Wednesday, 10 June 2022

Written by MYTHEO

It's difficult during times of intense market turmoil to decouple our emotions from our investments. The common impulse is to cut your losses and stop investing, but it's rarely the solution. The rise of the robo-advisor or automated portfolios based on investor preferences could be timely as the benefits are valuable to investors during any type of market environment, but especially when conditions become uncertain.

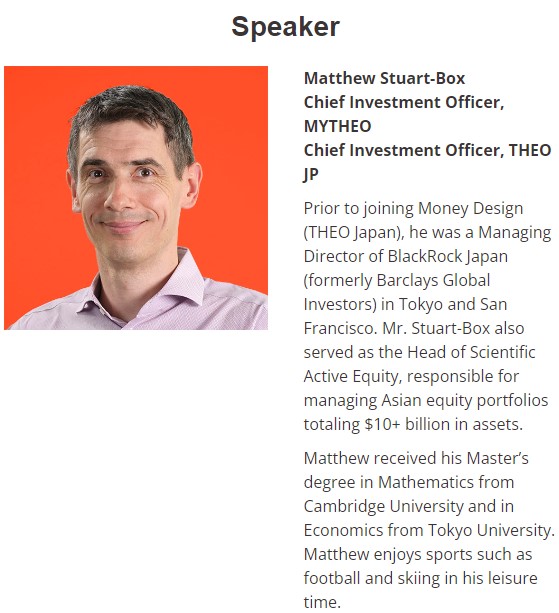

We spoke to Matthew Stuart-Box, Chief Investment Officer on the recent #MYTHEOLive Webinar Market Volatility: Can Robo Advisor Help? on how MYTHEO could help you stay the course during uncertain times and survive the market’s darkest days.

In case you missed it, you can view the full webinar below.

Here are the key takeaways from the webinar:

1) Market volatility is inevitable. It's the nature of the markets to move up and down over the short term. Trying to time the market is extremely difficult.

2) One of the most important things to do as investors is to get invested in a way that's appropriate with your longer-term goals and risk profile. Stay invested (and diversified) and ignore the short-term market noise.

3) Robo-advisors help take the emotion out of investing. When the market swings, so do our emotions. However, using advanced algorithms, a robo-advisor can help you stay disciplined and automatically rebalance your portfolio to account for these swings.

4) MYTHEO’s algorithm will automatically rebalance and also re-optimise your investment portfolio regularly to ensure it still matches your financial goals and risk tolerance.

With MYTHEO handling the A-Z’s of investing, you just need tosit back and relax. Find outmore about MYTHEO’s automated portfolios on our app or website today!

Back to Main Webinar

Back to Main Webinar