Wednesday, 13 December 2021

Written by Royce Tan, Chief Market Insights Officer of GAX MD

The Omicron variant of Covid-19 and fears over rising inflation spooked investors in November, which led to a massive sell-off in equities, especially towards the end of November while the United States (US) Federal Reserve’s (Fed’s) hawkish stance further compounded the negative sentiments in the market.

The S&P 500 index was down 0.83% in November while the Dow Jones Industrial Average (DJIA) tanked 3.73% due to the uncertainties in the market. The World Health Organisation (WHO) had said that the heavily mutated Omicron variant is likely to spread internationally and poses a very high risk of infection surges, leading to “severe consequences” in some places.

Commodities also plunged in November over concerns that the Omicron variant could result in reduced demand. The Brent crude oil retreated 16.37% to US$70.57 per barrel while the West Texas Intermediate (WTI) was down 20.81% to US$66.18 per barrel. Copper futures and gold futures were down by 2.06% and 0.53% respectively.

On Nov 30, Fed chair Jerome Powell, who was just reappointed to his post for a four-year term, said they were considering accelerating the tapering of monthly bond purchases, usually an indication that interest rates would be hiked in the near future, as a counter measure to the rising inflation. Though the Fed had previously described the inflation as “transitory”, it has since dropped that term, saying that factors pushing inflation upward will linger well into 2022.

The consumer price index (CPI) in the United States (US) rose to 6.2%, its highest in 30 years for the month of October while China’s hit a 13-month high at 1.5%. In the United Kingdom, its CPI jumped to a 10-year high of 4.2%. In Europe, estimates for its November inflation points to a rate of 4.9%, up from 4.1% in October, the highest inflation level since the Euro currency was introduced in 1999.

The yield on the benchmark 10-year US Treasury took a dive from 1.56% to 1.46% in November with an intra-month high of 1.69% as investors’ confidence in the markets were eroded, leading them to park their funds in safer avenues.

Meanwhile in Malaysia, the ringgit depreciated against the US dollar in November due to the changes in the outlook for the greenback currency as the Fed may wrap up the tapering of bond purchases a few months ahead of what was expected. The ringgit was down 0.36% to RM4.20 on Nov 30 from RM4.185 on Oct 30.

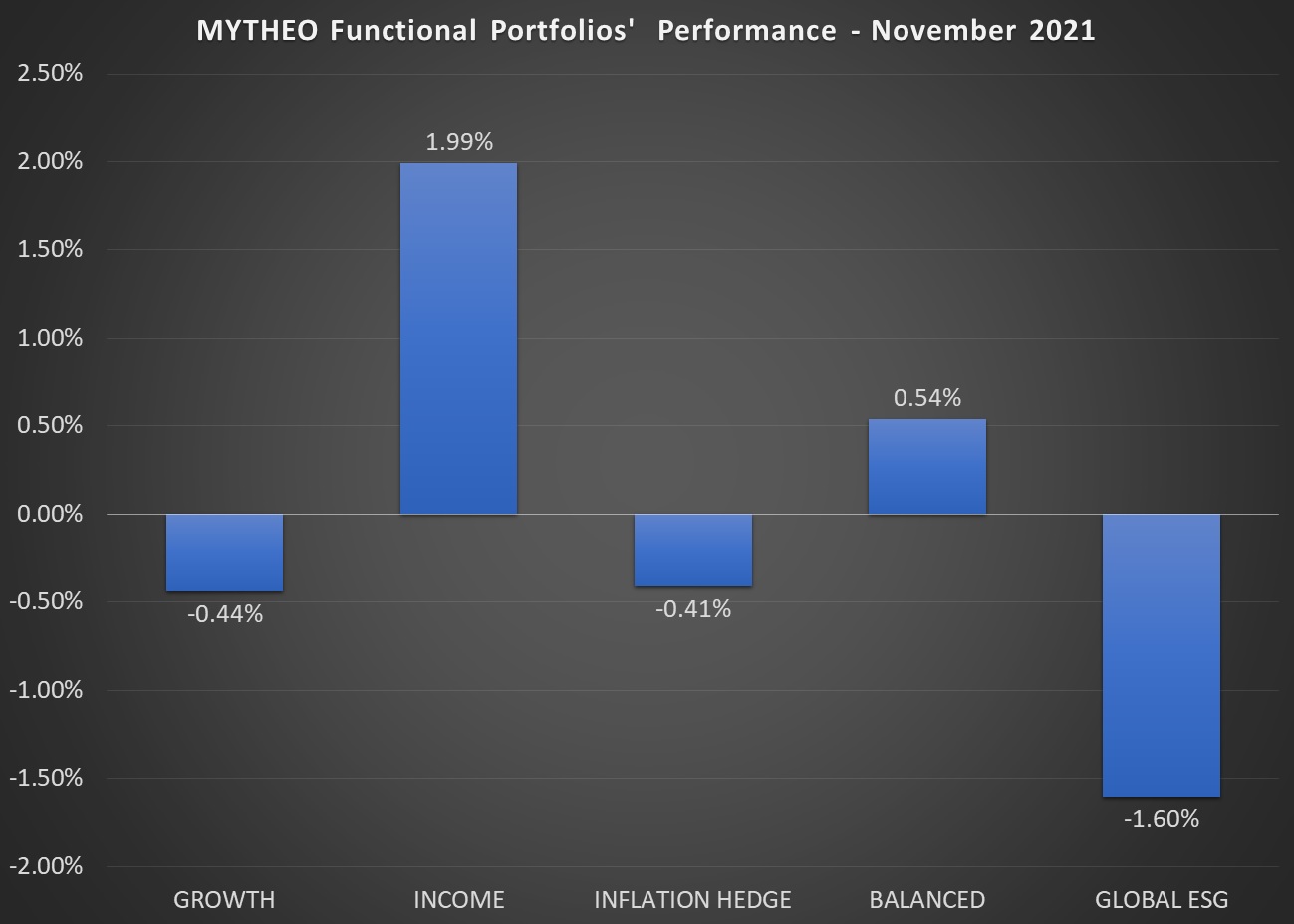

The performances of MYTHEO’s Three Functional Portfolios and the Global ESG portfolio:

Growth Portfolio

The growth portfolio retreated slightly at a rate of -0.44% due to a massive sell off in equities globally as investors grew wary about the rising inflation and the effects of the Omicron variant of Covid-19. Most of the ETFs in this portfolio registered declines, but this was cushioned by advances in heavyweight ETF Invesco QQQ Trust (QQQ) and iShares MSCI Taiwan (EWT), which were up by 2% and 2.65% respectively. Among the worser decliners in November was Vanguard Value (VTV), which is another heavyweight of ours, took a dip of 3.04%. Meanwhile, the iShares MSCI United Kingdom (EWU) and iShares Russell Mid-Cap Growth (IWP) were down by 4.87% and 4.30% respectively.

Income Portfolio

The income portfolio jumped 1.99% in November, led by our holdings in iShares 7-10 Year Treasury Bond (IEF), iShares 20+ Year Treasury Bond (TLT) and Vanguard Intermediate-Term Treasury (VGIT). The IEF was up 1.02% while the TLT and VGIT were up 2.64% and 0.36% respectively. These are in line with the rising demand for bonds in an erratic market that has eroded investors’ confidence due to the uncertainties.

Inflation Hedge Portfolio

As for the inflation hedge portfolio, it recorded a decline of -0.41% in November, mainly due to the negative performance of all the ETFs in the portfolio, except for iShares TIPS Bond (TIP), which was up 0.77% for the month. The laggards were mainly Invesco DB Oil Fund (DBO) and iShares US Real Estate (IYR), which declined 18.70% and 2.41% respectively.

Global ESG Portfolio

This is MYTHEO’s latest portfolio, which was launched on Oct 19, 2021. For the month of November, it posted a decline of 1.60%, as all the ETFs in the portfolio were on a downward trend, in line with the major sell down of equities on the back of uncertainties over the Omicron variant and inflationary fears. The negative returns were mainly attributed to the decline in iShares ESG Aware MSCI EAFE (ESGD) by 4.84% and iShares ESG Aware MSCI EM (ESGE) by 4.23%.

Chart 1: Functional Portfolios' Performance for the month of November 2021

Source: GAX MD Sdn Bhd, December 2021

Note: Past performance is not an indication of future performance

It must be noted that as a part of diversification, the actual portfolio returns to the investors is the combined weighted return from the allocation to each functional portfolio. For example, if an investor allocates 40% of their investment in Growth, 40% in Income and 20% in Inflation Hedge, the actual monthly portfolio return is 0.54% (40% x -0.44% + 40% x 1.99% + 20% x -0.41%).

Note: Past performance is not an indication of future performance

Rebalancing

For our rebalancing exercise in November, there were a total of five new inclusions and three exclusions in our Growth Portfolio and Global ESG Portfolio as it was an optimisation month for both portfolios.

For the Growth Portfolio, the ETFs removed were iShares MSCI Hong Kong (EWH), iShares MSCI Singapore (EWS) and Vanguard FTSE Pacific (VPL).

The four new ETFs added were iShares MSCI Mexico (EWW), iShares MSCI Brazil (EWZ), iShares Russell Mid-Cap Growth (IWP) and Vanguard FTSE Emerging Markets (VWO).

In terms of the weightage of the ETFs, there were notable changes to the Growth Portfolio composition as compared to October. The compositions of iShares MSCI Japan (EWJ), iShares China Large-Cap (FXI) and Invesco QQQ (QQQ) have been reduced while the weight of iShares MSCI United Kingdom (EWU) has been increased.

Meanwhile, the Global ESG portfolio saw the inclusion of Nuveen ESG Large-Cap Growth (NULG) while Nuveen ESG Large-Cap Value (NULV)’s weight has been reduced.

After rebalancing, MYTHEO has 36 ETFs across all its four functional portfolios - Growth, Income, Inflation Hedge and Global ESG.

Our thoughts

It has been almost two years since the first outbreak of Covid-19 and it has yet to show any signs of abating at this point, especially with the new Omicron variant spreading. It is still too early to determine the extent of its impact, with various questions left unanswered, such as its transmissibility, how effective the currently available vaccines are against it and how it is affecting the hospitalisation rate. This can only be clearer in weeks to come.

We still remain cautiously optimistic that we are in the early innings of a strong economic and earnings growth. If the Omicron variant remains under control, we should be looking at a favourable economic outlook in 2022. Inflation will continue to remain on the high side for the time being and we believe fiscal measures by policy makers worldwide remain accommodative to support the economy.

It is clear that the investors who diversified some of their investments into the offshore market would have enjoyed a better return at this point in the year. Investing offshore is no longer complicated given the advent of new technology. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by investing in the global markets in an easy and affordable way.

This material is subjected to MYTHEO's Notice and Disclaimer.