Wednesday, 11 August 2021

Written by Amirudin Hamid, Portfolio Manager of GAX MD

The global equity market continued to trend higher in July 2021 despite a series of regulatory shocks that hit Chinese stocks inside and outside of China. At first, Chinese regulators banned Didi Global Inc's app from the mobile app stores just a few days after it officially opened for trading on the New York Stock Exchange (NYSE) on 30 June 2021.

On 10 July 2021, China dropped another bombshell when the Cyberspace Administration of China published a draft revision requiring Chinese companies that collect personal information and listed outside of China to be subjected to a cybersecurity review. Then on 23 July 2021, China extended the control to the private education sector by requiring all institutions offering private tutoring to register as non-profit organisations. Also, the institutions were barred from raising funds through public listings or capital market-related activities.

Initially, the stock markets globally did retreat in reaction to the move made by China. At one point, the S&P 500 Index dropped by 2.87% in just five trading days from 12 to 17 July 2021 after a new draft on cybersecurity review was made known to the public. However, sentiments improved during the final two-weeks of July when the earnings reporting season for the second-quarter of 2021 in the U.S. kicked off with plenty of surprises. A data provider, Refinitiv, reported that over 88% of the corporates that reports profit in July were beating analysts' profit estimates, the highest percentage on record based on data going back to 1994.

By month-end, S&P 500 closed at 4,395.26 or up by 2.27% than a month earlier. The Dow Jones Industrial Average (DJIA) gained 1.26% to close at 34,936.13. Again, technology stocks were the biggest winner. Nasdaq 100 Index traded above 15,000 points level on 13 July 2021 before ended the month at 14,959.90 or 2.78% higher than a month earlier.

Bonds markets saw a big move upward in July 2021 amid a sharp decline in the U.S. treasury yields. The US Dollar (USD) strengthened further to 4.218 as rising infections of the Delta variant and political uncertainty weighed on Ringgit (MYR).

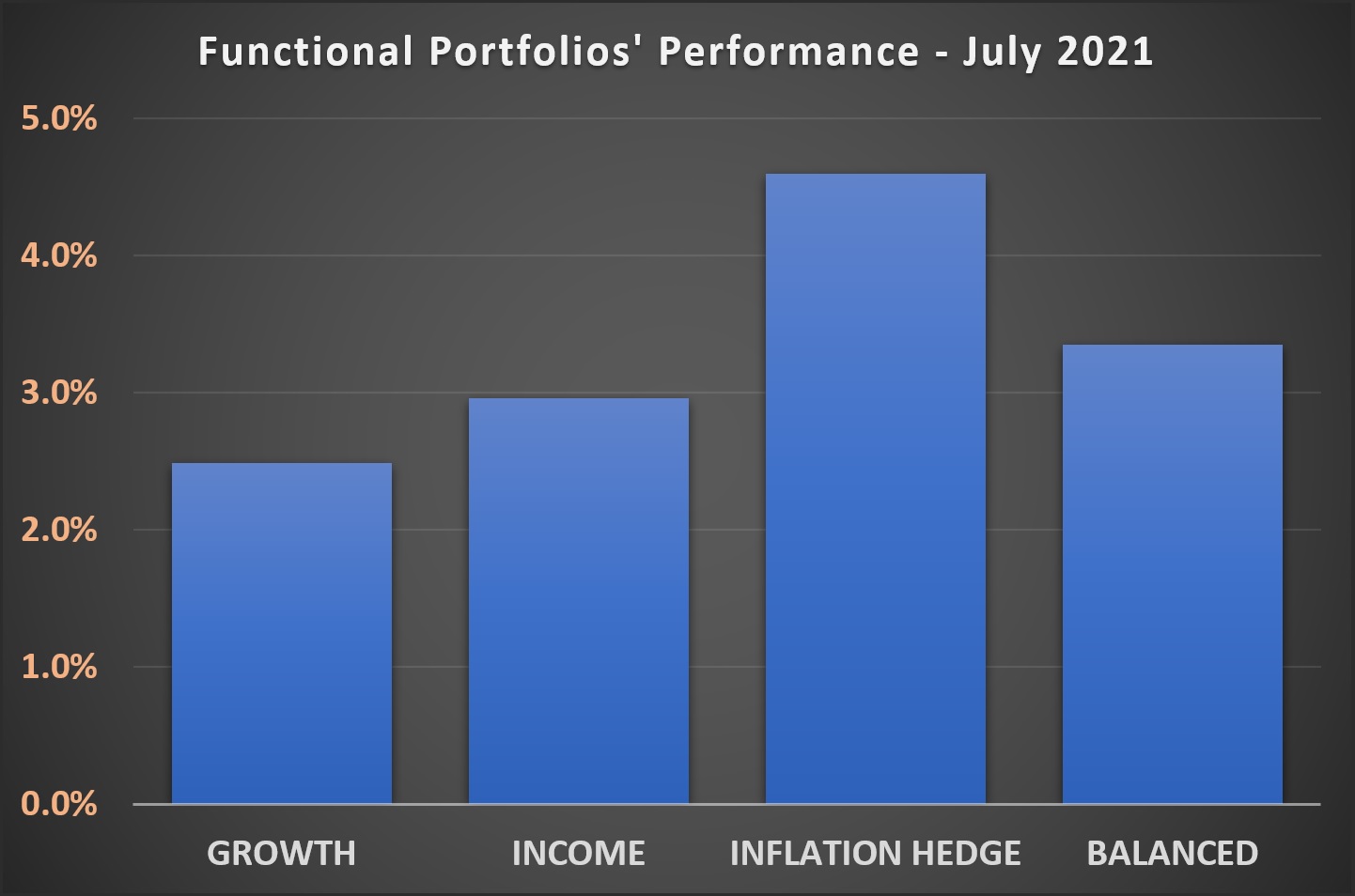

All MYTHEO portfolios recorded substantial positive gains in July 2021. The Growth, Income and Inflation Hedge portfolios rose by 2.49%, 2.96% and 4.59% respectively.

Chart 1: Functional Portfolios' Performance for the month of July 2021

Source: GAX MD Sdn Bhd, August 2021

Note: Past performance is not an indication of future performance

The GROWTH portfolio rose by 2.49%

Growth portfolios’ performance in July 2021 was anchored by exposure in the U.S., particularly the technology stocks. A proxy to technology stocks in the U.S., Nasdaq Trust Fund (QQQ) was the biggest gainer inside the portfolio after a gain of 4.63%. The U.S. Environmental, Social and Governance (ESG) stocks (SUSA) jumped by 4.62%. Technology stocks accounted for half of SUSA's total holdings.

Beyond technology, investors also favoured markets with high exposure in the real estate sector to counter against rising inflation. That helped to drive the Singapore market (EWS) for a 2.82% monthly gain. Real Estate accounted for more than 20% of EWS holdings and is the second-largest exposure after Financials.

Hong Kong stocks (EWH) was the only asset with a negative return inside MYTHEO’s Growth portfolio. EWH fell by 0.71% from the spillover impact of the regulatory crackdown in China.

The INCOME portfolio up by 2.96% in MYR

MYTHEO's Income portfolio had a rare perfect ten in July 2021. As at the end of July 2021, there were ten Exchange-traded Funds (ETFs) in the portfolio and all had gained more than 1%.

The U.S. 10-year Treasury yield sank from 1.468% in June to 1.226% in July 2021. Hence, Treasury bonds across all maturities were the biggest gainers in the portfolio. The U.S. Treasury, with more than 25 years to maturity (TLT) was up by 5.50%. Medium-term treasury with maturity from 3 to 7 years by iShares (IEF) and Vanguard (VGIT) rose by 3.75% and 3.59%, respectively.

On the other end, the worst performer in this portfolio, Emerging Market bonds (EMLC) still grew at 1.25% month-on-month. The next on the list among the laggards, Short-Term High Yield bonds (SJNK), and High Yields bonds (HYG) closed the month with 1.60% and 1.85% in gains, respectively.

The INFLATION HEDGE portfolio up by 4.59% in MYR

The inflation rate in the U.S. accelerated further to 5.4% in June 2021. Despite that, the Federal Reserve maintains that the current trend is temporary and continues to resist the call to raise interest rate quicker.

High inflation and low interest rate regimes are the sweetest spot for investment in the real estate sector, and the assets that hedge against inflation. That was the scenario that painted Inflation Hedge portfolios’ performance in July 2021. The U.S. Real Estate (IYR) climbed 6.59% and International Real Estate (RWX) gained 4.99%. Meanwhile, the Inflation Hedge bonds (TIP) added 4.45% in return over the same period.

It must be noted that the actual portfolio returns to the investors is the combined weighted return from the allocation to each functional portfolio. For example, if an investor allocates the investment 40% in Growth, 40% in Income and 20% in Inflation Hedge, the actual portfolio return is 3.35% (40% x 2.49% + 40% x 2.96% + 20% x 4.59%).

Note: Past performance is not an indication of future performance

Our Thoughts

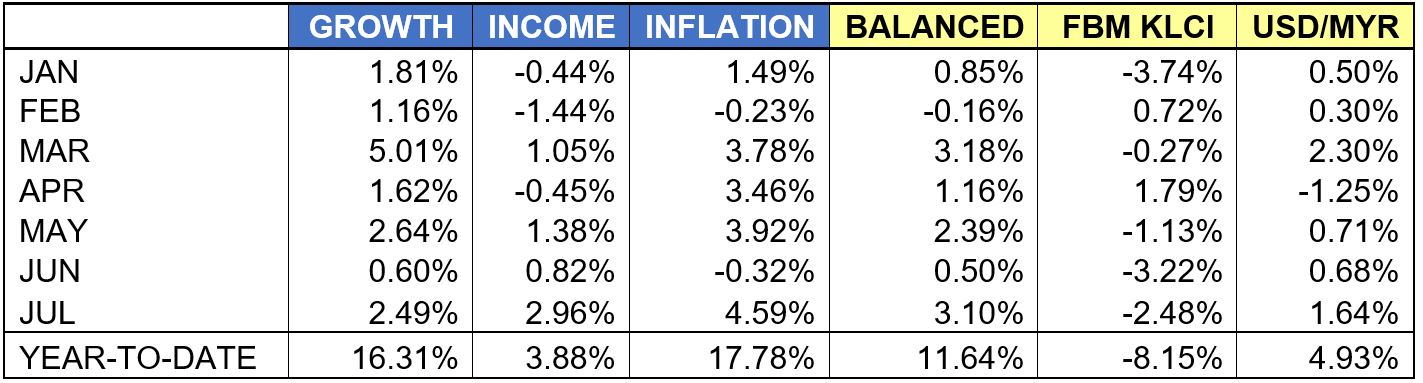

Looking back at MYTHEO’s performance as of July 2021, the Growth and Inflation Hedge portfolios have exceeded 16% in total returns. The Income portfolio, which performed poorly in the first part of the year amid rising treasury yields in the U.S. has turned a corner since May this year. As at the end of July, the Income portfolio has achieved a gain of 3.88%, a decent return for a portfolio of very low risk.

For those who invested in a balanced portfolio with a 40%:40%:20% allocation in Growth, Income and Inflation Hedge portfolios, the return should be 11.64%. In comparison, the FBM KLCI had a negative return of 8.15% over the same period.

In the face of the rising Delta variant infections and uncertainty in the country's political landscape, Malaysia Ringgit (MYR) had also depreciated by almost 5% against the US Dollar.

Table 2: Functional Portfolios' Performance Year-to-Date as of 2021

Source: GAX MD Sdn Bhd, Investing.com August 2021

Note: Past performance is not an indication of future performance

It is clear that the investors who diversified some of their investments into the offshore market would have enjoyed a better return at this point in the year. Investing offshore is no longer complicated given the advent of new technology. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by investing in the global markets in an easy and affordable way.

This material is subjected to MYTHEO's Notice and Disclaimer.