Wednesday, 11 April 2022

Written by Sonia Tan, Portfolio Manager of GAX MD

In this monthly report, we will review MYTHEO’s portfolio performances based on the financial market developments in March 2022.

You can also learn about MYTHEO’s portfolio performances by playback our webinar below.

1. Growth Portfolio

MYTHEO’s Growth Portfolio jumped +1.23% in March 2022, led by a rally in global equity markets where stocks had dropped as much as 13% from the peak previously.

Meanwhile, Russia’s invasion of Ukraine dampens the outlook for investments and consumer spending in Europe as well as the US.

Back home in Malaysia, the Ringgit depreciated -0.17% to RM4.203 against the US dollar, down from RM4.196 on February 28.

Top 3 ETFs (Growth portfolio)

ISHARES MSCI CANADA (EWC)

INVESCO QQQ ETF (QQQ)

VANGUARD VALUE ETF (VTV)

5.21%

4.54%

2.73%

Bottom 3 ETFs (Growth portfolio)

ISHARES CHINA LARGE-CAP (FXI)

ISHARES MSCI TAIWAN (EWT)

ISHARES MSCI FRONTIER 100 (FM)

-8.40%

-3.86%

-3.73%

2. Income Portfolio

MYTHEO’s Income Portfolio inched lower by -2.65% in March, in line with the rising bond yields as investors grew jittery over the prospect of more aggressive rate hikes by the US Fed.

The 10-year US Treasury bond yield added 0.265% to close at 2.327% in end-March, up from 1.839% on February 28 – this was a new high since May 2019.

Top 3 ETFs (Income portfolio)

SPDR BLACKSTONE/GSO SENIOR LOAN(SRLN)

MARKET VECTORS EMERGING MARKETS (EMLC)

SPDR BARCLAYS SHORT-TERM HIGH YIELD (SJNK)

-0.29%

-0.70%

-1.05%

Bottom 3 ETFs (Income portfolio)

ISHARES 20+ YEAR TREASURY BONDS (TLT)

ISHARES 7-10 YEAR TREASURY BONDS (IEF)

ISHARES INTERNATIONAL TREASURY (IGOV)

-5.57%

-4.15%

-3.81%

In response, we have conducted portfolio rebalancing for April 2022 and made some changes to the income portfolio composition:

-added the weightage of ISHARES SHORT-TERM CORPORATE (IGSB) and ISHARES 20+ YEAR TREASURY BONDS (TLT);

-included ISHARES IBOXX INVESTMENT GRADE (LQD) and ISHARES 3-7 YEAR TREASURY BONDS (IEI);

-exited VANGUARD INTERMEDIATE-TERM GOVT BONDS (VGIT) and ISHARES 7-10 YEAR TREASURY BONDS (IEF).

3. Inflation Hedge Portfolio

MYTHEO’s Inflation Hedge Portfolio saw positive growth in March, edging higher by +3.04%, as the Russia-Ukraine war kept global oil prices firmly above US$100/bbl in March.

Gold futures were also up by 2.55% to US$1,949.20 per ounce, while silver futures and copper futures rose 3.14% and 6.66% respectively as investors sought to hedge against inflation.

Top 3 ETFs (Inflation hedge portfolio)

INVESCO DB OIL FUND (DBO)

ISHARES US REAL ESTATE ETF (IYR)

Invesco DB Base Metals Fund (DBB)

9.41%

6.42%

5.77%

Bottom 3 ETFs (Inflation hedge portfolio)

ISHARES TIPS BOND ETF (TIP)

ISHARES GOLD TRUST (IAU)

SPDR DJ INTERNATIONAL REAL ESTATE (RWX)

-5.57%

-4.15%

1.91%

4. Global ESG Portfolio

Similar to the Growth Portfolio, MYTHEO’s Global ESG portfolio benefited from the global equities rally, up by +0.53% in March.

Top 3 ETFs (Global ESG portfolio)

NUVEEN ESG LARGE-CAP VALUE ETF (NULV)

ISHARES MSCI USA ESG SELECT ETF (SUSA)

NUVEEN ESG MID-CAP GROWTH ETF (NUMG)

3.62%

2.54%

1.67%

Bottom 2 ETFs (Global ESG portfolio)

ISHARESs ESG AWARE MSCI EM ETF (ESGE)

ISHARES ESG AWARE MSCI EAFE ETF (ESGD)

-3.14%

0.05%

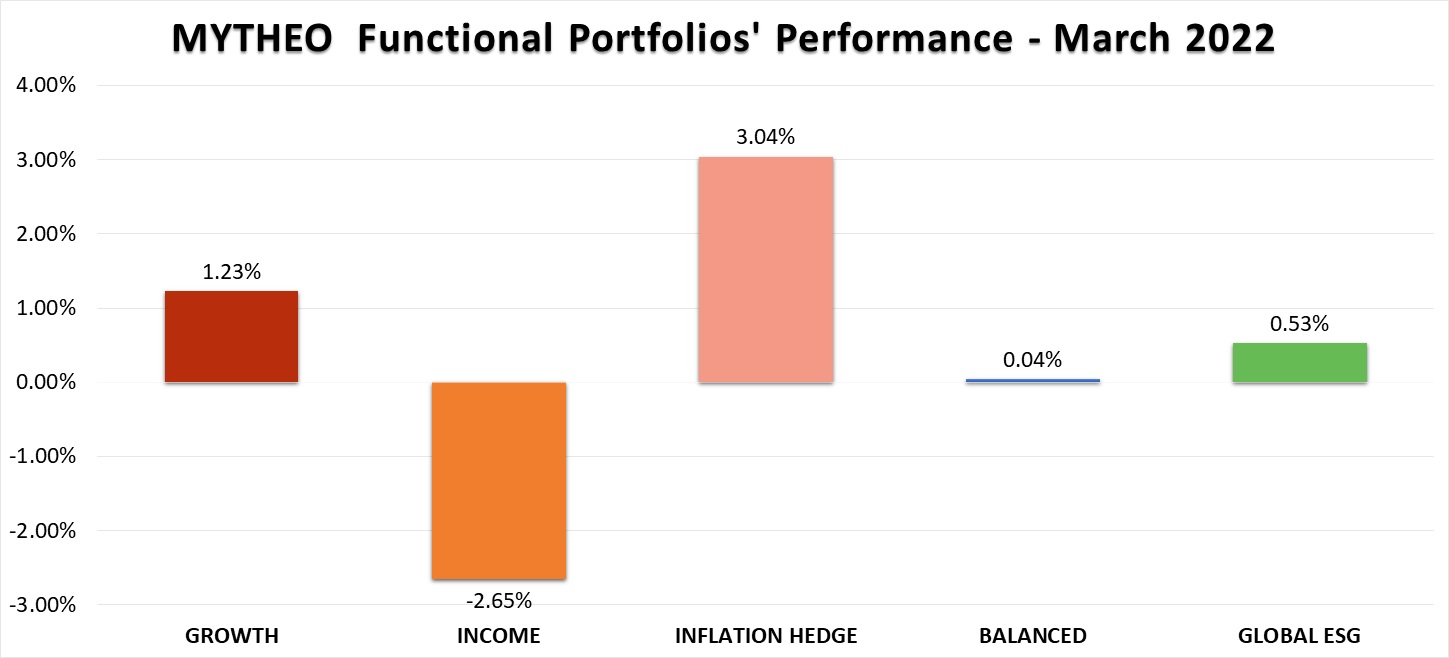

Chart 1: March 2022 - Portfolio Cumulative Rate of Return in % (MYR)

Balanced allocation consists of 40% Growth, 40% Income and 20% Inflation Hedge.

Source: GAX MD Sdn Bhd, April 2022

Note: Past performance is not an indication of future performance

Do you know how to calculate your actual monthly portfolio return?

As part of diversification, the actual portfolio returns to the investors are the combined weightage return from the allocation to each functional portfolio.

For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is 0.04% (40% x 1.23% + 40% x -2.65% + 20% x 3.04%)

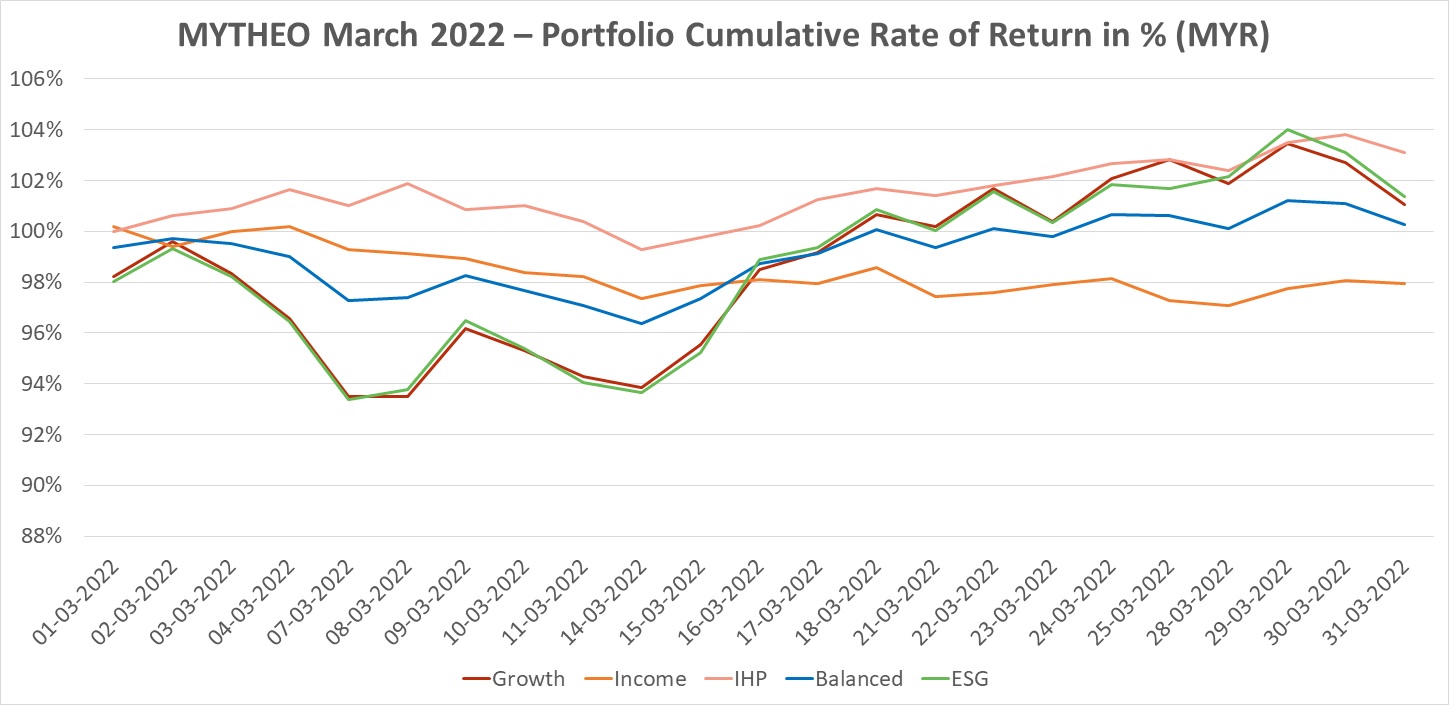

Chart 2: March 2022 – Portfolio Cumulative Rate of Return in % (MYR)

Source: GAX MD Sdn Bhd, April 2022

Note: Past performance is not an indication of future performance

*Please note that this is the cumulative performance based on model portfolios in March 2022. Your portfolio performance may differ from the model portfolio as it is subject to any deposits and/or withdrawals, as well as asset allocations made during the month.

Our key takeaways

MYTHEO’s Omakase portfolio combined Growth, Income and Inflation Hedge functional portfolios based on your needs. It offers global diversification to protect against extreme fluctuations in any single asset class.

As of March 2022, your Omakase portfolio was not only capable of tracking gains in the global equity rally, but also help to contain the fall in income-related assets (see Chart 1). Meanwhile, the Inflation Hedge portfolio which predominantly invests in real assets ETFs has managed to outrun inflation and minimise the overall volatility of the Omakase portfolio.

The collapse of the Russian market illustrates the severity of the environmental and governance concerns when they are fully priced in. With the increasing scrutiny on the environment, social and governance matters (ESG), corporations that are more capable of meeting sustainability standards are likely to outperform in the long-term.

So, we encourage investors to consider adding MYTHEO’s Global ESG portfolio, up to 20% of total investments, to complement the Omakase portfolio.

We remain confident and convinced that the most effective investment method is to invest with a long-term perspective through MYTHEO’s Omakase portfolio of growth, income and inflation hedge functional portfolios.

In MYTHEO, you can invest with peace of mind as we do the heavy lifting of helping you achieve your long-term financial goals so that you can focus and enjoy your life’s biggest moments.

This material is subjected to MYTHEO's Notice and Disclaimer.