Friday, 18 November 2021

Written by Royce Tan, Chief Market Insights Officer of GAX MD

INFLATION has been grabbing headlines in recent months. It is the three syllables that most common men on the street know about but at the same time, truly understanding it is pretty complex.

It is one that affects everyone’s daily lives, from rising prices of goods and services to higher costs of borrowing. We shall explore what inflation is all about in this article and how it affects you and your investments.

What is inflation?

Inflation is a rise in prices throughout the economy, which means that what you can buy with RM1 today is lesser than what you can buy for the same amount in the future. Another way of putting it is that inflation reduces the value of a currency over time. It happens when everything collectively becomes more expensive than what it used to be, rather than just that of one item or service.

The two forces that are driving this are the cost-push inflation and the demand-pull inflation. A cost-push inflation is a phenomenon of higher overall prices as a result of higher production costs such as labour and raw materials. One very common reason is the rise in commodity prices, usually due to the gradual recovery of the economy. The trigger comes from the lack of supply. A demand-pull inflation happens when demand outstrips supply or in simple terms, too much money chasing too little goods.

To keep inflation in check, central banks, such as the Federal Reserve in the United States and Bank Negara in Malaysia, use monetary policy tools, such as controlling the interest rates. When inflation is high, the usual regulatory response would be to raise interest rates to prevent the economy from overheating.

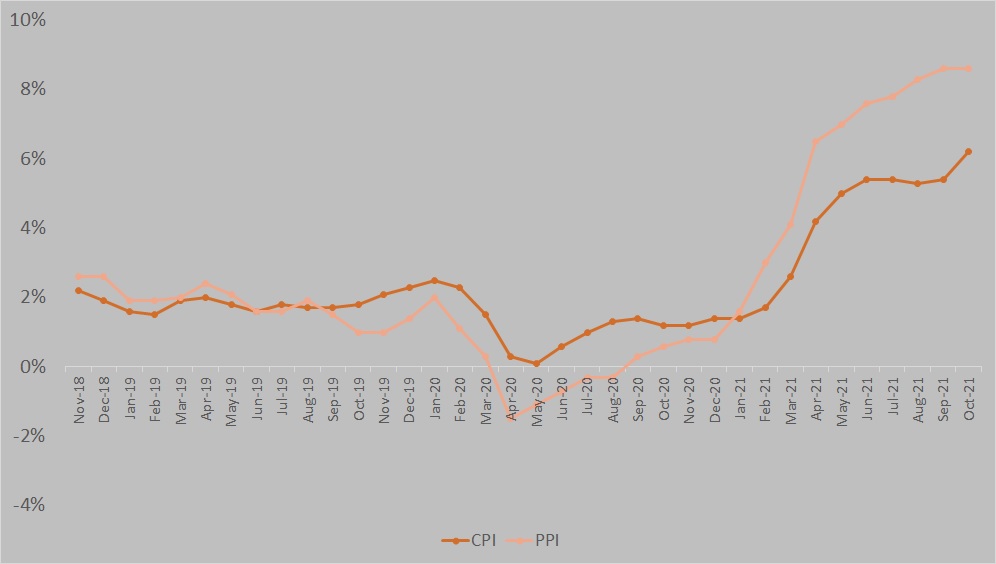

Chart 1: US CPI and PPI over a 3-year period

Source: US Bureau of Labour Statistics, GAX MD Sdn Bhd, November 2021

Post-Covid inflation

The reason why inflation is starting to hog the limelight again is because prices have been rising globally over the past months, especially in the world's two largest economies. The latest figures that have come out of the US showed that the consumer price index (CPI) has risen 6.2% year-on-year (y-o-y) in October, the highest it has seen in 30 years. This means that the price of a basket of goods and services, such as food and beverage, transportation, medical care, housing and others, were 6.2% higher last month compared to what it was in October 2020.

The producers price index (PPI), which measures costs from the perspective of industries and manufacturers, rose 8.6% in October 2021, mainly due to surging gasoline prices, which accounted for a third of the increase in prices of goods. Like the CPI, this suggests that the production costs of industries are on average, 8.6% higher last month than what it was in October last year. Both the CPI and PPI have been rising steadily since January 2021. These may suggest that inflation may drag on for a longer period than expected, although there are two schools of thought on this - one that the inflation is transitory and vice versa.

The Fed is on “Team Transitory”, although many renowned economists seem to think otherwise. Although the central bank expected high inflation to persist over the next few months, it still maintained its stance that it will likely be temporary, linking the current rise in prices to disruptions in the supply chain resulting from Covid-19 and that “it will pass”. The Fed announced on Nov 3, 2021 that it would start tapering the pace of its asset purchasing beginning the end of the month, which means that it will start buying less assets that were used to stimulate the economy. This will involve a monthly purchase reduction of US$10bil for Treasury securities and US$5bil for agency mortgage-backed securities.

For about a year and a half, the Fed has been buying at least US$120bil of bonds every month, which have provided support to the financial markets and the economy, which have helped to keep interest rates low. When the Fed starts tapering, it is usually an indication that interest rates will be raised in the future. Economists have predicted that this could happen by the end of next year or in 2023.

But what they really want is for the rate to be hiked now. In an economic environment that is still marred with uncertainties, the fear that is keeping Wall Street bankers up at night is the risk of stagflation. Stagflation is a persisting period of high inflation, slow economic growth and a high rate of unemployment.

As you may have realised by now, stagflation is a portmanteau of stagnant (referring to economic stagnation) and inflation. To tackle a stagnating economic growth, central banks would usually loosen monetary policies to encourage spending while in the case of inflation, it is the other way round. When both of them come together, that is the headache that policy makers face.

How does inflation affect your investments?

When inflation rises faster than the rate that wages increase, this leads to a reduction in purchasing power, forcing consumers to fork out more money for their necessities. In terms of investments, inflation is something that affects the real return rates. This will be a problem if the investments you make do not generate enough returns to outpace the inflation rate or at least, matching it.

While the impact of inflation may seem small or negligible over the short term, it is the long-term compounding effect that drastically erodes the purchasing power of one’s savings. It is therefore imperative that you choose the right investments, make the right diversifications and do it as early as you can, which allows you to take advantage of compounding interest.

Hedging Inflation

At MYTHEO, our Inflation Hedge portfolio is aimed at assisting investors in protecting the real value of their assets, especially those with a high net worth. These are usually investors who are not concerned about being able to fund their living expenses but want to avoid having the value of their assets eroded by inflation.

The portfolio is designed to match and to exceed the Malaysian inflation rate. It also works to reduce the correlation with global stocks and reduce the risks from events in major markets. The inflation hedge portfolio invests in ETFs such as crude oils, industrial metals, precious metals, real estate, Treasury short-term Government bonds, inflation-linked bonds and asset classes that are impacted directly by inflation.

From January to October, the Inflation Hedge portfolio on its own grew about 18% as prices of commodities and raw materials saw a surge. In terms of a balanced portfolio on MYTHEO, or what we like to call the 40-40-20 (40% in Growth, 40% in Income and 20% in Inflation Hedge), the return currently stands at 11.33%, year-to-date.

Note: past performance is not an indication of future performance

Yes, we know what you’re thinking. “Why don’t I switch my exposures entirely into Inflation Hedge?”. Although the Fed has indicated that higher inflation would continue in the US over the next few months, we would never encourage you to do that as it goes against the core principles of not timing the market and to diversify one’s investments.

MYTHEO’s portfolios are designed to have strategic diversification across different assets and countries. Therefore, your investment with MYTHEO is not overly exposed to a single factor or event. This is how we help you achieve your long-term financial objective smoothly with a peace of mind.

This material is subjected to MYTHEO's Notice and Disclaimer.