Wednesday, 16 June 2021

Written by Amirudin Hamid, Portfolio Manager of GAX MD

The Global equity market settled higher once again despite facing a significant bump in May. During the month, the equity market declined by more than 3% in three days when an economic report in the U.S. showed that inflation was accelerating.

The U.S. Labor Department reported on 9 May 2021, that the Consumer Price Index was 4.2% year-on-year in April, the fastest pace since 2008.

Investors were worried that higher prices might force the Federal Reserve in the U.S. to raise interest much earlier than expected. However, the sell down only lasted for a few days before the equity market closed higher by month-end, underpinned by further progress on the re-opening and positive signs that the vaccine rollout has reduced infections in the U.S. and Europe.

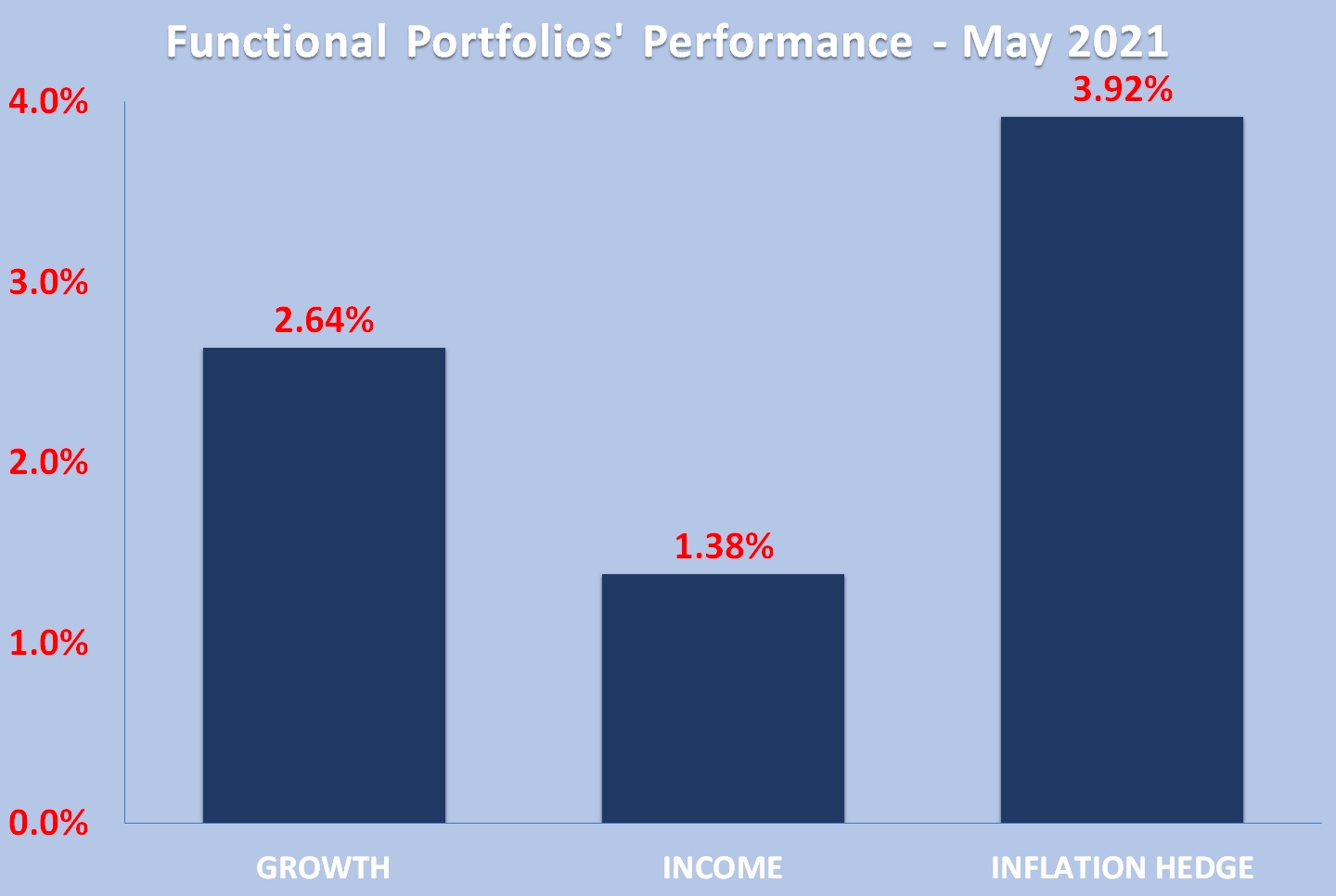

All functional portfolios of MYTHEO ended the month with positive returns. The Growth, Income and Inflation Hedge portfolios were up by 2.64%, 1.38% and 3.92% respectively.

Chart 1: Functional Portfolios' Performances for month of May 2021

Source: GAX MD Sdn Bhd, June 2021

Note: Past performance is not an indication of future performance

The GROWTH portfolio rose by 2.64%

Market rotation to the cheap or" value" stocks helped boost the equity market higher in May. The top gainers in this portfolio were Frontier Market (FM), United Kingdom (EWU) and Germany (EWG), which gained 5.40%, 5.02% and 4.49% respectively.

From a valuation perspective, all these assets are still not expensive. Above all, FM is incredibly cheap at a Pricing-to-Earning (P/E) valuation of 11.4x compared to the S&P 500 that is valued at 21.0x. EWU and EWG were not as cheap as FM. However, at a P/E of 13.09x and 16.27x, both assets were trading at 37.7% and 44.19% discount to the U.S. market.

When the rotation from "growth" to "value" were progressing, assets that have exposure to high growth sectors such as Technology and green energy were the losers.

Taiwan (EWT) and Nasdaq (QQQ) were the only assets in the Growth portfolio that fell into the red zone. EWT fell by 2.31% and QQQ eased by 0.11%.

The INCOME portfolio rose by 1.38% in MYR

The Income portfolio rose by 1.38% in MYR10-year Treasury yields declined to 1.581% in May from 1.626% in April. Meanwhile, the US Dollar (USD) gained 0.71% against Ringgit (MYR). Consequently, all the assets in the Income portfolio had positive gains in May.

Although the USD rose against MYR, the currency weakened against almost all major currencies. The US Dollar Index (DXY) which is used to measure the value of the USD against a basket of world currencies – Euro (EUR), Swiss Franc (CHF), Japanese Yen (JPY), Canadian Dollar (CAD), British Pound (GBP) and Swedish Krona (SEK) declined by 1.37%.

Hence, all the best-performing assets in the Income portfolio were the non-US Dollar assets led by Emerging Market Local Currency Bonds (EMLC) which registered a gain of 3.57%. EMLC invests mainly in treasury bonds issued by emerging countries in their home currency.

International bonds that invest in developed countries other than U.S., such as Japan, U.K., Singapore and European countries performed strongly too. MYTHEO invests in both international treasury bonds issued by iShares (IGOV) and SPDR (BWX). IGOV was up by 2.17% and BWX rose by 2.09% during the period under review.

The INFLATION HEDGE portfolio jumped by 3.92% in MYR

The Inflation Hedge portfolio got better in May as the inflation trade continued. Soaring commodity prices sent all commodity-related assets in MYTHEO holdings to rise more than 5% in a single month.

The biggest winners were Silver (SLV) and Gold (GLDM) which jumped by 9.06% and 8.78% respectively. Meanwhile, Oil (DBO) spiked up by 6.32% and Metal (DBB) rose by 5.91%.

Clean energy (ICLN) was the only asset with a negative return in the portfolio. ICLN dipped by 0.29% as investors continued to lock in gains on assets that had performed well in recent years. Despite five consecutive months of losses, ICLN is still trading almost twice the share price of one year ago.

It must be noted that, the actual portfolio returns to the investors is the combined weighted return from the allocation to each functional portfolio. For example, if an investor has an investment allocation of 40% in Growth, 40% in Income and 20 % in Inflation Hedge, the actual portfolio return is (40% x 2.64%) + (40% x 1.38%) + (20% x 3.92%) = 2.65%.

Note: Past performance is not an indication of future performance

Our Thoughts

The inflation fear was triggered once again in May 2021 after a surprise jump in the Consumer Price Index (CPI) in the U.S. The report caused havoc to the equity market, but it only lasted for a couple of days. Eventually, the stocks reversed and recouped earlier losses. By the month-end, most of the equity markets closed the month with a positive gain.

Investors who reacted to the inflation report were more likely to have sold their holdings closer to the bottom of the market and missed out on the opportunity when the market rebounded. That shows how easily market "noise" can derail investors from achieving their long-term financial objectives.

We need to understand that market "noise" is not necessarily chit-chats from unknown rumour mills. In May, the source of market noise was a verified inflation report published by the U.S Bureau of Labor Statistic. The data that was published were negative and due to that, many investors reacted to it irrationally by dumping shares that they were holding. Please be mindful that these kind of monthly published reporting may be only short-term in nature. So, a negative report today does not mean the following reports will be negative too. In fact, it could be a very positive one.

Furthermore, we are all live in a world where news travels fast. Today, one negative news can be easily overwhelmed by a piece of favourable news that popped out just a few days later. That's what happened in May; market sentiment turned so bearish after inflation data was released. But a few days later, investors found themselves with a piece of fresh news on the prospect of a full re-opening of the economy in the U.S. and Europe after new COVID-19 cases were seen to be declining.

Our reminder to you is to always focus on the big picture, be more disciplined, do not get intimidated by market noise and stay true to your long-term financial objectives.

This material is subjected to MYTHEO's Notice and Disclaimer.