Wednesday, 10 November 2021

Written by Nazifah Mohd Arshad, Senior Portfolio Manager of GAX MD

After cooling off in September, stocks surged to new highs in October as the Standard and Poor’s 500 (S&P 500) recorded its best month of the year. Stocks were buoyed by earnings and increased risk appetite as congressional leaders pushed towards a robust spending package. During the month, the West Texas Intermediate (WTI) oil price jumped over 10%, registering a seven-year high price of US$85 per barrel during the month as consumption outpaced supply, draining stockpiles. Oil has been a leader in the commodities space as the recovery from the pandemic continues to drive increased energy usage.

The United States (US) Gross Domestic Product (GDP) growth in the third quarter (Q3) decelerated to 2.0% quarter-on-quarter (q-o-q) from Q2’s 6.7%. Despite a slowdown from supply constraints, the economy continued to expand for five quarters. The Treasury Secretary is confident that inflation, which has been at a 30-year high for three months, will return to normal levels during the second half of 2022 (2H22) as supply bottlenecks dissipate. In light of the improving labour market, consumer sentiment and orders of durable goods, it is expected that the US economy would continue to grow in Q4, which could encourage the Federal Reserve (Fed) to raise interest rates, possibly at the end of next year, especially with the recent announcement of the quantitative easing (QE) tapering.

The Eurozone’s GDP grew 2.20% q-o-q in Q3, slightly up from 2.10% in Q2 and above market expectations. The latest data reflects the improving outlook for the Eurozone, supported by the reopening of the economy, though high energy costs and supply chain disruptions have stoked inflationary pressures. The European Central Bank (ECB) kept policy interest rates low and left the ceiling on its Pandemic Emergency Purchase Program (PEPP) unchanged at €1.85 trillion through March 2022. The President of the ECB has admitted that inflation may remain elevated for longer than expected, but this will ease as inventories build up next year. Policy interest rates can thus be expected to stay low through 2022.

The yield on the benchmark 10-year US Treasury (UST) rose to its highest level of 1.68% in October as the tighter labour market pointed to a recovering economy. Nonetheless, the 10-year UST closed the month at 1.56% from 1.52% in September after the Fed Chair Jerome Powell told reporters that the economy is not yet at maximum employment, meaning it is not time to raise interest rates.

The ringgit continued to appreciate against the greenback as commodity prices had been supportive of the Malaysian economy. The ringgit appreciated by 1.10% to RM4.14 in October from RM4.19 in September.

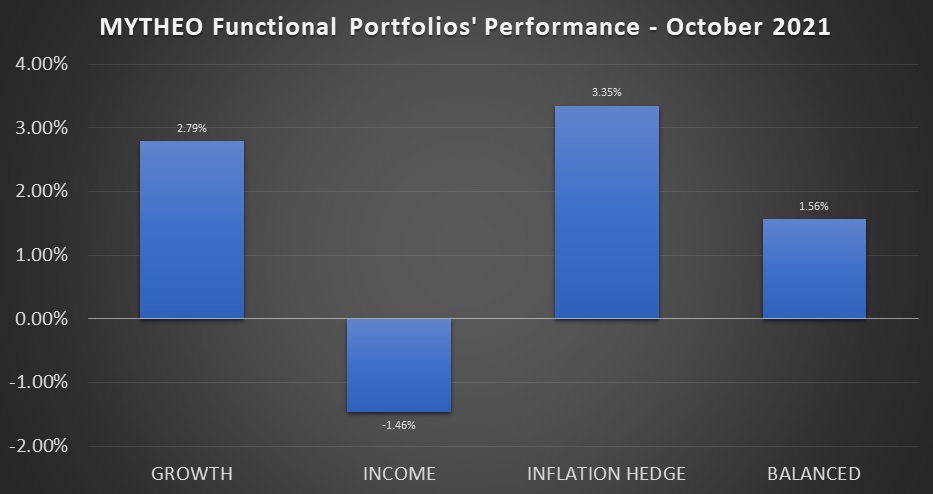

Chart 1: Functional Portfolios' Performance for the month of October 2021

Source: GAX MD Sdn Bhd, November 2021

Note: Past performance is not an indication of future performance

It must be noted that the actual portfolio returns to the investors is the combined weighted return from the allocation to each functional portfolio. For example, if an investor allocates the investment 40% in Growth, 40% in Income and 20% in Inflation Hedge, the actual portfolio return is -1.94% (40% x -3.09% + 40% x -0.39% + 20% x -2.32%).

Note: Past performance is not an indication of future performance

Growth Portfolio

MYTHEO’s Growth portfolio recorded a positive return of 2.79% for the month of October mainly attributed to the positive performance of its heavyweight ETFs of Invesco QQQ Trust (QQQ) and Vanguard Value (VTV) which increased by 7.86% and 5.44% respectively.

Income Portfolio

The Income portfolio recorded -1.46% return in October due to the negative performance of the portfolio’s ETFs. The top ETFs that have contributed negatively to the portfolio were the iShares 7-10 Treasury Bond ETF (IEF) and VanEck JP Morgan Emerging Market Local Currency Bond ETF (EMLC), which recorded -0.51% and -1.77% returns respectively in the month of October. The performance was in line with the performance of the 10-year UST which increased further in October to close at 1.56% from 1.52% in September.

Inflation Hedge Portfolio

The Inflation Hedge portfolio registered 3.35% return in October mainly due to the positive performance of all ETFs in the portfolio. The top ETFs that have contributed positively to the portfolio were the iShares US Real Estate ETF (IYR), iShares Global Clean Energy ETF (ICLN) and Invesco DB Oil Fund (DBO) which registered 7.28%, 16.72% and 10.28% respectively.

Meanwhile, the rebalancing exercise undertaken in October led to some changes in the portfolio composition as well as the ETFs’ weightage allocation. There were two exclusions and one inclusion for the Income portfolio as it was an optimisation month for the portfolio. Investco Senior Loan ETF (BLKN) and iShares iBoxx Investment Grade Corporate Bond ETF (LQD) have been removed while SPDR Blackstone Senior Loan ETF (SRLN) has been included.

In terms of the ETFs’ weightings, there were notable changes to the portfolio's composition as compared to the previous month. More weight was allocated to the iShares International Treasury ETF (IGOV) due to the removal of LQD. After the rebalancing, MYTHEO has an exposure to 30 ETFs across all three functional portfolios - Growth, Income and Inflation Hedge.

Our Thoughts

We believe that we are still in the early innings of the cycle and that strong economic and earnings growth as well as the relatively low rates through 2022 should support higher equity prices and sustain the bull market.

Nevertheless, uncertainties remain due to a rebound in COVID-19 infections, largely driven by the spread of the Delta variant in areas with low vaccination rates. The authorities are unlikely to reintroduce lockdowns, but local restrictions may be tightened in certain areas. It would weigh on services in these areas, while the overall economic recovery is likely to continue.

It is clear that the investors who diversified some of their investments into the offshore market would have enjoyed a better return at this point in the year. Investing offshore is no longer complicated given the advent of new technology. A digital investment platform like MYTHEO is here for you to achieve your long-term financial targets by investing in the global markets in an easy and affordable way.

This material is subjected to MYTHEO's Notice and Disclaimer.