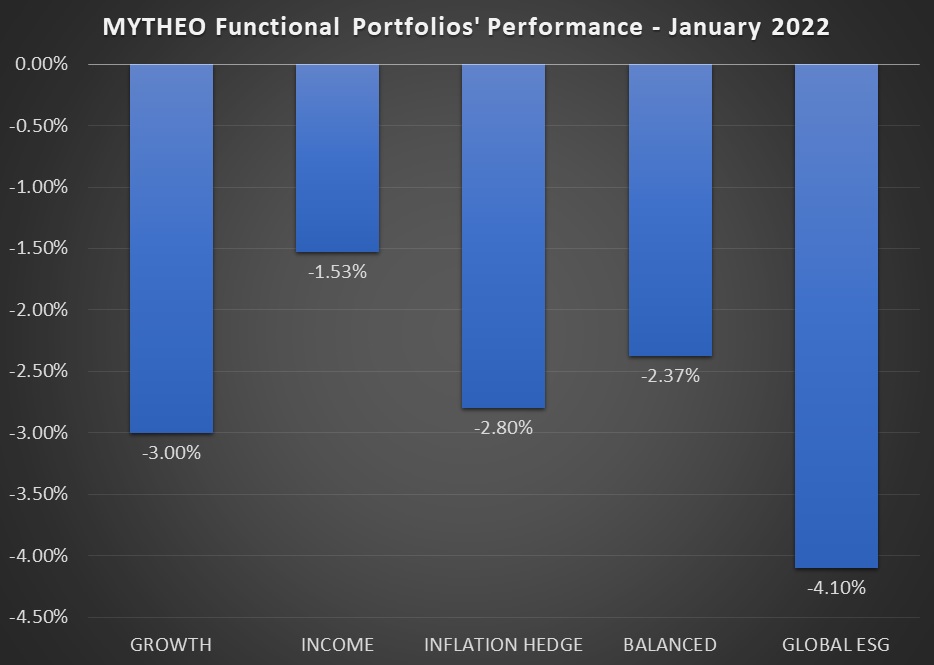

The performances of MYTHEO’s Three Functional Portfolios and the Global ESG portfolio:

Growth Portfolio

The Growth Portfolio was down 3% for the month of January, in line with the poor performance of equities globally. Out of 14 ETFs in this portfolio, 11 of them registered declines, with the laggards being Invesco QQQ Trust (QQQ) at -8.75%, iShares Russell Mid-Cap Growth (IWP) at -12.93% and iShares MSCI Japan (EWJ) at -4.30%. Cushioning some of the declines in the portfolio were iShares MSCI United Kingdom (EWU) with a growth of 2.26%, iShares China Large Cap (FXI) at 3.72% and iShares MSCI Hong Kong (EWH) at 2.24%.

Income Portfolio

The Income Portfolio inched lower by -1.53% in January, alongside the lower demand for bonds and as the Fed accelerated its tapering, which saw bond yields rising. Nine of the 10 ETFs in this portfolio posted losses, dragged down by the iShares 7-10 Year Treasury Bond (IEF) by -2.11%, iShares iBoxx $ High Yield Corporate Bond (HYG) by -2.65% and iShares 20+ Year Treasury Bond (TLT) by -3.91%. The only advancer in this portfolio was the VanEck J.P. Morgan EM Local Currency Bond (EMLC) at 0.35%.

Inflation Hedge Portfolio

The Inflation Hedge Portfolio was down by -2.80% in January. Portfolio heavyweights iShares US Real Estate (IYR) and iShares TIPS Bond (TIP) weighed on the performance, with declines of -8.23% and -2.06% respectively. The Invesco DB Oil Fund (DBO) and Invesco DB Base Metals Fund (DBB) were the only two that advanced, at a rate of 11.59% and 2.74% respectively.

Global ESG Portfolio

Like the Growth Portfolio, the Global ESG portfolio declined by -4.10%, due to the poor performance of global equities. Portfolio heavyweights iShares MSCI USA ESG Select (SUSA) and iShares ESG Aware MSCI EAFE (ESGD) were the laggards with declines of -7.80% and -3.80% respectively. Out of the six ETFs in this portfolio, fellow heavyweight iShares ESG Aware MSCI EM (ESGE) was the only advancer at 0.38%.

Chart 1: Functional Portfolios’ Performance in January 2022

Source: GAX MD Sdn Bhd, February 2022

Note: Past performance is not an indication of future performance

It must be noted that as part of diversification, the actual portfolio returns to the investors is the combined weightage return from the allocation to each functional portfolio. For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is -2.37% (40% x -3.00% + 40% x -1.53% + 20% x -2.80%)

Note: Past performance is not an indication of future performance

Our thoughts

As we have mentioned previously, we do not anticipate 2022 to be a smooth sailing year but we remain cautiously optimistic that we are in the early innings of a strong economic and earnings growth.

Inflation will be a major theme that shapes the global markets this year and we can expect central banks to start tightening their monetary policies in their battle against the rising inflation. We will be discussing more on the impact of higher inflation on various asset classes and how to hedge against it in Higher Inflation: Where to put your money webinar at 11am, 19 February 2022.

Covid-19 cases are now rising exponentially again, mainly due to the highly infectious Omicron variant and there are now renewed restrictions to curb the spread, although there are no total lockdowns expected, which would not hit the economy as bad as what we have seen in 2020.

We advise investors to maintain a long term investment strategy with a well diversified global portfolio consisting of growth, income and inflation hedge assets classes. Stick with your investment objective and stay invested through market cycles to achieve better long term results.

For potential investors who wish to diversify their investments into offshore markets, it is as easy as a few clicks on your smartphone. Just download the MYTHEO app on the App Store or Google Play Store to get started.

This material is subjected to MYTHEO's Notice and Disclaimer.

Back to Main Blog

Back to Main Blog