Wednesday, 19 July 2021

Written by Amirudin Hamid, Portfolio Manager of GAX MD

U.S. market hit an all-time high in June 2021, supported by the rally of large technology stocks. The S&P 500 climbed by 2.20%. Meanwhile, Nasdaq Index, a proxy to large-capitalization technology stocks in the U.S jumped by 6.34%. At month-end, S&P 500 traded at 4,297.50 points, which is a new all-time high. Also, Nasdaq was trading at a record high on 29 June 2021, after hitting the 14,572.82 mark.

Strong market performance in the U.S. was a surprise considering how bad the country's inflation number is. The latest report showed that consumer prices surged 5% year-on-year in May 2021, the fastest pace since 2008. Seemingly, investors appeared to have looked past the inflation number and took into account Federal Reserve Chair Jerome Powell's repeated assertion that high inflation is likely temporary and will resolve by itself. Moreover, the market was boosted with news of both Democrats and Republicans agreeing to the U.S. infrastructure plan initiated by President Joe Biden.

However, everything was less rosy outside of the U.S. Shares in Europe and Asia were mainly down as investors were worried the spread of the Delta variant of COVID-19 would derail the economic recovery in these countries.

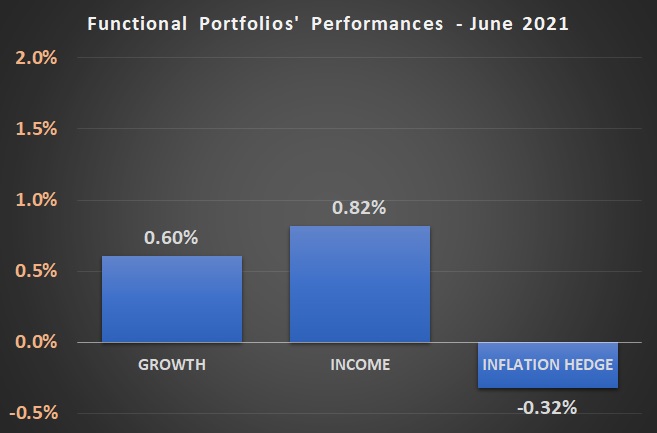

In June 2021, the Growth and Income portfolios were up by 0.60% and 0.82% respectively, but the Inflation Hedge portfolio eased by -0.32%.

Chart 1: Functional Portfolios' Performances for month of June 2021

Source: GAX MD Sdn Bhd, July 2021

Note: Past performance is not an indication of future performance

The GROWTH portfolio rose by 0.60% in MYR

There was a significant divergence in the equities market performance across different regions and sectors. Technology and energy sectors and stocks in the U.S were the most notable winners in the market. Invesco QQQ Trust (QQQ) ETF, which mainly invests in technology stock listed on Nasdaq, jumped by 6.67%. Taiwan ETF (EWT), which also invests heavily in technology stocks was up by 2.95%.

Also, a rise in Crude Oil prices supported Frontier Market (FM) to substantial 5.20% gains. FM has high exposure to oil-exporting countries such as Kuwait, Vietnam, Bahrain, Oman and Nigeria.

On the other hand, markets with little exposure to either technology or energy stocks traded lower. Most markets in Asia and Europe were weighed by fear following the rapid rise of new COVID-19 cases following India's highly contagious Delta strain.

Subsequently, Hong Kong (EWH), Singapore (EWS), Germany (EWG) and United Kingdom (EWU) dropped by 3.18%, 1.95%, 1.23% and 1.17%, respectively.

The INCOME portfolio rose by 0.82% in MYR

10-year Treasury yields slid below 1.50% for the first time since early March this year. The rate on the U.S. 10-year Treasury fell to 1.468% from 1.581% a month earlier at the month-end. Meanwhile, the US Dollar (USD) added 0.68% against Ringgit (MYR), closing the month at 4.15 level, which is the highest monthly closing since October 2020.

A combination of lower yields and stronger US Dollar are good for bonds issued in the U.S and denominated in US Dollar. So, all the U.S denominated assets in the Income portfolio posted positive gains in June. Bonds with a longer-term to maturity are more sensitive to interest rates and thus, performed better than short-term bonds.

The U.S. Treasury bonds with more than 20 years to maturity (TLT) and U.S Investment Grade Corporate bonds (LQD) rose the highest after a 4.82% and 2.61% gain. TLT has a weighted average maturity of 26.3 years and LQD is 13.8 years. Both are ETFs with the longest time to maturity inside MYTHEO’s Income portfolio.

As the US Dollar trades higher, most international bonds were weak across the board. In MYTHEO holdings, International treasury bonds issued by iShares (IGOV) and SPDR (BWX) declined by 1.74% and 1.58%. Meanwhile, the emerging market bond issued in the local currency (EMLC) dropped by 0.75%.

The INFLATION HEDGE portfolio dipped by -0.32% in MYR

Likewise, performance inside the inflation Hedge was also mixed. Crude Oil ETF (DBO) soared by 9.47% after the meeting among the energy alliance, otherwise known as the Oil Producer and Exporting Countries Plus (OPEC+) ended without any decision. That means there will be no significant increase of oil output to meet the rising demand, which is favourable to oil price in view that the supply remains constrained despite much stronger demand.

Clean Energy (ICLN), a substitute for oil, was also up by 3.30%, partly benefitting from the spillover effect from the tighter oil market.

However, aside from higher crude oil, most other commodities lost ground as inflation trade started to fade. Other commodity-related assets inside MYTHEO’s Inflation Hedge portfolio ended the month with negative returns. The worst among the losers were Gold (IAU), Silver (SLV) and Metal (DBB), which fell by 6.67%, 6.12% and 4.03%, respectively.

It must be noted that, the actual portfolio returns to the investors is the combined weighted return from the allocation to each functional portfolio. For example, if an investor allocates the investment equally: 33.3% in Growth, 33.3% in Income and 33.3% in Inflation Hedge, the actual portfolio return is (40% x 0.60%) + (40% x 0.82%) + (20% x -0.32%) = 0.37%.

Note: Past performance is not an indication of future performance

Our Thoughts

During the month, a report in the U.S showed the worst ever inflation numbers since 2008. The consumer Price Index (CPI) was up by 5% from a year ago. Many investors would easily expect that high inflation to negatively impact the equity market, and the assets that benefit from inflation would gain further. Yet, the equity market continues to trend higher, particularly the growth stocks in the U.S. Treasury yields eased for three months in a row, a clear signal that investors are less convinced that inflation would stay elevated at the current level.

That is how fast investors have changed their expectations of the market. Barely a few weeks ago, investors talked about the threat of inflation, but today the tone has changed dramatically. Today, most investors believe that inflation has already hit its peak and should be easing off moving forward. Movement in the financial market seems to have priced in the current expectations. That clearly showed how efficient the financial market is. That is why it is almost impossible to predict market direction, and trying to time the market will do more harm than good. Be wary of the market sentiment changing further as and when the data is updated and refreshed.

That is why “diversification” is a magic word in investment. It is the best practice that helps you achieve your financial objective in the face of the unpredictable market cycle.

This material is subjected to MYTHEO's Notice and Disclaimer.